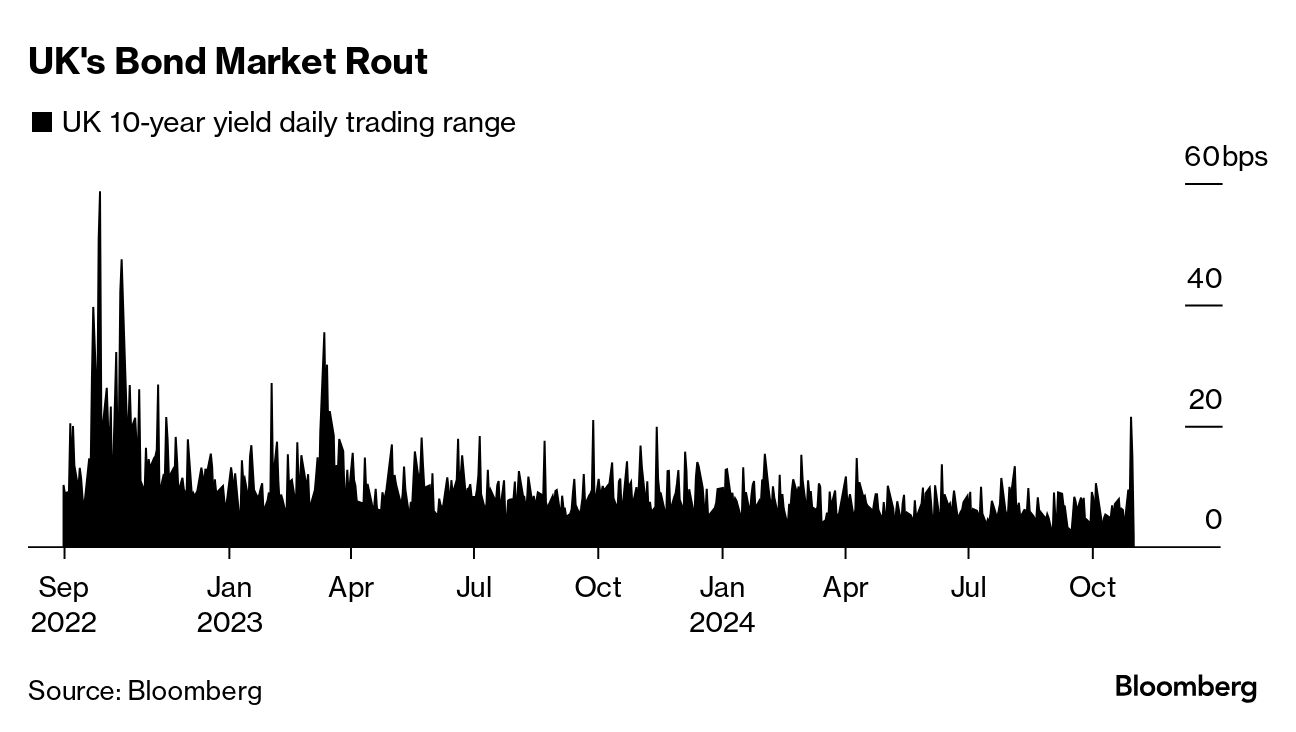

| Everything in markets is kicking into high gear. The US election is days away. Bond vigilantes have perked up on the other side of the Atlantic. Big tech earnings are fueling volatility, spurring an October wipeout in stocks.

