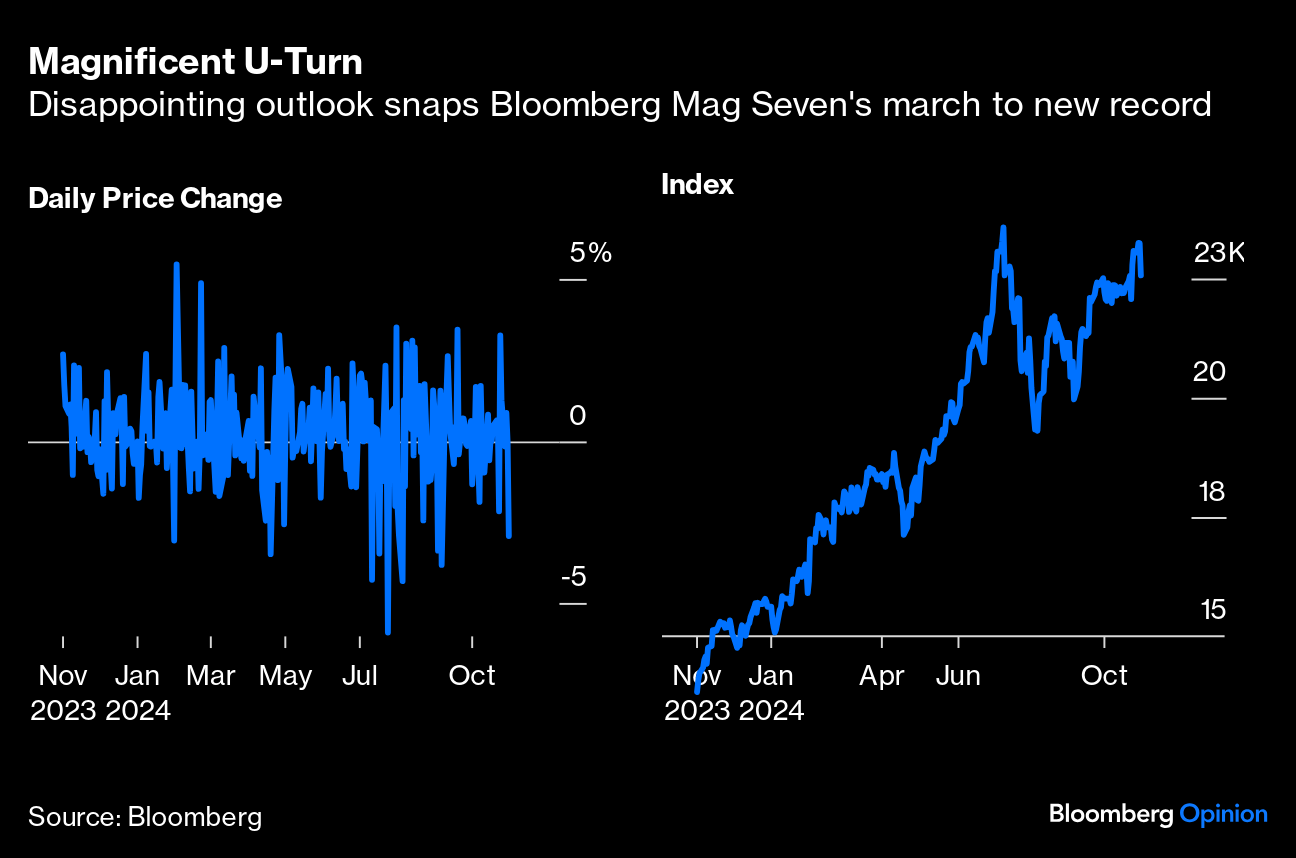

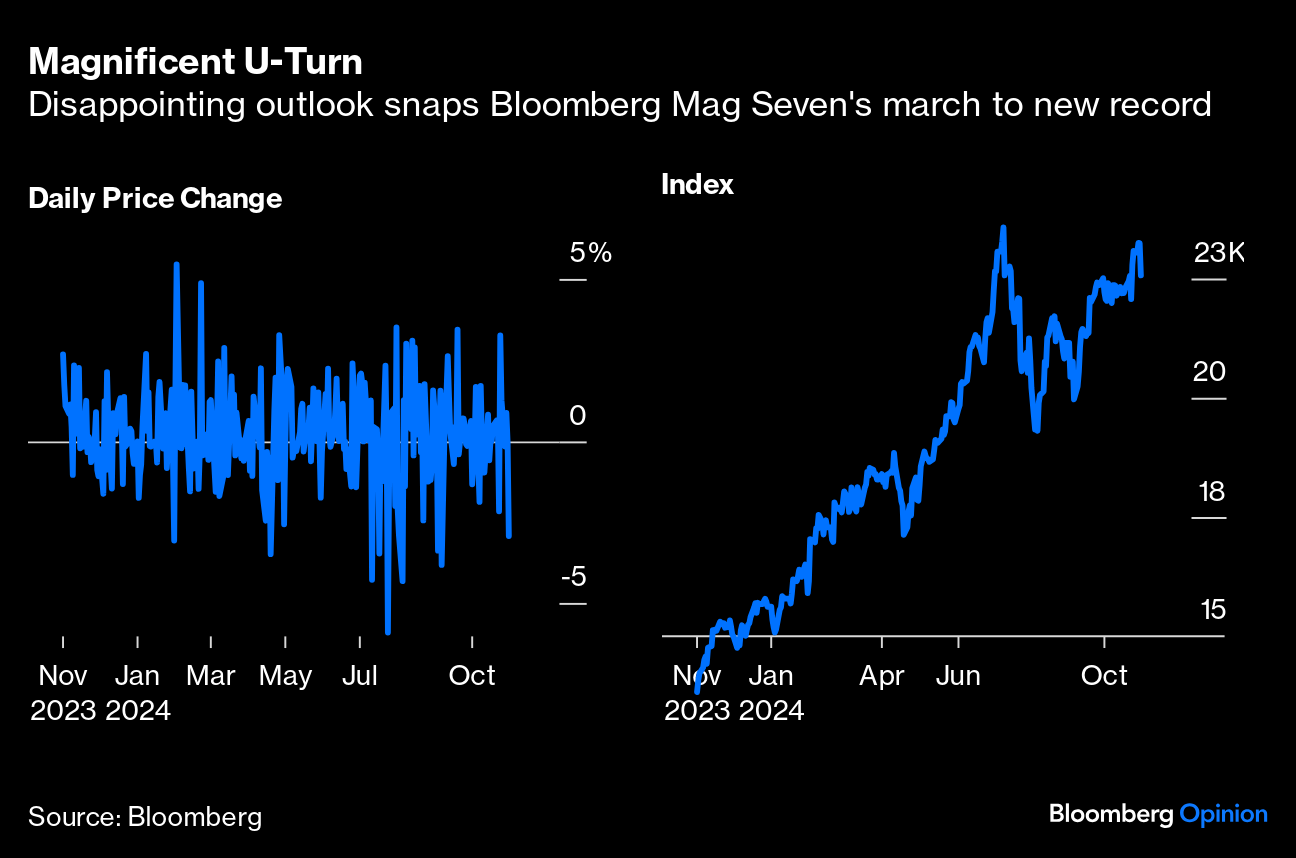

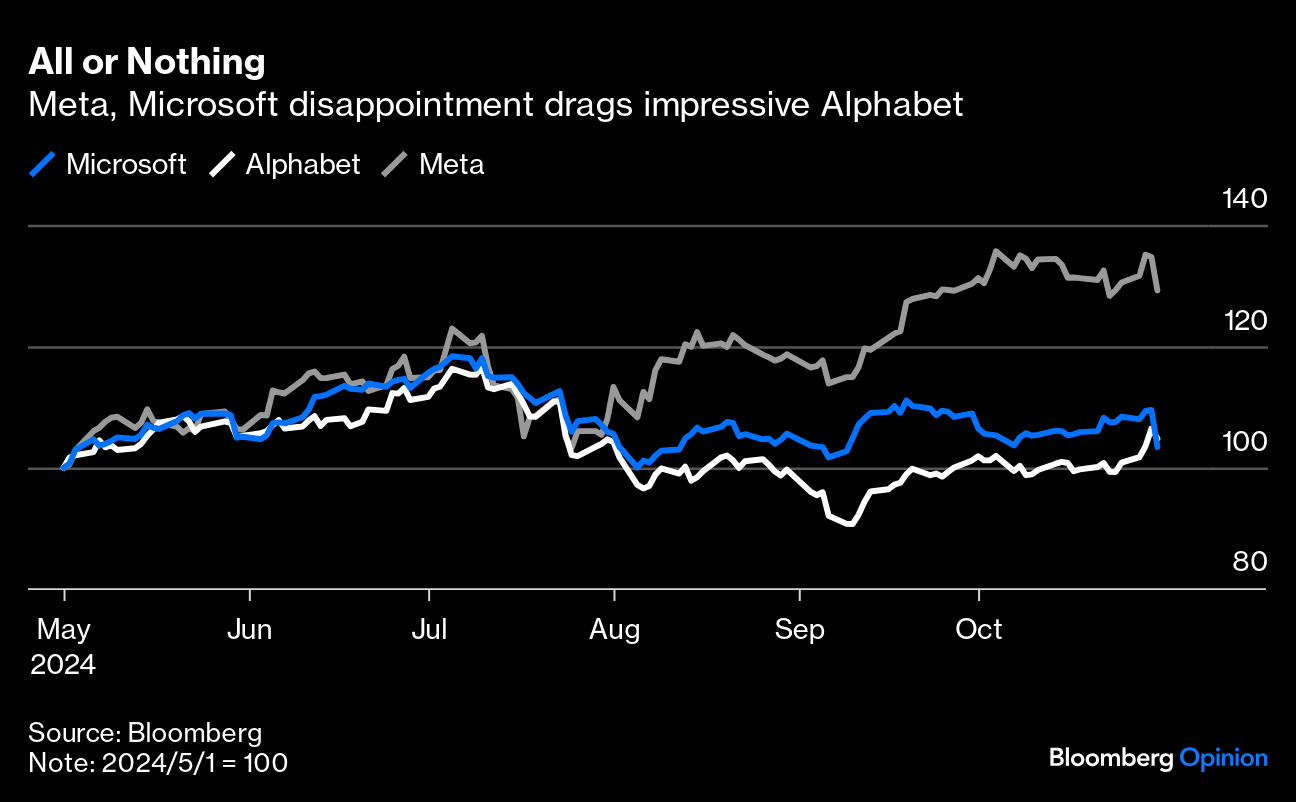

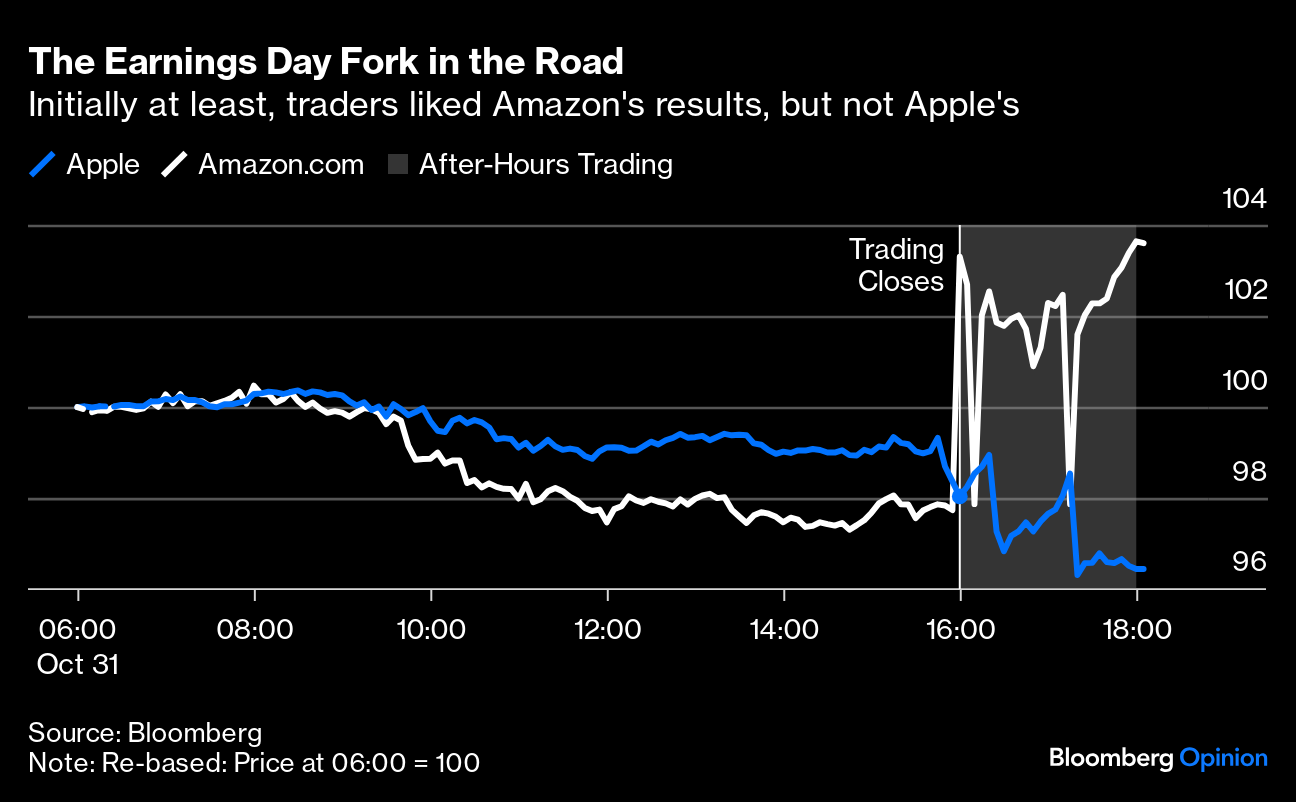

| Sometimes it's hard to know which way to look. International markets have been buffeted by vital new data from across the world. This is an attempt to summarize the most important numbers. Magnificent (and Not-So-Magnificent) Earnings Tech companies are in a race to rationalize the massive investments they made in artificial intelligence after the arrival of OpenAI's ChatGPT ignited a frenzy almost two years ago. Until fairly recently, getting on the bandwagon was nearly an open-sesame to greater market cap. The bar is now a notch higher. Investors are parsing every earnings report for signs of AI-increased productivity, and they're inclined to punish companies when they can't find it. So far, quarterly earnings reports have been mixed, even among the so-called hyperscalers, a group that includes Meta Platforms Inc., Alphabet Inc., Microsoft Corp., and Amazon.com Inc. All are uncomfortably leveraged to AI. Microsoft dropped following its inability to turn its massive investment into sales, while Meta also took a hit after saying it expects losses from its AI division to persist. The bad news weighed on their peers. Until last week, the Bloomberg Magnificent Seven looked as if it was closing in on an all-time high but has since retreated:  As AJ Bell's Russ Mould sums it up, the reaction shows that tolerance for big spending on AI without immediate signs of a return is waning. On Microsoft, Mould notes that while third-quarter earnings and revenue were a touch ahead of expectations, the market was always likely to focus on the outlook, and here, the massive investment in OpenAI is expected to deliver a hit to profits. The softening revenue in its Azure cloud business contrasted with a more positive cloud outlook from Alphabet — which received kinder market treatment: After the market closed Thursday, two more Magnificents, Apple Inc. and Amazon.com, also announced results. They continue to be dispersed, with Amazon's share price rallying in after-hours trading while Apple sold off: All face challenges as they try to ramp up data centers and meet their energy demands. What matters most to investors is swift resolution that paves the way for AI to bring in the envisaged returns. Mould adds that the AI journey is more marathon than sprint: Investors know there is significant potential in AI, but they increasingly want to see that the money being invested in its development is being allocated sensibly and that, at some point in the not-too-distant future, it will deliver tangible rewards.

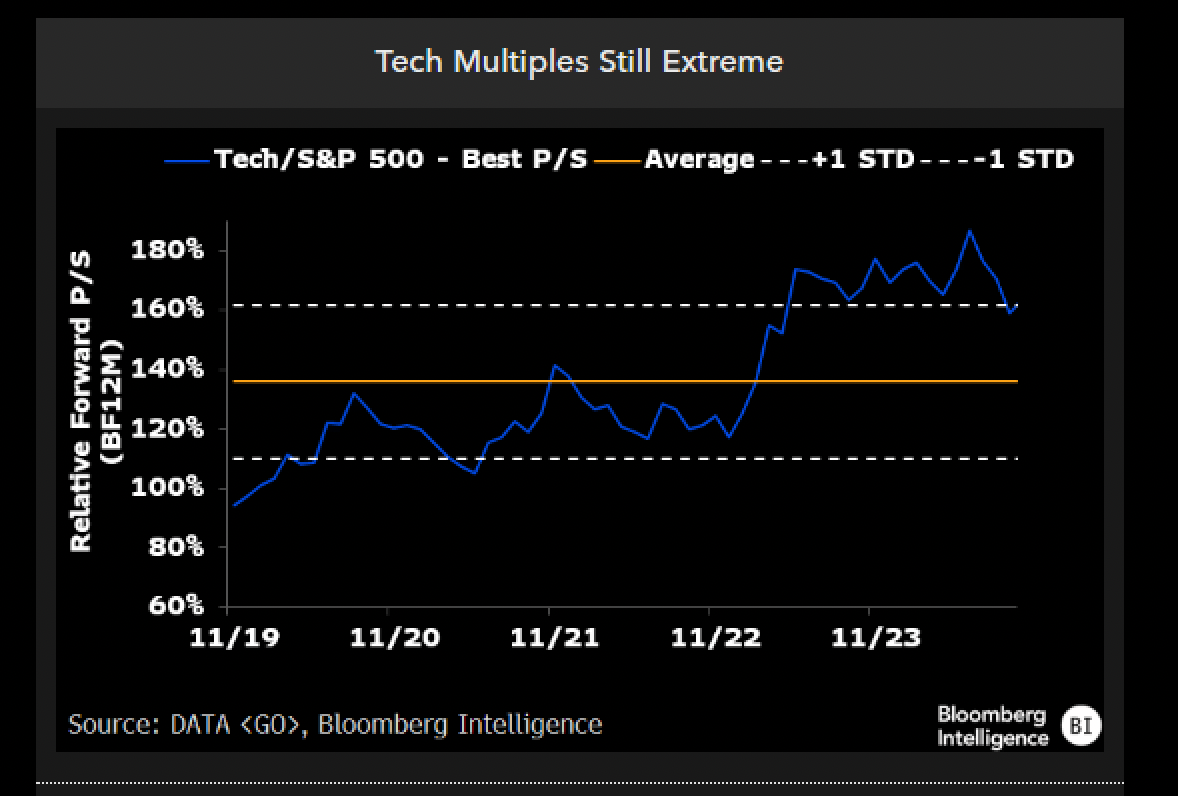

Predicting where tech goes from here is not easy. The high valuations are unmissable, and spread beyond the Magnificents. At 28% above recent five-year norms, Bloomberg Intelligence's Gina Martin Adams and Michael Casper say that the valuations — which continued to grow into the third quarter — are extreme: Tech's multiple is a bit lower without its behemoths, but the rest of technology is undoubtedly also contributing to the sector's premium. Without Apple, Microsoft, and Nvidia, tech's forward P/S is 4.97x, 36% below the sector multiple and closer to the S&P 500's 2.94x. However, this is far from cheap from a historical perspective. The sector's multiple minus the mega caps is 1.5 standard deviations above its average since 2017.

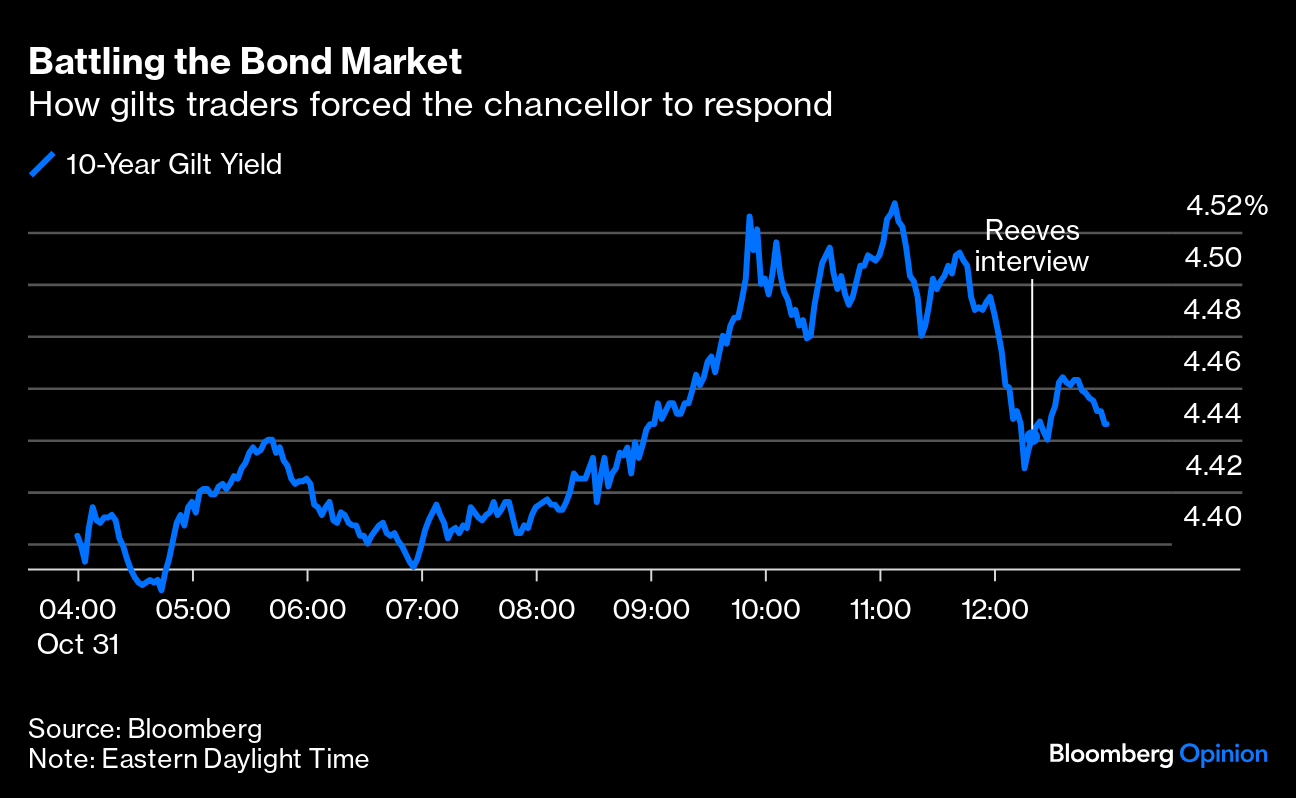

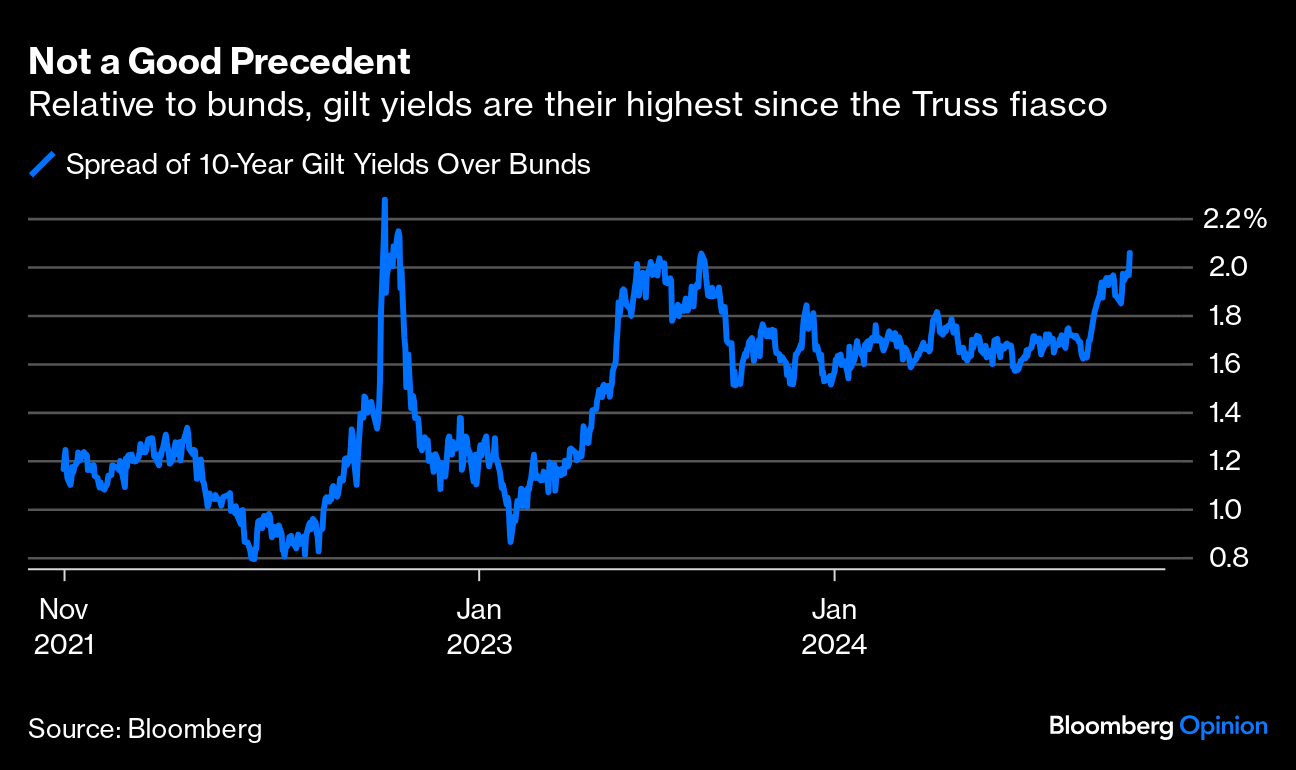

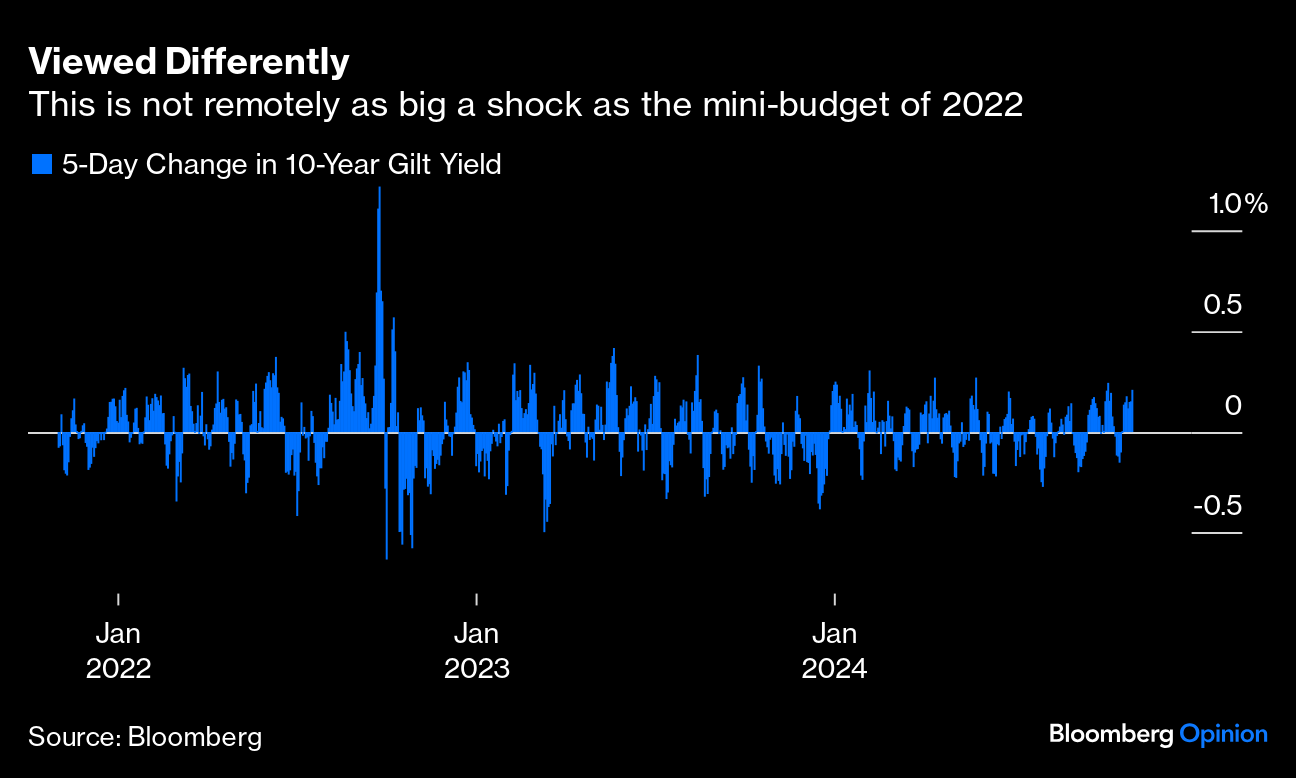

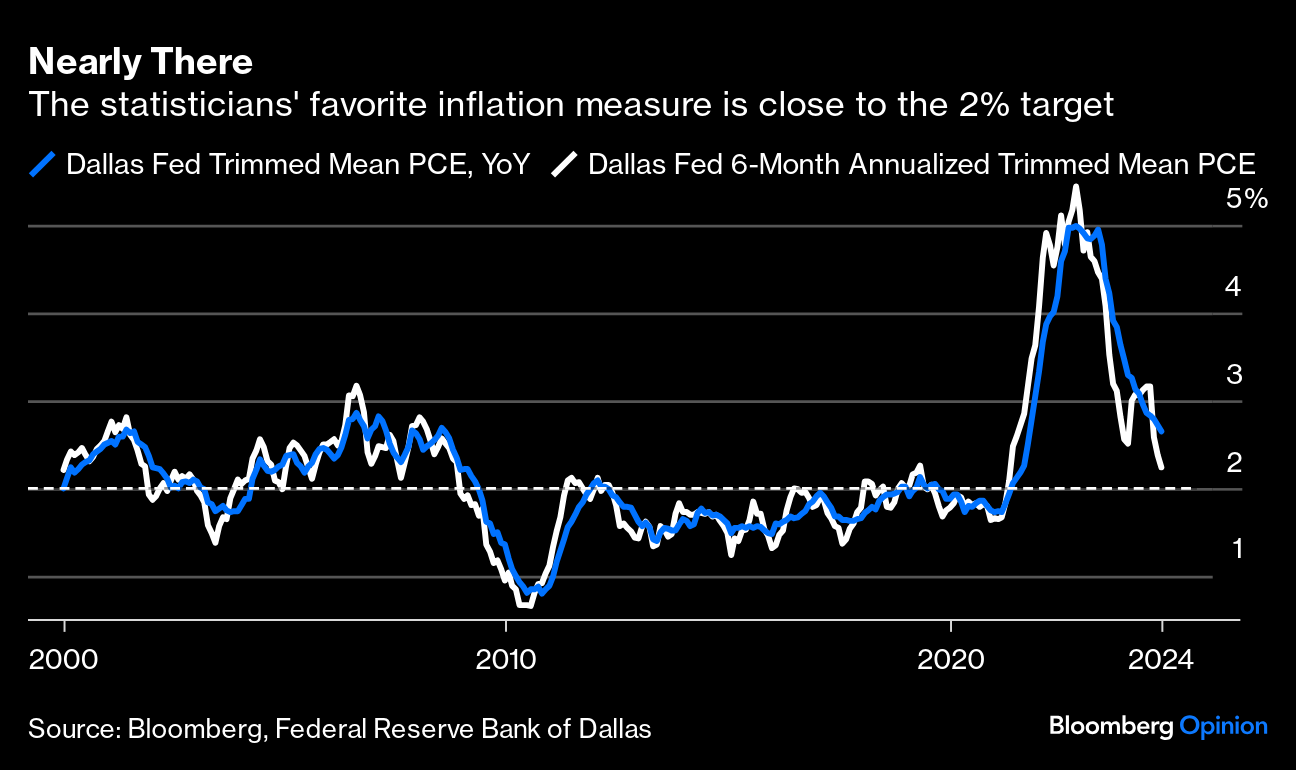

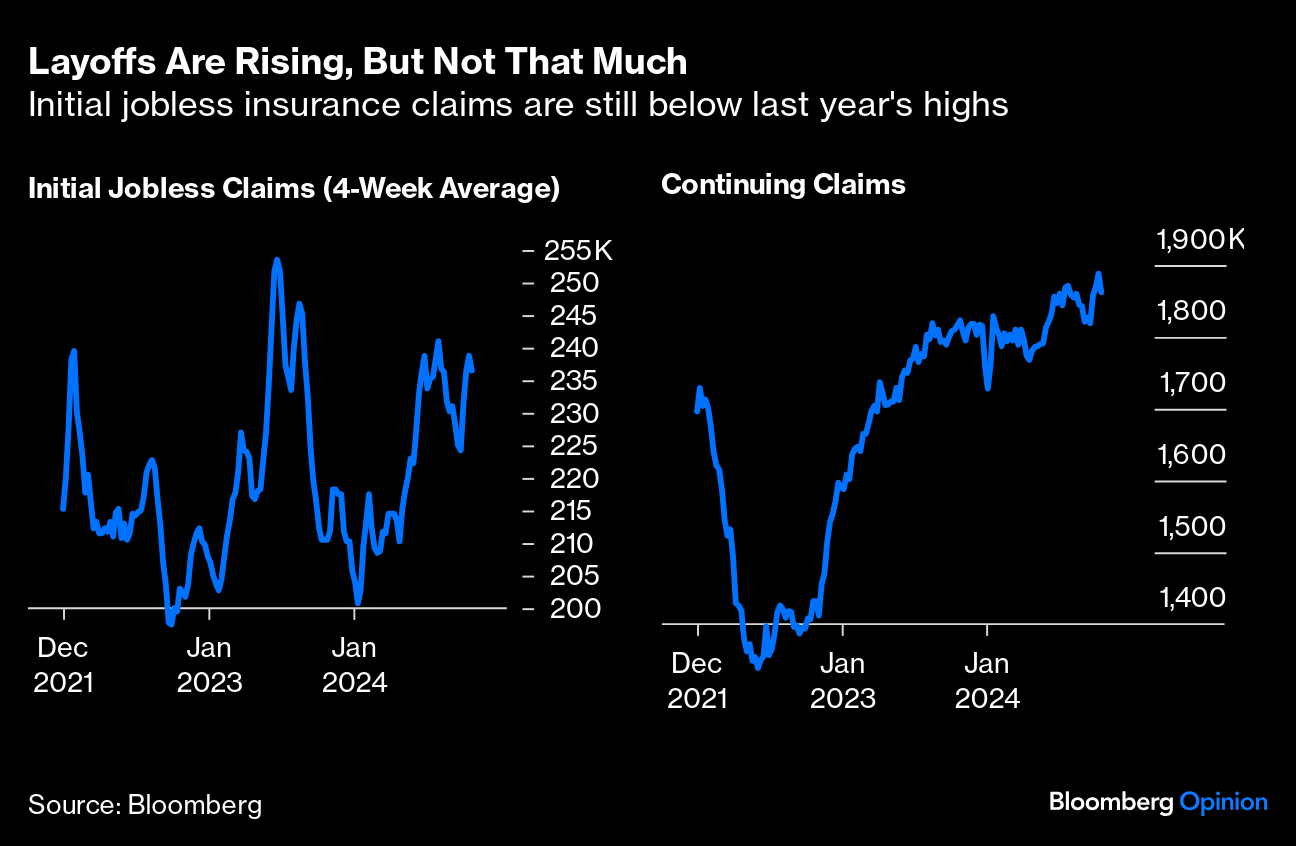

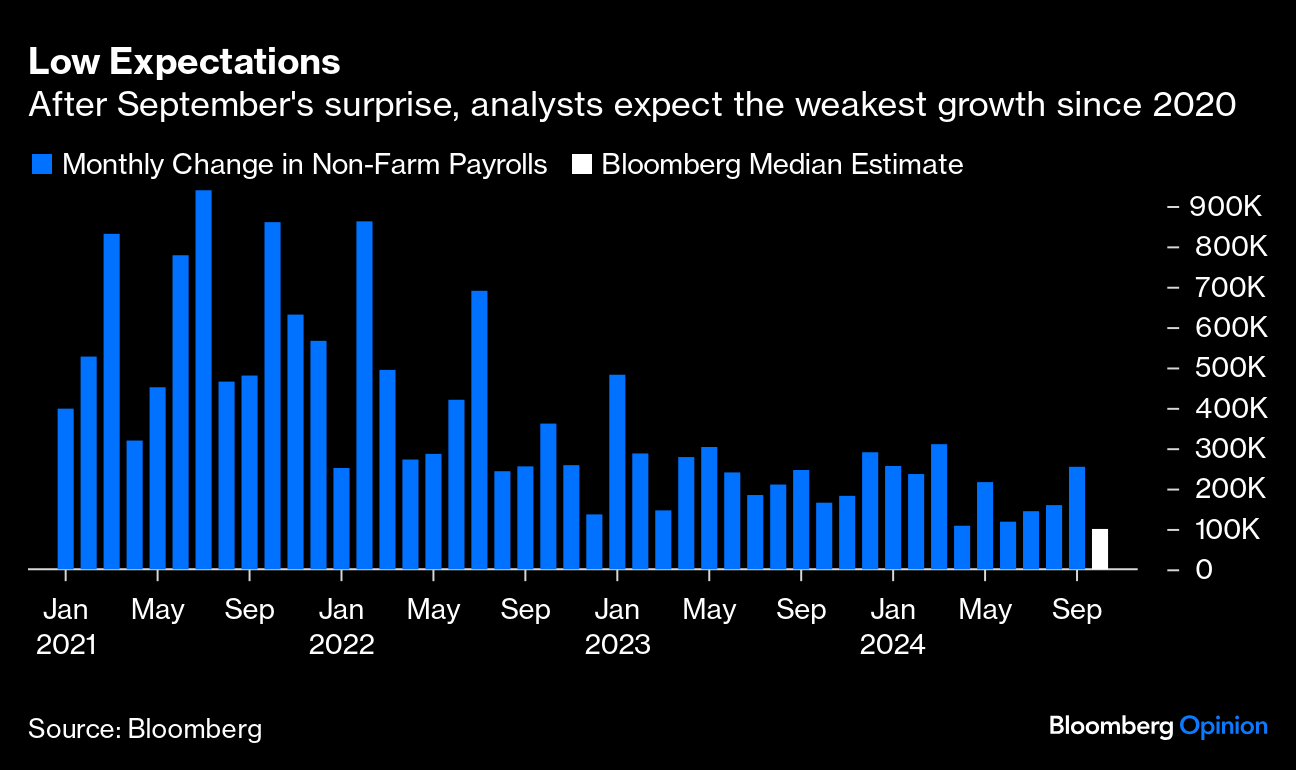

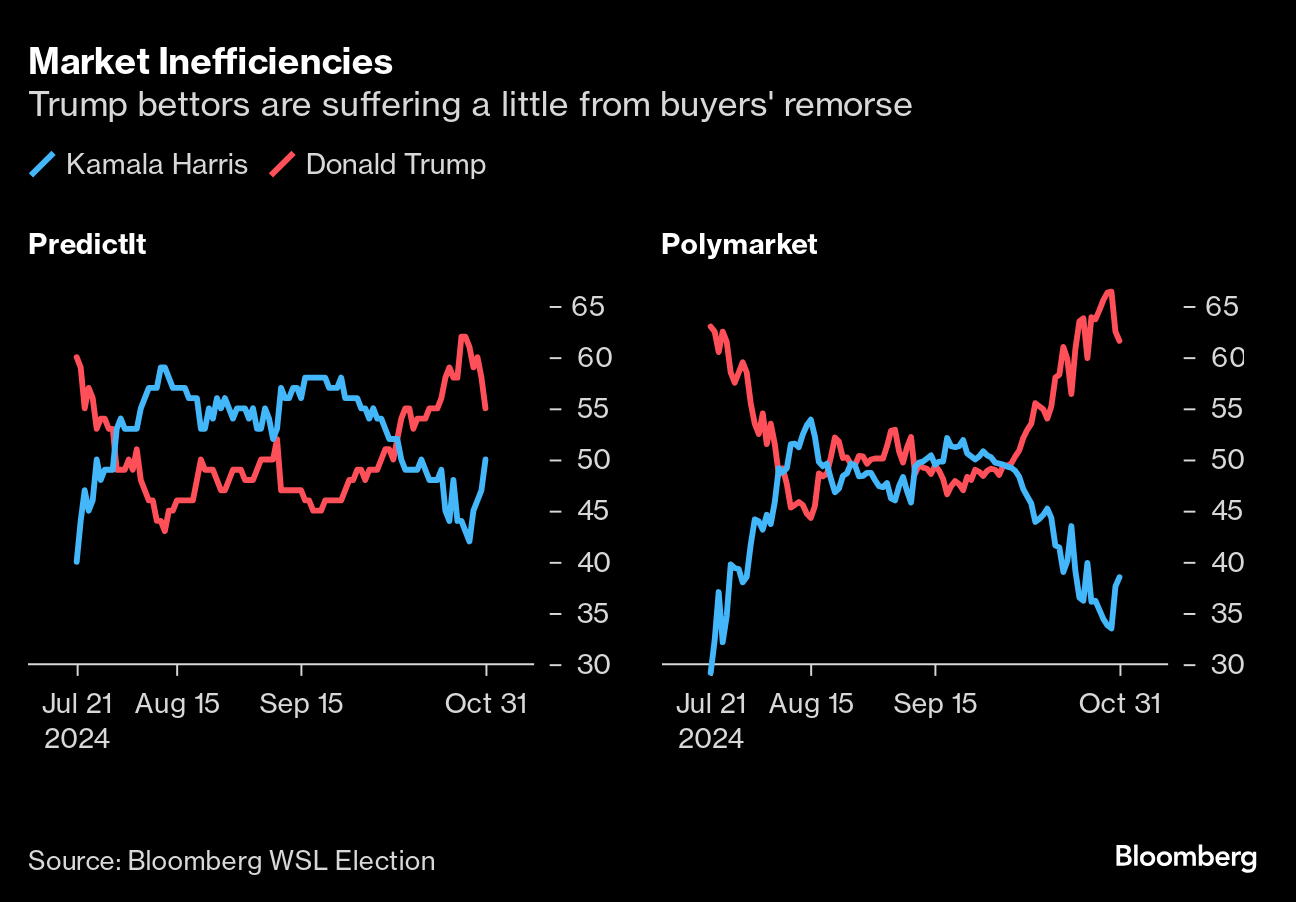

This Bloomberg Intelligence chart tells the high valuation story within the context of the broader market: Switching to the broader picture, with about 60% of the S&P 500 market cap having reported earnings, UBS expects revenues to grow by 4.7% and earnings per share by 5.9%. So far, firms beating on both revenues and EPS have received more positive responses than typical, outperforming the market by 2.2% versus a historical average of 1.7%. If anyone finds the focus on the Magnificent Seven excessive, be aware that they're dominating earnings growth. FactSet forecasts that in aggregate, the Magnificents are on course to report year-over-year earnings growth of 18.1%, while the blended earnings growth rate for the "other 493" would be 0.1%. Overall, the blended earnings growth rate for the entire S&P 500 for the third quarter is 3.4%. We have no choice but to spend a lot of time looking at the Seven. —Richard Abbey Don't Forget China There was one startling market response — to the numbers from the luxury group Estee Lauder Inc. Its shares sold off more than 20% after it warned that sales would fall and profits disappoint in the current quarter, while slashing its dividend by 47%. It was the company's worst ever single-day selloff. Over the last 20 years, Estee Lauder now lags the S&P 500. Two years ago, that would have been unthinkable: Its