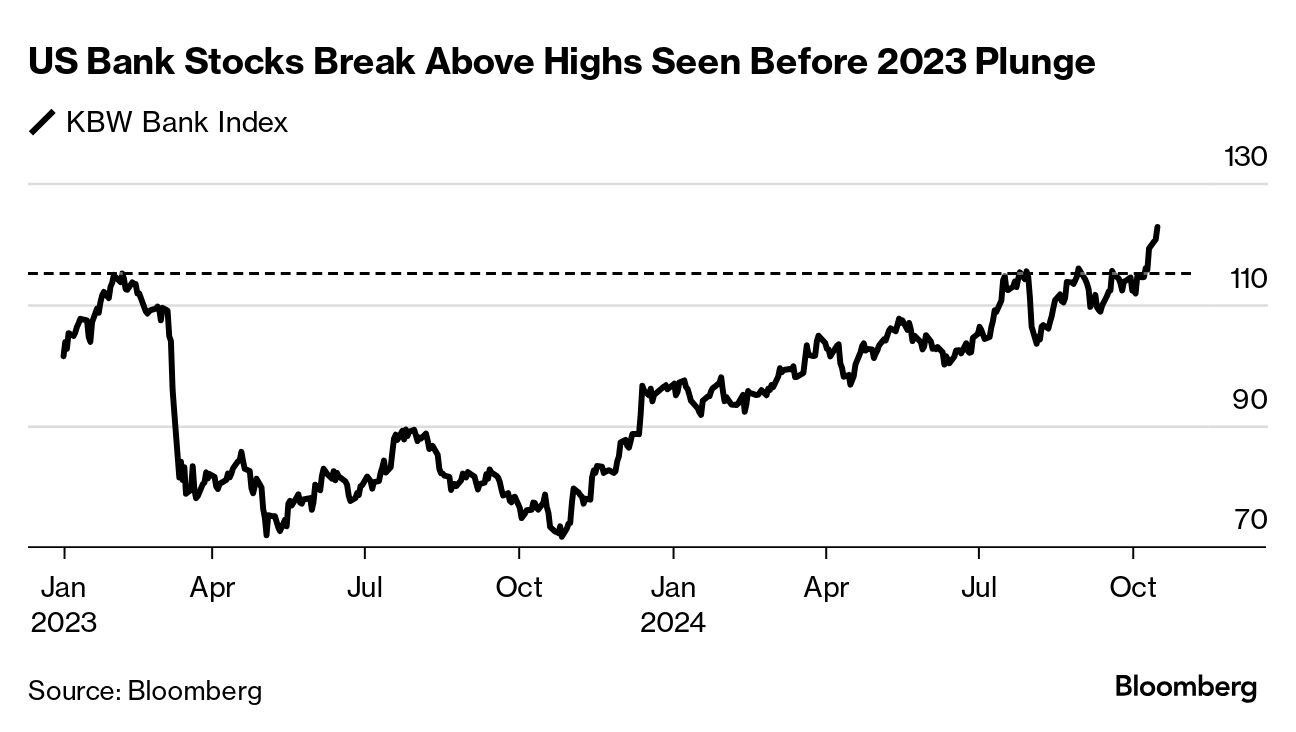

| Investors love a story, and politics makes for spicy plot lines. Just ask hedge fund manager Stan Druckenmiller, who made waves this week by telling Bloomberg Television that much of the frantic motion in markets of late reflects the pricing in of a Trump presidential victory. It may be true, but other explanations exist for what's driving stocks and bonds right now — in many cases far simpler ones. Among them: positive economic trends that predate recent polls and have only tenuous connections to the executive branch at best. Data on Thursday, for instance, showed that US consumers and the labor market, more generally, are holding up well. September retail sales strengthened more than forecast, while applications for jobless benefits fell further than economists were expecting. Among the smattering of earnings released so far, most have surprised to the upside on metrics like sales. Banks issued almost unanimously strong guidance on their outlooks. In short, while politics may dominate the discourse, you don't need it to explain the ascent in the S&P 500 that is approaching six straight weeks, or why inflation worries are creeping back into the Treasury market. The yield on the 10-year US Treasury note is hovering around 4.11%, the highest since late July, and gold set a fresh record. Over at JonesTrading, Michael O'Rourke says it's a little of both. Trump-themed trades are winning right now — things like crypto and the ex-president's media stock for example — but there are other big trends at play. He said: "Broad market strength is due to a massive broadening of the equity market rally, from the Magnificent Seven throughout the balance of the S&P 500 to mid-caps and small-caps."

A combination of a strong economy and prospects for further rate cuts are also fueling the fire, per O'Rourke. In markets, there are always many stories to choose from. —Emily Graffeo |

No comments:

Post a Comment