| Christine Lagarde has a way with words. "We're breaking the neck of inflation," she said in the Slovenian capital of Ljubljana as she announced that the European Central Bank was cutting interest rates. "It's not broken completely yet, but we're getting there." She was responding to a question that made the analogy. Rather like "exorbitant privilege," the description applied by Valery Giscard d'Estaing to the dollar's status as a reserve currency, the phraseology might be inadvertently powerful due to a direct translation from French. But it's difficult to imagine her US counterpart Jerome Powell being quite so emphatic.

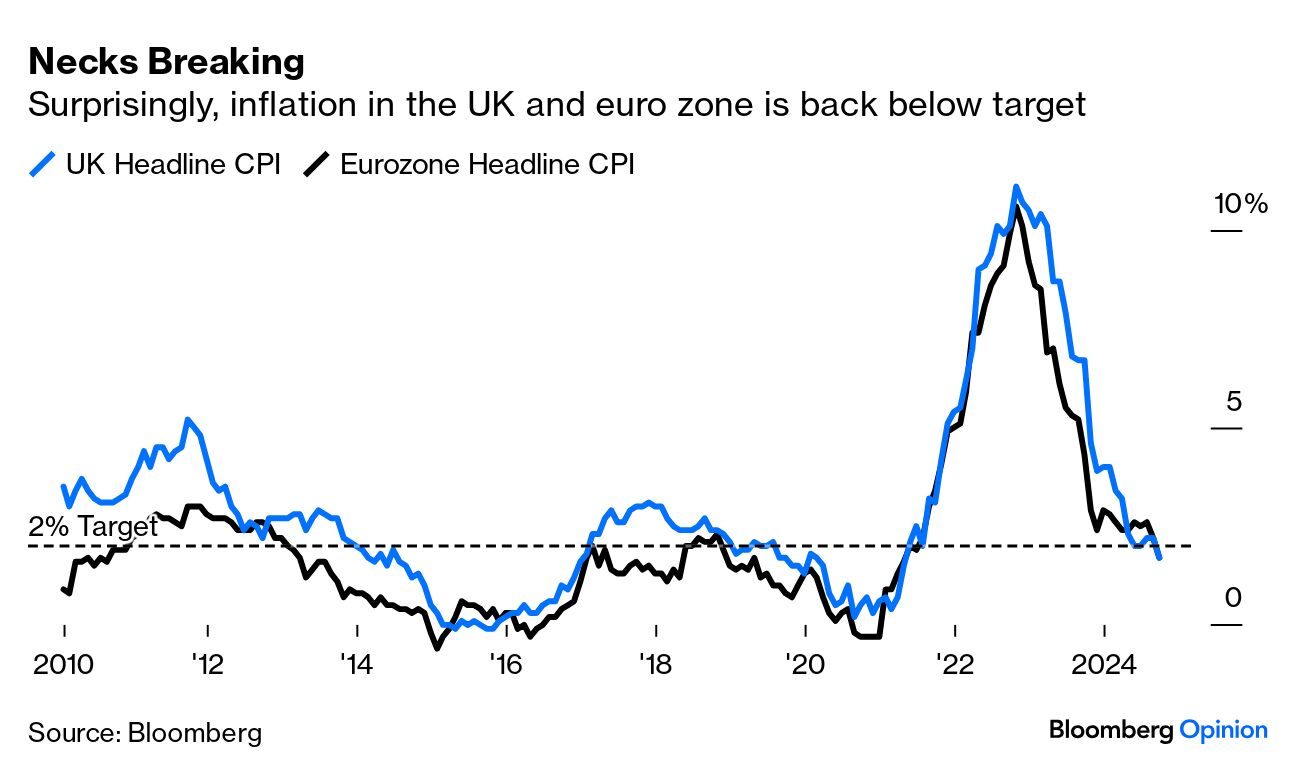

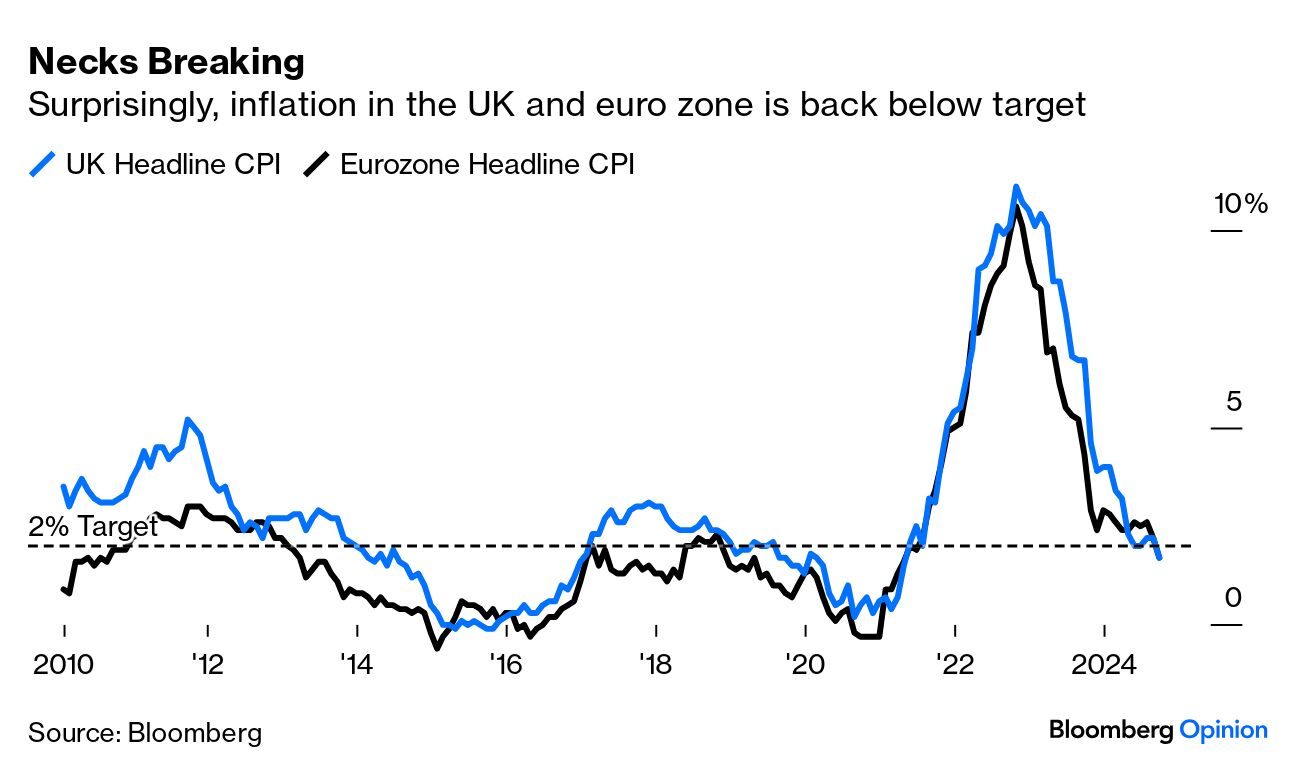

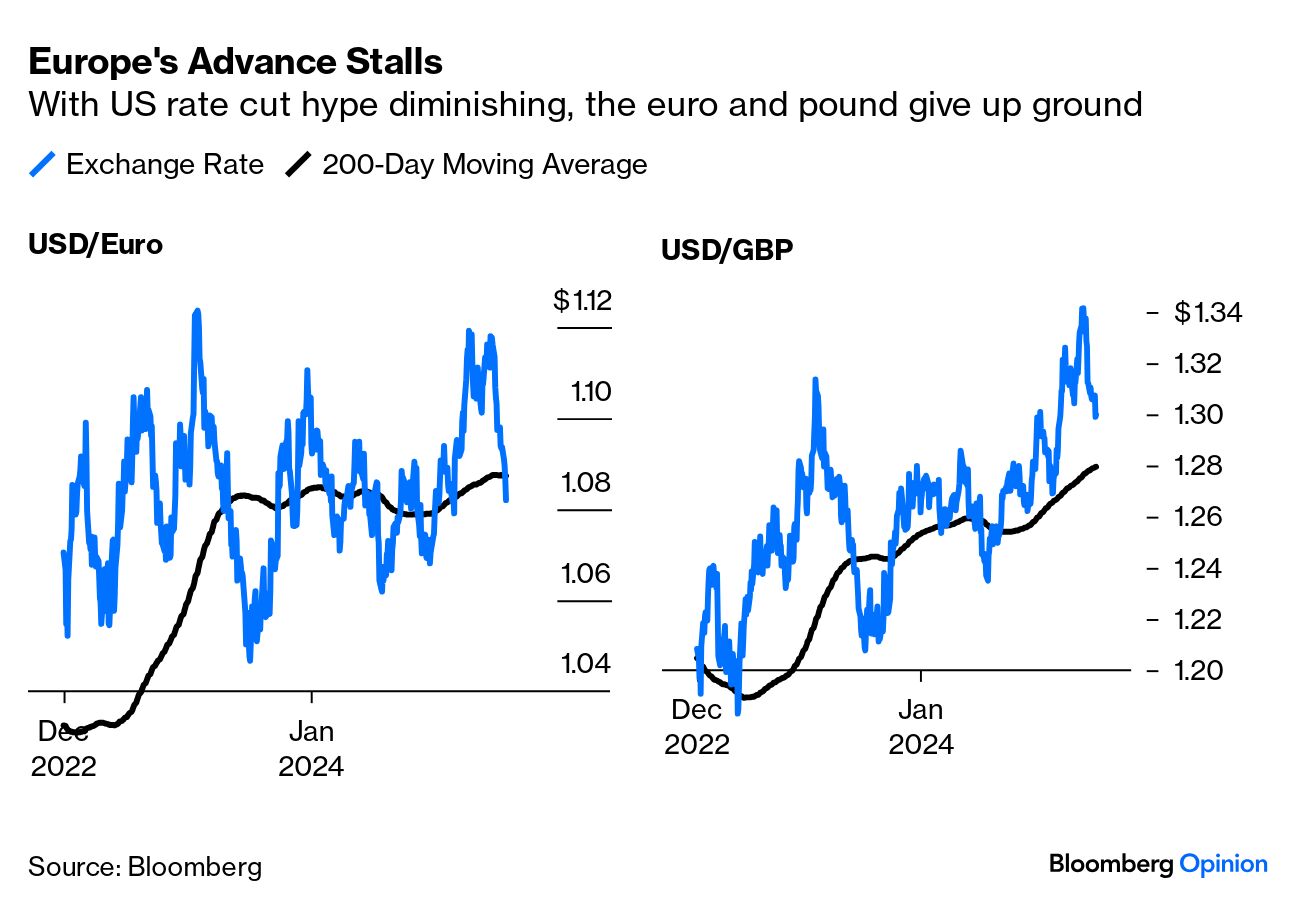

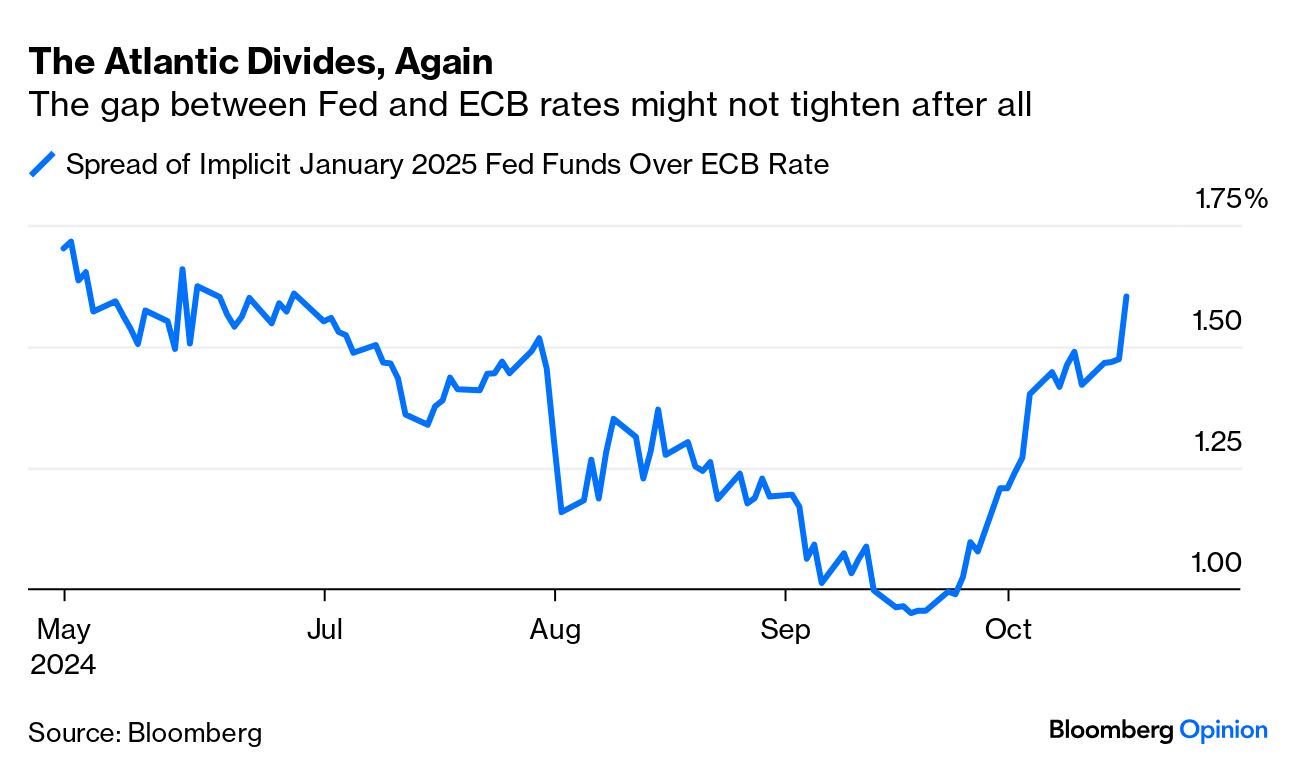

There is good reason for Europe's central bankers to take heart, because headline inflation in both the euro zone and the UK has — to much surprise — dropped in the last month below the official 2% target:  Lagarde was careful to talk down the significance of the headline rate, including food and fuel, dropping below 2%, but it plainly gives the ECB far more freedom to cut rates, while signs that European growth is stalling suggests that she and her colleagues might well want to do so. Currency markets certainly have that message, and the result is a new surge for the dollar, while the euro recedes below its 200-day moving average and sterling snaps back after a strong rally: Put this together with more surprisingly strong data from the US, where the consumer continues to be in rude health, and the biggest support for a weakening dollar is gone. This chart, drawn from the trusty Bloomberg World Interest Rate Probabilities function, shows the expected gap between the overnight rates of the Fed and ECB once they've completed their policy meetings in January. Europe's rates are lower. Less than a month ago, the gap was expected to tighten below a percentage point. Now it's back above 1.5%: This looks wholly reasonable and corrects what always looked to be a very strange market call. For now, the risk is that the neck of the euro might also be broken. The US election, with the possibility of a higher fiscal deficit prodding the Fed into raising rates, might easily widen this gap further. That might further strengthen the dollar. On which subject…

