| I'm Chris Anstey, an economic editor in Boston. Today we're looking at reporting by Saleha Mohsin and Carter Johnson on risks to the dollar from the US election. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China's economy showed signs of stabilizing after Beijing unleashed the boldest stimulus measures since the pandemic.

- The Bank of Japan kept its benchmark interest rate unchanged while sticking to its view that it's on track to achieve its inflation target.

- Euro-area inflation accelerated more than expected — matching the European Central Bank's target and boosting arguments for gradual rate cuts.

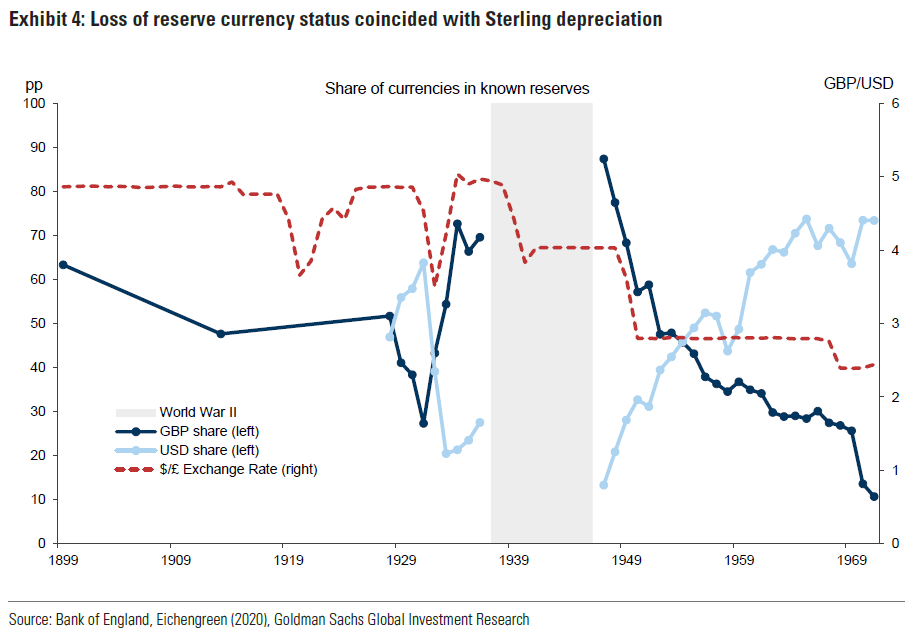

In 2009, after the meltdown in US mortgage securities triggered the biggest financial crisis since the Great Depression, China's central bank chief of the time issued a high-profile call to move the global financial system away from the dollar. Fifteen years later, it continues to reign supreme — having weathered the launch of trade wars under Donald Trump's administration and a welter of US sanctions on other countries that showcased the risk, for some nations anyway, of keeping assets in dollars. The greenback remains the main currency of choice in global reserves and massively dominates the foreign-exchange market. But history shows that the world's base currency can lose its position, as happened with Britain's pound in the 20th century. The US economy is much smaller as a share of world output now than it was after WWII, when its dominance began. And now some investors are flagging concerns about the potential for chaotic images emanating from the US election that could undermine confidence in American rule-of-law and the broader political system. Multiple stewards of US economic policy over decades have highlighted the importance of democratic, transparent governance and respect for the law in underpinning the dollar's role. A violent attempt to disrupt the transfer of power occurred in the wake of the last election, and had little impact on markets. But further instances could have consequences, some warn. "You can't be complacent around any of these things" with regard to the dollar, Robin Vince, CEO of BNY Mellon — one of the world's largest custodians of financial assets — said in an interview last week. "As is the case with many tipping points, you don't quite know when you're approaching it until you go over the other side." Thierry Wizman, a three-decade Wall Street veteran, said "the American exceptionalism narrative could end if traders lose faith in US institutions." "The way that could happen in the next few weeks is if we have an election without a definitive result for several weeks, and where people can't trust the institutions to adjudicate any of these disputes," said Wizman, a global currency and rates strategist at Macquarie. - The US economy expanded at a robust pace in the third quarter.

- The budget that Chancellor Rachel Reeves delivered will take so long to bear fruit that the Labour Party will need to win another election to claim its reward. Here are five key takeaways from her fiscal plan.

- The Bank for International Settlements is leaving a project for digital cross-border payments after Vladimir Putin identified the underlying technology as a tool to circumvent sanctions.

- Asian companies that have recently invested in the US are waiting to see if Donald Trump returns to office and scraps industrial policies that helped lure them.

- The IMF lowered its economic-growth projections for the Middle East and North Africa, citing conflicts, geopolitical uncertainty and oil-production cuts.

- Indonesia's president needs a plan to deal with rising borrowing costs for key state-owned enterprises carrying $186 billion of debt.

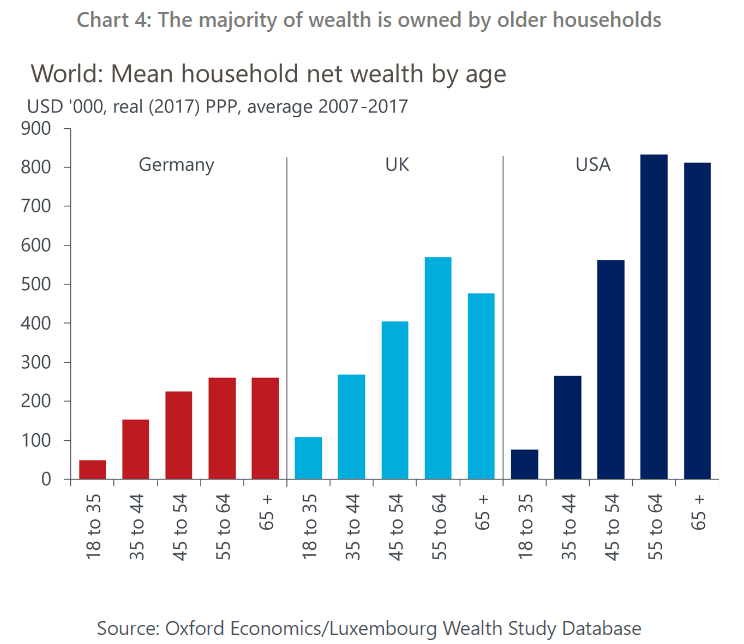

As is well known, most nations face shrinking and aging populations in coming decades. What's unclear is exactly how that will affect longer-term economic trends. Oxford Economics argues that it will depress inflation and rates. Many argue that a shrinking labor supply will drive up wage pressures — as indeed is now happening in Japan — and therefore inflation. Daniel Harenberg, lead global economist at OE, agrees. But, he wrote in a note this week, slowing and aging populations will also depress demand. "Our assessment is that population ageing will in fact dampen inflation." As for rates, "during working life, households accumulate wealth by saving part of their income and by receiving bequests, but on average they don't spend much of that wealth during retirement." As the wealth gets invested, it puts downward pressure on rates worldwide, Harenberg wrote. |

No comments:

Post a Comment