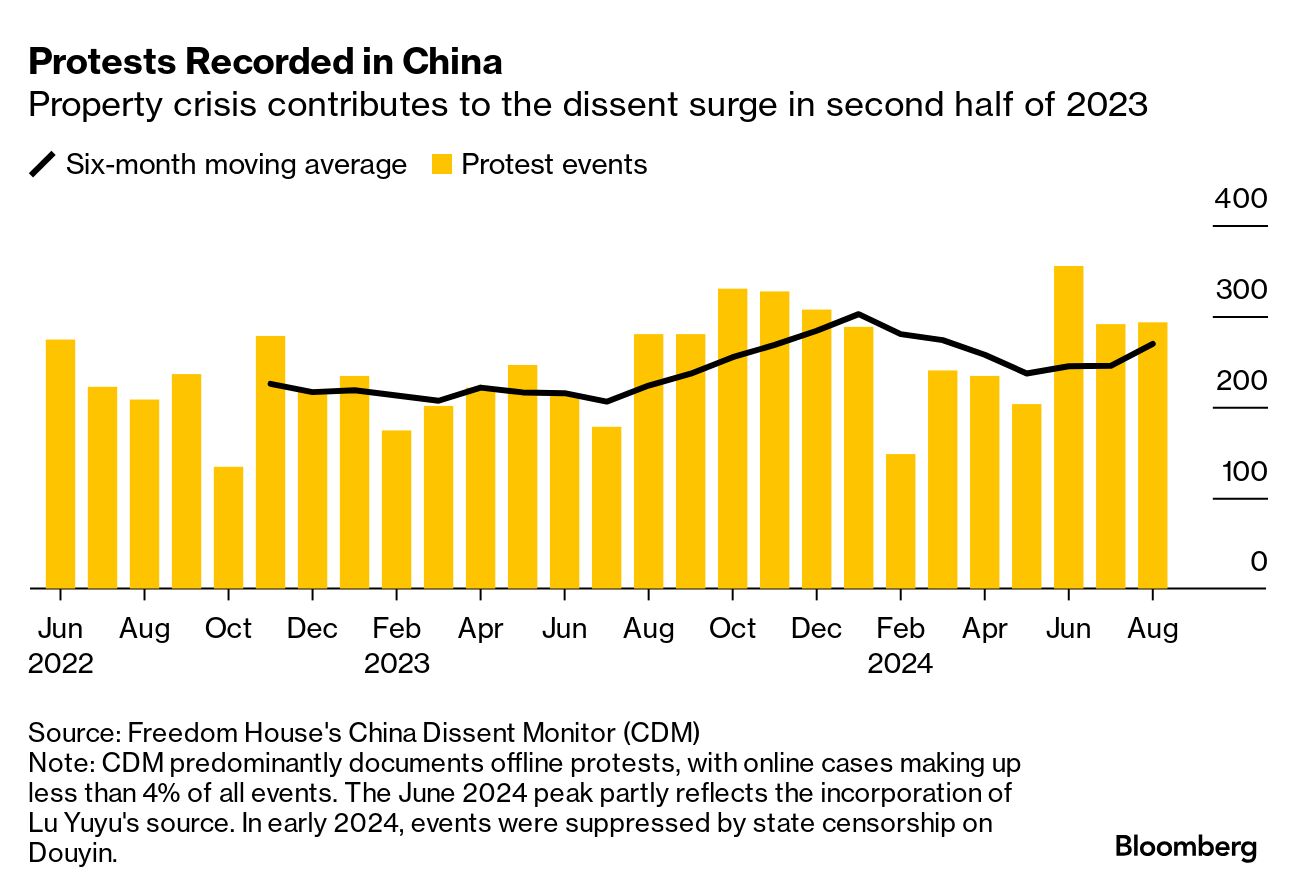

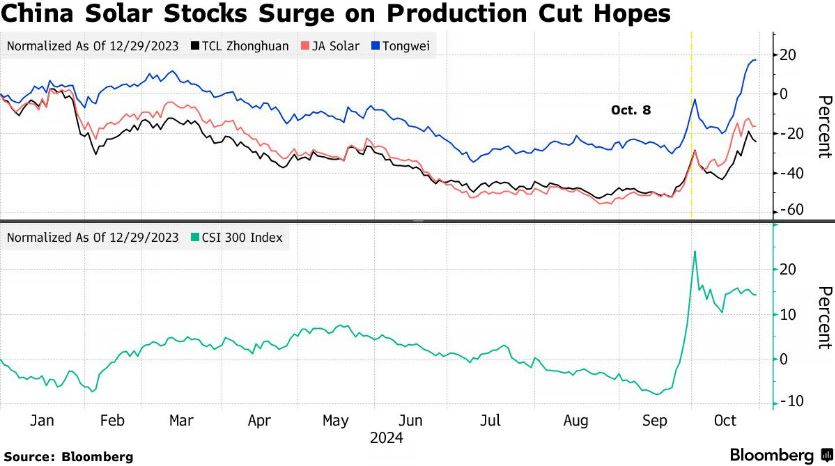

| Hi, I'm Rebecca Choong Wilkins in Hong Kong, where — like everyone else — I'm trying to figure out just how much support Chinese President Xi Jinping will roll out for the beleaguered economy. The secret to answering that question might lie with a dissident in Canada and his cat. So say money managers who are increasingly looking at metrics around dissent and social discontent to determine if and when Xi might pivot to so-called bazooka stimulus. The trouble is the most direct measure of discontent – protest – relies on some of the hardest, and riskiest, information to collect. Meet Lu Yuyu, compiler of a free database tracking unrest in China. For about 10 hours each day, sometimes accompanied by his cat Anthony and fueled by coffee, Lu scours the internet for evidence of group protests before it gets scrubbed by Chinese authorities. He works from a home office in a spacious, poorly lit basement in Calgary. Lu said he settled for the accommodations because it was hard to find a pet-friendly rental when he first arrived as a refugee fleeing the Chinese authorities about a year ago. His task is tall. Filtering through billions of social media posts, researchers like Lu are often in a race to beat censors, who can delete content in a matter of minutes and are constantly changing what they deem sensitive. For Lu, collecting this data has also been dangerous. China once handed him a four-year prison sentence that ended an earlier, similar endeavor. His data was recently included in Freedom House's China Dissent Monitor, which focuses on documenting in-person protests. With the help of Lu's work, their findings show a rise in economic grievances — issues like workers demanding unpaid wages or homebuyers voicing anger over undelivered apartments. This kind of data is increasingly of interest to investors. Over the past few months, I've fielded more queries from readers about this issue than any other topic. Banks and consultancies are taking notice, too. In late September, Morgan Stanley launched its own index that includes data like wage growth and labor incidents to identify a potential moment for policy tipping points. Still, Lu isn't particularly phased by the interest from the financially minded audience he has attracted. For him, the political aspect of the project is the most important: providing a record of the struggles of ordinary people that would otherwise be lost. "It captures and preserves the images and voices of those who bravely stood up to resist unfair treatment," he said. What We're Reading, Listening to and Watching: A Trump victory in the US presidential election may turn out to be pretty good for Chinese equities ... wait wait, hear us out! For one thing, it is the view of strategists from some of the world's top brokerages. At the very least, they believe that Beijing will soon turn on the stimulus spigots, protecting a recent stocks rally that sent a benchmark equities gauge soaring over the past month. And Jefferies's global head of equity strategy, Christopher Wood, recommends investors buy the dip if Trump prevails in his exceedingly close race with Kamala Harris. Wood says Trump's record shows he's "not as anti-China as he is perceived to be" and points to the trade deal the two sides ultimately worked out in 2020. Despite a possible 60% tariff on Chinese goods and a solid chance of surprises straight out of left field if Trump returns, to a degree investors know what they're getting in him because they've experienced four years of his governance: tariffs, tax cuts, deregulation and an immigration clampdown. Goldman Sachs strategists expect Chinese stocks to rise in the two to three months following the vote, though they warn there may be a reaction if Trump wins. While fears of a possible trade war flare-up may fuel a shift from risk assets, a stimulus blitz by Beijing has created a so-called "policy put," protecting stocks investors against declines, they say. That extra stimulus may be approved by China's legislature just next week. Maybe some of the safest stocks picks are hiding in plain sight – namely companies in tech industries favored by Xi. After all, the Chinese leader has been making progress positioning his nation to dominate industries of the future despite US curbs. Of 13 key technologies tracked by Bloomberg researchers, China has achieved a global leadership position in five and is catching up fast in seven others. Analysts are pointing to Chinese solar stocks benefiting from the government tackling oversupply, health-care firms that have little exposure to the US market and chipmakers like Semiconductor Manufacturing International Corp. that have proven to be surprise survivors despite the US push to slow their advances. |

No comments:

Post a Comment