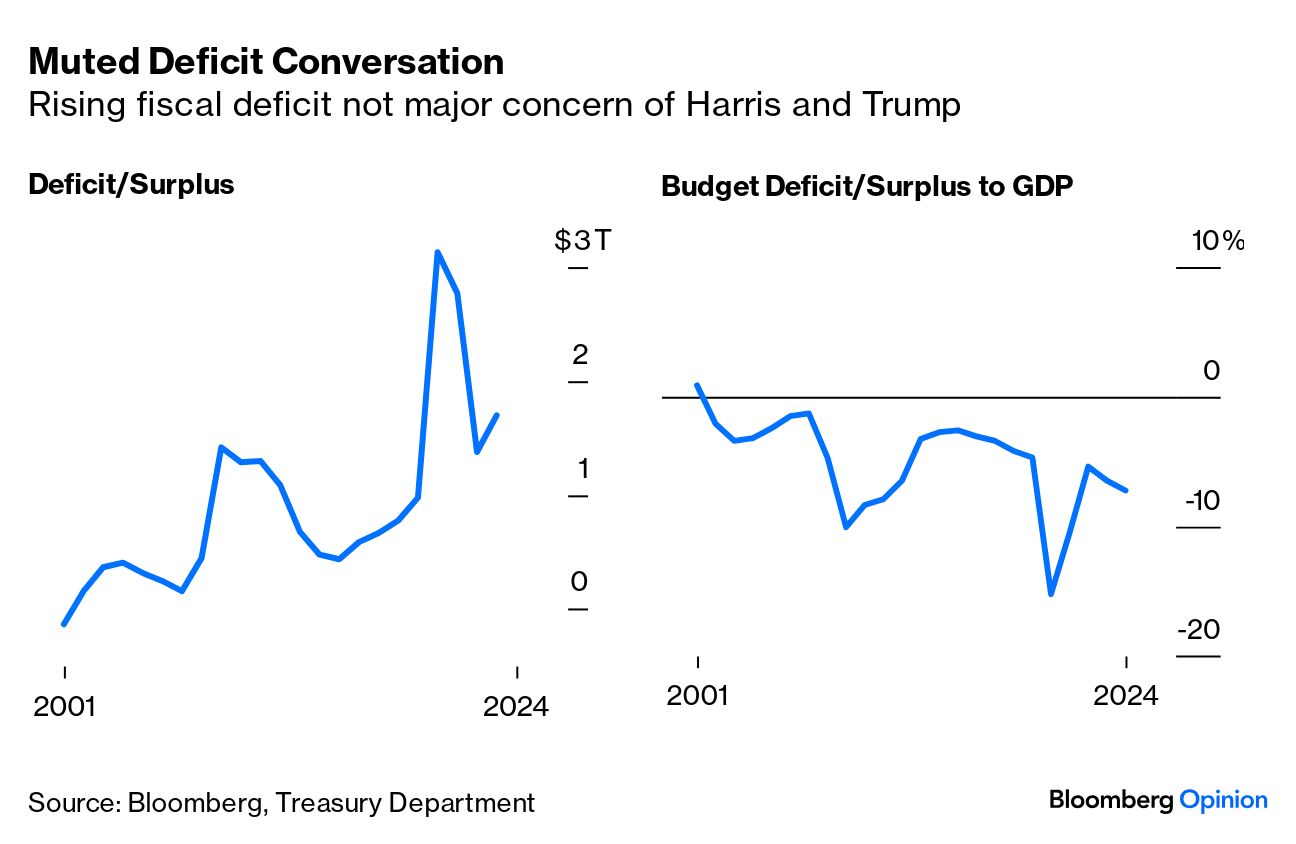

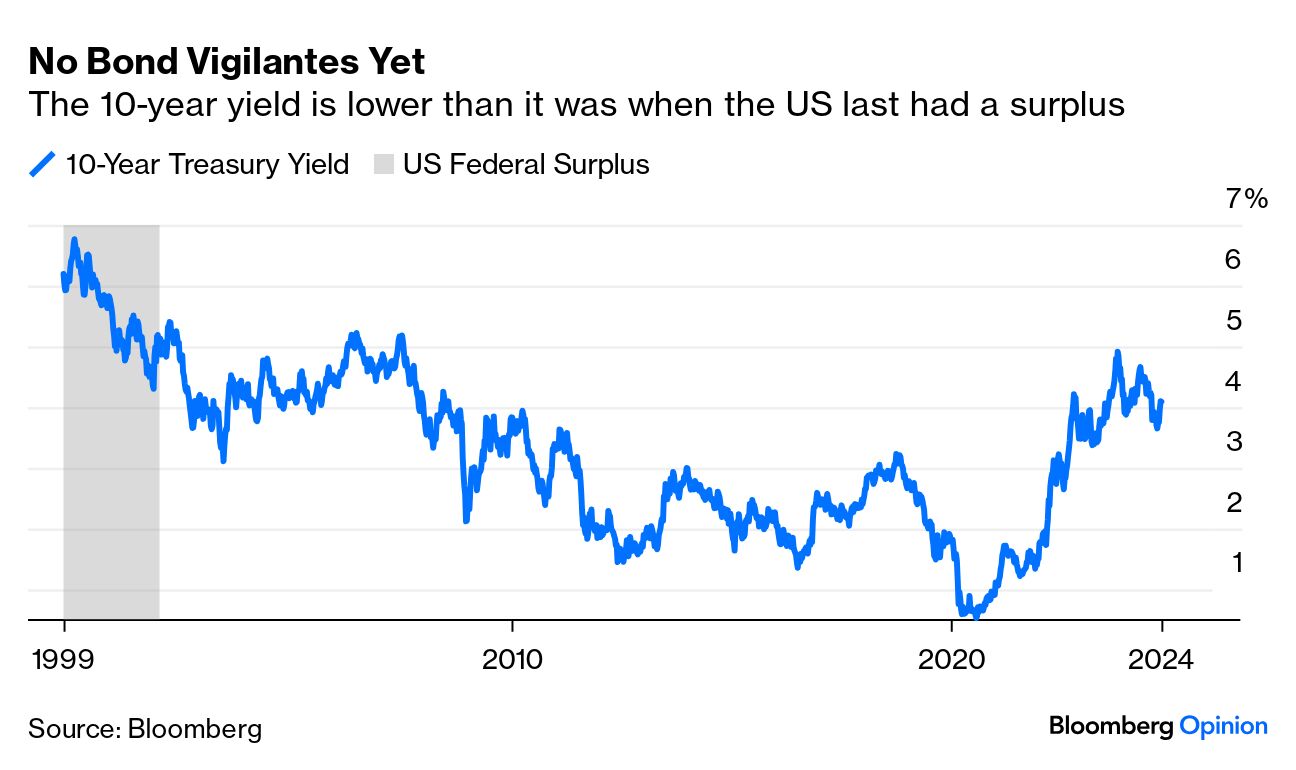

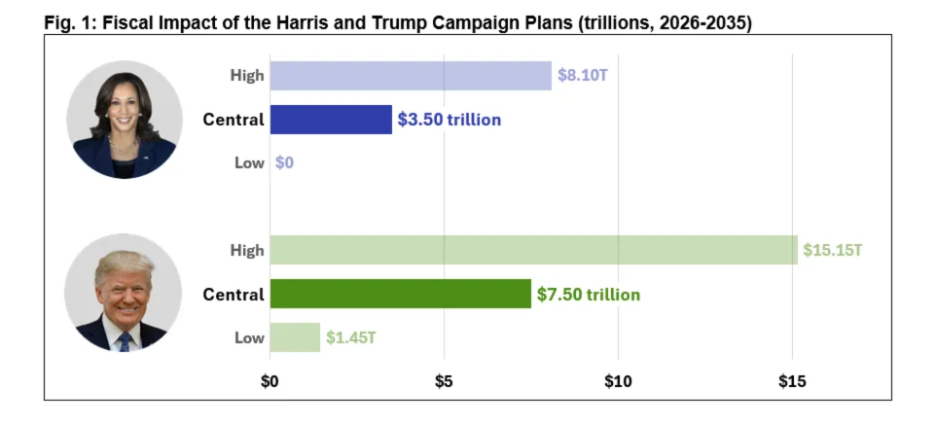

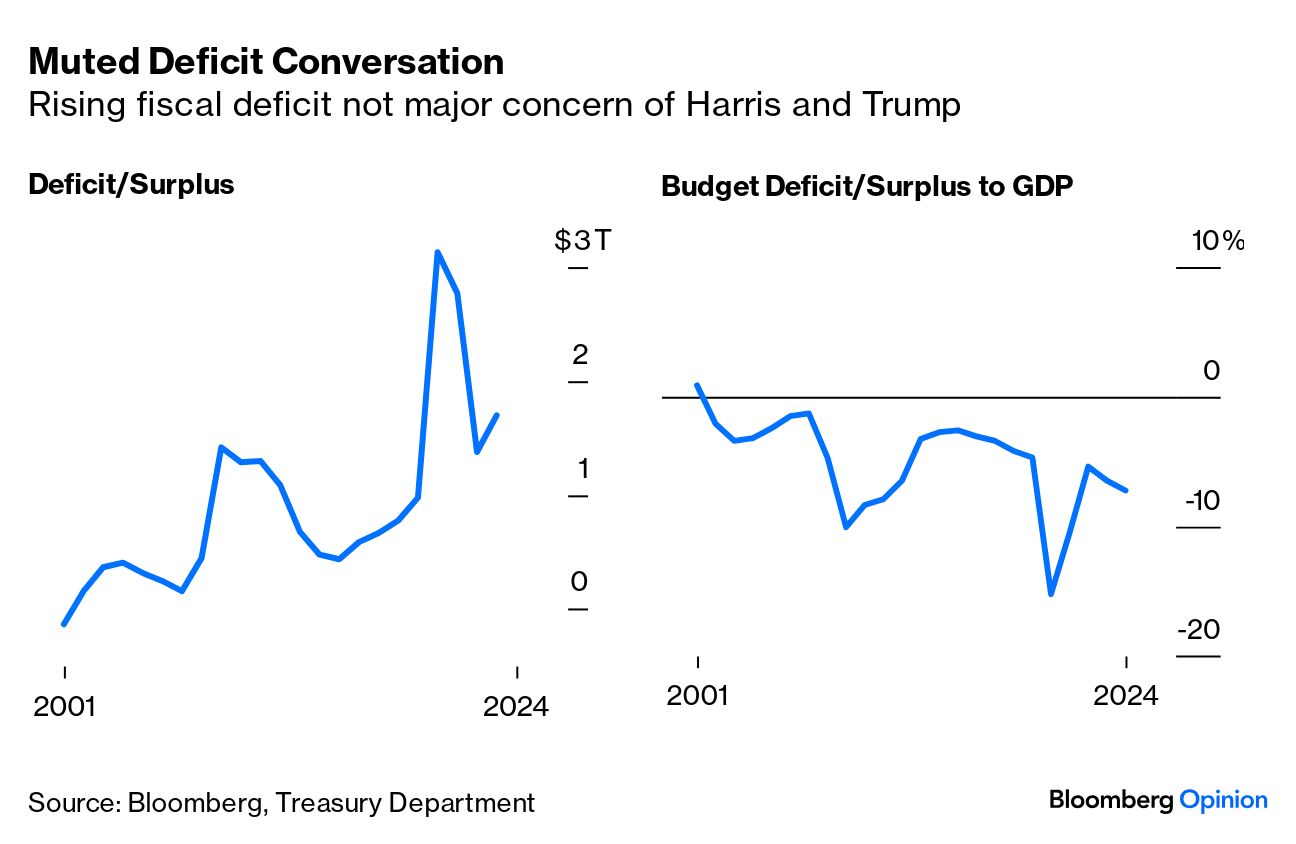

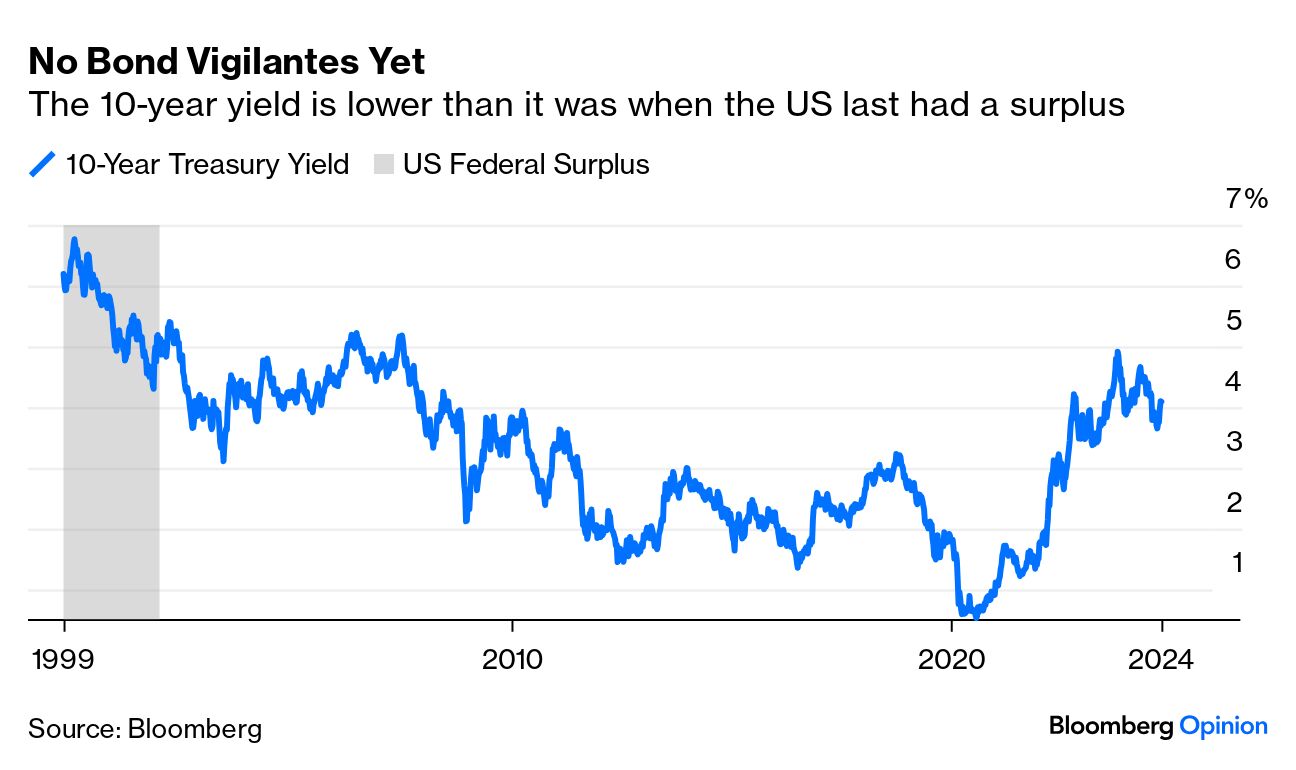

At $ 1.8 trillion (7.2% of gross domestic product), the US federal budget deficit is the third-highest in history. It's been 23 years since tax revenue exceeded money going out. The last surplus did not come by accident. It was engineered by a bipartisan approach under Bill Clinton's administration. Today, polarization makes such a venture not even a remote possibility. And yet the shortfall hardly gets a mention in the presidential campaign. September's debate was light on the issue, as both Kamala Harris and Donald Trump are campaigning on expensive programs that on their face would widen the deficit. The bipartisan Committee for a Responsible Federal Budget forecasts Harris' plan would increase the debt up to $8.1 trillion through 2035, compared to Trump's $15.15 trillion: The Congressional Budget Office's latest estimates show the national debt approaching $36 trillion. It's possible that the steady economic growth since the pandemic has come at a cost. When President Barack Obama left office, the deficit was about $700 billion, not adjusting for inflation. Even before the massive spending provoked by Covid-19 in 2020, there was little political commitment to narrow it:  Should Americans be concerned about this mounting debt? Definitely. Powell, the Federal Reserve chair, describes it as an "adult conversation" that elected officials need to have. Myriad reasons might justify a Clinton-style bipartisan approach. But it might require the intervention of bond vigilantes to make this happen. Incessant borrowing to fill the revenue shortfall should theoretically push up the interest rates that lenders demand. That means higher interest payments for the government (and hence for taxpayers), and also for corporations and individuals. But even if bond yields have been jolted out of their long-term declining trend in recent years, they remain lower than in 2001, when the US had a surplus. The much feared bond buyers' strike is still not happening:  What explains this? PGIM's Tom Porcelli argues that the US gets away with such an avalanche in new debt issuance due to what Giscard would have called "exorbitant privilege" — the dollar's position as the world's reserve currency: When you're the world's reserve currency, it's difficult for investors to walk away. That's the interesting push-pull in this whole debate that's going on about where yields should be on the back of a fiscal deficit that's deteriorating.

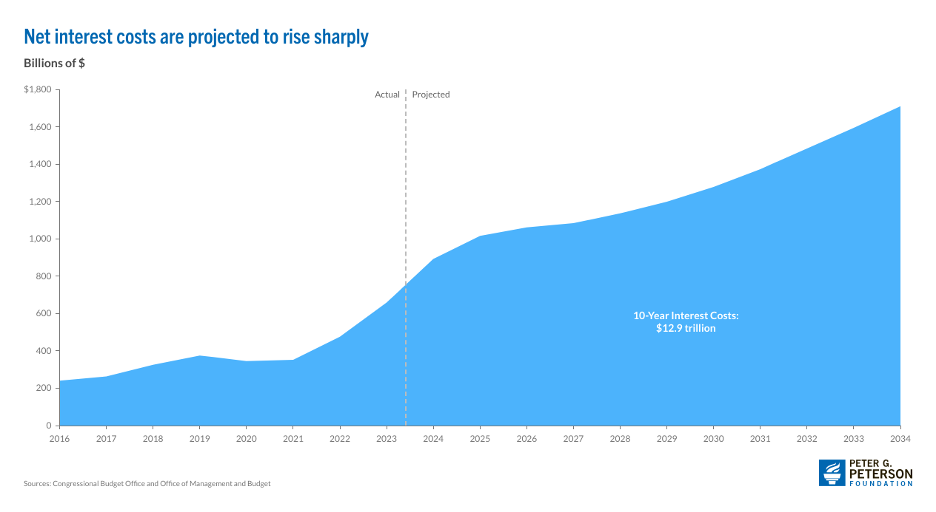

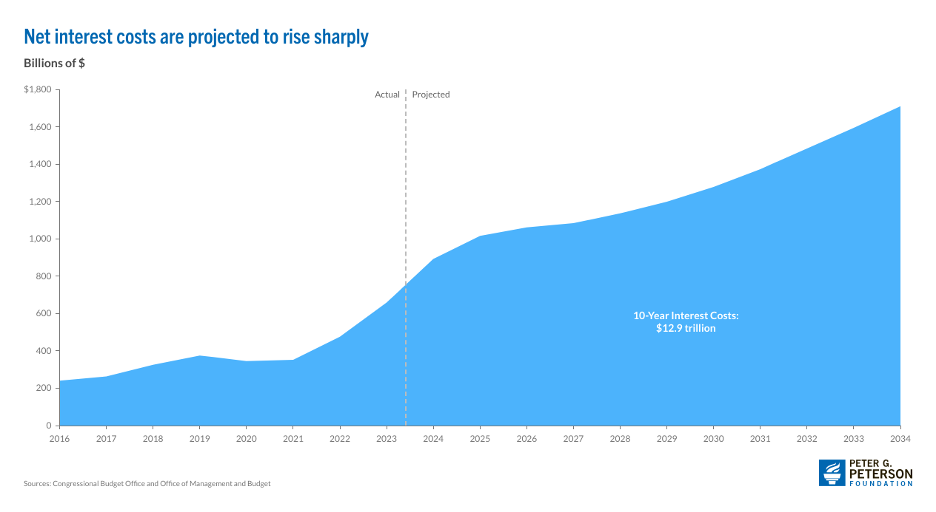

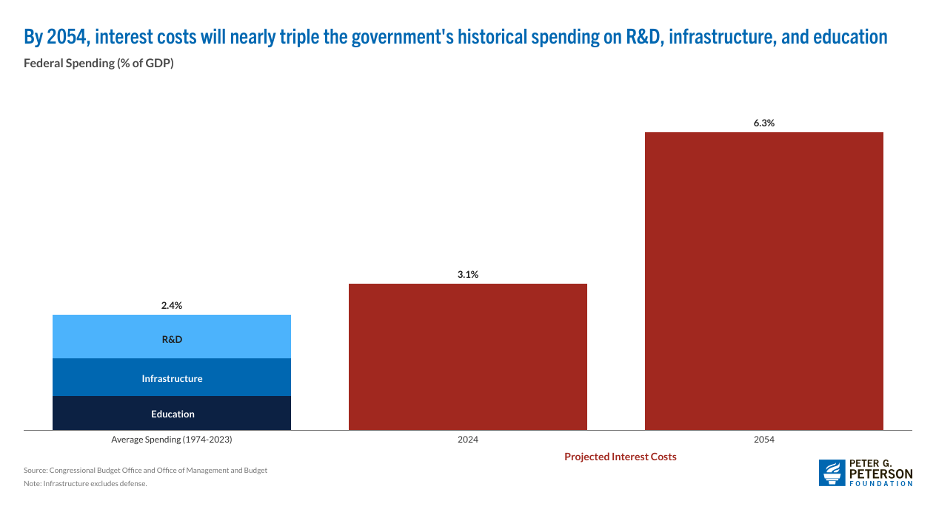

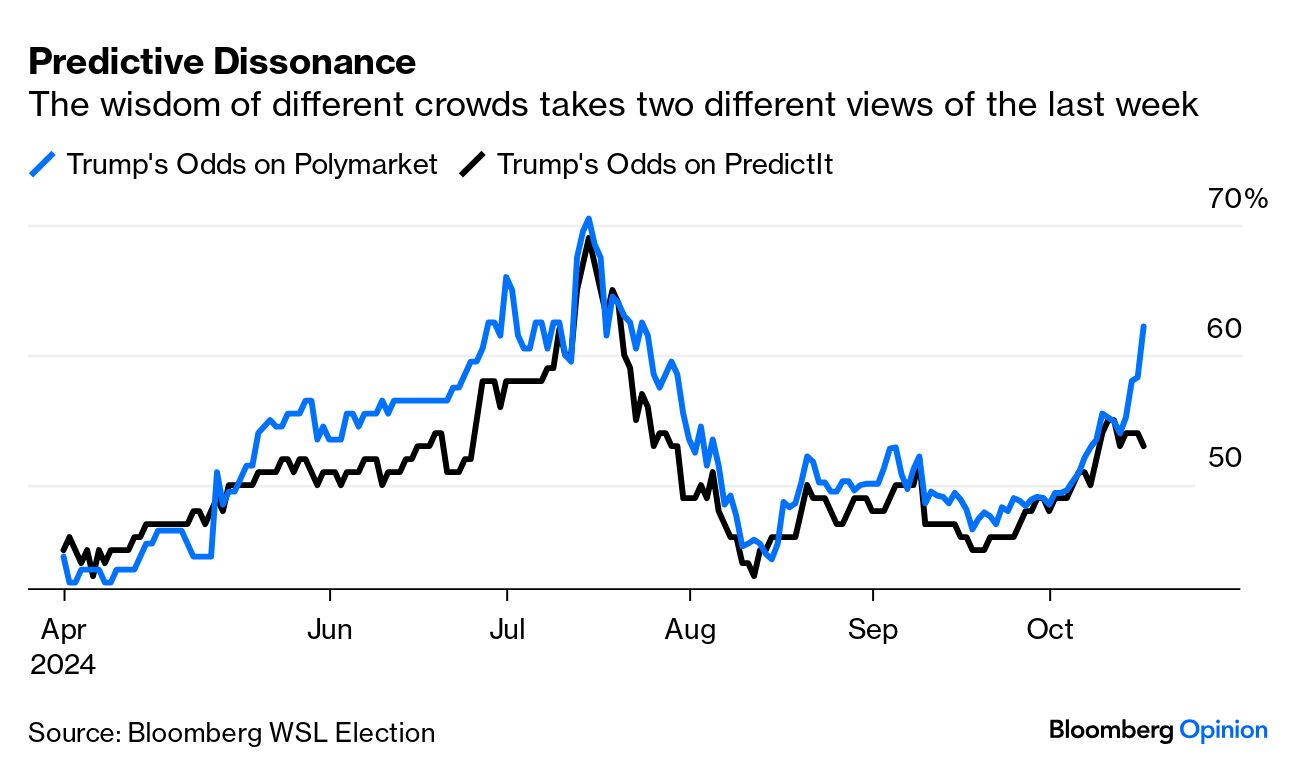

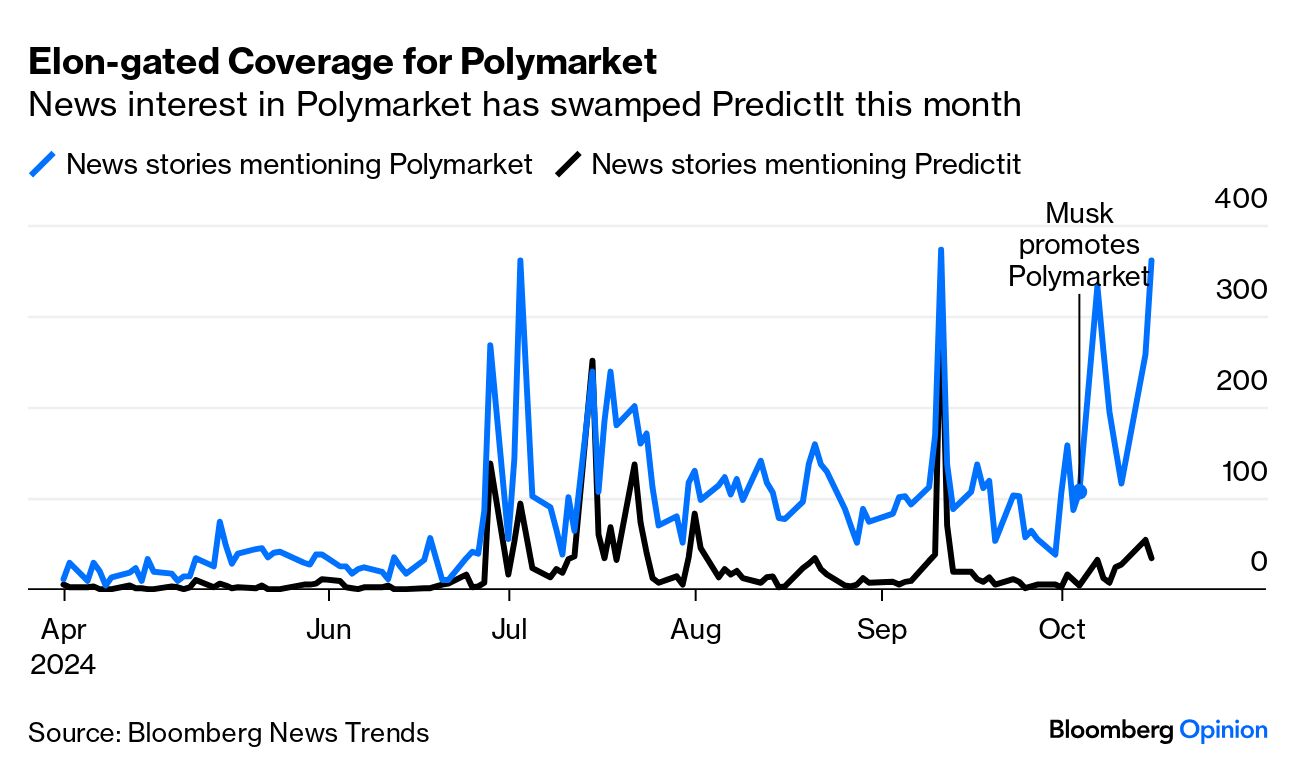

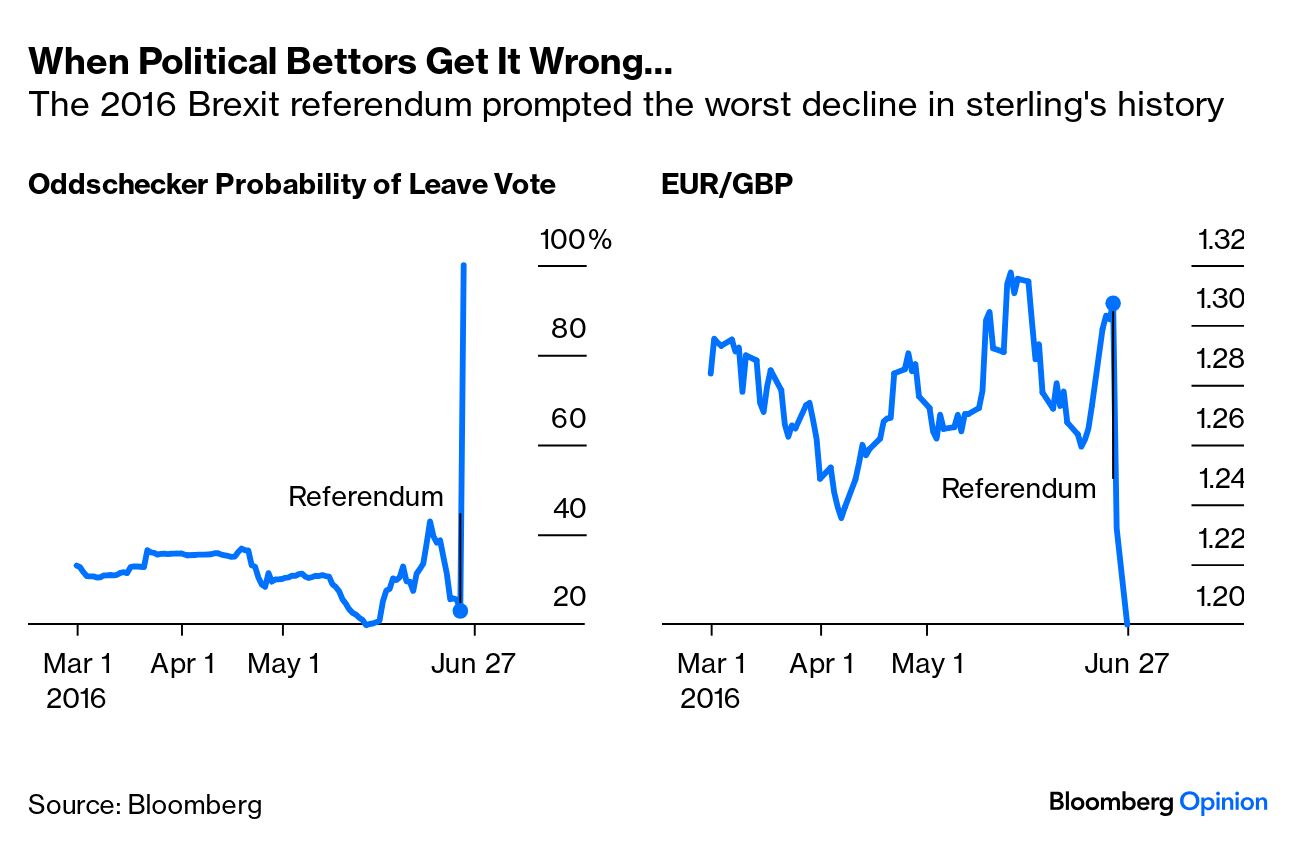

However, a strong relationship exists between fiscal deficits and inflation, as shown in this study by Michael Bordo and Mickey Levy. All else equal, the researchers concluded that bond-financed fiscal deficits, unbacked by future taxes, may have contributed to inflation. This lends credence to Powell's calls for fiscal authorities to get their house in order; otherwise, the Fed's fight could be in vain. While it's helpful that lower fed funds rates will reduce the interest burden, savings won't be great if revenues continue to lag expenditure. The annual net interest costs would total $892 billion in 2024 and almost double over the upcoming decade — rising to $1.7 trillion in 2034 from $1 trillion next year, according to the Congressional Budget Office. This assumes that short-term rates fall to 2.8% — which is contentious given the evidence that the neutral rate of interest is rising. The Peter G. Peterson Foundation notes that should interest rates turn out to be higher than that, costs would rise even faster than in its already alarming projection:  Rising interest bills may not be at the top of voters' minds compared to the more direct rates they pay for mortgages or auto loans. But more interest expense squeezes out government expenditure in other areas. It will hurt. Chilton Trust's Tim Horan explains that the individual feels far removed from defense spending and Federal Emergency Management Agency relief, concepts that seem beyond most people's lives and experience. The CBO's long-term projections forecast interest payments of about $78 trillion over the next 30 years — about 34% of all federal revenues by 2054. By 2051, interest costs would become the largest "program," surpassing Social Security. Empower's Marta Norton argues that such a substantial financial outlay is not a productive use of capital and "means that you can't necessarily spend dollars on other things." This Peterson Institute chart illustrates how costly debt servicing could be: So far, talk of potential pain from the "unsustainable" national debt is not in the near term. Norton says these are "hard conversations and the analysis is difficult… I've heard some folks say that maybe politicians won't tackle it until the market forces them to." Whether it's rationalizing Social Security and Medicare, or ramping up taxes, the inertia from both presidential candidates is understandable. So it might be time to remember the immortal words of Bill Clinton's political Svengali, James Carville, who said that he'd like to be reincarnated as the bond market: "You can intimidate everybody." Casting votes isn't going to solve the problem; dumping Treasuries just might. —Richard Abbey Here we go again. There's a perception in markets that the presidential race is swinging decisively toward Trump. That has profound implications for a range of asset classes. But polling averages continue to show a virtual dead heat (a narrow lead for Harris, but Trump outperformed the polls in 2016 and 2020), and there has been no obvious defining moment in the last few weeks. That raises the question of whether this is one of those times when the market affects perceptions of reality, rather than the other way around. Points of Return has covered the differences between Polymarket (with no position limits, making it more liquid but prone to intervention by whales) and PredictIt (an academic exercise where nobody can bet more than $850, which is less liquid but trickier to manipulate). Both see Trump's chances rising over the last three weeks. But in the last few days, they've parted company: It's possible that there's some kind of feedback loop at work here. The spike on Polymarket began after the Oct. 6 post by Elon Musk on X, which he owns, saying that Polymarket was more reliable than polls because real money was at stake. Since then, coverage for Polymarket has utterly swamped coverage for PredictIt, judging by the daily count of stories published on the Bloomberg terminal: It would be easy to dismiss this as a game, but the press interest suggests we shouldn't. To the extent that it creates a narrative that's wrong, it could cost people a lot. During the Brexit referendum, polls persistently showed a very tight race (and indeed the final result was