| Former President Donald Trump shifted from a mostly defensive stance of his protectionist trade policies to more of an offensive posture by going after those he considers to be "anti-tariff." That was among several observations made during Trump's hour-long interview Tuesday with Bloomberg News Editor-in-Chief John Micklethwait at the Economic Club of Chicago. (Click here to watch the full interview.) Read More: Trump Defends Tariff Plan While Pressing for More Fed Influence The Republican nominee in the Nov. 5 election pushed back against the idea that trade policies — like a broad expansion of US tariffs that he's espousing — will be inflationary and bad for economic growth. On the contrary, he said. American consumers "are going to be the biggest beneficiaries" of a more widespread use of import taxes if he returns to the White House, and countries targeted by tariffs are the ones who "will pay," he said. Under questioning, the first half of which covered trade issues, Trump indicated that tariffs have many benefits and can align with foreign policy. Here are the various applications: - Generate tax revenue. "We got hundreds of billions of dollars just from China alone and I hadn't even started yet," he said, even though it's US importers that pay tariffs in Chinese goods.

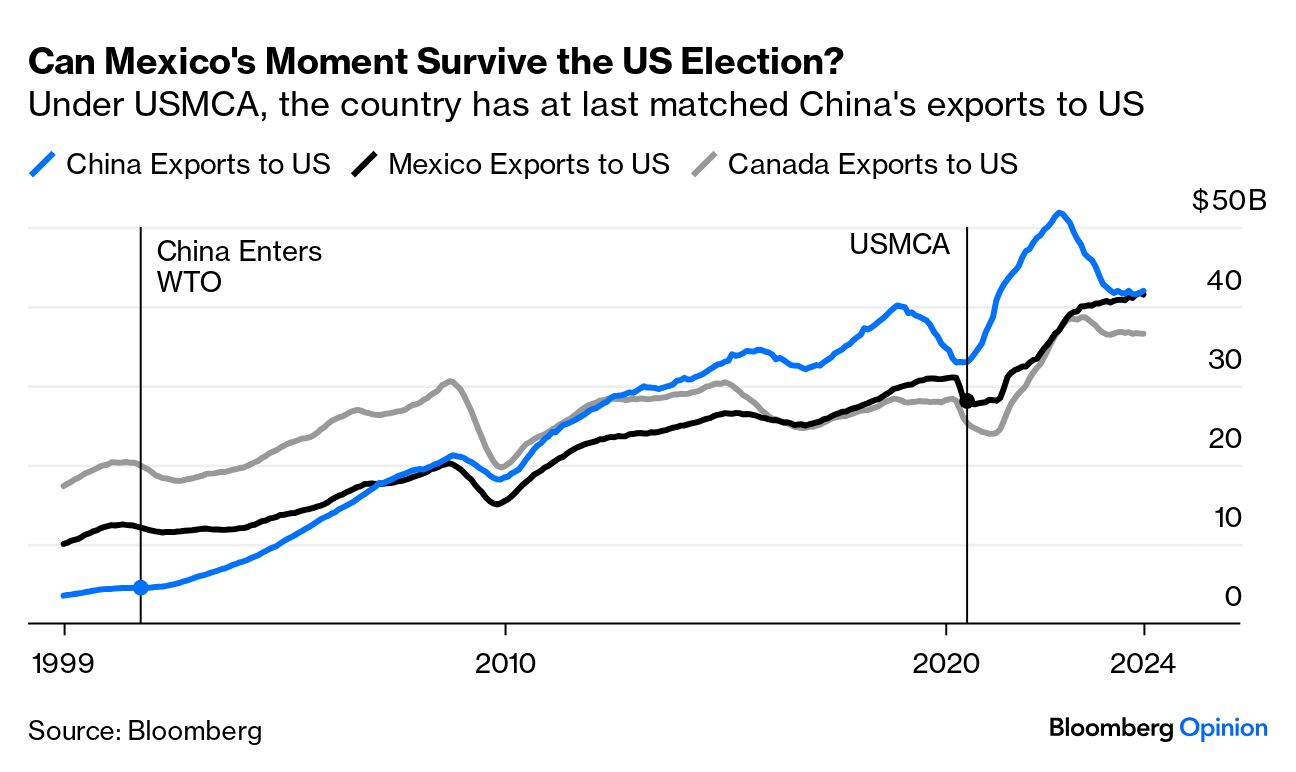

- Protecting domestic companies. He said auto companies that set up production facilities in Mexico to sell into the US market will face prohibitive tariffs aimed at protecting domestic industry.

- Incentivizing foreign investment. "All you have to do is build your plant in the United States and you don't have any tariffs," Trump said.

- Leverage against allies. He recounted how he successfully pressured France to reverse a tax on US companies with his personal threat of 100% tariffs on its wine and champagne. "Our beautiful European countries — wonderful, wonderful. They treat us so badly," he said. "We're going to put tariffs on them."

Some of Trump's comments were warmly received by attendees, who cheered his argument that dramatically increasing tariffs on foreign goods would protect "the companies that we have here and the new companies that will move in." Read More: Trump's Interview Remarks on Economic Policy Fact-Checked To Trump, tariffs aren't bad — they're just getting bad press. "The most beautiful word in the dictionary is 'tariff,' and it's my favorite word," he said. "It needs a public relations firm to help it." What Trump didn't talk about was the likely response to US tariffs: retaliation and trade wars. To avoid being caught flat-footed, the European Union has prepared a list of American goods it could target with tariffs should he win the election and follow through on his threat. Related Reading: Other Bloomberg newsletters: - For Economics Daily, click here

- For Balance of Power, click here

- For Washington Edition, click here

—Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment