| Donald Trump says "tariff" is his favorite word, campaigning on a bet that steep import taxes will force manufacturers to move factories to the US. The former president has also criticized the Inflation Reduction Act as a "scam" and the CHIPS and Science Act as a bad deal. That's created angst among the giant Asian firms that have already announced US investments as they worry a second Trump administration would impose tariffs and also rip up the Biden administration's tax breaks and subsidies that helped lure them. (Click here to read today's full story.) - US Election: Follow our coverage of the US presidential race here.

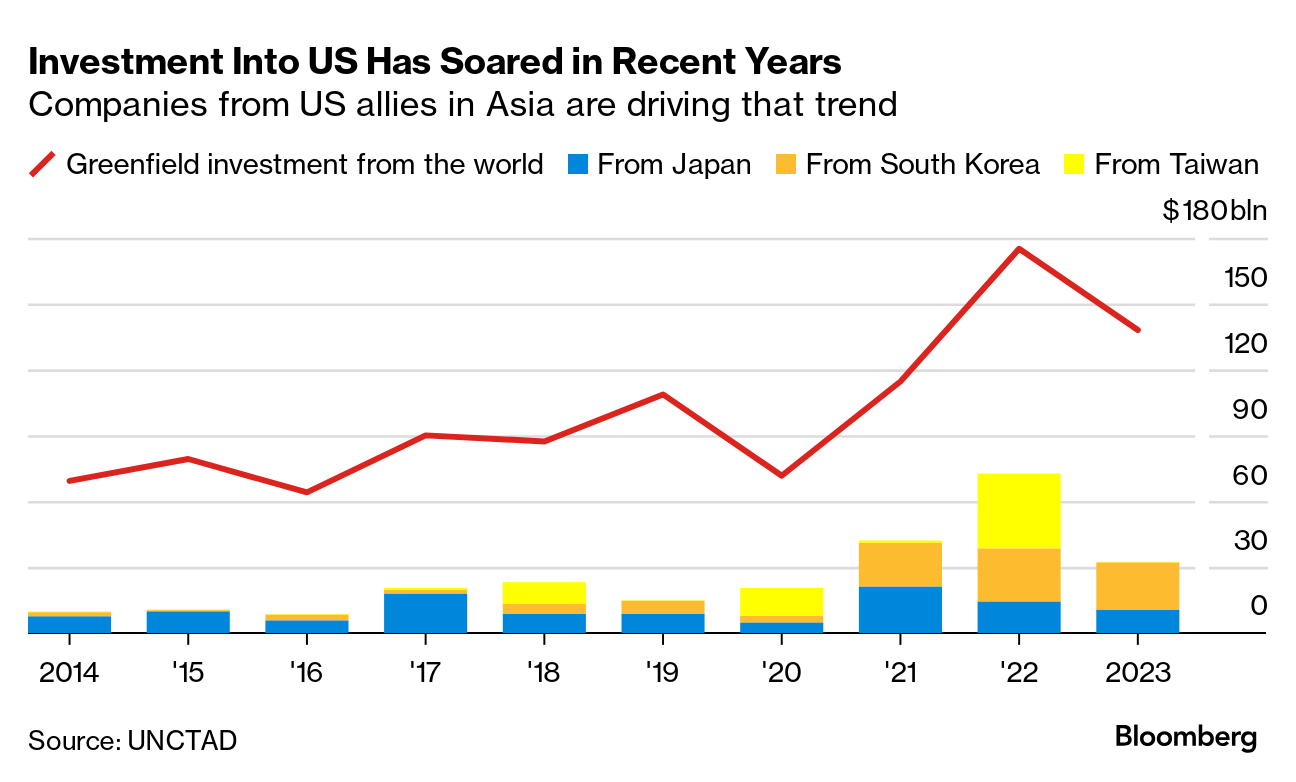

More than $110 billion in new greenfield investments into the US has been announced in each year since 2021, according to data from the UN Conference on Trade and Development. Leading the charge are the economies of East Asia, with a combined $147 billion from Japan, South Korea and Taiwan over those three years. Companies such as Toyota, Hyundai Motor, TSMC and Samsung Electronics are adding to their US footprint to take advantage of the strong economy and cash in on Biden's industrial incentives. Now, uncertainty surrounding the election is hanging over those plans. "Trump is a master of unpredictability" and abrupt actions are likely if he takes office, said Bill Reinsch, a senior adviser at the Center for Strategic and International Studies, a Washington-based think tank. Big Take: US Efforts to Contain Xi's Push for Tech Supremacy Are Faltering The Biden administration's IRA offers tax credits and other incentives for the production of electric vehicles, renewable energy, sustainable aviation fuel and hydrogen. Trump described the policy as the "Green New Scam" in a recent Bloomberg interview. Meantime, the CHIPS and Science Act of 2022 offers incentives to bring more advanced semiconductor manufacturing to US shores. In a recent interview with Joe Rogan, Trump said the "chip deal is so bad" arguing that applying hefty tariffs would be a better way of forcing companies to set up factories in the US. Targets for Repeal Multiple electric vehicle-related provisions could be key targets for repeal if Trump wins, especially if Republicans take both houses of Congress, BNEF analyst Corey Cantor wrote in a report on the Bloomberg Terminal this week. South Korea's Finance Minister said last week that he expected strong ties with the US and investment to continue no matter who wins on Nov. 5. Companies, by contrast, expect greater trade barriers and geopolitical tensions, with about two-thirds of manufacturers surveyed by the Korea Chamber of Commerce and Industry saying they expect trade protectionism to intensify next year. According to a government-affiliated think tank, South Korea's economy would likely suffer a contraction if Trump returns to the White House and ratchets up tariffs against trading partners. So until there's clarity on what America's industrial and trade policy is going to look like, firms may hold off on delivering on their investment plans or making new ones. Related Reading: —Bloomberg News in Beijing Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment