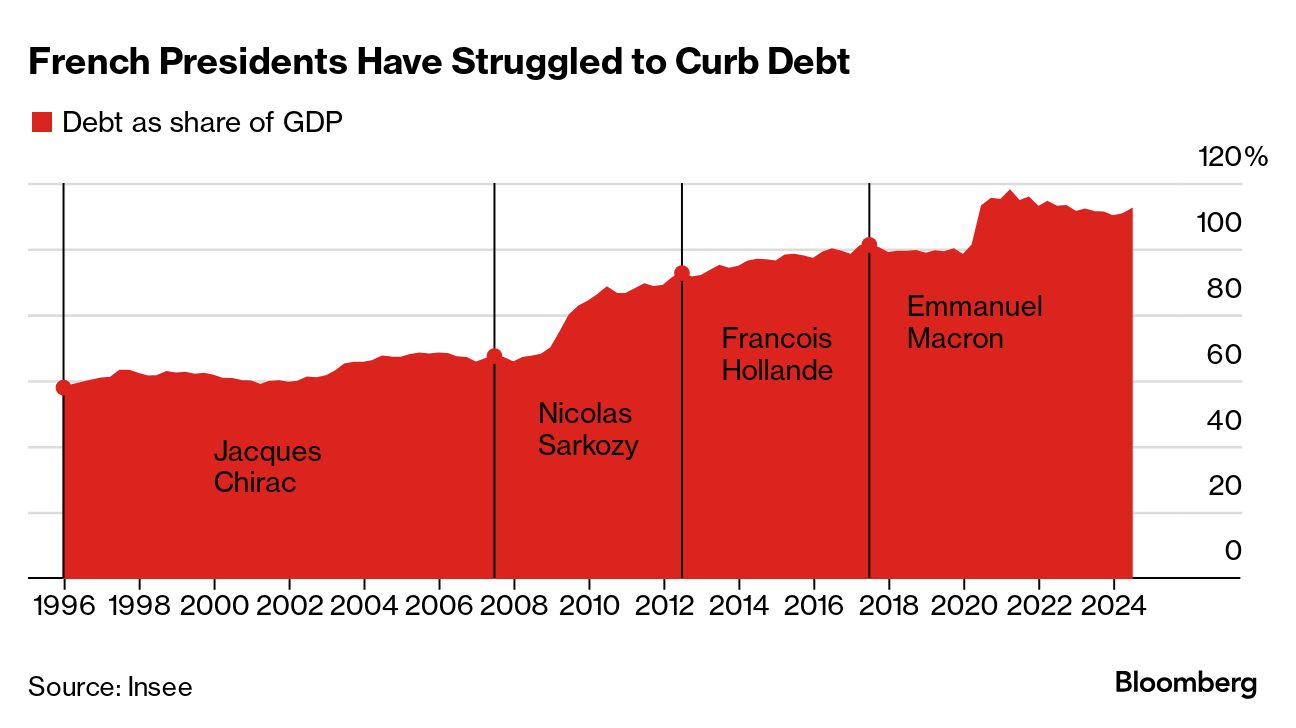

| I'm Craig Stirling, a senior editor for economics in Frankfurt. Today we're looking at France's fall from favor among bond investors. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. "Brutal" is how Jean-Claude Trichet labeled big currency swings when he ran the European Central Bank. To sum up his nation's fall from favor among debt investors, the Frenchman's description would be just as apt. France's bonds were historically seen as a proxy for German bunds, Europe's safest asset. But after the shock of a snap election in June, and the political trauma from an inconclusive result, a market selloff has recast the nation as a poster child for budgetary incontinence, as we report here. "The French economy has been getting away with fiscal murder for a very long time," said Raphael Gallardo, the Paris-based chief economist at Carmignac Gestion. "We need to straighten the ship very quickly if we don't want to get into much more troubled waters." France is taking action, but in its own time. Hamstrung by a hung parliament, officials are warning Brussels that it will take five years just to bring deficits down to the European Union's limit of 3% of output. An attempt to kick off that task is due on Thursday, when Prime Minister Michel Barnier's government unveils its budget for 2025. With international investors owning more than half of the country's €2.6 trillion ($2.9 trillion) debt pile, the new-found stigma attached to France means some are already voting with their feet. Funds in Japan — notable buyers of its bonds in recent years — offloaded French government securities on a net basis for a fourth month in August, the longest run of sales since late 2022. "France has the highest level of political uncertainty," said Akira Takei, a Tokyo-based fixed income manager for Asset Management One Co., who has held hardly any of the country's debt since June. "With other options available in Europe, there is no longer any need to invest." Limping toward a presidential election in 2027, France is adapting to a painful shift in status. A nation that was once in Europe's driving seat is increasingly perceived by investors as a deadweight, sullied by budgetary largess and buffeted by the extremes of its political spectrum. France's sentence to financial purgatory offers a wider lesson — that no country is forever immune from the wrath of the bond market. Given the incessant ballooning of US debt, next month's presidential contenders might take note: when it happens, it's brutal. - Unemployment in most US swing states that will likely decide the election is now below levels from before Covid.

