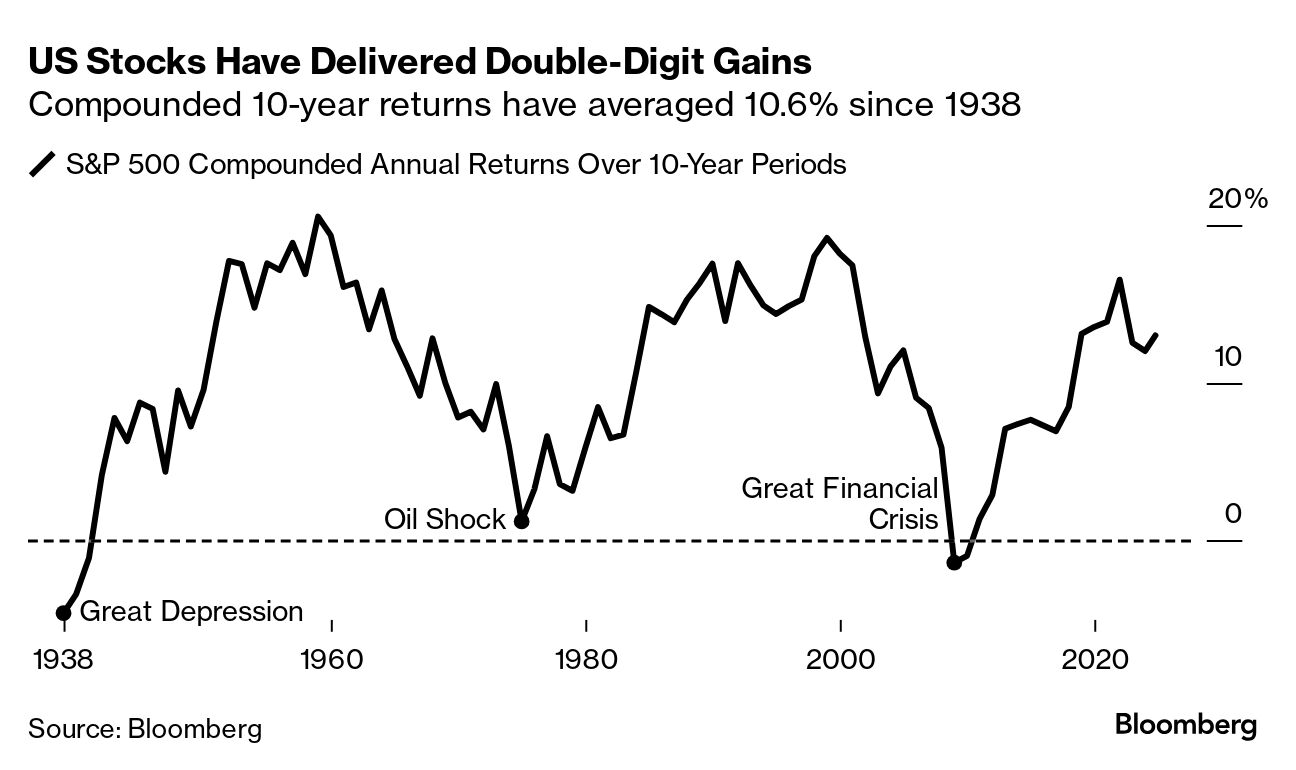

| Forecasting the market is hard, some would say impossible. But that doesn't keep Wall Street's best and brightest from diving in to the fray, year after year. Rarely have their predictive energies been on greater display than this week, when Goldman Sachs warned that annual S&P 500 returns may narrow to a paltry 3% over the next decade, only for JPMorgan Asset Management to say the view is too dour. Why is it so hard to see the future of stocks and bonds? The main reason is the role of big, calamitous events in shaping their destiny. Things come out of nowhere — a pandemic, wars, oil embargoes - and predictions premised on business as usual are often torn up. This fact led Nicholas Colas, co-founder of DataTrek Research, to argue in a note yesterday that unless something of that scale happens again, getting as gloomy as Goldman Sachs did in its outlook is usually a mistake. Long-term returns of 3% or less have happened just a handful of times, coinciding with traumas such as the financial crisis, the 1970s oil shock and Great Depression. "We have read nothing that outlines what crisis their researchers are envisioning," they wrote. "Without one, it is very difficult to square their conclusion with almost a century of historical data."

This year has been a lesson in the relative futility of forecasting. Back in January, Wall Street strategists on average were expecting the S&P 500 would rise by about 2%. It's up 23%.

Of course, it's the nature of calamity that it comes without warning — to say there's no crisis looming over markets now doesn't mean there won't be sometime soon. And while it's true that most of history's lean seasons in equities correspond to catastrophes, there is a notable exception: the early 2000s bursting of the dot-com bubble, a period when the biggest problem investors faced was valuations. With the S&P 500's price-earnings ratio approaching those levels, it may be an exception worth noting. —Denitsa Tsekova |

No comments:

Post a Comment