| I'm Chris Anstey, an economics editor in Boston, and together with reporter Viktoria Dendrinou in Washington, we're looking at the Fed in the context of the US election. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Investors pared bets on a win for Donald Trump as polls show him poised for a photo finish with Vice President Kamala Harris — and a long US election night.

- Chinese lawmakers are gathering to sign off on a fiscal package set to run into the trillions of yuan, including a proposal to reorganize local government debt.

- The Bank of England may extinguish hopes of a shift to quicker interest-rate cuts after the budget reignited inflation concerns and triggered a selloff in UK bonds.

It's probably safe to say few US voters in Tuesday's election will be making their choice based on how the new president approaches the Federal Reserve. But it's a not-unimportant question in the minds of many Fed-watchers. Former President Donald Trump repeatedly and publicly put pressure on Fed Chair Jerome Powell to loosen monetary policy when he was in office, and in the current campaign has specifically said that the White House has the right to express its opinion. He's also indicated that he can do a better job than Powell in deciding on interest rates. Outgoing President Joe Biden wasn't completely silent on the Fed — predicting, for example, in April that it would lower rates despite elevated inflation readings at the time. But he stopped miles short of Trump's sort of verbal intervention. Vice President Kamala Harris's campaign has described Trump's Fed policy as "reckless." "Tensions could emerge over the course of four years," says Kathryn Judge, a Columbia Law School professor who served on a US Treasury advisory panel during the Trump administration. "The question is, is he willing to be patient" if the Fed has to raise rates to quell inflation, she said. Trump blamed the Fed for a strong dollar in 2019: Powell's term as Fed chair is set to end in the spring of 2026, giving the new president the chance to put his or her candidate in charge, subject to confirmation of the Senate (which polls suggest may tip Republican.) "Trump is not a hard-money guy," and would likely tap a Fed chair who would "bend" toward his perspective, says Steven Blitz, chief US economist at TS Lombard. Undermining Fed independence could feed through to higher inflation expectations, pushing up longer-term borrowing costs in the Treasuries market. That dynamic could end up being even more powerful than projections for fiscal deficits, according to Wendy Edelberg, director of the Brookings Institution's Hamilton Project. "If you lose Fed independence then, you know, all this is like a rounding error," said Edelberg, a former chief economist at the nonpartisan Congressional Budget Office. - An immigrant workforce is thriving in Georgia's MAGA heartland. Meanwhile high-income Americans are opting for used cars over $48,000 new ones.

- Tax hikes on UK businesses will lead to the "death of entrepreneurship" and could "kill off" growth, according to billionaire James Dyson.

- Brazil's finance minister Fernando Haddad canceled a trip to Europe amid extended losses of the real and uncertainty over spending cuts the government is considering.

- Thailand delayed naming a new central bank chairman as opposition mounted against the government's bid to push the candidacy of a former finance minister.

- Infighting within Germany's three-party coalition escalated as top officials dismissed Finance Minister Christian Lindner's latest economic proposals.

- A Goldman Sachs economist reckons South Africa is unlikely to suffer the large revenue shortfall projected by the country's own finance minister.

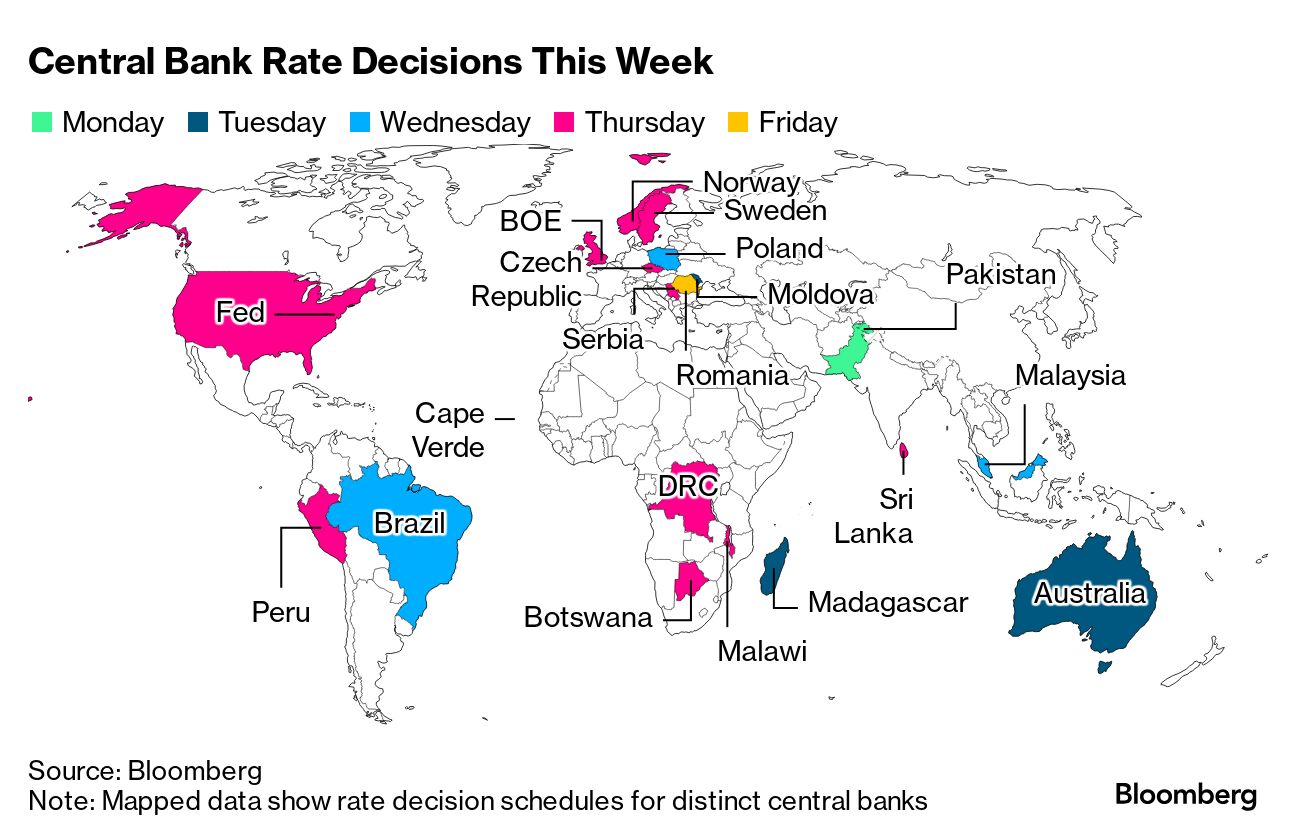

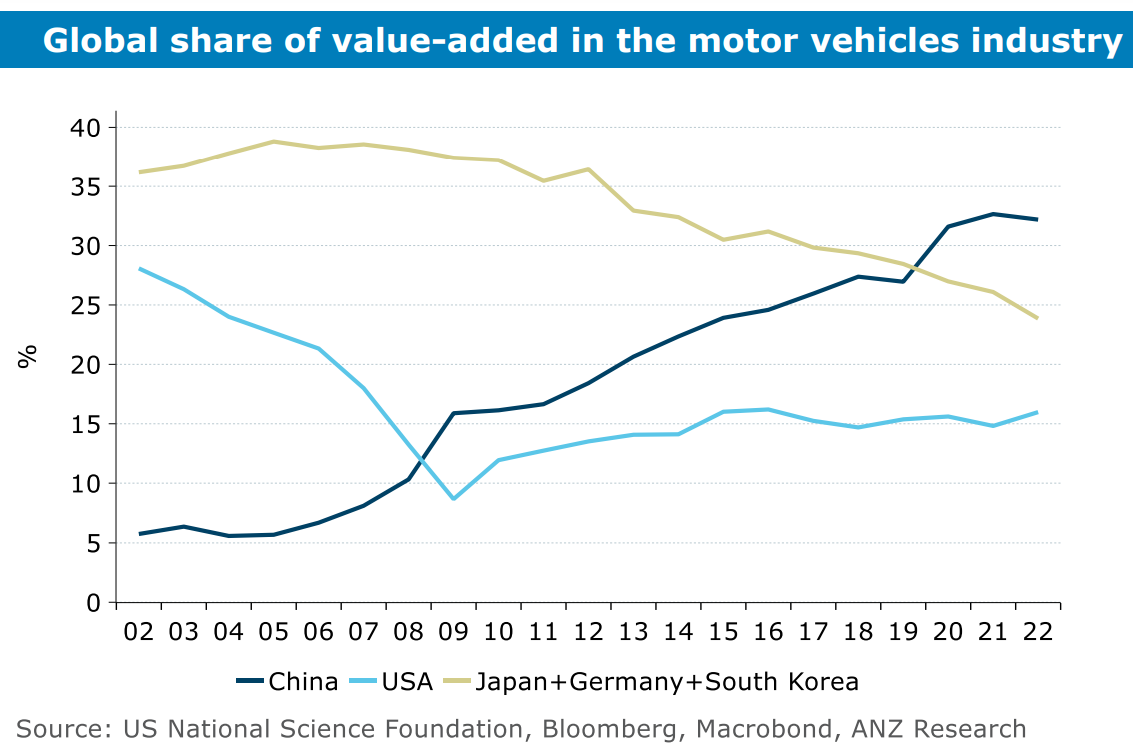

The Fed and many rich-world peers are widely expected to lower rates again in the coming week, right after a US presidential election that may not be decided yet. Central banks responsible for more than a third of the global economy will set borrowing costs in the wake of the vote, clinging to whatever certainties they can discern on the likely path of American policy for the next four years. Click here for a rundown of the week ahead. World-beating manufacturing strength can emerge right alongside economic stagnation, economists at ANZ Bank wrote in a note last week looking at the roots and implication's of China's success in the electric-vehicle industry. The EV sector is "no fuel injection" for the economy, despite the major inroads Chinese manufacturers have made in the world, ANZ's Raymond Yeung and Vicky Xiao Zhou wrote. "The contribution of car manufacturing to China's GDP is less than 4%. Unlike property, EV investment will not generate wealth. It is not an immediate growth driver." "The auto sector did not rescue Japan from the 'lost decade' and the EV sector will not rescue China," the duo wrote. "Despite the property crisis and economic stagnation in the 1990s, Japan continued to be the world's biggest auto producer for nearly 20 years thanks to affordable prices and fuel efficiency of its products." |

No comments:

Post a Comment