| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the last batch of US pre-election economic indicators. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China's manufacturing activity unexpectedly picked up last month.

- COMING UP: Forecasters anticipate US employment will show a steady jobless rate even as storms and strikes put a temporary dent in hiring.

- Oil prices jumped after a report that Iran may be preparing to attack Israel.

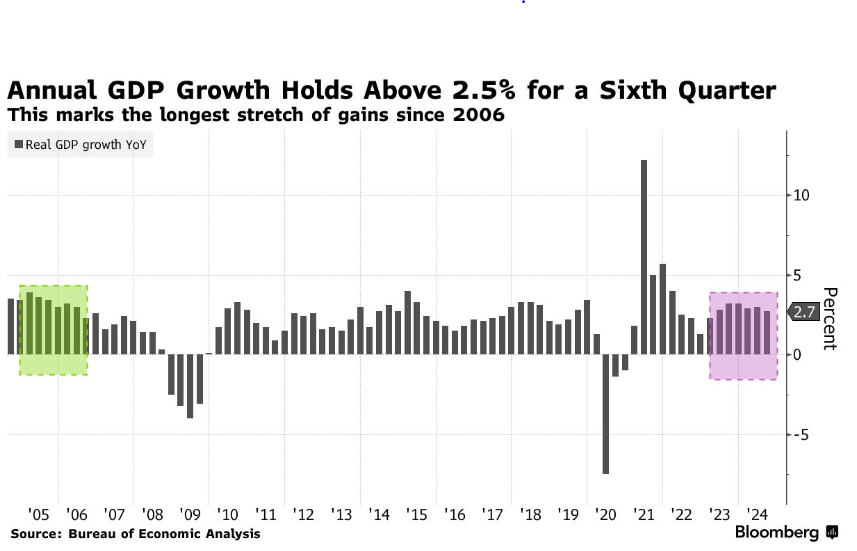

For many years now, economists as a group have viewed the US as having a potential growth rate of roughly 2%. That's a sort of speed limit: keep expanding faster than that, and it will cause inflation to accelerate, eventually triggering a bust that takes growth back down or even shrinks GDP. Federal reserve policymakers see that rate at around 1.8%. The IMF is slightly more optimistic, projecting growth five years from now, which is effectively the same thing as potential, at 2.1%. That makes the 2.8% annualized growth rate for last quarter look smoking hot, especially after a 3% pace for the second quarter. The Atlanta Fed's initial "GDPNow" tracking estimate for the final three months of 2024 came out Thursday: another strong reading, at 2.7%. The latest growth figures have come alongside evidence of a slowing in both the labor market and in cost-of-living increases. In other words, the "theoretical interpretation" of faster-than-potential growth being inflationary "is at odds with the reality," as Citigroup's economists put it. The unemployment rate was 4.1% at the end of the third quarter, up from 3.7% at the beginning of the year. (Economists project it to hold at that level for October when the data are released Friday, though the release is likely to be significantly affected by hurricanes and a Boeing strike.) As for prices, the Fed's core preferred measure, which strips out food and energy, climbed 0.25% in September — still not low enough to get to the 2% annual inflation target, but notably better than the 0.4% monthly average back in 2022, when policymakers started jacking up interest rates. Inflation may not be completely defeated, but the data also don't suggest the economy's overheating. So what's going on? "The only way to square that circle is if the non-inflationary speed limit of the economy, potential output, has improved materially," says Ali Jaffery, an economist at CIBC Capital Markets. In other words, "3% is the new 2%!" and GDP figures such as seen this week "should no longer be eye-popping at this point." Over time, there are two ways to lift the speed limit: having more workers, and getting more out of those workers through productivity growth. Immigration has helped to stoke the first element, while new technologies may be helping on the second. - Chancellor of the Exchequer Rachel Reeves sought to reassure the financial markets after her budget on Wednesday triggered a selloff in UK bonds.

- China's residential property sales rose in October, the first year-on-year increase of 2024, as a stimulus blitz bought back buyers.

- The Bank of Japan shouldn't raise interest rates again before March next year, according to Yuichiro Tamaki, a key potential ally for Japan's weakened government.

- South Korea's export momentum moderated last month in a sign that the latest rally driving economic growth may be starting to taper off.

- Australia's household spending edged down in September, suggesting high interest rates and stubbornly strong inflation are forcing consumers to hunker down.

- East Asia's fertility crisis is about to get a whole lot worse.

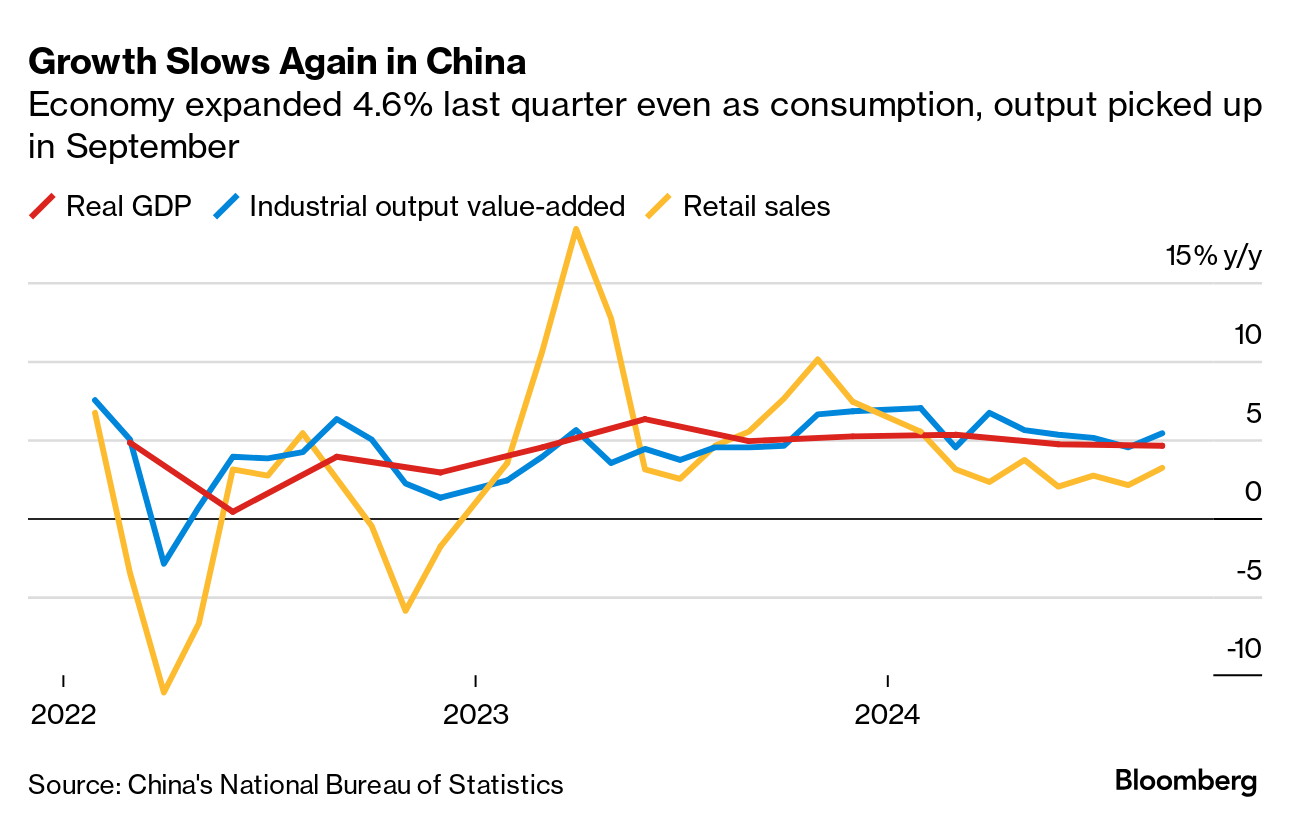

The US election outcome is set to determine the scale of stimulus in China, where President Xi Jinping's government is seeking to draw a line under the property slump. Economists at Nomura estimate the size of the overall fiscal package would be 10% to 20% larger under a Donald Trump win compared to a Kamala Harris victory. "The scale of the fiscal stimulus package could eventually be between 2% to 3% of GDP per year over the next several years," Nomura economists led by Ting Lu wrote in a recent note. "A Trump win would result in a package closer to 3%, while under a Harris win, the package might be closer to 2%." The Standing Committee of the National People's Congress meets Nov. 4-8, and may approve an extra budget, with other spending programs likely announced in March. |

No comments:

Post a Comment