close, with 52% voting to leave the EU against 48% wanting to stay), while various betting markets kept oddly confident that Remain would prevail. That led to an almighty shock on election night, with the pound suffering by far the biggest one-day decline in its history: After two successive elections involving Trump that came down to a few thousand votes in a few swing states, it would be foolish indeed to be as confident of any outcome as people apparently were about Brexit. But it does look as though the Polymarket odds are creating a narrative in the market that's much clearer cut than it should be. An investment banker shared with me this message from a client: I think Harris a bit underpriced — but — there is always a big data bias towards Trump on voting day These factors COULD easily swing it his way Together with big Musk endorsement Betting market has pretty much decided

One betting market has pretty much decided, yes; I'm not sure the others have. As usual with markets, the real opportunities to make money come when the consensus is wrong. If you think Harris still has a decent chance, be aware that buying Harris futures on Polymarket will yield a 162% profit if she wins (while the same bet on PredictIt will make you 108%). I'm not allowed to bet on these things, but those Harris odds on Polymarket sound really generous to me. If you want to bet on Trump, don't do it on Polymarket. It was 20 years ago today. The Red Sox were a run behind the Yankees entering the bottom of the ninth inning, facing 4-0 humiliation in the American League Championship Series. Then a succession of things happened that you can see in this video. It could so easily have been otherwise, but Dave Roberts (managing the Los Angeles Dodgers these days) narrowly evaded the glove of Derek Jeter to steal second base, and the Red Sox went on to win the game, the series, and the World Series that followed. It all hinged on the tiniest of margins. Let that be an inspiration for everyone. Do the small things right and good things could happen. With a very real risk that the Yanks will win the World Series this year, I think I will now watch this another 100 or so times. Enjoy the weekend everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment