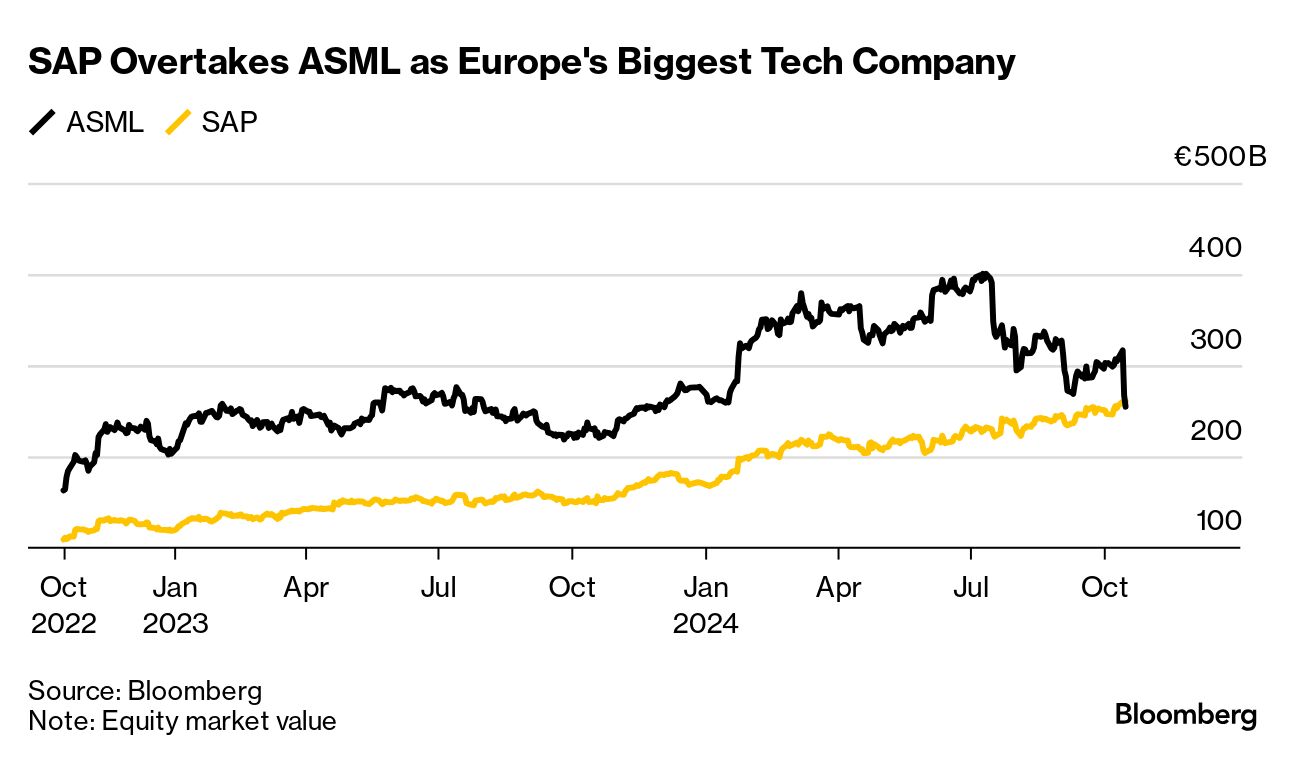

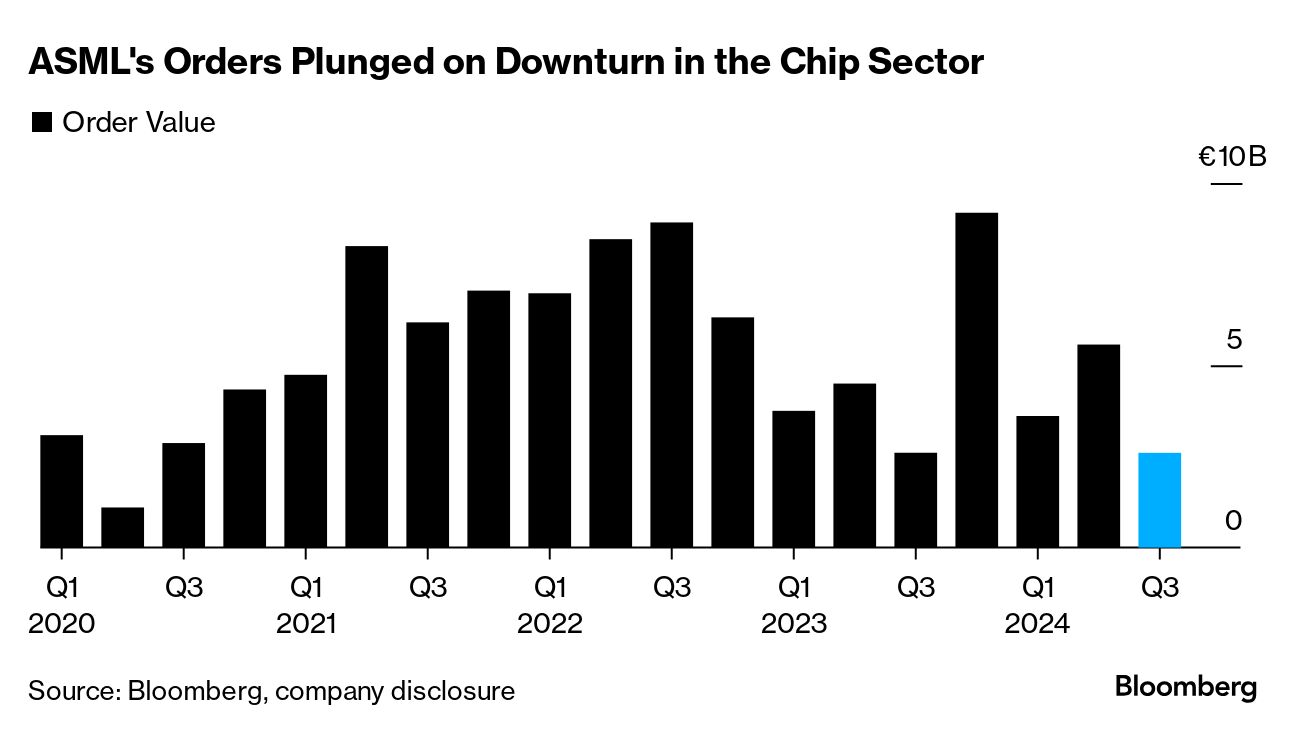

| German software firm SAP has taken the title of Europe's most valuable technology company away from ASML. More than €60 billion ($65.3 billion) in market value has been wiped away from the Dutch chip-machine maker. ASML sank about 5% in Amsterdam on Wednesday, adding to a 16% selloff yesterday. The stock reaction was all the more fierce because ASML mistakenly published its press release early and surprised investors by booking only about half of the orders analysts had expected. So there was none of the accompanying color that investors look for from company executives via interviews and conference calls.

Adding to the selloff: Traders had flocked to ASML as the best way in Europe to bet on the boom in AI. That means more short-term, momentum-style investors likely traded the stock. Those types tend to focus on sentiment, and thus adopt a shoot-first, ask-questions-later mentality when news breaks. It's worth noting that bookings for the company's machines, which can cost hundreds of millions of euros, are inherently volatile. (Read this Big Take for a deep dive into ASML.) Still, the company has often reported disappointing bookings in past quarters, with only short-term effects on the stock price. Longer term, bulls argue, ASML will benefit because its gigantic extreme ultraviolet lithography machines make the chips that power the next wave of AI devices. |

No comments:

Post a Comment