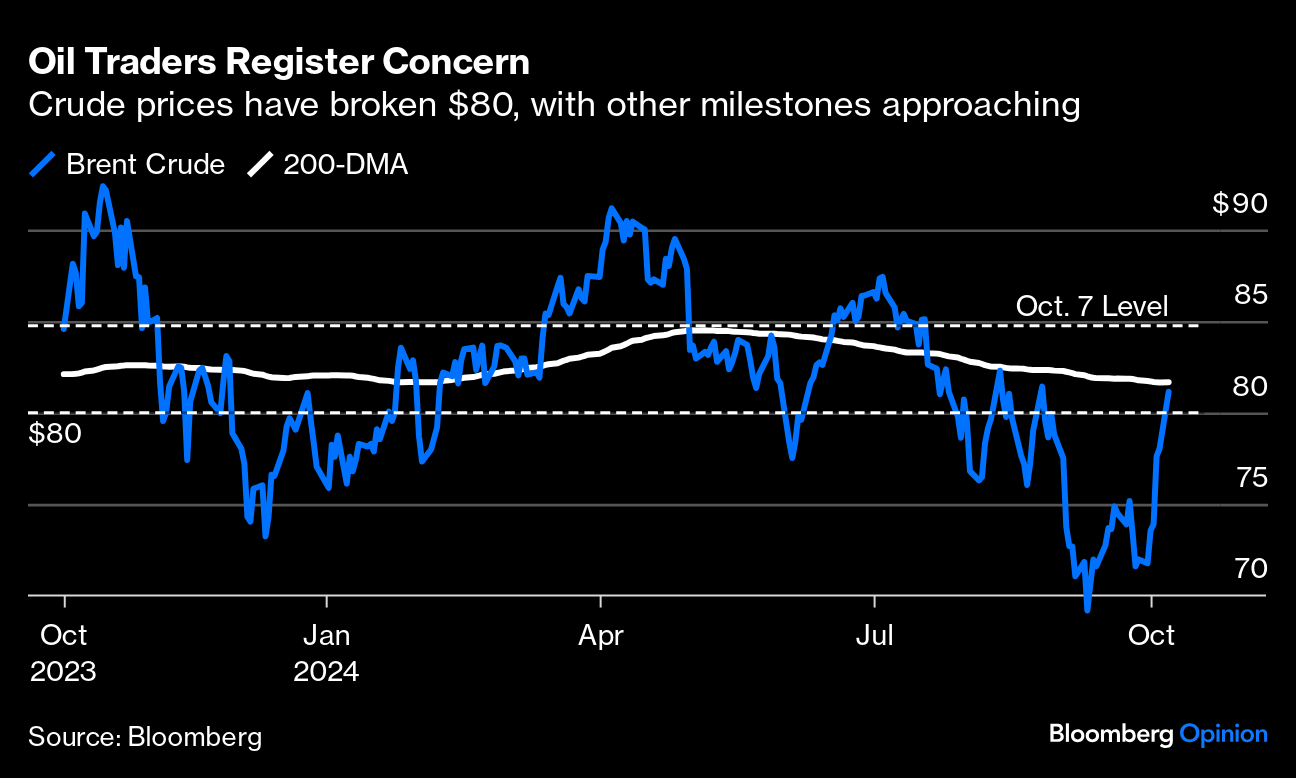

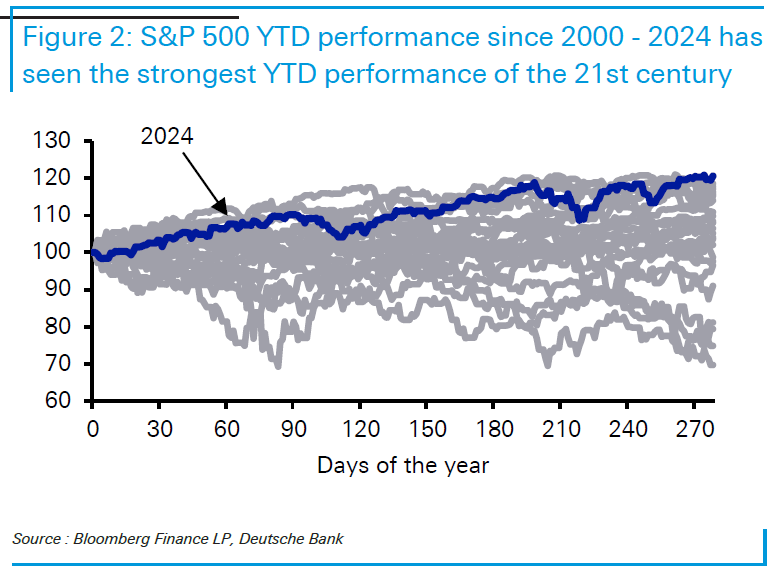

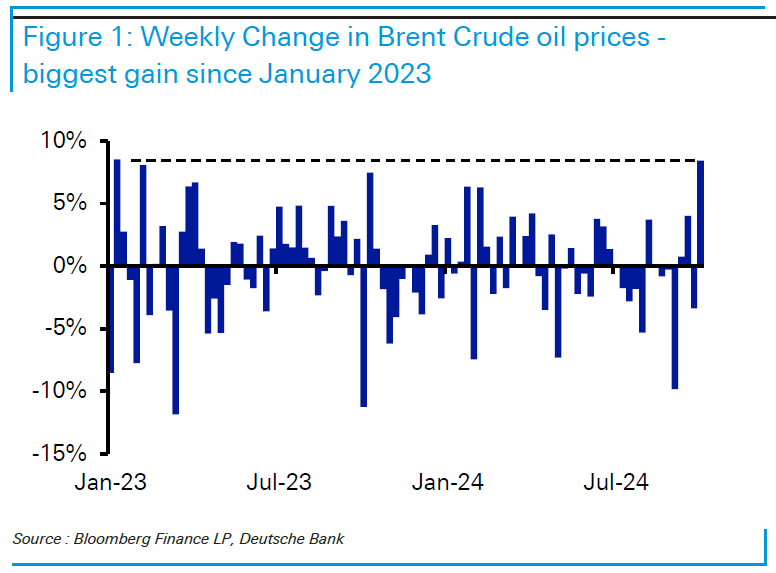

| Markets are offering stark contradictions, which could soon be resolved — for better or worse — in the Middle East. In bonds, the ripples from last week's startlingly strong employment numbers (and China's stimulus) were clear to see. Selling of two-year Treasuries, sensitive to short-term rates, was so aggressive that their yields briefly exceeded those of the 10-year. In other words, the dreaded inverted yield curve was back, scarcely a month after it appeared to have disinverted for good: Doubt is now beginning to seep in whether the Federal Reserve will cut rates at all next month, only days after a jumbo cut of 50 basis points was seen as probable. Fed funds futures now put a 15% chance of no cut at all, even of the standard 25 basis points. With the economy looking stronger for the long run, the 10-year yield also surged above the 4.0% milestone for the first time since July: That move in bonds is a big postive macro surprise, but unusual geopolitical tensions are high. That would normally prompt investors to rush for Treasuries as a shelter. And the tension is clear. Brent crude, below $70 per barrel two weeks ago, is now back above $80, very close to its 200-day moving average and approaching its level from the eve of the Oct. 7 Hamas attacks on Israel. It's a drastic move: In another clear sign of anxiety, the VIX index, which gauges equity market volatility from the options market, is back above 20. Save for the few days of near-panic when the yen carry trade was unwinding at the beginning of August, this is its highest since the regional banking crisis in March last year. Positive US economic data can't explain this. Heightened anxiety in the Middle East can: Deutsche Bank provided a few other illustrations of how incongruous the situation is. This year has witnessed growing fears of a slowdown, persistently high interest rates, and an exceptionally divisive and unpredictable election campaign. So of course, over the first three quarters, it turns out the S&P 500 had its best performance this century: Meanwhile, as credit spreads remain very tight and show no great concern, the Brent oil price last week saw its biggest percentage increase since January 2023: Deutsche suggests that the angst in the Middle East isn't having an impact, because oil prices are rising from a low base. "If we did see a bigger rise in oil prices that pushed up global inflation, then that would be concerning from a market perspective, as it would likely mean that central banks felt less able to deliver rate cuts," said Henry Allen of Deutsche Bank. "But that isn't happening so far." Jean Ergas of Tigress Capital Management suggested that Middle Eastern risks remain binary. "It's not linear, there's a step function," he said. "The situation is very dangerous, and it's being reflected asymmetrically in oil and the dollar but not bonds." Without the rising tensions, he suggested that the 10-year yield might be as high as 4.5%. Any escalation that brought Iranian and Israeli forces into direct conflict, or cut the flow of oil (most plausibly through attacks on Iranian production facilities or by blocking the Strait of Hormuz), would create the step change. "Is there oxygen or not? You know there's no oxygen when you choke." For oxygen, read oil. And while the oil keeps flowing, the market can breathe easily. Returning to the election. There's a broad feeling that Kamala Harris hasn't built on her win at the debate with Donald Trump a month ago. Much might explain this; some find her interview performances unconvincing, Hurricane Helene and the rising risk of all-out Middle East war make the incumbent administration look bad, and Trump has just held a big rally at the site of the first attempt on his life in July.

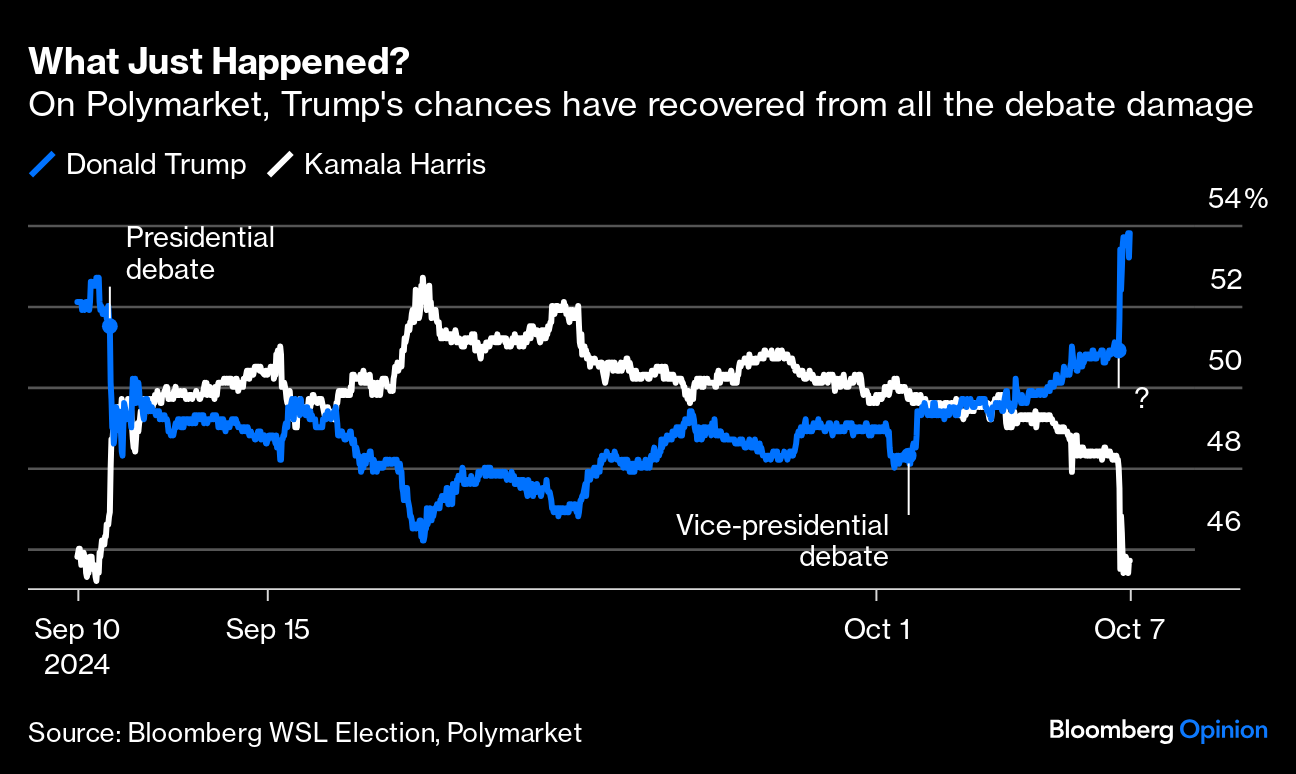

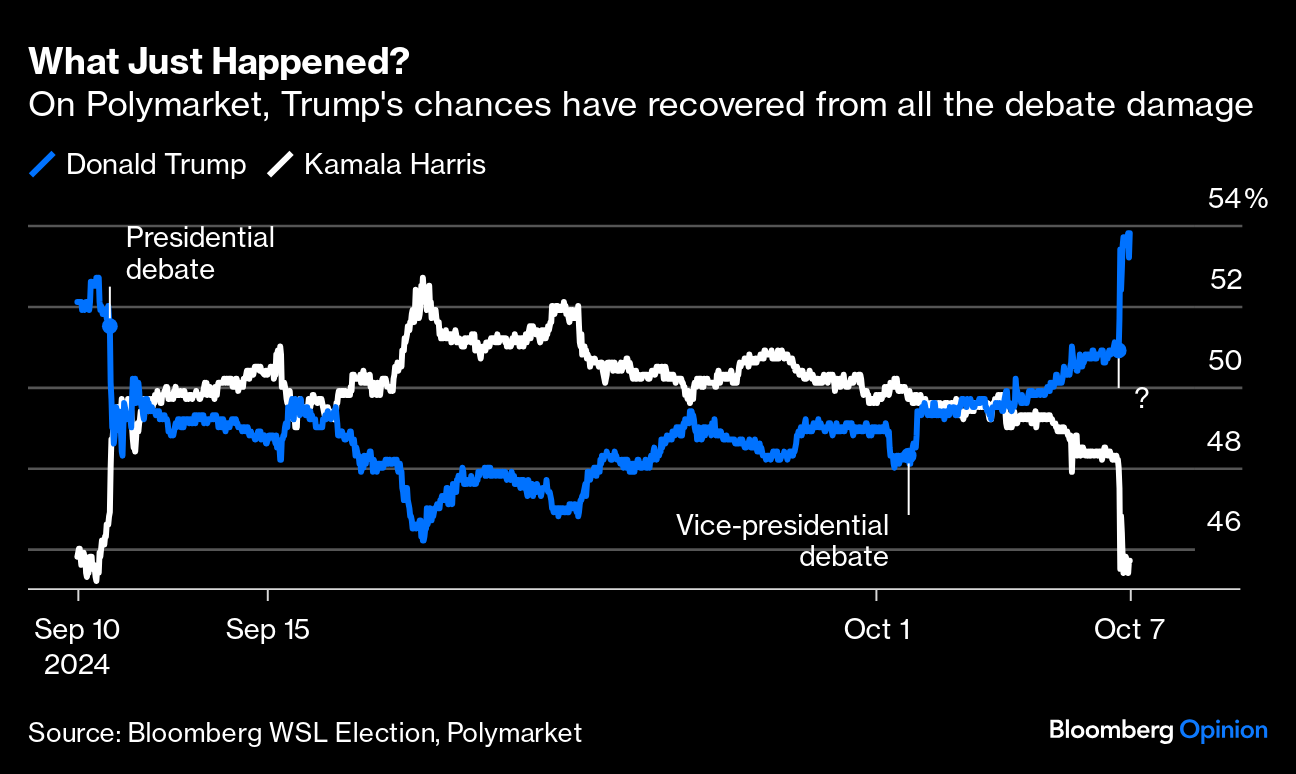

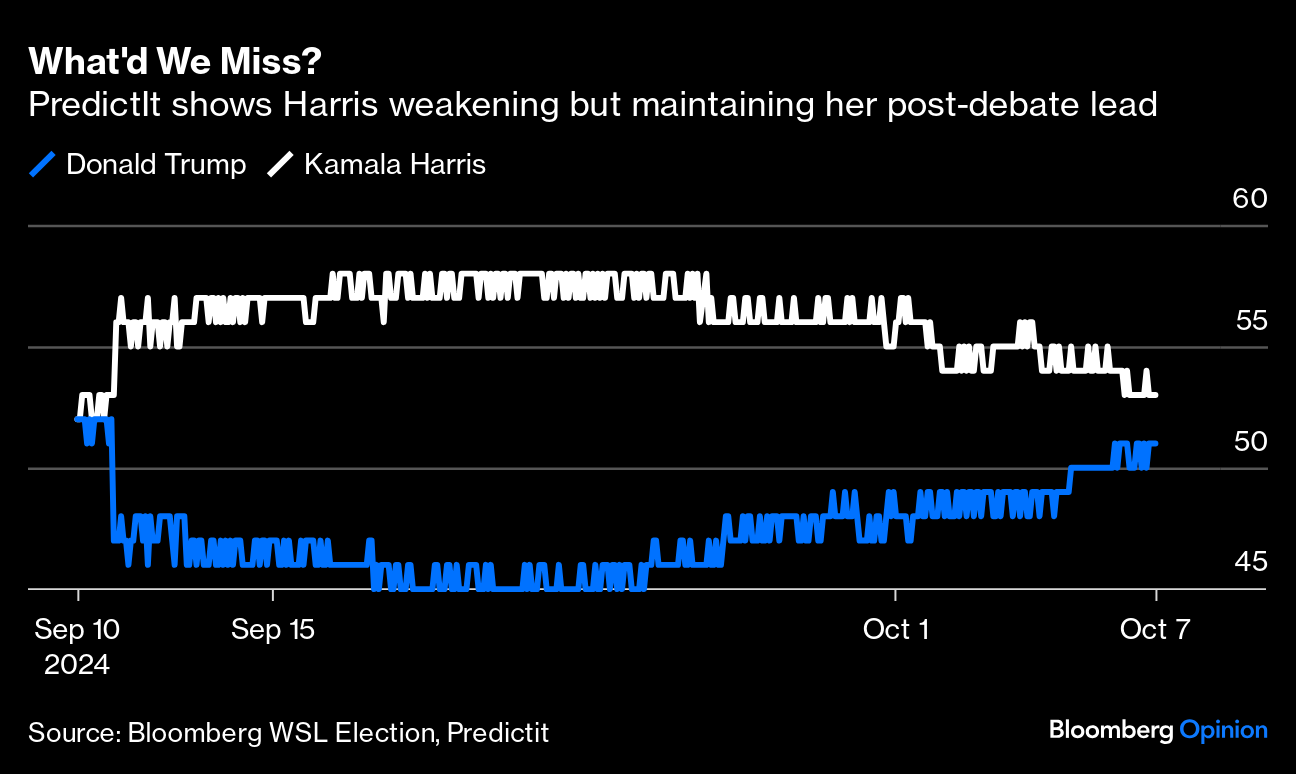

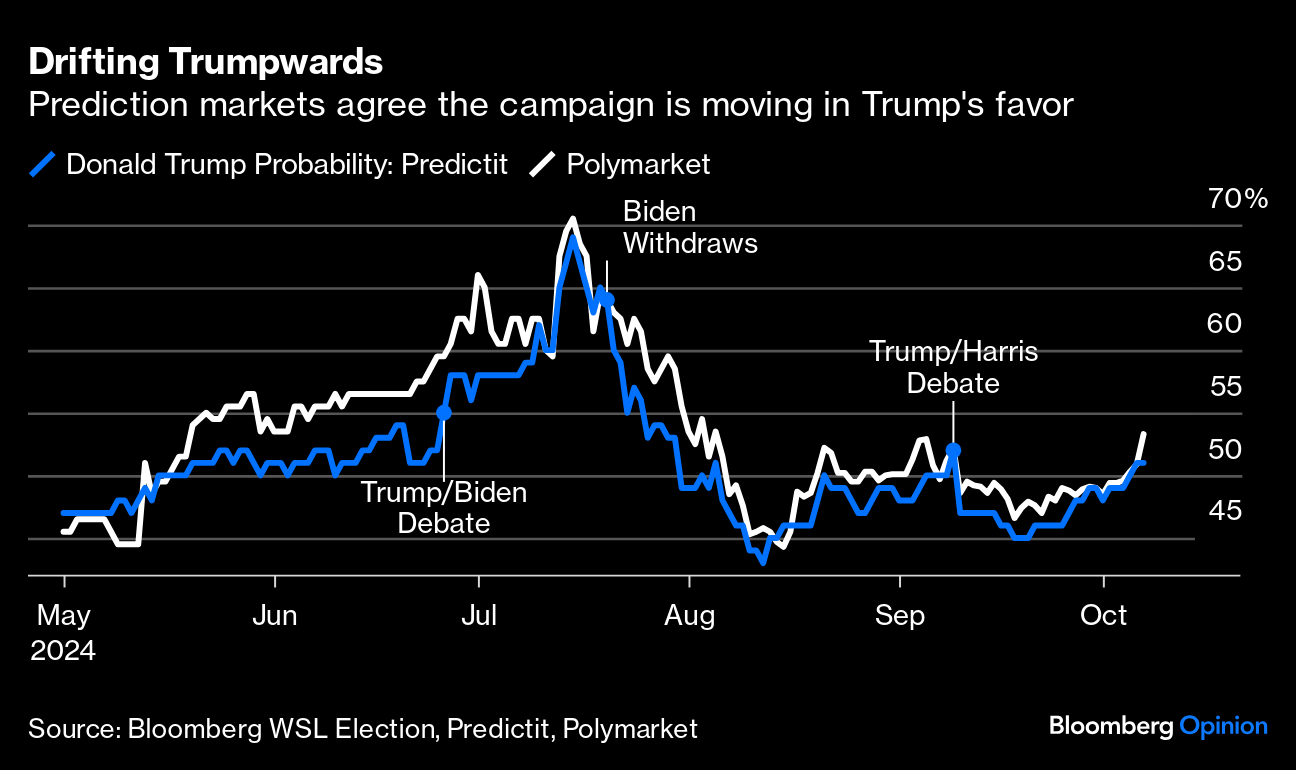

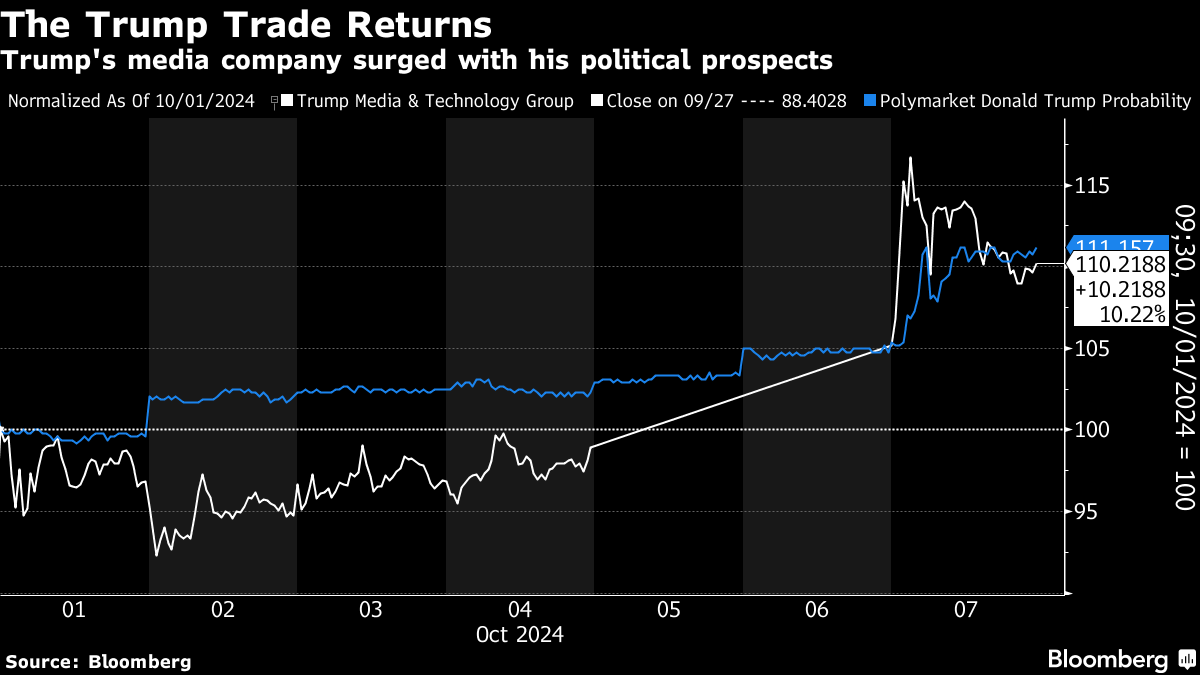

But it's hard to see how this can explain the sudden leap in Trump's chances of victory on the Polymarket prediction market, which implies he did as well Monday morning, on no new news, as Harris did on debate night. On Polymarket, he's erased all the damage from his "they're eating dogs" soundbite:  Polymarket is relatively liquid and operates on the blockchain. The PredictIt market, regarded as less liquid, has persistently perceived Harris' chances as stronger, and her odds there have also declined in the last two weeks. But she is still ahead, slightly stronger than before the debate, and there was no big Monday morning move: Over the slightly longer term, the markets have seen the race similarly since May, moving together with odds that have shifted in line with the drama of the last few months, and the polls, and common sense: Monday morning, however, looks strange. Trading in Trump Media & Technology Group Corp. also saw a big bump. Investing in either Trump's business or his political futures is seen as a way to help him, and so the issue of manipulation, or at least irrational exuberance, seems relevant: Prediction markets are already controversial. Another, Kalshi Inc., is going through a legal battle with the Commodities and Futures Trading Commission on whether it should be allowed to offer political futures. Intrade, widely followed during the 2012 campaign, was forced by regulators to close down the following year. "Please look at what happened to Intrade," said Tina Fordham of Fordham Global Foresight. "Why does anyone take political prediction markets seriously?" The answer is that over a long history, they have been more accurate than Gallup polls. They failed to see Brexit or Trump coming in 2016, but Intrade did call every single state correctly in the knife-edge elections of 2004 and 2008. The logic behind them is clear; people with money at stake will gauge investments carefully, and take advantage of egregious mispricing. If someone interfered to push up the Trump price, it should soon be possible to correct it. But these markets aren't big and a whale can cause a big splash. Where this becomes contentious — explaining the dispute over Kalshi — is the possibility of political manipulation. Conspiracy theorists quickly pointed out that Elon Musk, the world's richest man and a Trump-backer, had posted on his social media site X about Trump's improving Polymarket odds shortly before the price spiked, describing the market as superior to polls. If such markets can be co-opted to create momentum where it doesn't exist, then they could be harmful.  Uncurbed enthusiasm. Photographer: Justin Merriman/Bloomberg Perhaps the most interesting voice on this is the statistician Nate Silver, also famed for successful election predictions and now an adviser to Polymarket. In his Silver Bulletin newsletter, he traces a careful line. His model shows Harris with a slightly better chance than Trump, but "the race remains a toss-up for all intents and purposes." Monday's swing is "larger than justified by the models." He suggests circular logic is at work: Sometimes market sentiment has a mind of its own, and that can especially happen when traders are bored and angsty because they're in the doldrums. And what you can also see is a circular thought process. Someone (say Elon Musk) tweets about Trump gaining ground at Polymarket. On a slow news day, that becomes news, and people just let their imaginations run wild. People assume there must be something there, that somebody knows something, but usually it's just a Rich Guy With Opinions.

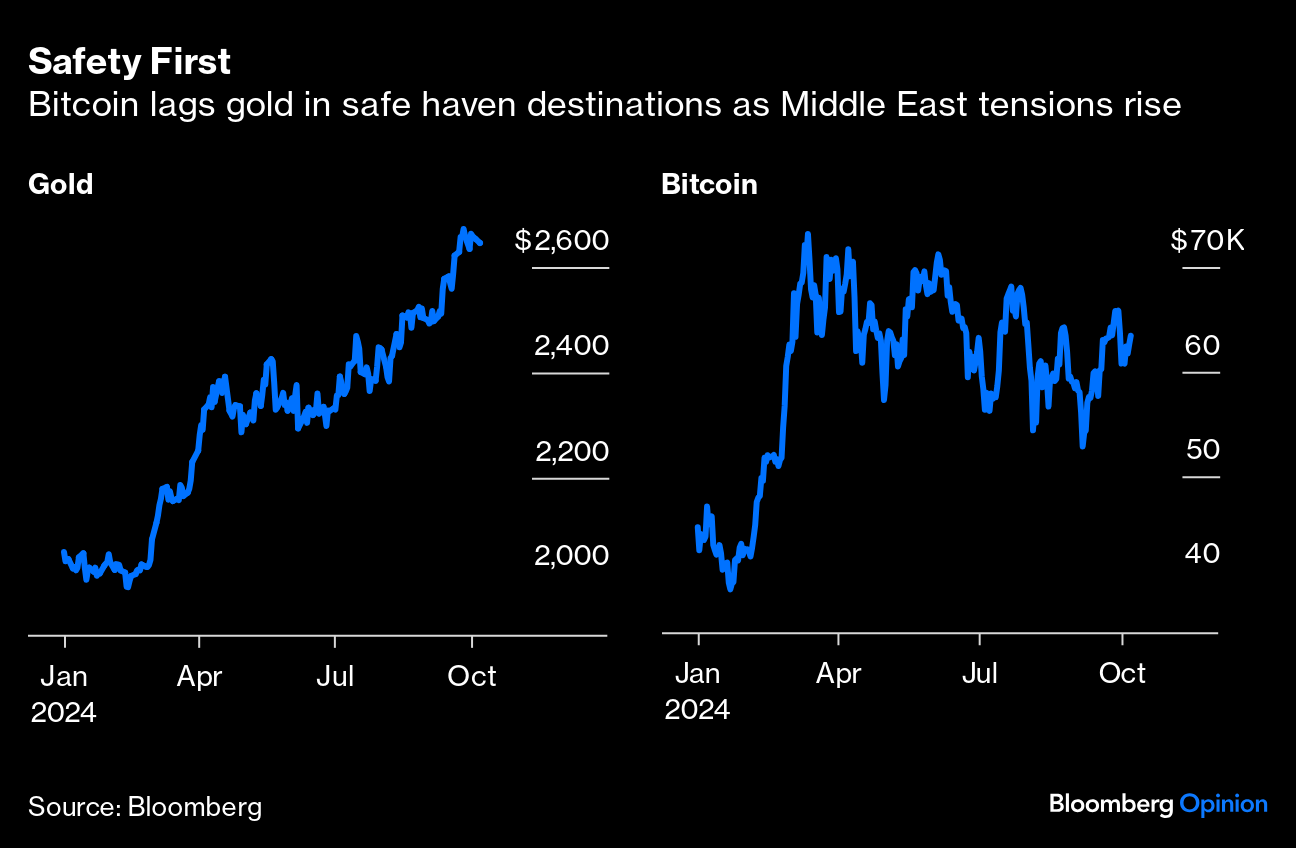

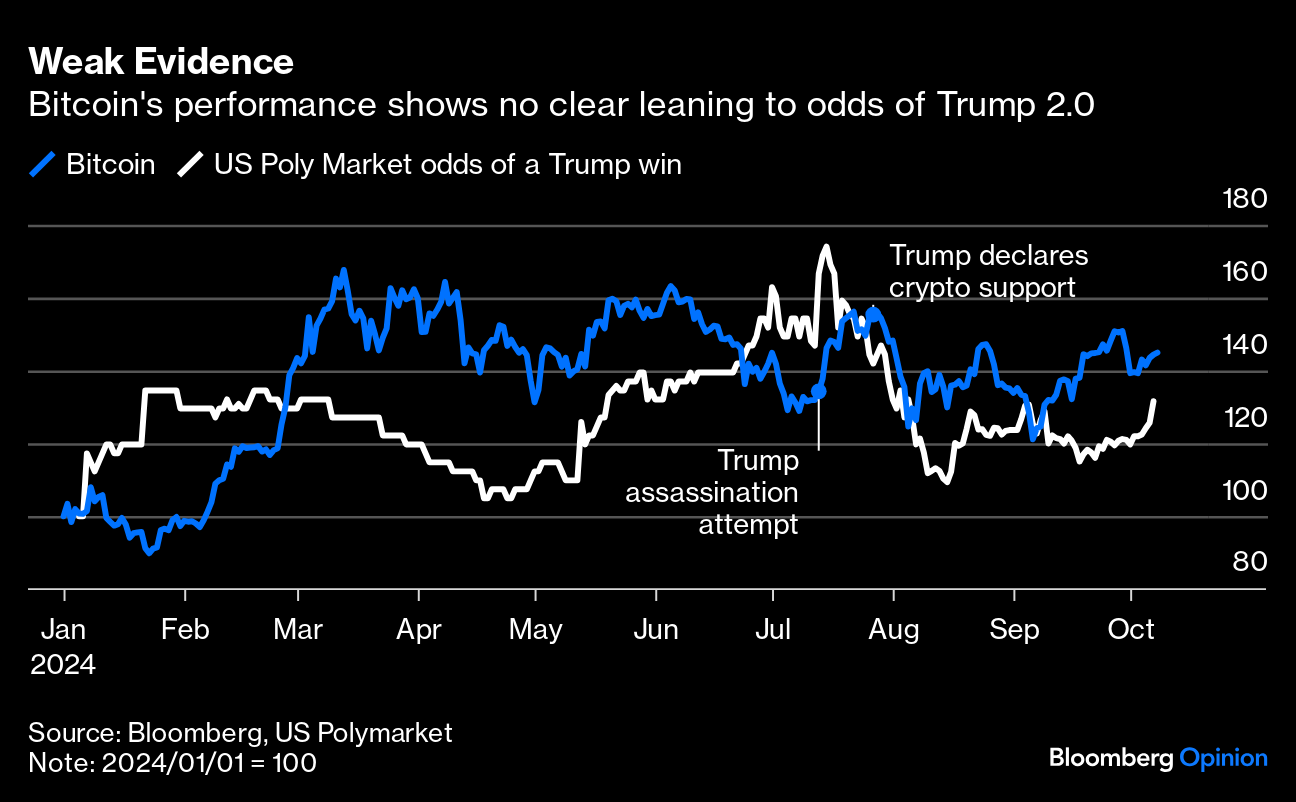

Silver adds that even if Harris' "true" odds are 55 and she can be bought for 46, it's a good bet that would still lose money nearly half the time. A whale can feed the market for years, and sharp bettors might be well advised not to get involved. Further, the Polymarket trading community, full of crypto bros, might naturally be skewed toward Trump. "My experience is that there are mostly just a lot of true believers — have you heard that Trump has some extremely enthusiastic fans? — plus maybe a few technical traders who are trying to time the market." Between the courts and the electorate, the next month could be a crucial testing time for prediction markets. As geopolitical risks ratchet up, investors are seeking cover in haven assets. Gold is up by about 30% this year, and trades close to its all-time high. The greenback is above its 50-day moving average for the first time since early July. But Bitcoin isn't a popular haven if recent price movement is anything to go by. The digital asset has moved sideways since its peak in March, while bullion has been on a steady march: Why is Bitcoin perceived differently? Frnt Financial Inc.'s Stephane Ouellette explains that as gold's digital cousin, Bitcoin has a different profile among market participants, who tend to see it differently. He argues that while there are hoards of professional speculators in assets like gold who represent the critical mass of the market, that's not the case in Bitcoin, which remains nascent. In the long term, Ouellette says it's viewed as a hedge against political and financial risks, and an opt-out from devaluation of fiat currencies. Moves to deal with such risks tend to happen gradually over time as part of portfolio allocation decisions. Back in April when tensions between Israel and Iran surged, Standard Chartered's Geoff Kendrick observed that Bitcoin's performance was muted. The uninspiring showing is playing out again. He suggests that Bitcoin's passivity partly reflects positioning as well as its tendency to behave as an extension of the tech sector. Instead, Kendrick argues that in a scenario of US fiscal dominance, Bitcoin would provide a good hedge against de-dollarization and declining confidence in the Treasuries market. For now, Bitcoin's 47% haul this year — 128% in the last 12 months — masks its impotence during risk-off events. ByteTree's Charlie Morris, who oversees the BOLD ETF, a risk-weighted blend of gold and Bitcoin, argues that the two assets are complementary. The fund, listed in Switzerland, is up by more than 33% year-to-date. In the last five years, the sweet spot for the two worlds has outclassed bullion by a mile (although it hasn't blown out the lights like Bitcoin), and it recently hit a new high: The Polymarket excitement feeds into the belief that a second Donald Trump administration will create a supportive regulatory environment for crypto and eventually spur fresh highs. Thus it would make sense to expect a clear positive correlation between Polymarket's Trump odds and the Bitcoin price. But if there's a relationship, it's far from clear-cut during this year's dramatic trading: Nonetheless, the impact of Trump's endorsement on crypto fanatics can't be dismissed. On Polymarket, crypto bros' enthusiasm for Trump can't be ignored, either. Expect much more Bitcoin excitement in the next four weeks. —Richard Abbey Back on Election Day in 2020, I recommended listening to the late Bill Withers to manage stress. I'd recommend that again for the next month. Try Lovely Day, Just the Two of Us, Lean on Me, or Do It Good. All stress-busting musical suggestions gratefully accepted.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Claudia Sahm: America's Jobs Market Has Entered the Twilight Zone

- Mohamed El-Erian: How to Think About the Surprising US Jobs Data

- Shuli Ren: China Is Making Investor Calls So Awkward

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment