| Hi, it's Natalie in New York. With rideshare and delivery apps becoming commonplace for more US consumers, the companies behind these popular services think they can win your loyalty and grow even bigger if they work with one another. But first... Three things you need to know today: • SpaceX scrapped its land deal with Texas to expand the company's Starship rocket operations

• Applied Materials' forecast sounded a discouraging note about chip spending

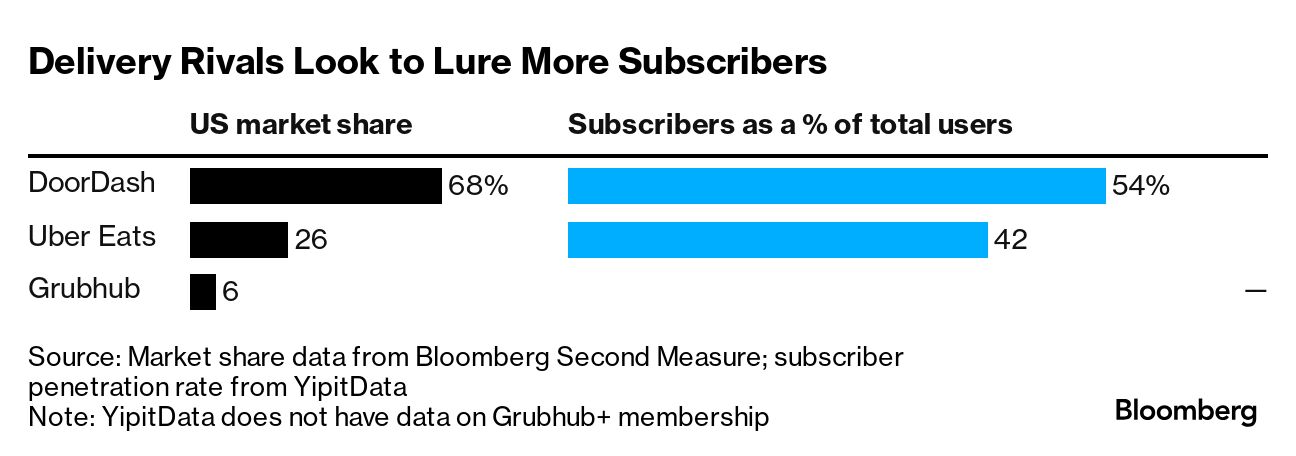

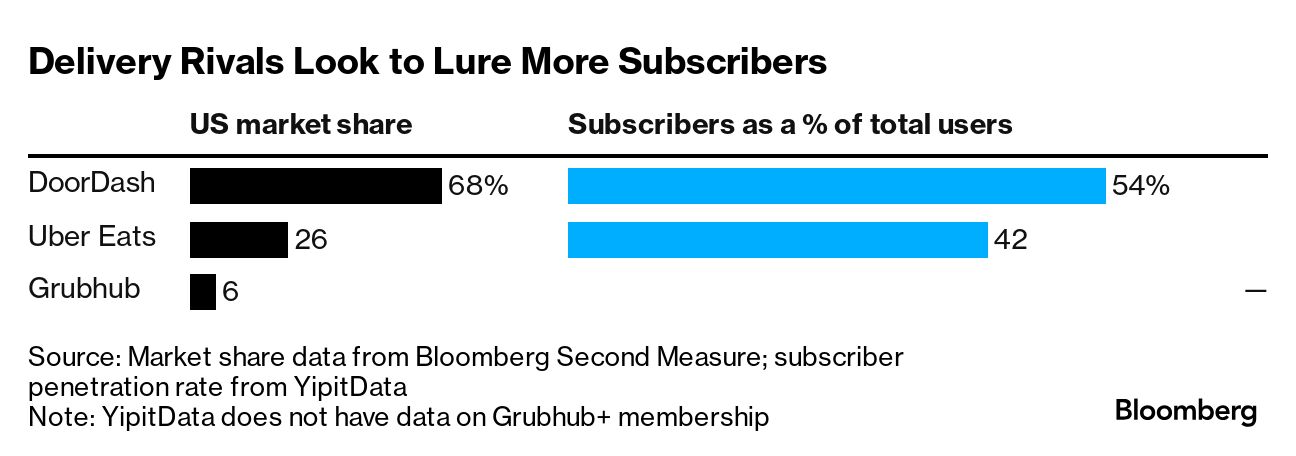

• Palantir's rise is defying increasingly skeptical Wall Street analysts DoorDash Inc. Chief Executive Officer Tony Xu has spent the past 11 years building the company that now owns more than two-thirds of the food delivery market in the US, far exceeding Uber Eats (26%) and Grubhub (6%). The app also has a loyal user base, with more than half of DoorDash users owning a DashPass subscription, according to YipitData. More importantly, for investors, the company finally became profitable from its operations in the third quarter this year. But Xu says building out the product is only 80% of the work to keep the company successful. The rest will come from external partnerships, a strategy that his gig economy peers, including Uber Technologies Inc., the biggest company in the industry, have also increasingly leaned on as they seek new avenues of growth. The latest effort to boost paid subscriptions is DoorDash's partnership with Lyft Inc. announced last month. The tie-up is an example of two brands tapping into each other's customer base to boost engagement without having to merge or make an acquisition. Uber has a restaurant-delivery partnership with Instacart, while Amazon.com Inc's Prime membership offers a Grubhub subscription perk. After spending about a decade offering habit-forming services —whether it's hopping into a stranger's car instead of hailing a taxi, or opening a door to someone who picked up a restaurant meal and a bottle of wine from the deli down the block — these companies now have a clearer understanding of the competitive landscape. Even as diners returned to restaurants in the post-pandemic era, take-out has become such an ingrained habit that companies know getting customers into a subscription will mean more dollars and time spent on their apps.  So now it's about finding partners strategically to build a larger system and lock in a more diverse pool of customers. Lyft CEO David Risher had earlier this year rejected the idea of his company offering food delivery on its own because that would keep people at home and exacerbate the loneliness epidemic. But he sees value in joining with the largest food delivery app because it gives millions of DoorDash members "a reason to prefer Lyft" for their rides and provides Lyft a way to compete better with Uber, which offers rideshare and delivery. For DoorDash, which launched its membership in 2018, three years earlier than Uber, the deal offers customers Lyft discounts in addition to the existing benefit of free access to the ad-tier version of the Max streaming service. DoorDash is also getting new customers through an expanded partnership that offers certain Chase card holders a free subscription and discounted orders. These external perks have helped it maintain a lead on user penetration over the Uber One subscription. (As of September, 42% of Uber Eats users were subscribers, per YipitData. That percentage is lower if all users including rideshare customers are counted.) Keeping subscribers isn't easy, however. According to Bloomberg Second Measure data, only 35% of annual DashPass subscribers who made their first membership purchase in September 2023 were retained after a year. Annual subscriptions to Instacart+ show similar numbers with a 32% retention rate. (These figures do not include free trials and free subscriptions through credit card or other partnerships.) The real challenge will be finding creative ways to retain paying users, or at least keep them in the ecosystem so it's not as costly to acquire them again. DoorDash Chief Financial Officer Ravi Inukonda said the data doesn't reflect how membership really works. The company has increased the flexibility it gives to accommodate consumers' lifestyles with monthly, annual and student plans. "If you're traveling with young kids, or you're traveling in the summer and you want to put the program on hold, that's completely OK with us," he said. These people who churn off the membership program are not leaving DoorDash, Inukonda said. And the company is confident in earning their membership back through offering more benefits in the future, as well as through the core product delivery service, which includes not just restaurant takeout, but also alcohol, grocery, makeup and even mattress deliveries. "If you did a bad job with the delivery, all the other benefits are not that attractive," he said. "The core value proposition is: Did you have a great experience across selection, quality and affordability using the underlying product? Are you using us for restaurants and other categories? That is what is going to differentiate us." After all, partners won't matter if the main product isn't drawing members. Case in point: Grubhub hasn't been able to reverse a streak of losses in orders and users, ceding market share to DoorDash and Uber even as it has been offering free food delivery to hundreds of millions of Amazon Prime members since 2022. That is one of the reasons parent company Just Eat Takeaway.com NV announced this week it will be selling Grubhub to startup Wonder Group for $650 million, a steep discount to the $7.3 billion price tag at its peak during the pandemic.—Natalie Lung Amazon is under scrutiny from Congress over its partnership with popular video app TikTok. Representatives of the e-commerce company were called to Capital Hill for a meeting with the House Select Committee on China to discuss its relationship with TikTok, which is owned by China-based ByteDance Ltd. ByteDance faces a January deadline to sell the app or have it banned in the US under bipartisan legislation approved earlier this year. Squid Game returns to Netflix as the streaming service flexes its global marketing muscles. Thomas Kurtz, co-creator of the computer language Basic, dies at age 96. A bankruptcy judge isn't ready to approve the purchase of Alex Jones' Infowars website by the satirical news site The Onion. |

No comments:

Post a Comment