| Lawyers, accountants and freelancers know to the penny what an hour of their professional labor costs. Most of those same people, I'd wager, don't have a similar figure at the ready for their personal time. Why not? There is a strong case for estimating the value of our non-working hours, treating them like any other financial-planning input. Failing to do so makes it harder to make rational choices about the costs and benefits of an Uber versus the bus, delivery versus home-cooked or even whether to hire a personal assistant. These sound like champagne problems. They are. But they come up more often at times like this, when the labor market is still showing signs of unexpected strength and the busy final quarter of the year is in full swing. Failing to address them can leave time-poor professionals feeling worse than they should, especially given how much they make. Tackling them, experts say, can help the chronically busy feel more fulfilled in their jobs, at ease in their personal lives, more equal in their relationships and happier overall. "People don't usually think about it, but implicitly we all have a value that we place on our time," says Spencer Greenberg, a New York-based mathematician who founded ClearerThinking.org, an organization aimed at improving decision-making. The group created a tool to calculate the implicit value of your time. It asks a series of questions about pay, how much you would spend to save time on a given task or how long you would be willing to wait to get something for free. "It looks like you value your free time considerably," my test results told me. They added "it's possible that you're more reluctant than you should be to spend money in order to free up time." That rang true. I do most of the cooking and cleaning in my household. I could probably afford to spend a bit more on services to save time. But I feel guilty and awkward doing so, and am not sure how much is too much to spend on things that might free up time. I asked a host of financial advisers about these issues. Funnily enough, they were broadly in favor of what the test told me. "Buying back your time is like any other regular expense and can be included in your budget," said Noah Damsky of Marina Wealth Advisors in Los Angeles. "If you have savings of $4,000 per month and you spend $400 buying back several hours every week, that might be a great deal for you." The key is using that extra time in a way that will help you and is in line with your values. Philip Weiss of Apprise Wealth Management in Phoenix, Maryland recommends breaking your time and tasks into four quadrants: - Things you don't like doing and are bad at

- Things you don't like doing but are good at

- Things you like doing but are bad at

- Things you like doing and are good at

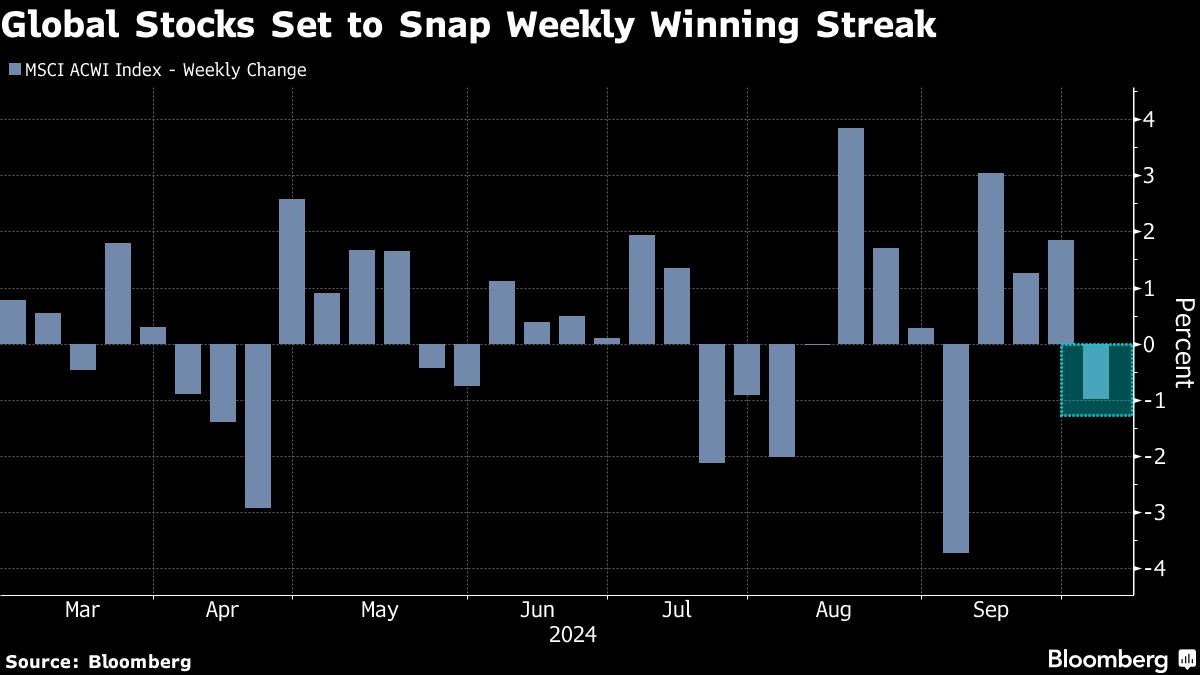

To me, it makes sense to pay for help on 1 and 2 in order to do more of 3 and especially 4. This issue hits home for Penny Di Giovanna, founder of Financial Planning By Design in Satellite Beach, Florida. Earlier in her career, Di Giovanna found herself too busy to stay on top of both work and housework, so she hired someone to help clean her home. This freed her up to attend more of her son Dakota's soccer games. She's thankful for that: Dakota died in a car accident when he was 15, and Di Giovanna says the time she bought back to be with him is priceless. She shares her story with clients to make sure they're prepared for the worst and ready for their lives to change in an instant. As far as guilt goes, Ian Bloom of Open World Financial Life Planning in Raleigh, North Carolina points out that paying someone to clean your home, babysit your children or drive you to work can be a win-win both for you and the person you pay. Just be sure to remain appreciative, treat them right, and pay them well. Important caveat: Experts don't want you to run every minute of your life under the "time is money" mantra. It's helpful to think about tasks and chores using market norms, but personal time has more than a simple dollar value. Jeremy Ouchley of JCO Advisors in Boise also says there are some tasks we benefit from doing ourselves, even if they take more time. Cooking and household repairs, he notes, can be stress-relieving. And Dan Markovitz, whose runs a consulting firm focused on enhancing organizational performance, says we should resist the urge to throw money at problems. It can be easier — and much cheaper — to address unhelpful assumptions. His advice is pretty simple if you're finding yourself too busy to get done what you want. "Be deliberate," he told me on the phone this week. — Charlie Wells Global equities are on course for their first weekly loss in four as the world awaits Israel's response to a missile barrage by Iran. Investors are also awaiting a raft of US data — including Friday's key payrolls report — for signals on the health of the economy. Brent crude oil rose, eclipsing $77 a barrel. Investors are concerned that, should Israel strike key Iranian assets, the Islamic Republic will lash out and escalate their conflict, dragging in more countries and potentially disrupting global energy shipments. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Colin Huang gained the most in dollar terms this week, adding $13.7 billion to his net worth, which now totals $53.8. Huang is the founder of Pinduoduo, the ecommerce operator. Chinese stocks have been soaring after the country's top leaders gave the green light to a massive stimulus designed to lift the world's second-largest economy. Jeff Bezos clocked a $7.2 billion loss this week, one of the largest in dollar terms. Much of the Amazon.com founder's wealth is tied up in the company's stock, down around 6% from early last week. Mortgages Make a Comeback in Manhattan A higher percentage of house hunters are using mortgages to fund purchases in Manhattan's market, driving sales up for a second straight quarter.  Photographer: Jeenah Moon/Bloomberg Closings of co-ops and condos climbed 6.7% in the three months through September compared with the previous quarter, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. The percentage of those sales that were done in cash fell to the lowest share in nearly two years as mortgage rates eased ahead of the Federal Reserve's rate cut in September. Sydney Doesn't Have Enough Three-Bedrooms for Boomers News from Down Under: Cashed-up older homeowners in Australia seeking to leave houses with empty bedrooms and high-maintenance gardens are finding their options are fewer than expected. In Sydney, there's almost triple the amount of two-bedroom apartments on the market as three-bedders, which is seeing the price of the larger properties soar three times the rate of the smaller ones — the biggest premium on record. This week, we're looking to speak with families who have someone applying for college this year. Application season is in full swing and tuition is slowly creeping to $100,000 a year. How is your family planning to pay? Are you considering any financial tradeoffs to help cover tuition? Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. Join us in New York on Oct. 16 as we bring together finance, government and business leaders from across various sectors to discuss advances in their fields and how they plan to sustain their leadership into the future. This year will mark the 12th anniversary of the Canada-focused event, continuing a tradition of providing timely, actionable insights and strategies for a global audience of leaders and decision-makers. Register here. |

No comments:

Post a Comment