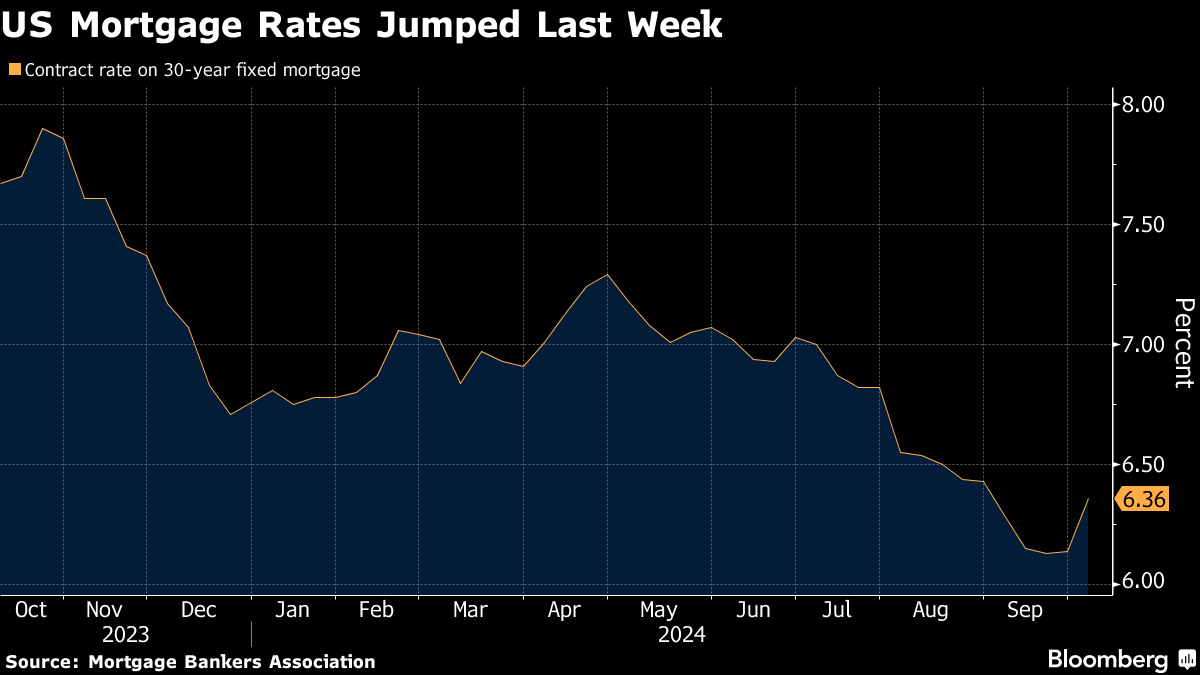

| If you feel stuck in your career right now, you're in good company — economists say the labor market's current trends leave aspirational professionals vulnerable to stagnation. Thankfully, there are strategies you can deploy to tackle it head on. First, the facts. Big picture, America's employment situation looks pretty good right now. Yes, jobless claims are up. But last week's jobs report blew past expectations. The unemployment rate fell. Wages are up. Layoffs remain low. Yet all you have to do is walk over to the watercooler to hear gripes about raises, promotions and even boredom. According to data from LinkedIn, 43% of professionals in the US feel stuck in their careers right now. Part of this is tied to where hiring is happening: it's been concentrated in industries like hospitality, health care and government, rather than more traditionally white-collar fields, says Daniel Zhao, lead economist at Glassdoor. "When we look at some of these sectors like professional and business services or information, the hiring rates are comparable to what we had seen back in 2013 or 2014 when the economy was much weaker," says Zhao. That can translate into workers feeling stuck. While their current roles may no longer fit their needs or aspirations, they feel forced to stay in them because there aren't better options on the market. In fact, the so-called quits rate, which measures the percentage of people voluntarily leaving their jobs each month, fell to the lowest since June 2020. This suggests workers are less confident in their ability to find a new position than they were at the height of the pandemic. "We have seen firms turn inward and focus more on internal mobility because of the fact that there are not as many people going out," says Kory Kantenga, head of economics for the Americas at LinkedIn. He notes that this is particularly true for professional services, where more expense-conscious firms have been relying on moving and reorganizing staff they already have, rather than recruiting from the outside. Fewer hires, fewer quits, more internal mobility. That's a bad combination for strivers seeking better jobs. But Melody Wilding, author of the forthcoming book Managing Up says there is something you can do about it. It's called "job crafting." "You turn the job you have right now into more of the job you want," she says. Ironically, Wilding notes that when things are in flux — firms reorganizing, relying on internal mobility — employees may actually have more flexibility to change their roles. The key is not just going to your boss and saying you want a change because it would be more interesting or fun. It's important to show how a shift in your position could provide more value to the company. Some of Wilding's clients are working on what she calls "project prioritization trackers." They are noting everything they are working on and rating projects based on how they contribute to important performance metrics. They will present these trackers to their managers as rationale for reconfiguring their jobs. Timing is key. There are roughly 12 weeks left in 2024. Often, firms finalize decisions about moves, pay, and even layoffs in this quarter as profitability crystallizes and the new year arrives. Even if you've had a great year, one of the most important things you can do right now if you're gunning for a raise or a promotion is to show up and deliver, says Dan Kaplan, a senior client partner for Korn Ferry's global chief human resources officers practice. Sealing the deal is a bit like watching a marathon, he says. People tend to tune in at the beginning, maybe tune out a bit in the middle, and then focus in on the ending. "You want to make that last mile count," he says. — Charlie Wells P.S. I like answering your biggest financial questions. If you have an issue you'd like me to look into, drop me a line at bbgwealth@bloomberg.net I know a lot of you either live in the path of the storm or may be affected. Hoping you are safe and well. Here is our latest hurricane coverage: Alphabet shares are down some 2.5% from a week ago. In a court filing Tuesday, the US Justice Department made clear it is considering asking a federal judge to force Google to sell off parts of its business. That would be a historic breakup of one of the world's biggest tech companies. Nearly half of hedge funds focused on traditional asset classes now have exposure to cryptocurrencies. Among hedge funds trading in traditional markets, 47% had exposure to digital assets, up from 29% in 2023 and 37% in 2022, according to the Global Crypto Hedge Fund Report published Thursday. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Larry Ellison gained $8.5 billion, bringing his net worth to $188.5 billion. The founder of Oracle got a boost from a share-price rise in the software company. Elon Musk lost $5.7 billion, taking his net worth down to $262.1 billion. Despite the drop, Musk is still the world's richest person. A large chunk of his wealth comes from shares in Tesla, down some 3.6% this week. US 30-Year Mortgage Rates Climbed by the Most in More Than a Year The contract rate on a 30-year mortgage increased 22 basis points to 6.36% in the week ended Oct. 4, according to Mortgage Bankers Association data out Wednesday. The rate now stands at the highest level since August. Mortgage rates tend to move in tandem with Treasury yields, which have been rising recently as last week's strong US jobs report prompted traders to sharply reduce bets on aggressive Federal Reserve interest-rate cuts. Boston Residents Face a 28% Tax Hike as Office Values Slump The hit could come if the Massachusetts legislature fails to sign off on a proposal to temporarily raise commercial rates before the end of next month, Mayor Michelle Wu said. The city is particularly vulnerable to the nationwide slump in office demand because of its heavy reliance on property tax revenue and state restrictions on its ability to tap other funding sources. This week, we're looking for people who have taken out loans to pay for cosmetic procedures. We are interested in hearing about what services you used and how you paid for them. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. Join us in New York on Oct. 16 as we bring together finance, government and business leaders from across various sectors to discuss advances in their fields and how they plan to sustain their leadership into the future. This year will mark the 12th anniversary of the Canada-focused event, continuing a tradition of providing timely, actionable insights and strategies for a global audience of leaders and decision-makers. Register here. |

No comments:

Post a Comment