problem is the Chinese consumer. All luxury goods makers concentrate on China, but Estee Lauder had made a strategic decision to prioritize the country even more than its competitors. That decision is hurting. The Rachel Papers Rachel Reeves, the UK's new chancellor, made an unscheduled Thursday afternoon appearance on Bloomberg TV, which you can see here, as she continued to try to defend her budget. Watching it shows her difficulties reconciling the two vital audiences of domestic voters and international bond investors. Although both ultimately share a desire for strong economic growth, bond vigilantes are as unforgiving and ruthlessly efficient as the Spanish Inquisition. Her appearance was a recognition that she needed to address their almost fanatical devotion to fiscal restraint directly after a brutal day of trading: While things had calmed down somewhat by the close, the spread of 10-year gilts over equivalent German bunds had reached its widest since the Liz Truss crisis of 2022. The market perceives a problem: However, at no point has this selloff been as extreme as two years ago. This chart shows five-day movements in the 10-year gilt yield over the last three years; what happened in September and October 2022 was on a wholly different scale: For the next 24 hours, Reeves could be at the mercy of events in the US, where the October unemployment data is due at 8:30 a.m., New York time. A surprisingly strong number would likely push Treasury yields upward, and add to the pressure on gilt yields to rise. Adventures on the Phillips Curve In the US, the data has (mostly) run in the direction of an economic soft landing (although