- New premier Shigeru Ishiba won't impede the Bank of Japan's path toward raising rates, a former central bank official said.

- An ECB rate cut next week looks inevitable, though one official just offered the only real resistance so far to such a move.

- Egypt's inflation quickened slightly for a second month, potentially pushing back the timing of its first cut in borrowing costs since 2020.

- Coming up: Germany will scrap forecasts for growth, Israel may keep rates on hold, and the Fed will release minutes of its last meeting.

- Finally, here's our guide to the new fault lines of geopolitics—from BRICS versus the G-7 to Lula and Milei's ideological rivalry in Latin America.

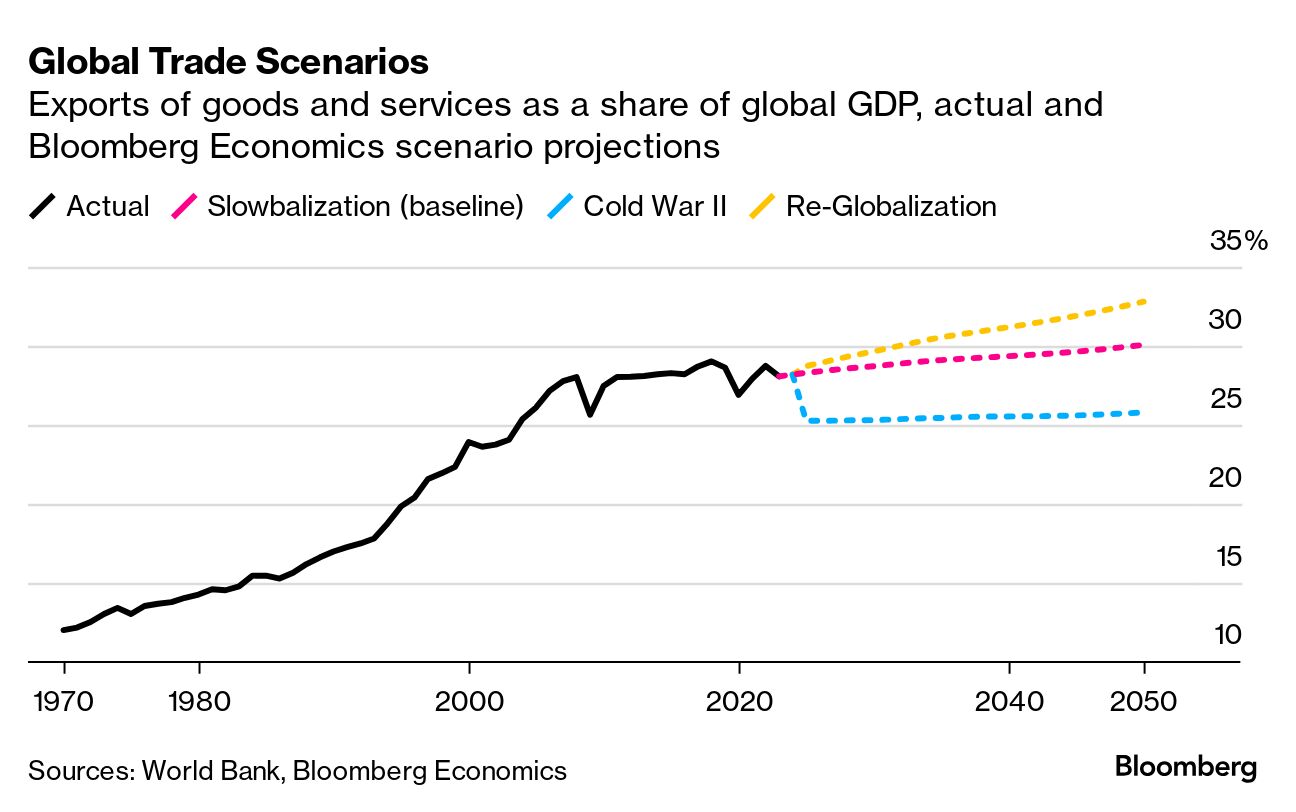

Against today's backdrop of geopolitical tensions, Bloomberg Economics has mapped out three scenarios for world trade over coming decades. In the base case — dubbed slowbalization — barriers to trade, investment and migration aren't lowered much, but don't get higher either. That would see global growth average 3.3% over the next decade, down from 3.7% over the decade before Covid-19 hit. The worst-case scenario, Cold War II, "would knock $7.1 trillion from global GDP in 2035 relative to the level if the current slowbalization trend continues. Debt would be propelled higher by slower growth and increased defense spending." In a "less likely return to go-go globalization," the Bloomberg Economics team sees slightly faster growth than in the base case. World GDP climbs 3.4% in the decade ahead — adding $800 billion to 2035 output. That would help shave down debt ratios, though without any adjustment to defense spending relative to baseline, "the impact is marginal." - Read the full analysis here.

Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment