| I'm Chris Anstey, an economics editor in Boston. Today we're looking at Donald Trump's proposed economic framework. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Import substitution was a cutting-edge economic policy idea in the 1950s, championed by Argentine economist Raul Prebisch. By the 1960s, his home nation took tariff rates to around 200% — but its legacy of debt defaults over the decades showcases how it proved no magic solution. Now, Donald Trump is pledging to use elevated tariff rates as a cudgel to force manufacturers around the world to move their production to the US. The bet is that European and Asian companies will see the investment as worth the trouble, retaining access to the world's biggest economy. "To me, the most beautiful word in the dictionary is 'tariff,' and it's my favorite word," Trump said in an interview with Bloomberg News Editor-in-Chief John Micklethwait Tuesday at the Economic Club of Chicago.  Donald Trump and John Micklethwait during an interview at the Economic Club of Chicago on Tuesday, Oct. 15. Photographer: Christopher Dilts/Bloomberg The former president, in a tight race against Vice President Kamala Harris ahead of the Nov. 5 election, made clear that he's not just taking aim at China, but longtime US allies and trade-treaty partners as well. - "Our country's being threatened by Mexico," he said.

- Trade deficits with Europe "are crazy, and we're not going to have them anymore."

- "Our allies have taken advantage of us more so than our enemies."

- Past trade deals were "so bad" that they were overseen by people who were "either very stupid" or corrupt, he said.

- "I was just getting started" with tariff hikes in his term as president, Trump said.

High import duties didn't work for Argentina. But, starting in the 1980s, protection did pay off for China — with its vastly larger and cheaper labor force and its potential as a huge domestic market. Whether the US, a developed economy with a giant market but much higher labor costs — not to mention subdued labor force growth in the absence of large-scale immigration — can succeed with the strategy would be a grand policy experiment. But it's one Trump seems set on. "All you have to do is build your plant in the United states and you don't have any tariffs," Trump said. "This is what I want." When challenged that it would take years for factories to get set up, he said, "there's another theory — that the tariff, you make it so high, so horrible, so obnoxious, that they'll come right away." - San Francisco Fed President Mary Daly said the US central bank must stay vigilant as inflation slows and the labor market cools.

- Bank of Japan Board Member Seiji Adachi emphasized the need for taking a gradual approach to raising the benchmark interest rate.

- Italy is tapping banks and insurers to help finance €3.5 billion of its budget, in a new plan designed to deliver on giveaways pledged to voters.

- Chancellor Rachel Reeves faces growing Cabinet disquiet over spending cuts, just as the IMF warns that she needs to stabilize the UK's debt.

- Argentina plans to adopt a flexible exchange rate.

- Meet the 16 inventors, entrepreneurs, visionaries, activists and investors who make up Bloomberg New Economy's class of 2024 Catalysts.

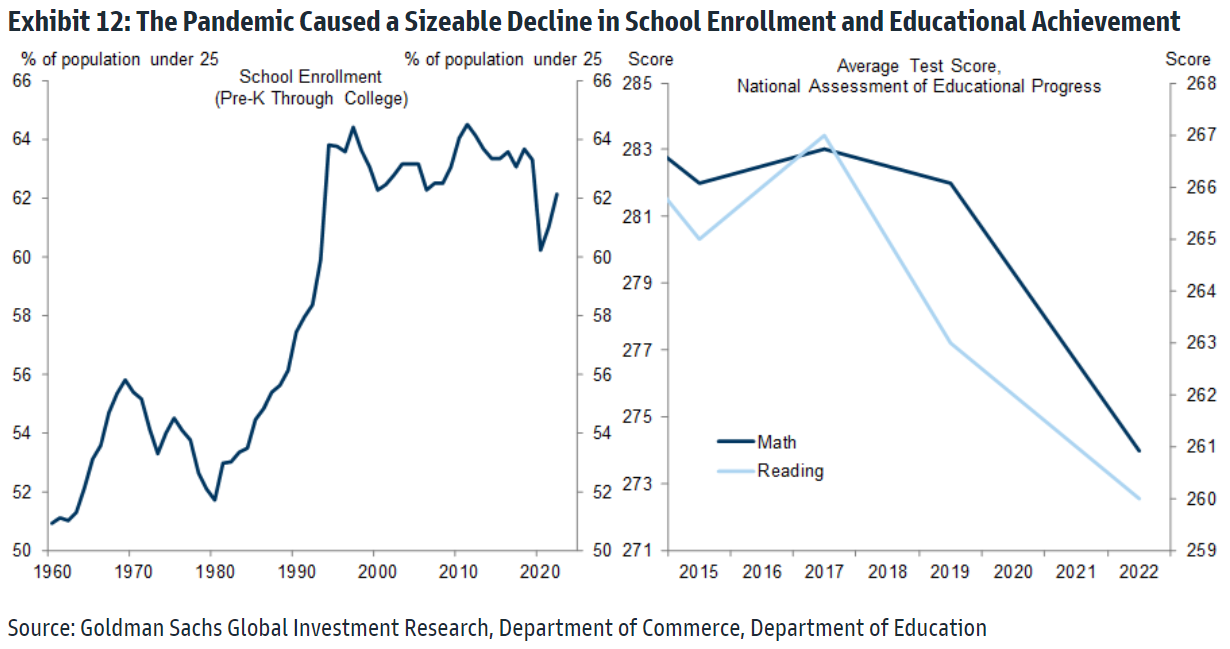

US productivity growth has picked up over the past several quarters, in a potential sign of corporate investments paying off. A jump in new-business formation might also have helped. But one thing likely to be a drag in coming years is marred educational attainment due to the pandemic. That's one observation from a recent Goldman Sachs economists' note that took a fresh look at the outlook for productivity. While they see a 1.7% average pace over the next few years — up from 1.4% in the decade through 2019 — they impute a 0.1 percentage point hit from educational shortfalls. Both school enrollment and educational achievement, as measured by average test scores, fell after Covid. "We use estimates from the economics literature on the effects of schooling years and changes in standardized test scores on lifetime earnings" to gauge the impact on productivity over time, the Goldman team wrote. "On average, these estimates suggest a modest 0.1 percentage point drag" over the next several years, they wrote. IMF/World Bank Meetings: Policymakers around the world face tough choices to create better economic outcomes and opportunities for people. Gain insights on how to help strengthen the foundation for growth during the Oct. 21-26 annual meetings. Join the conversation. |

No comments:

Post a Comment