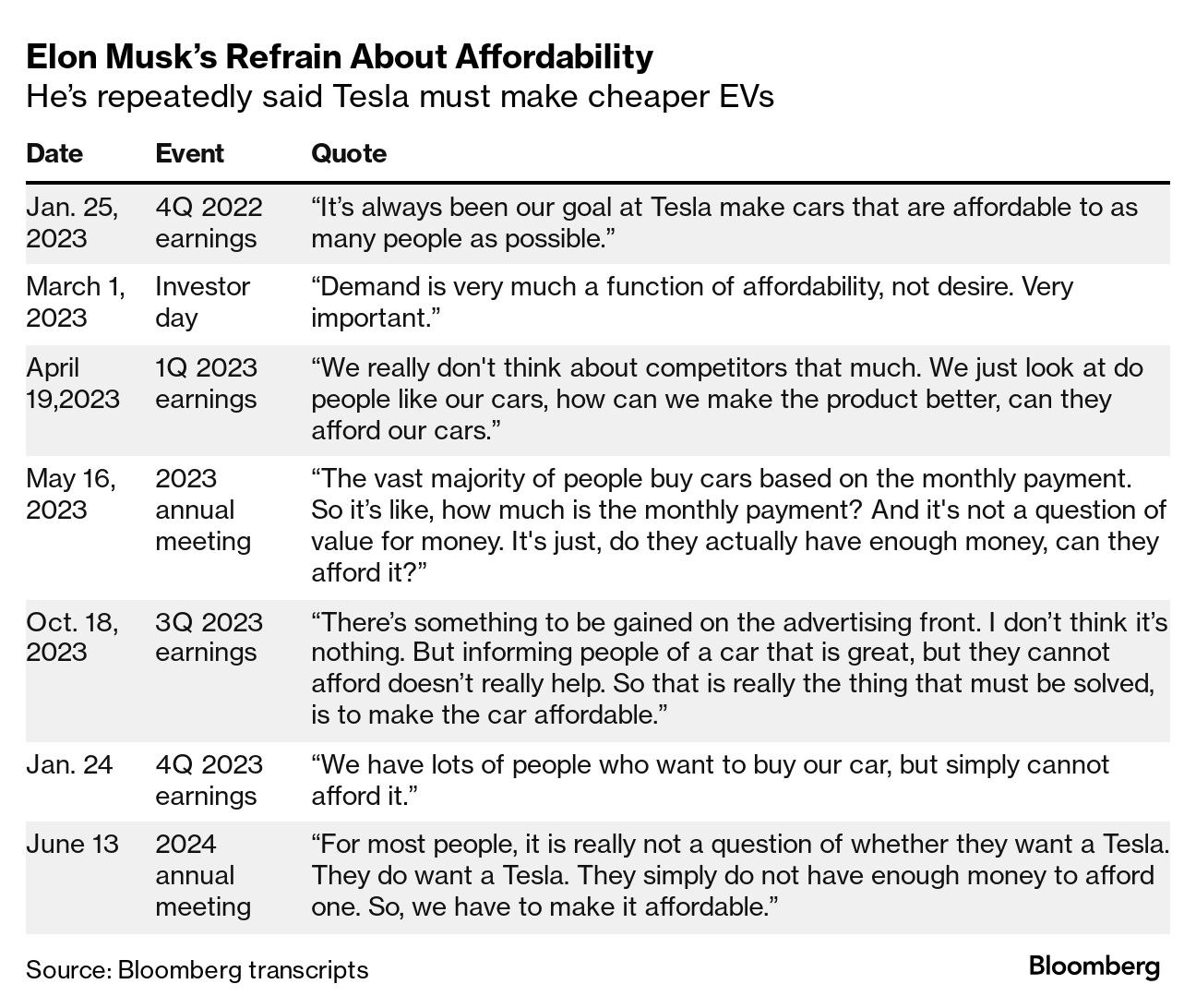

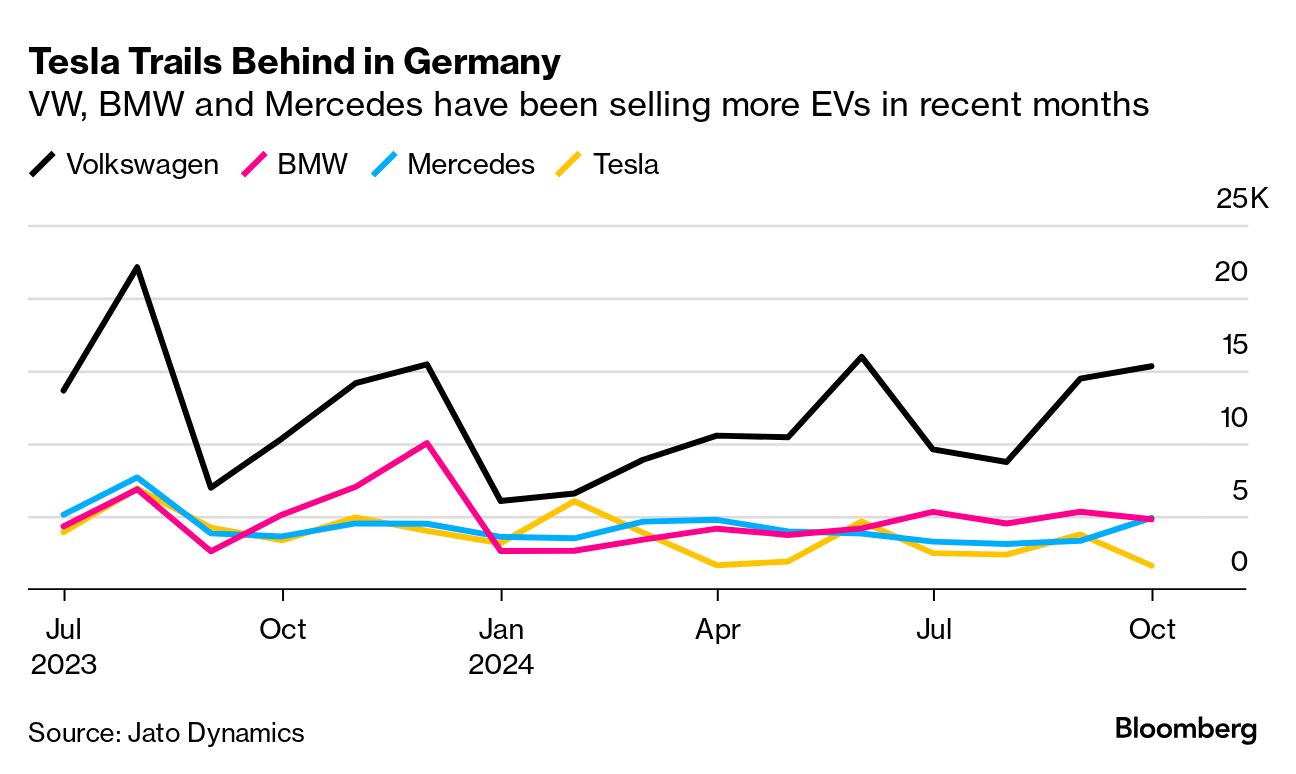

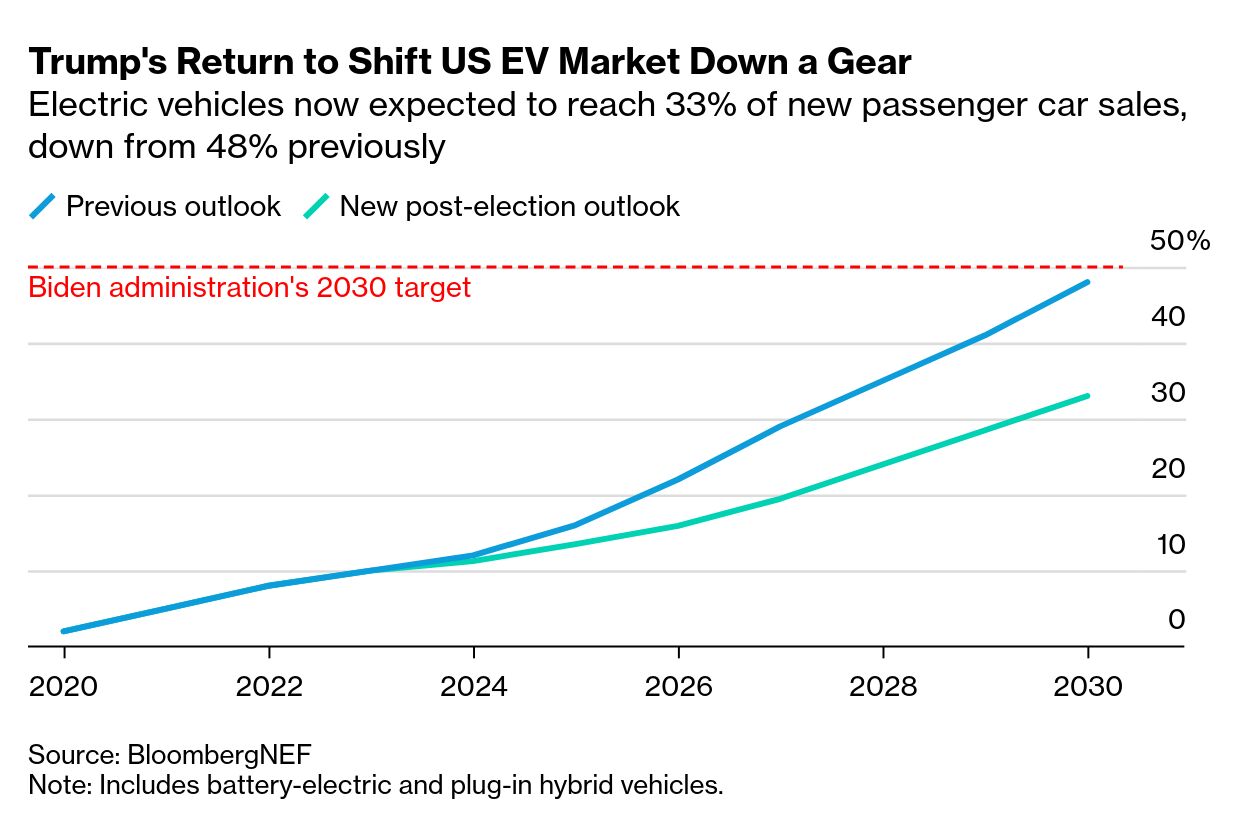

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Does Tesla believe in its own mission anymore? Elon Musk's many staunch supporters will surely recoil at the mere suggestion this question could be up for legitimate debate. But one must wonder how the world's leading electric-car maker, whose stated objective is to accelerate the transition to sustainable energy, could possibly get behind eliminating a $7,500 incentive that supports consumers purchasing EVs. Tesla did, after all, offer a ringing endorsement of this federal tax credit and the Inflation Reduction Act shortly after President Joe Biden signed it into law two years ago. "We want to use this to accelerate sustainable energy, which is our mission and also the goal of this bill," Zachary Kirkhorn, Tesla's chief financial officer at the time, said on a January 2023 earnings call. That was then. Now, Tesla is having to contort itself to stay onside of its CEO, whose political lurch to the right has only exacerbated an extreme self-consciousness about a hard truth: Musk's most valuable company would not have survived its tumultuous early years without government support.  Musk jumping on stage at an America PAC event last month in Oaks, Pennsylvania. Photographer: Ryan Collerd/AFP via Getty Images After Reuters reported Thursday that President-elect Donald Trump's transition team was planning to kill the EV purchase credit as part of broader tax-reform legislation — and that Tesla representatives had expressed support — Musk wrote on X that he believes all government subsidies should end, including those for oil and gas. Musk has said this before. When he made an appearance at a Wall Street Journal conference in December 2021, Teslas were no longer eligible for EV tax credits because the company had already reached its limit. When asked if his position against plug-in car subsidies had anything to do with the effect that removing them would have on Tesla's competitors — most of which hadn't yet hit their limit — Musk replied: "Maybe they need it, I don't know." But if Musk didn't want EV tax credits, he had a funny way of showing it. One of the criteria for plug-in cars to qualify for the IRA's purchase credit is that manufacturers must offer EVs below certain retail prices. In the course of just nine months last year, Tesla slashed what it charged for the Model X by $41,000 to make the SUV eligible for the full $7,500 perk from Uncle Sam. Tesla also took advantage of a temporary opening in tax credit rulemaking to stock up on $2.5 billion worth of cheaper Chinese batteries, then switched up its sourcing strategy to make all versions of the Model 3 sedan eligible for the full tax credit. All that angling for subsidies that Musk had suggested Tesla didn't need isn't the only way he's contradicting himself. Time and again in the last two years, he's emphasized how hard Tesla works to make its vehicles affordable for consumers. "It's like Game of Thrones, but pennies," he said on an earnings call last month, evoking the notoriously violent HBO series to describe how relentless Tesla is about slashing little bits of cost out of thousands of car components. Musk is now apparently willing to undermine all that work, to the tune of $7,500 per car purchased by a huge portion of his customers. Tesla derived half its revenue in the first nine months of this year from the US. When asked in July if a potential repeal of the IRA would negatively affect Tesla's profitability, Musk projected confidence. "I guess that there would be like some impact, but I think it would be devastating for our competitors, and it would hurt Tesla slightly," he said. Musk even suggested IRA going away actually end up helping the company in the long term, though he didn't elaborate on how. Those comments likely fed into some analysts offering similarly tenuous takes after last week's election result. "We believe a Trump presidency would be an overall negative for the EV industry, as likely the EV rebates/tax incentives get pulled, however for Tesla we see this as a huge positive," Wedbush Securities analyst Daniel Ives wrote in a Nov. 6 note. "Tesla has the scale and scope that is unmatched in the EV industry, and this dynamic could give Musk and Tesla a clear competitive advantage." There's a problem with this line of thinking: We've seen governments cut EV incentives in other markets where Tesla competes over the last year or so, and Musk's company hasn't been immune from the fallout. Take Germany, for example. Volkswagen, BMW and Mercedes-Benz all felt ill effects from Berlin paring back subsidies in the second half of the year, but each of the three have been consistently outselling Tesla in their home market the last few months. The US will be a different story, as Tesla is operating from a far stronger starting position. But let's not pretend this is some Sun Tzu-like move where Musk will outflank his competitors. If Trump follows through on his promises to gut plug-in friendly promises, it will hurt Tesla, and more importantly, its stated mission.  Trump and Musk at a campaign event last month in Butler, Pennsylvania. Photographer: Alex Brandon/AP By helping bankroll Donald Trump's campaign, Elon Musk has gained unprecedented power. His new role as the arbiter of government efficiency opens up glaring conflicts of interest, allowing him to potentially reap huge rewards for his companies while sidelining rivals. Now that Republicans have secured all three branches of government, US electric vehicle adoption is poised to slow significantly. With fuel-economy standards on the chopping block and tax credits from the Inflation Reduction Act looking vulnerable, BloombergNEF sees EVs reaching only a third of the country's passenger-car sales by the end of the decade, down from 48% previously. |

No comments:

Post a Comment