| Earnings season has arrived with a bang on Wall Street. And investors, who've spent months debating the economy's many mysteries, will now get a glimpse of the real world in action as Corporate America reveals its latest profits and losses.

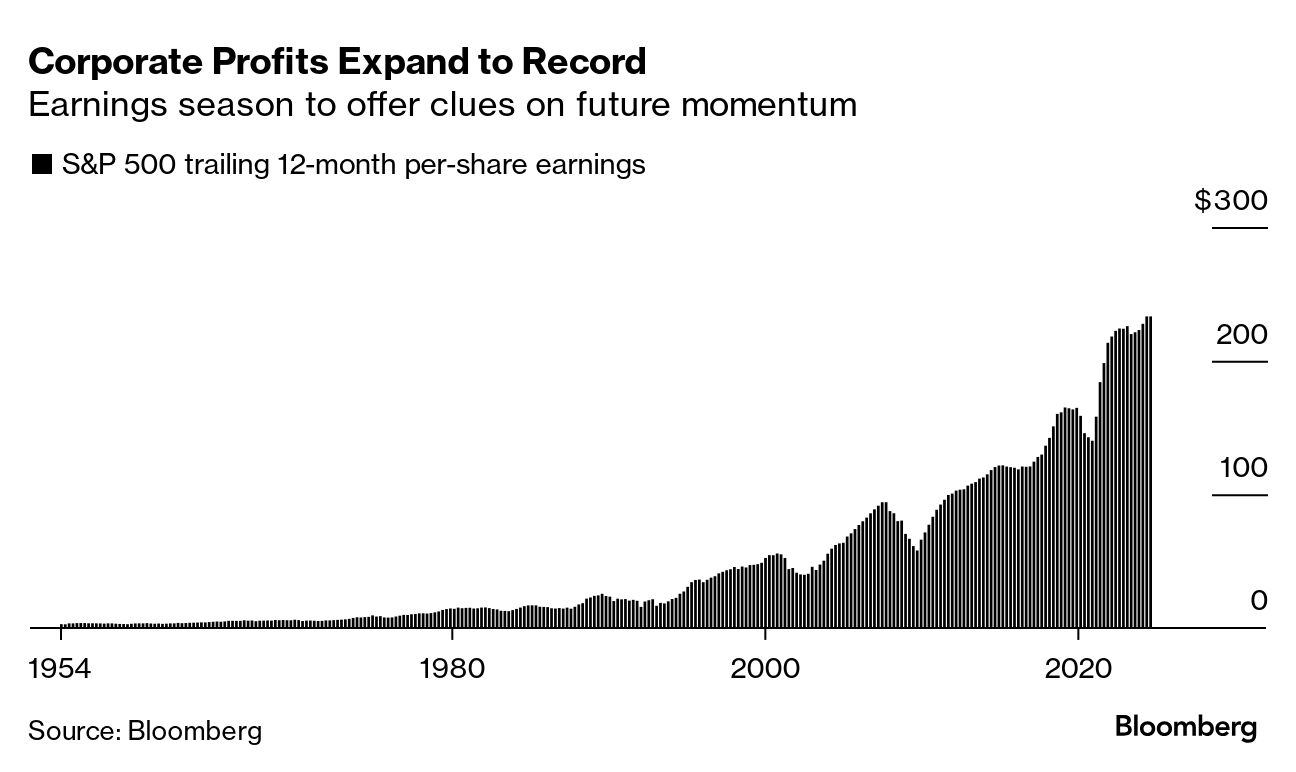

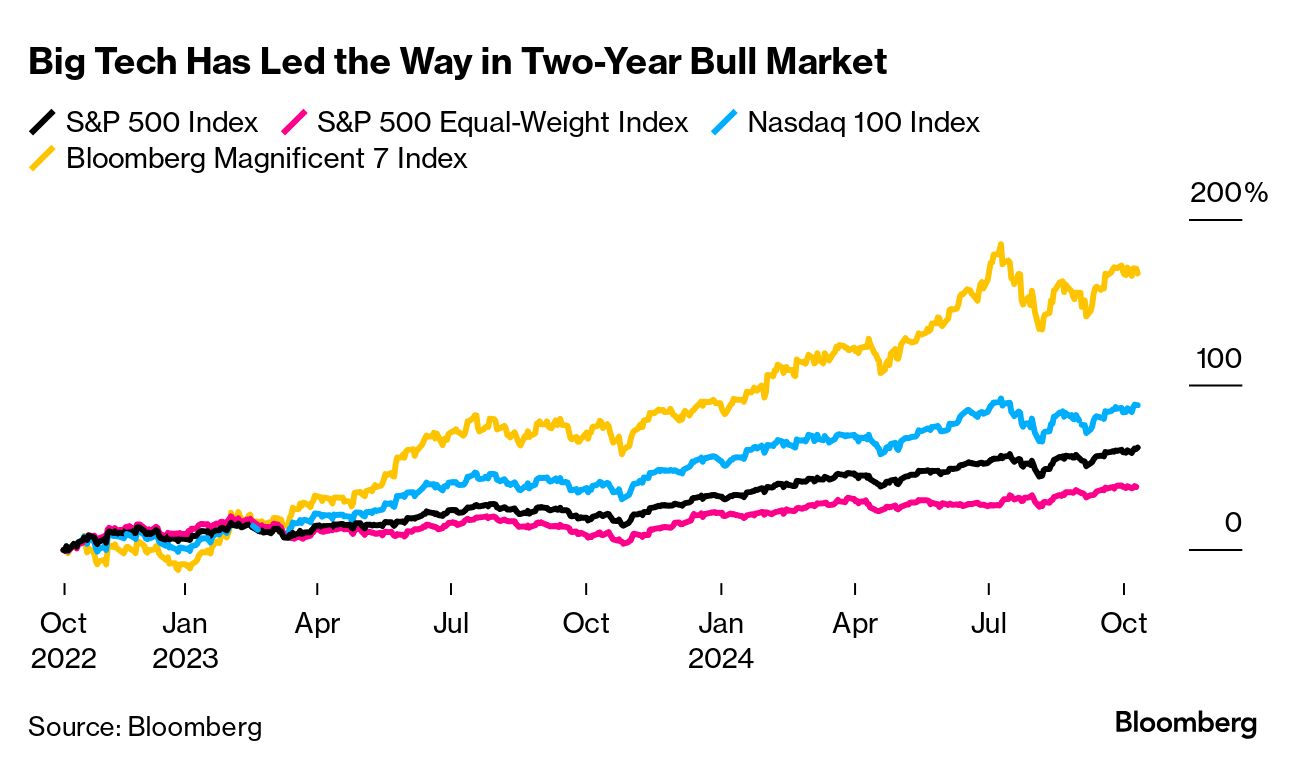

So far, the tidings have been good. Results on Friday from JPMorgan and Wells Fargo came in above estimates, helping to lift the S&P 500 through the 5,800 level for the first time. This week, the likes of Goldman Sachs, United Airlines and Netflix will provide fresh clues on the health of US households and businesses. Among the themes to watch: How much Big Tech's AI-driven earnings growth has slowed, and whether wage pressures are still squeezing profit margins in some industries. In truth, US companies are the envy of the world by consistently beating already high expectations for their profits, year in, year out. That big fact largely explains the boom in the S&P 500 in the post-pandemic era. Amid all manner of upheaval — massive inflation, the Federal Reserve's aggressive interest-rate hikes, political headwinds — the profit machine has chugged along. Market valuations rise, then strong earnings arrive to justify all that optimism. Yet keeping the cycle going gets harder as time goes on. While third-quarter profits are forecast to expand 4%, the slowest rate in a year, the bar is higher for 2025 as a whole, with consensus estimates calling for earnings to rise another 14%. That's certainly doable given economic data is still largely benign, even if consumer sentiment remains stubbornly depressed. Yet, the pace of earnings is now leaning toward the high end of the long-term average. Hitting next year's target would send the post-pandemic growth rate in S&P 500 earnings above 9% a year, well past what's been normal in post-war America. On one level, it shows how companies are firing on all cylinders. Good news. On another, it's also reason for caution for investors going forward. Broad corporate profits as a percentage of gross domestic product now sits at 15%, a level reached only twice before the pandemic. So, yes 'tis the season to rejoice in the almighty earnings power of S&P 500 companies. But spare a thought for the future. A lot is being asked of it. —Lu Wang |

No comments:

Post a Comment