there's still little evidence that voters are feeling it). The PCE deflator for September, the Fed's official inflation target, is still not back to the 2% goal, but the trimmed mean (excluding outliers and taking the average of the rest) compiled by the Dallas Fed suggests it's getting close: That on balance suggests the Fed can go ahead with cutting rates next week. Meanwhile, claims for unemployment insurance suggest that hurricans Helene and Milton have wrought less damage than feared. Initial claims are still below their highs from last year: The employment cost index, regarded as a critical indicator of whether the jobs market is pushing prices higher, rose by only 0.8% in the third quarter, its lowest rise since the summer of 2021 — another indicator that a rate cut can probably proceed. But the hurricanes have made non-farm payrolls, due Friday morning, unusually hard to predict. Economists polled by Bloomberg think that only 100,000 jobs will have been added in October, which would be the weakest growth since the pandemic shutdowns: That might prove to be an easy number to beat. Even Higher Stakes The confident traders who have been betting big on Donald Trump to win the presidency are just beginning to think they might have overdone it. How much buyers' remorse they're showing, and how much they think they overplayed their hand, varies according to the market they're using. The two best-known markets that have been offering prices since Joe Biden dropped out on July 21 are PredictIt, an academic exercise with limited stakes, and Polymarket, an offshore operation based on the blockchain that doesn't limit positions. They