| US election day is finally here and the only foolproof trade for investors is to go long cups of coffee as the votes are counted.

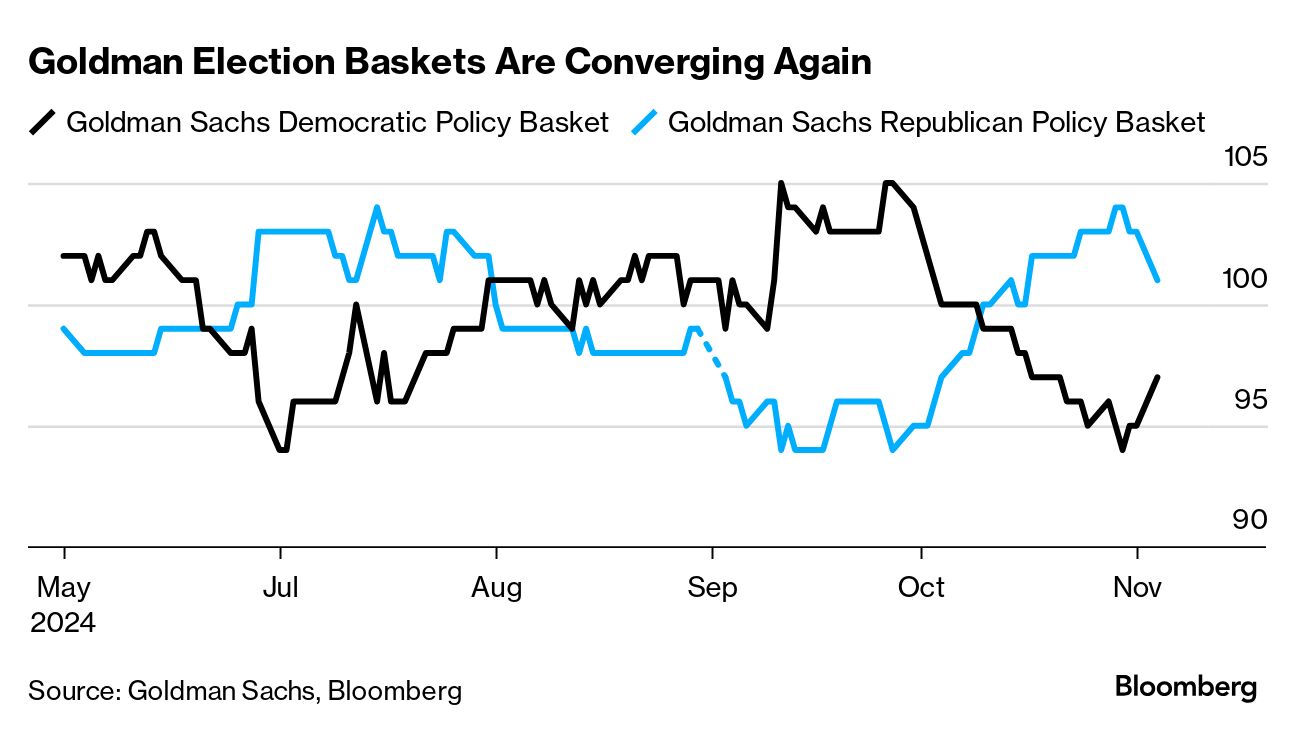

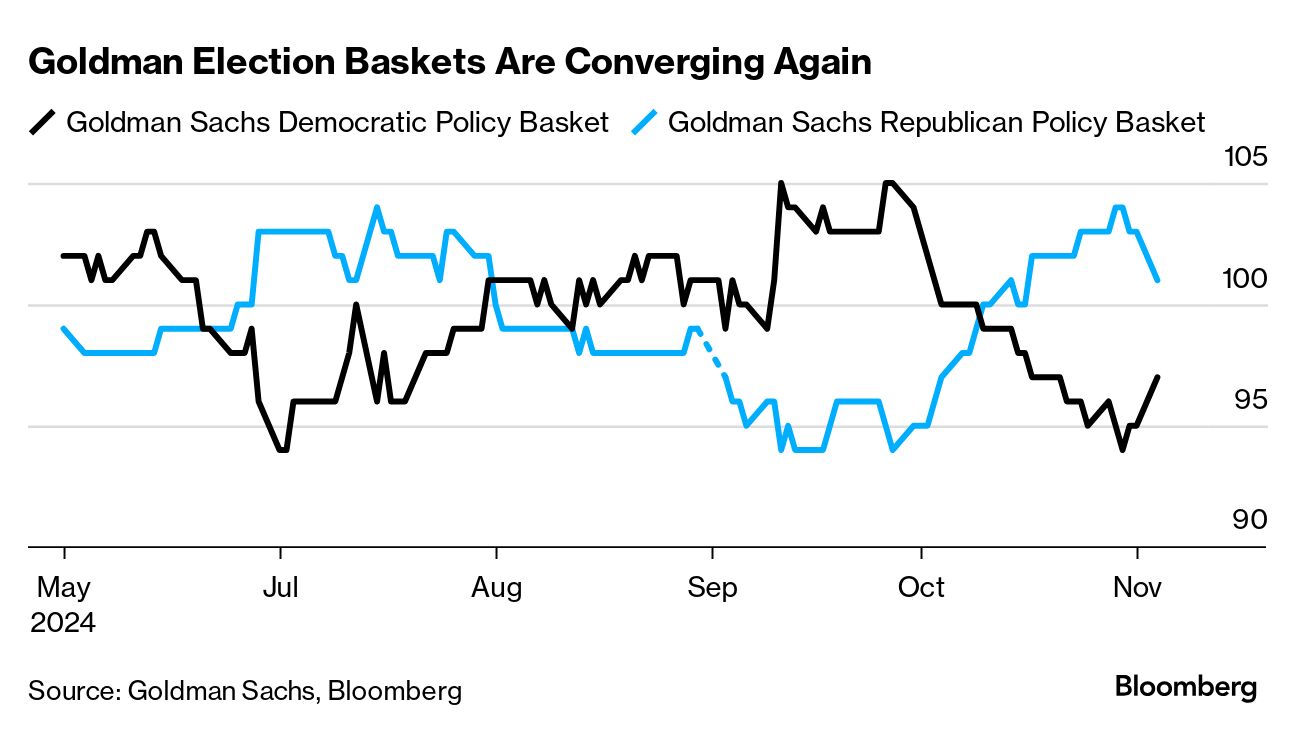

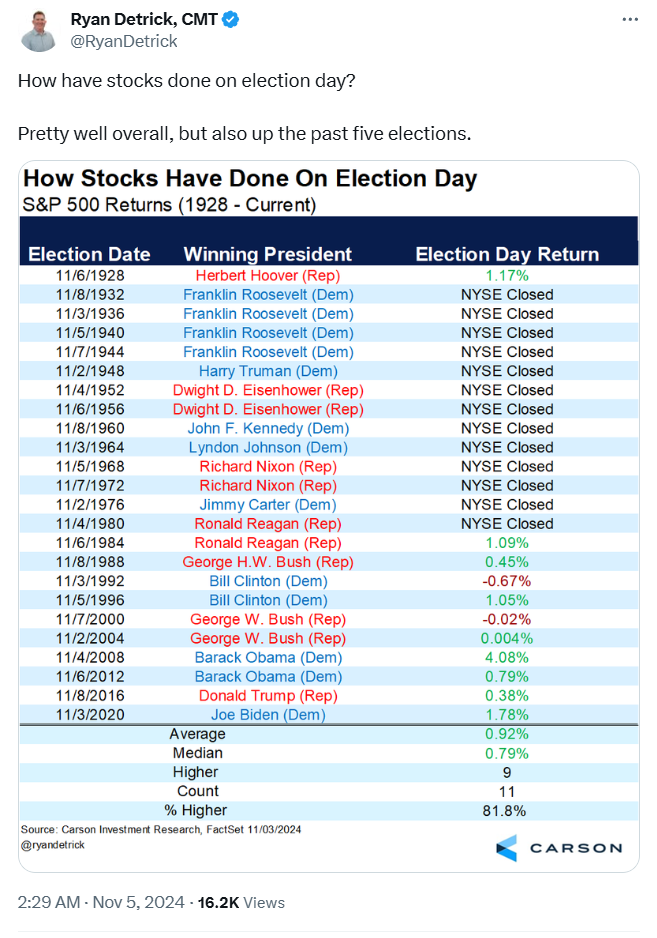

Markets will provide a real-time indicator of how Republican Donald Trump and Democrat Kamala Harris are perceived to be faring in their push to win the Electoral College.

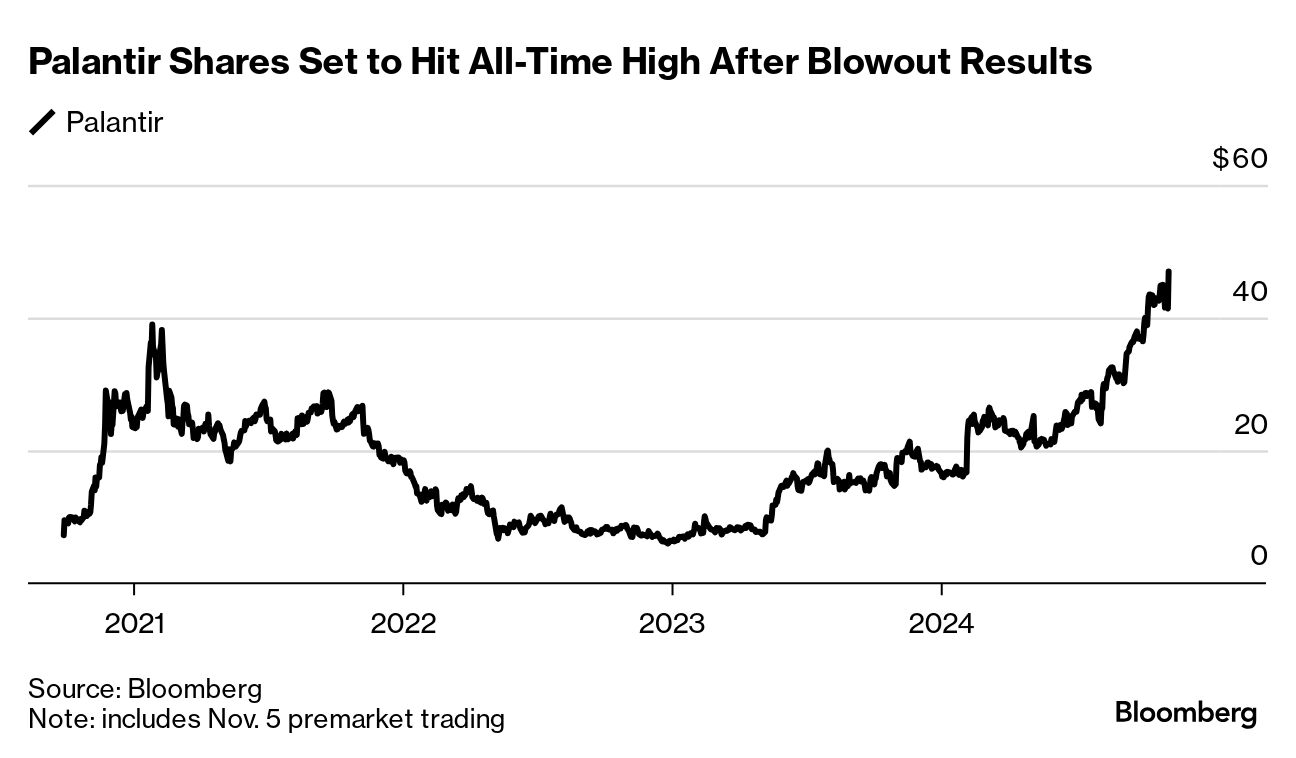

Here's our comprehensive guide to election trades and our live map showing results as they roll in. Sign up here for email alerts on key election news and analysis. Trump trades — wagers that would profit from his platform of easy fiscal policy, high tariffs, low immigration and loose regulation — have been front and center on Wall Street for weeks.

This meant buying the dollar against peers such as the Mexican peso, Japanese yen and Chinese yuan. Other versions of the trade involved selling Treasuries, while favoring crypto and stocks, especially security companies and his own media brand.

The momentum behind that strategy has turned in the opposite direction in recent days as some polling data tilted in favor of Harris. Soybeans, for example, enjoyed a brief boost on Monday as traders pulled back expectations of a trade war with China after a surprise Iowa poll showed the Democrat making inroads with Midwestern voters.  As polls prepared to open on Tuesday, the overall mood in markets was subdued but nervous, with traders anxious about outcomes that could shape Washington's agenda for years ahead.

Many investors said the Mexican peso will be a crucial barometer. Implied volatility for the currency is now near levels seen in sterling right before 2016's Brexit vote.

A disputed election is also a major wildcard – one BlackRock Investment Institute's Jean Boivin has warned investors aren't adequately prepared for.

The undercard of how the Senate and House of Representatives look after the vote is also critical for what happens no matter who resides in the White House.

"It's not two outcomes, it's six, you're looking at one of six outcomes," said Alex Chaloff, chief investment officer at Bernstein Private Wealth. "This is a toss-up of toss-ups. —Simon Kennedy |

No comments:

Post a Comment