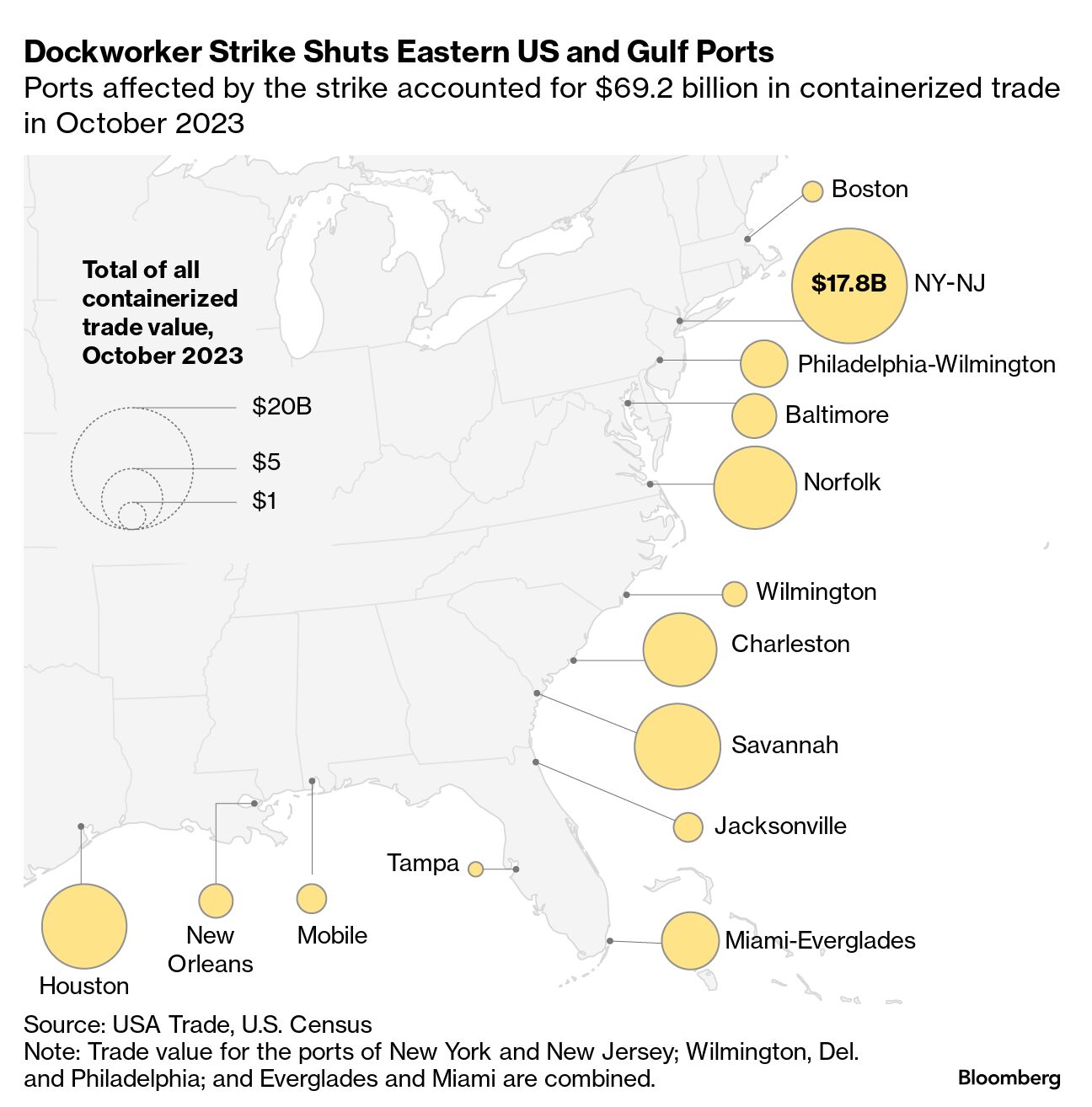

| The CEO of the Port of Long Beach said the nation's second-busiest gateway for maritime trade can absorb more cargo that's diverted away from East and Gulf coast ports, where dockworkers on Wednesday were on strike for a second day. Currently running at about 70% capacity, Long Beach is operating fluidly and is "in a very good position to handle any continued surge that comes," Mario Cordero told Bloomberg TV. (Watch the full interview here.) As of early Wednesday, there were 28 container ships anchored outside the four biggest Atlantic ports and Houston in the Gulf, with dozens more headed in their direction from Asia and Europe, according to Bloomberg tally. Read More: US Port Strike is Emblematic of Workers' Growing Tech Anxieties Cordero was a Barack Obama appointee to the Federal Maritime Commission in 2011 who served as FMC chairman during a labor dispute that slowed operations at West Coast ports back in 2014-15. - Lee Klaskow, senior logistics analysts with Bloomberg Intelligence, is hosting a webinar about the dockworkers strike today at 10 a.m. New York time. Register here.

Asked for his advice to the Biden administration about whether or not Washington should intervene to stop the strike, Cordero said stakeholders in the dispute are in a "wait-and-see" mode and there's optimism for a resolution quickly without government involvement. Meanwhile, with the union and employer group still apart on the key sticking points of wages and automation, politicians largely sided with the dockworkers and called on the carriers to withdraw any surcharges related to the strike. Read More: Dockworker Chief Aims to Make History With Election Day Looming Bloomberg Economics published a fresh analysis of the economic fallout, estimating a hit to GDP of as much as $3 billion a day from lost spending and production. (Read the full note on the Terminal.) Alternate Routes Mia Ginter, director of North American ocean shipping at C.H. Robinson Worldwide, said companies are dealing not only with the strike but the aftermath of Hurricane Helene and another strike at the Port of Montreal this week. She said that supply chain managers are prioritizing freight based on urgency and that air cargo or West Coast diversions might be needed for businesses with lean-inventory models. Here's what Japanese automakers are saying about the situation: - Mazda said ports in Baltimore and Jacksonville, Florida, are key for timely vehicle deliveries, and that its hoping for a swift conclusion to the strike. For now, Mazda will rely on stock at its US dealerships while negotiations continue

- Honda said it prepared ahead of time by unloading deliveries before the strike

- Toyota said it would continue to watch the situation, and declined to comment further

- Nissan said it hasn't received word of any impact from the strike

Related Reading: —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment