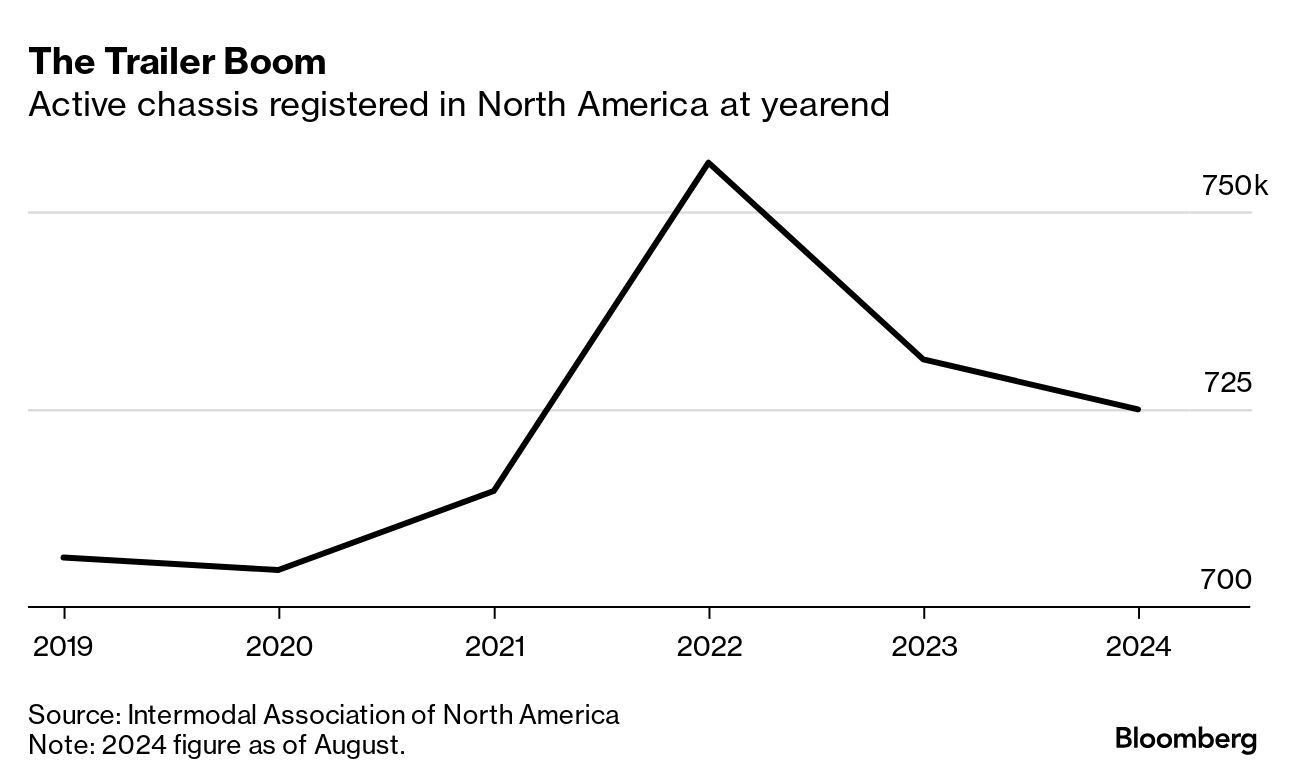

| The US debate about tariffs has often focused on either who pays for them or the broader economic impact. What gets less attention: The way they can end up being used as cudgels in messy commercial fights. Consider what happened after the US in 2021 imposed anti-dumping tariffs on the humble trailer chassis — those steel frames on wheels used to carry shipping containers behind big rigs. They got their 15 minutes of fame during the pandemic because they fell into short supply. Now they're the main character in a new feature in the annual economics issue of Bloomberg Markets magazine. Here are the key players: China International Marine Containers, or CIMC, is a Chinese firm that dominates the global shipping container market. At its height CIMC sold more than 45,000 new Chinese-made chassis annually in a US market of 70,000 to 80,000. That business dried up when the tariffs went into place. CIMC didn't give up, though. It shifted production to the US. It also created a new non-Chinese supply chain. A US competitor, Pitts Enterprises, was part of the coalition that lobbied for the tariffs and decided not just to ramp up US production but to team up with a Vietnamese company to import almost 18,000 new chassis. In a saga that played out in small-town America, both companies were were part of separate investigations into the sourcing parts from China and circumventing the tariffs. CIMC was eventually cleared, and Pitts is still fighting its ruling. What's the lesson learned? Tariffs sound simple enough when politicians threaten them, but they often turn costly and complicated not just for the targets of the levies but those they're meant to protect, too. —Shawn Donnan in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment