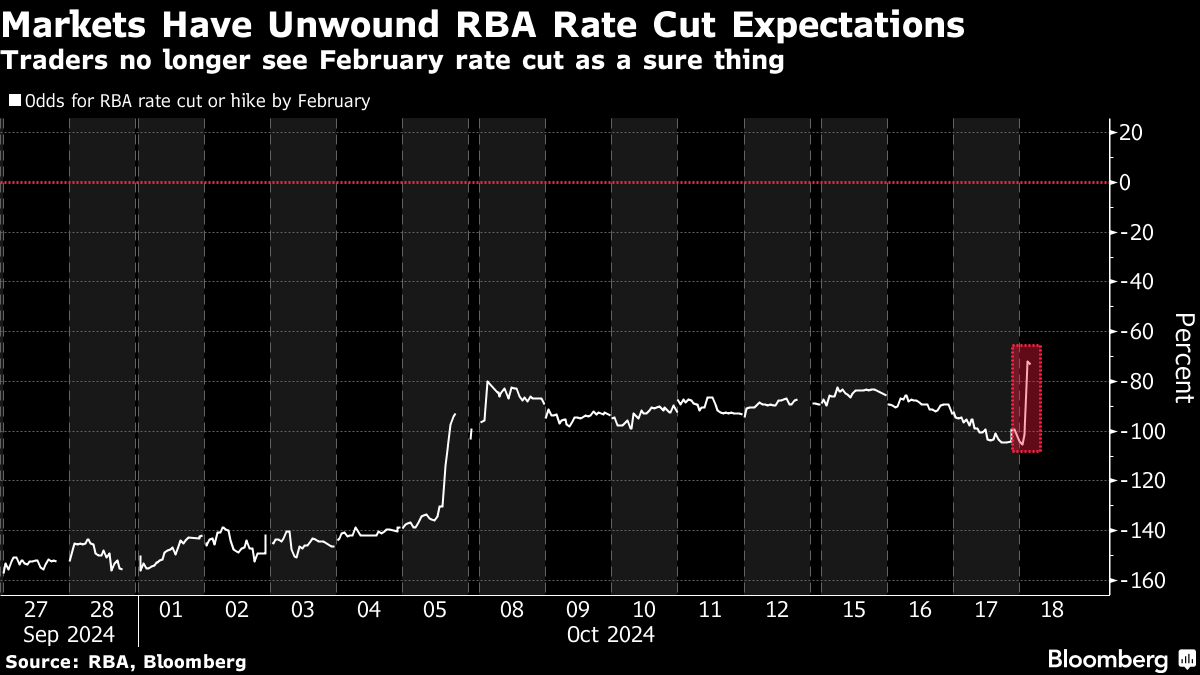

| Strong jobs data has prompted traders to scale back bets on the Reserve Bank of Australia's first rate cut, even after the central bank all-but ruled out easing in the near-term. Employment rose more than double estimates in September, and the jobless rate held at 4.1%. The latest Bloomberg Australia podcast has landed. This week, Rebecca Jones talks to our cryptocurrency senior editor Sunil Jagtiani about why crypto-mad Australians should be watching the looming US presidential race especially closely.

The beleaguered Star Entertainment Group's survival rests almost entirely on new CEO Steve McCann. That's after the casino operator copped a A$15 million fine, escaping serious punishment months after an inquiry found it had breached the terms of its license and remained unfit to run its flagship Sydney venue. Hedge fund manager Jun Bei Liu has hired Jason Todd, chief investment officer of Commonwealth Bank of Australia's private banking unit, for her new A$1.5 billion fund, she told us yesterday. The fund has the backing of Tribeca Investment Partners.

Thousands of mysterious tar balls are washing up on Sydney beaches. The New South Wales state Environment Protection Authority is investigating the source of the objects, which range from pea-sized to as big as a tennis ball.  Black, ball-shaped debris found washed up on Coogee Beach in Sydney. Randwick City Council Anthony Albanese has been facing public scrutiny this week, after buying a pricey coastal property in the middle of a national housing crisis. The house in Copacabana, north of Sydney, cost around A$4.3 million, local media reported. |

No comments:

Post a Comment