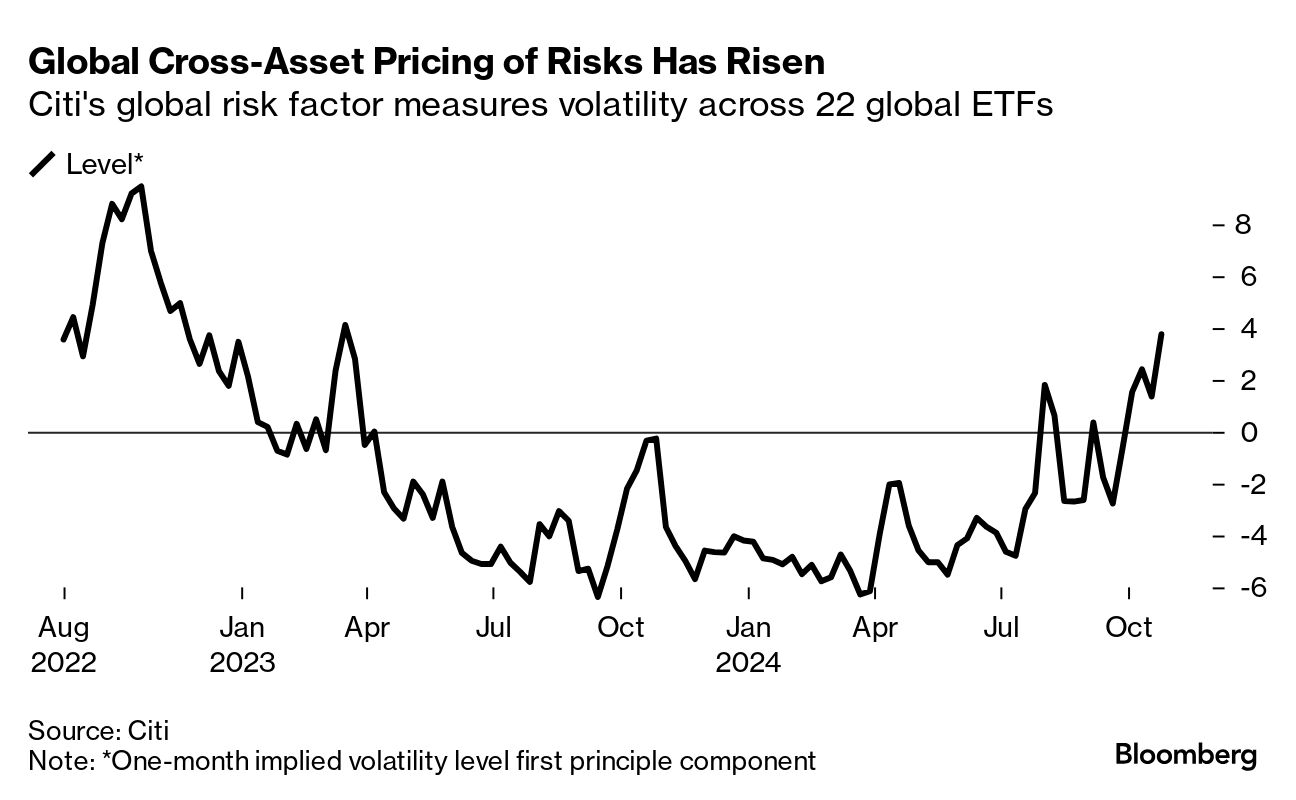

Next up: the all-important jobs report. Traders are bracing for jobs data that will be tougher than normal to dissect after hurricanes disrupted business operations and a strike rocked Boeing. Estimates in a Bloomberg survey of economists vary widely, from a 10,000 decline to a 180,000 gain. The median projection of a 110,000 increase in October payrolls would be one of the smallest since the end of 2020 and less than half the advance in September. All these kinds of cross currents are adding to a sense of angst. Take a look at the Citigroup's gauge of global risk factors, which tracks price swings in different assets, that's risen to an 18-month high. Meanwhile earnings growth — the lynchpin of the equity rally — has eased with the lowest beat rate versus the Wall Street estimates since the last quarter of 2022. Given all the uncertainties, Raphael Thuin, head of capital market strategies at Tikehau Capital, has trimmed some of the firm's equity allocation in the past days to raise some cash. "It's very a good idea to take some chips off the table, especially after such a strong year for risk assets," he said. "We're going to get volatility in the US elections. We don't know what's going to happen. You don't know how the market is going to react." Long term, though, refrain from trading on noise over signal, is the word of warning from Emily Roland of John Hancock Investment Management. "We suggest that investors try to put on noise canceling headphones over the next week or so and focus on what's happening from an earnings perspective," says the co-chief investment strategist. "Over time, stock prices follow profits. They follow earnings." |

No comments:

Post a Comment