| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at signs of stabilization in China's economy. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Federal Reserve Chair Jerome Powell said the recent performance of the US economy has been "remarkably good," giving room to lower interest-rates at a careful pace.

- The UK economy cooled by more than expected in the third quarter.

- The Republican sweep has transformed what could have been a struggle to merely renew Donald Trump's tax cuts into a multi-pronged campaign to slash levies.

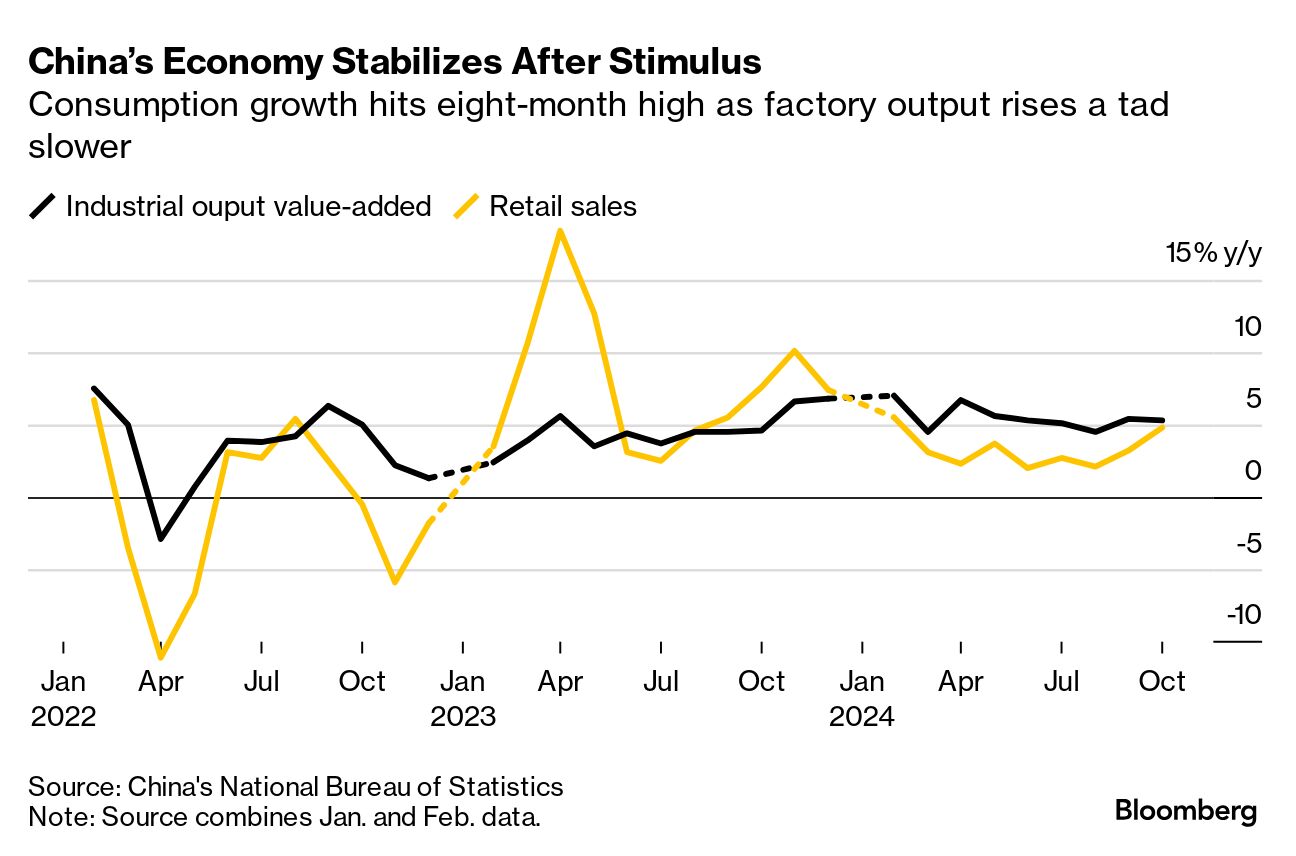

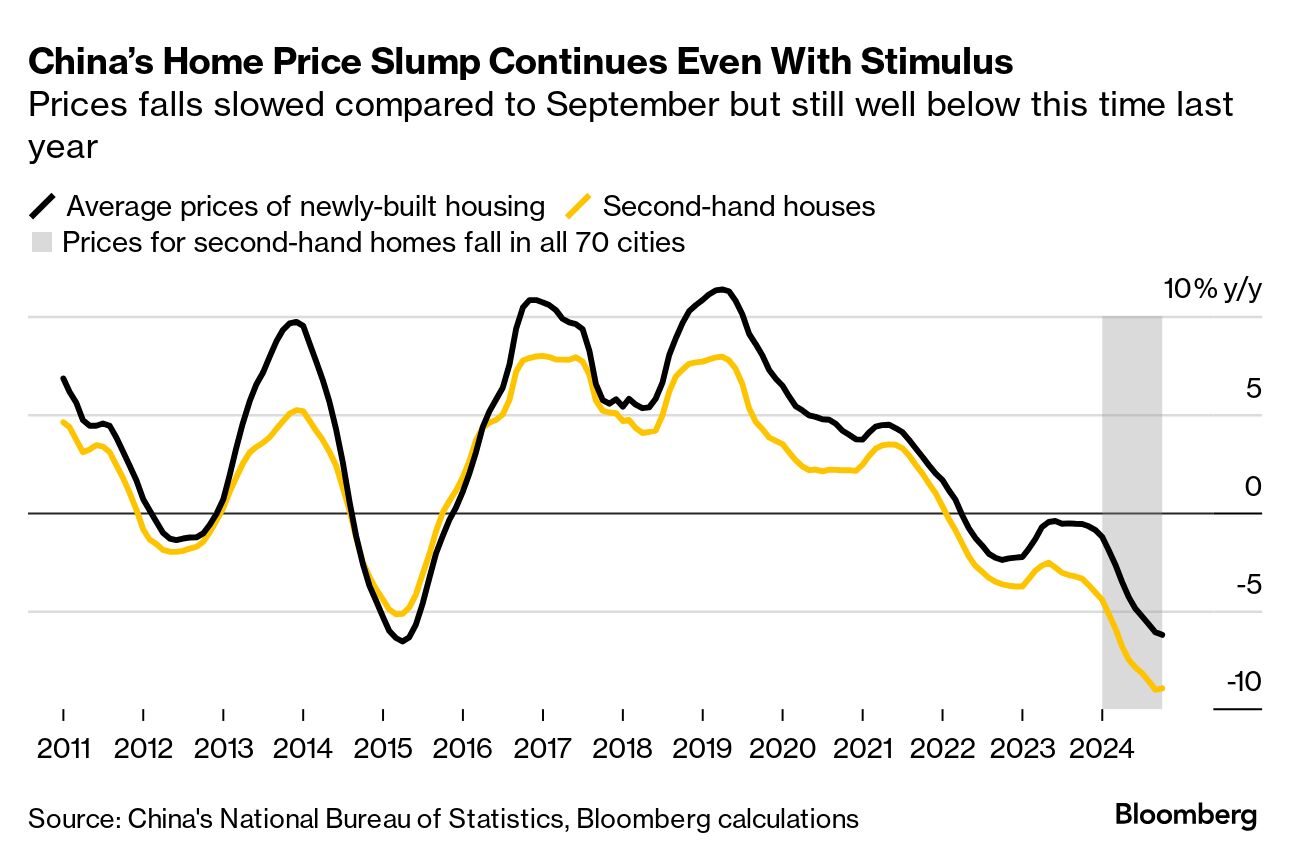

If you think of China's economy as a twin-jet passenger aircraft, it's been propelled by its export engine for most of the past year as the ongoing property slump left the domestic consumption turbine sputtering. That — and increasing injections of stimulus — has been enough to keep this year's economic growth target of about 5% in sight. Now, just as Trump's election win casts a giant tariff-shaped cloud over the world's second-biggest economy, it seems the Chinese shopper might be ready to take up more of the growth slack. Retail sales increased 4.8% in October from a year ago, the strongest growth since February and exceeding all estimates in a Bloomberg survey, data Friday showed. A cash-for-clunkers-like program whereby Beijing has been subsidizing purchases of equipment, appliances and cars also helped: The sales of home appliances rose 39% compared to the same period last year, the fastest growth since 2010. As for the all-important real estate sector, there was mixed news. Property investment fell 10.3% in the first 10 months of the year, suggesting still subdued confidence among developers despite an initial recovery in housing sales. Meantime, home-price declines moderated for a second month in October, aided by the recent policy support. With economists at Goldman Sachs, UBS and many others cutting their 2025 GDP growth forecasts for China due to anticipated blow from fresh tariffs on its exports to the US, stabilization in the property sector and a recovery in consumption couldn't come at a more important time for President Xi Jinping and his officials. But they're not celebrating just yet. "The external environment is increasingly complicated and severe, effective demands are still weak at home and the foundation for continuous economic recovery needs to be strengthened," the National Bureau of Statistics said in a statement accompanying the data. "The overall economy is bottoming out but not yet recovering," wrote Chang Shu at Bloomberg Economics. "Maintaining policy support is needed to sustain momentum." Click here for a look at steps China could take to retaliate if the trade war worsens. - The US Treasury added South Korea to a "monitoring list" for foreign-exchange practices that still includes Japan and Germany.

- Bank of Japan Governor Kazuo Ueda will speak at an annual event Monday that will attract close scrutiny for any hints over the timing of the next rate hike.

- The euro area's economic growth will pick up as obstacles to consumption and investment fade away, though geopolitics poses an increasing threat, the EU said.

- Thailand is working on a raft of fresh fiscal measures to sustain an economic recovery, foster new foreign investment and lower the near-record household debt.

- Mexico's credit outlook was lowered to negative from stable by Moody's, which said recent constitutional changes risk hurting Latin America's second-biggest economy.

- The Bloomberg Odd Lots podcast explores some of the thorniest issues facing the US economy, through the medium of chicken.

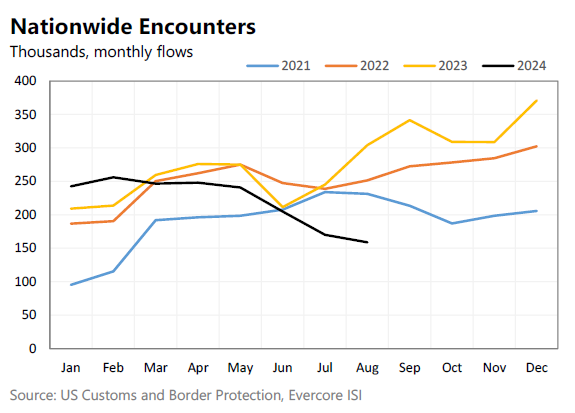

The sustainable US monthly payroll growth rate has likely already come down thanks to a shift in policies over immigration, and a steep decline is in store for 2025 after Donald Trump becomes president again, according to economists at Evercore ISI. Earlier this year, the group estimated the rate at around 200,000 — which about matches the first-half average, and helps explain US economic resilience in the wake of sharp Fed rate hikes. A mid-year Biden administration crackdown on asylum claims has contributed to a reduction in the sustainable rate to possibly 170,000, Evercore ISI says. "We estimate Trump immigration policy will lower the sustainable rate of payrolls towards 60-70,000 or a bit higher" by the second half of next year, Evercore economists including Marco Casiraghi wrote in a note Thursday. "Taking into account realistic deportations, the overall impact of Trump 2.0 immigration policy will turn net inflows negative." |

No comments:

Post a Comment