agree on the shape of the race, and have both pared Trump's chances this week. But Polymarket has been persistently more bullish about Trump: Prediction markets have risen to the top of the agenda, with Polymarket in particular fostering the impression that Trump has this won, even though the wagers have been driven by a few very large bettors. You can follow the saga here, here, here and here. A reminder about the meaning of probability. If Trump loses, that doesn't mean that the markets were "wrong" but merely that an event that would happen four times or more out of 10 has indeed happened. PredictIt was quicker to grasp that Harris would get the nomination and be a viable candidate. It's too soon to tell whether the experts betting small stakes in that forum will also look clever for never drinking quite so much Trump Kool-Aid. A strong win for Harris, after the publicity of the last month, would somewhat unfairly do the image of betting markets a lot of harm after the weight that's been put on them.

In political futures, and in the much bigger markets for stocks, bonds and commodities, the bottom line remains that it would be unwise to stake anything on the outcome if you don't have to. Markets will have plenty of room to move once we know the victor, and that might be as soon as Wednesday morning. When is schadenfreude OK? I ask, because the pleasure I take in the intense unhappiness of the many New York Yankees fans I work with is beginning to make me feel bad. For me, the fifth inning of Wednesday's decisive fifth game was one of the most satisfying spectacles ever staged. The Yankees were up 5-0, with a 94% chance of winning. Then they dropped an easy catch, and muffed a simple throw to third base, to put two Dodgers on base who shouldn't have been there. Still, with two outs, the Dodgers had failed to get anyone home when former Red Sox star Mookie Betts hit a ball softly toward first base and started running furiously. The first baseman fielded the ball and just stood there, while the pitcher barely moved from the moeund. Having once been a Little League assistant coach, I can attest he should have run to cover first base. A seven-year-old would get into trouble for not doing so. As it was, Betts was safe, and two hits later the Dodgers had scored five, all of them unearned. It was, shellshocked colleagues agreed this morning, the worst defensive inning in World Series history.  The celebrations extended to Red Sox fans. Photographer: Elsa/Getty Images How many ways do I love this? Red Sox fans can't stand the Yankees, so that's good. But for 38 years we've borne the stigma of the costliest and most embarrassing error in World Series history, when Bill Buckner let a soft roller to first base through his legs. The error cost us the entire series, just like the Yankees' horror show this week. The batter was the New York Mets' Mookie Wilson. Not only are the late Buckner and the Red Sox now off the hook, but in amazing karma the new worst ever error was also hit softly to first by a man called Mookie. What are the chances? You'd think the Yankees were cursed or something. Anyway, my apologies to Yankee fans for enjoying this so much. Please don't take it personally. Have a great weekend everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment