| I'm Chris Anstey, an economics editor in Boston, and today we're looking at Craig Torres's reporting on Fed guesstimates of Trump policies in his first term. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Donald Trump's team could pair former Fed official Kevin Warsh as Treasury secretary with hedge fund manager Scott Bessent at the National Economic Council.

- Two of the world's biggest foreign holders of US government debt offloaded a pile of Treasuries in the third quarter as they rallied before the presidential election.

- The European Central Bank should cut interest rates far enough to ensure they no longer constrain economic growth, Bank of Italy chief Fabio Panetta said.

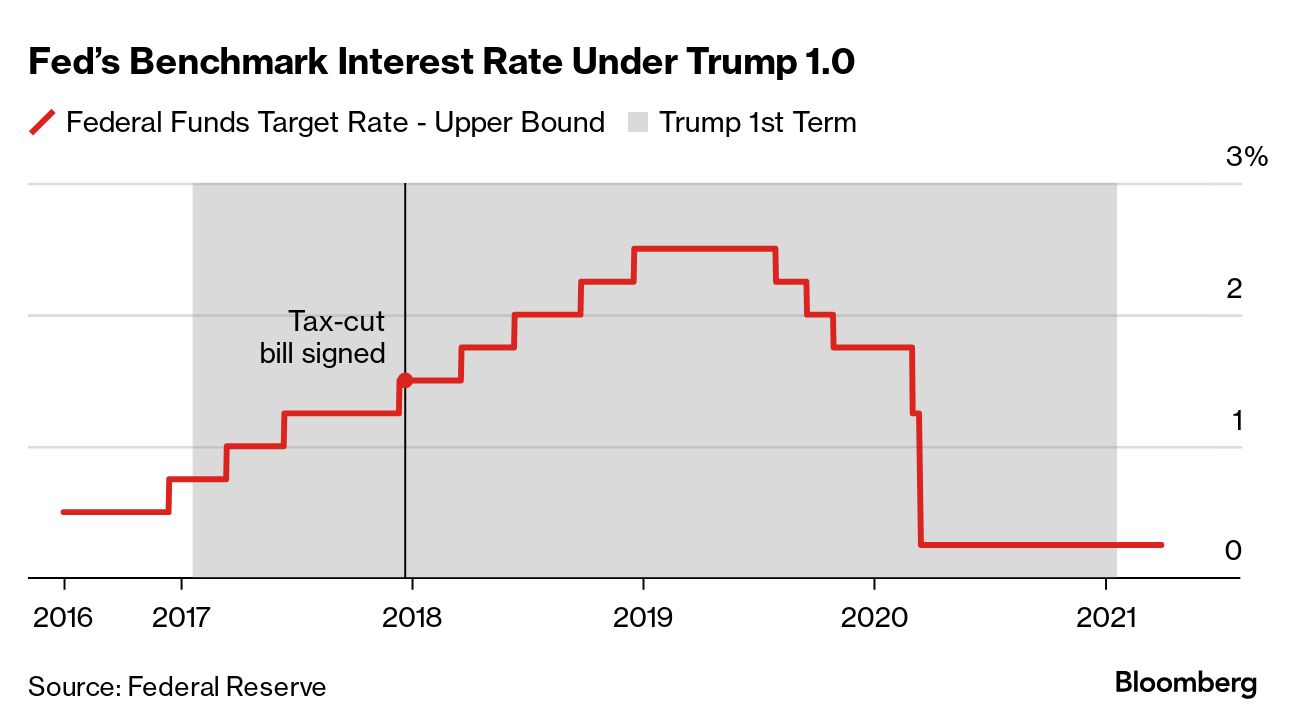

A slew of Federal Reserve watchers have altered their forecasts for interest rates on the basis of Donald Trump's election victory alongside his Republican party winning control of both chambers of Congress. Bank of America economists, for example, were clear on Friday, saying the political result "is likely to bring sweeping policy changes," predicting that "inflation will likely get stuck above 2.5%, since the policy mix appears to be modestly inflationary." The Fed will halt rate cuts when the upper limit for the target range hits 4%, compared with 4.75% now, they said. Policymakers will "respond to tariff increases by going on hold" at that point. Fed Chair Jerome Powell insisted that he and his colleagues wouldn't be altering their own views. "There's nothing to model right now," Powell said at his Nov. 7 press conference. "We don't guess, we don't speculate and we don't assume." But that's not how the Fed responded to Trump's win in 2016, transcripts from meetings at the time show. A month before the inauguration, the Fed's staff began forecasting a fiscal boost to growth that would be partly offset by higher interest rates, based on an assumption that promised tax cuts would get passed. And several policymakers — including Powell himself — also incorporated fiscal policy changes into their forecasts. "It seems likely that more accommodative fiscal policy will arrive during 2017," Powell, then a governor, wrote in comments submitted with his forecasts at the December 2016 meeting of the Federal Open Market Committee. "I have therefore followed the staff baseline in assuming a personal income tax cut of 1% of GDP, as a placeholder." He went on to say he had changed his rate projections to incorporate three, instead of two, quarter-point interest-rate hikes in 2017. A spokesperson at the Fed declined to comment. But the history suggests BofA and countless other Fed watchers may be well justified in tweaking their 2025 rate outlooks. Indeed, some warn that the Fed could err if they wait too long to react. "The patterns we have here for unified Republican control has not been a model of restraint," said Sarah Binder, a senior fellow at the Brookings Institution. "I could see why central bankers might want to duck out of the wind and get a better sense of what's coming," Binder added. "But it does risk getting behind the eight ball." - Top Chinese policymakers vowed to keep opening up to foreign investors. Meanwhile the push to improve local finances could hit spending on big infrastructure projects.

- The UK government's move to raise taxes on employers means the Bank of England will need to be cautious about cutting rates, Governor Andrew Bailey said.

- Apple has increased its offer to invest in Indonesia by almost tenfold in its latest bid to persuade the government to lift a sales ban on the iPhone 16.

- Most African central banks deciding on the level of borrowing costs over the next three weeks are set to lower them.

- China has an opportunity at the COP29 climate summit to score points with the European Union, potentially easing trade tensions over its green exports to the bloc.

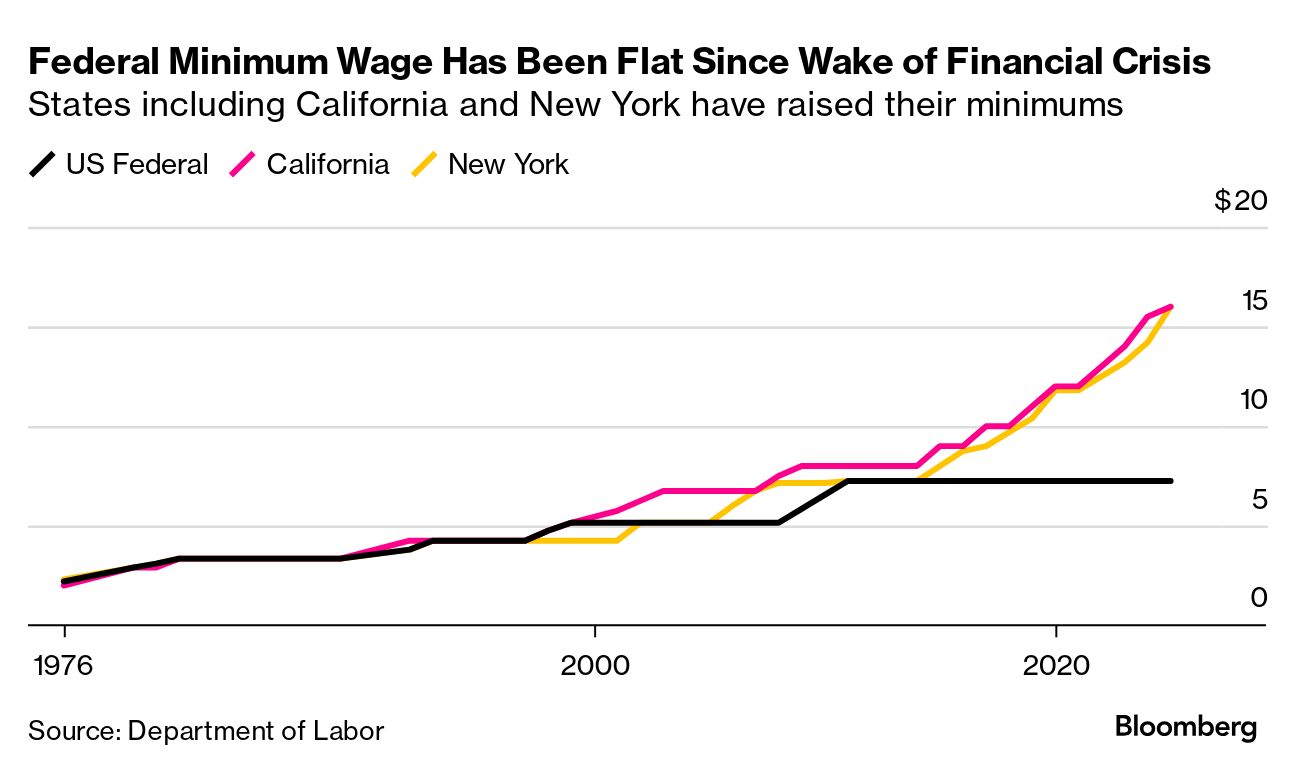

Minimum-wage increases appear to have the unintended consequence of harming Black workers, who bear a disproportionate burden of employment loss, according to a National Bureau of Economic Research working paper. David Neumark and Jyotsana Kala at the University of California, Irvine, found "that the adverse employment effects of minimum wages on Blacks are sufficiently large, relative to the positive wage effects, that minimum wages seem quite likely to reduce earnings of Black workers." Their estimates also pointed to major gaps between races. "The unintended consequence is that Blacks appear to bear a steep cost, while Whites bear very little cost and more likely benefit," from the minimum wage, they wrote, citing "substantial disemployment effects" for Blacks but little sign of that among Whites. The duo said that one plausible reason for the racial disparity is that employers simply choose to reduce employment of Blacks as they respond to minimum-wage hikes. |

No comments:

Post a Comment