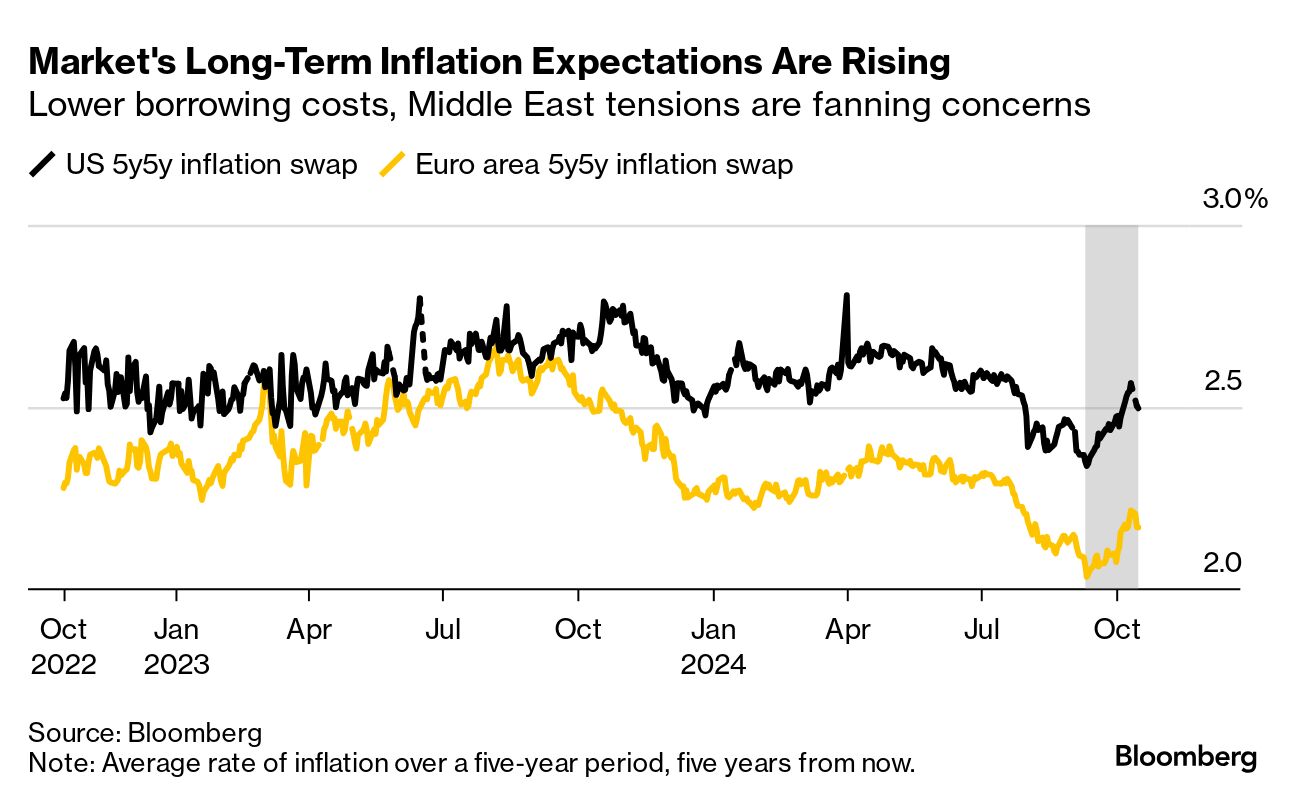

| Markets are sending a clear signal that the war against US inflation isn't over yet. Gold has soared 30% this year and is on the cusp of reaching $2,700 an ounce. A measure of long-term expectations for consumer prices, called the Treasury breakeven rate, climbed steadily over the past month and now stands around 2.3% — above the Federal Reserve's target. "There is a bubbling sense that the absolute conviction of inflation returning to 2% might be more faith than fact," says TS Lombard economist Steven Blitz.

To be sure, most investors don't expect the economy to face another big spike in price pressures. Treasury markets are calm, the ECB is about to cut rates again and the UK consumer price index recently fell below 2%. But skeptics warn that inflation will be harder to vanquish than people realize — the so-called "last mile problem." Here are some of the reasons behind that thinking:  - The US economy is strong. Today's retail sales report is likely to show resilient consumer spending. There's even some talk among strategists that the Fed may hold off on cutting rates, though the consensus is for at least one more reduction this year.

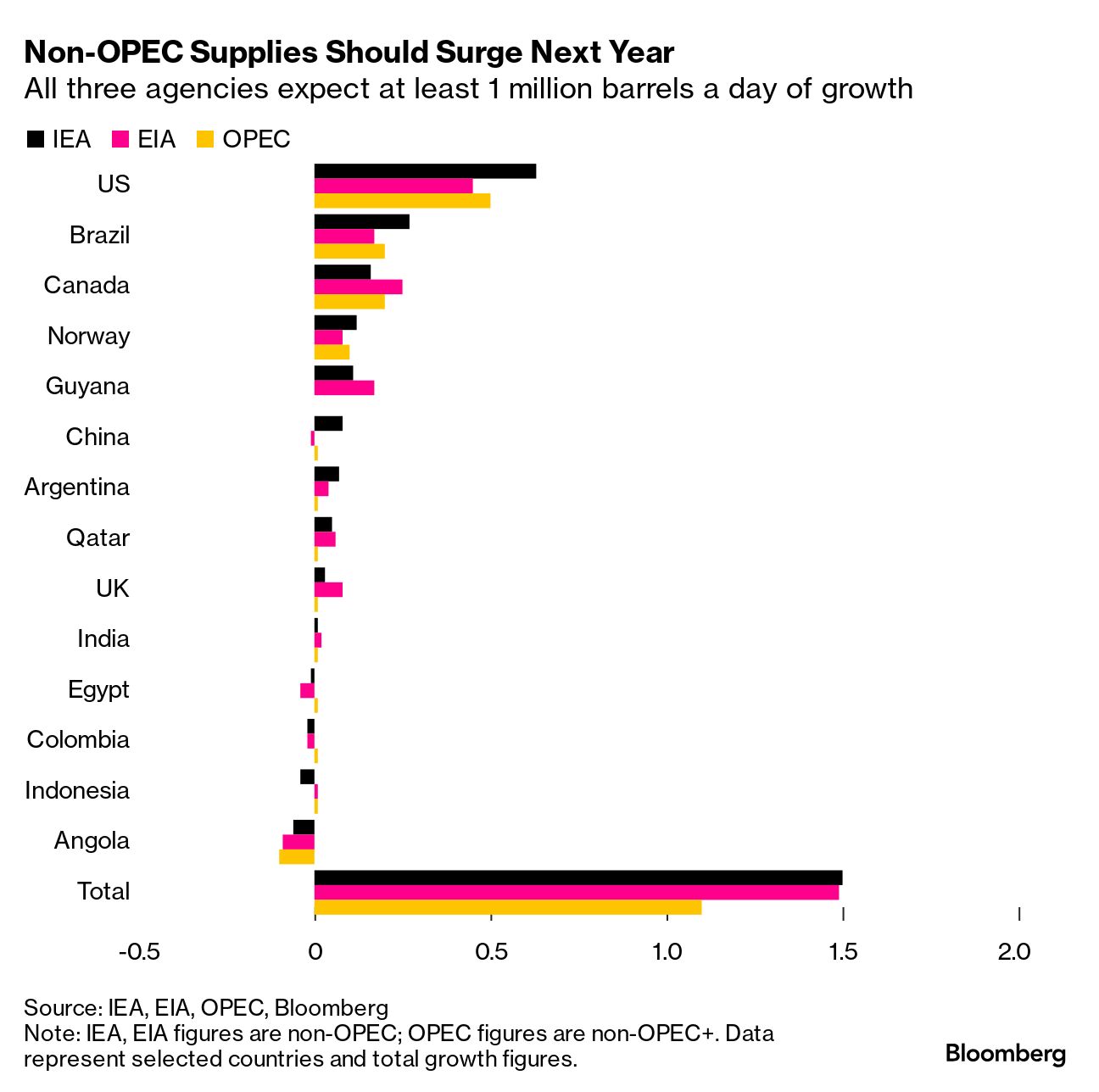

- Conflict in the Middle East. While oil prices have fallen back to the $70 a barrel mark, there's still a risk that fighting between Israel and Hezbollah spirals into wider regional warfare and could disrupt energy supplies.

- US CPI topped expectations. The so-called core index — which excludes food and energy costs — increased 0.3% in September, disrupting a string of lower readings. Some have said that's a hint at underlying pressures.

- There's excess liquidity. Corporate profits have been a primary driver of wages and prices in this cycle, writes Bloomberg strategist Simon White. He cites a measure of excess liquidity – real money growth minus economic growth – that's been surging as another inflation indicator.

- Donald Trump might win the White House. The Republican candidate has put steep tariffs at the center of his economic agenda. Goldman Sachs estimates that those policies would add about 1 percentage point to the US inflation rate.

- Or it could be Kamala Harris. There's another argument that a Democratic administration would be inclined to boost government spending and drive up the national deficit. Though, polls pointing to a split Congress suggest whoever wins the presidency will be limited in their agenda.

- In summary: "While market participants are cheering central banks going into full cutting mode, some of us are indeed staring at our screens, concerned," wrote investors at Man Group this week. "The inflation genie has not quite been pushed back into its bottle." — Alice Gledhill

|

No comments:

Post a Comment