| It's as though the American debate has gone back 120 years. Not only are we discussing tariffs, beloved of President William McKinley, but now antitrust, associated with his successor Theodore Roosevelt, is at the top of the agenda. When Roosevelt set about dismantling the huge conglomerates that had been pieced together by J.P. Morgan, he described them as "creatures of the State," which had not only the right but was "duty bound to control them wherever the need of such control is shown." No politician is talking in such fiery terms now, but these ideas are back on the table.

The proposal is to break up Alphabet Holdings Inc., which controls Google. There's an argument to be made for this, as well as the other dominant internet platforms — notably Amazon.com Inc., Apple Inc., Meta Platforms Inc. and Microsoft Corp., all of which could fairly be claimed to be monopolies in one way or another.

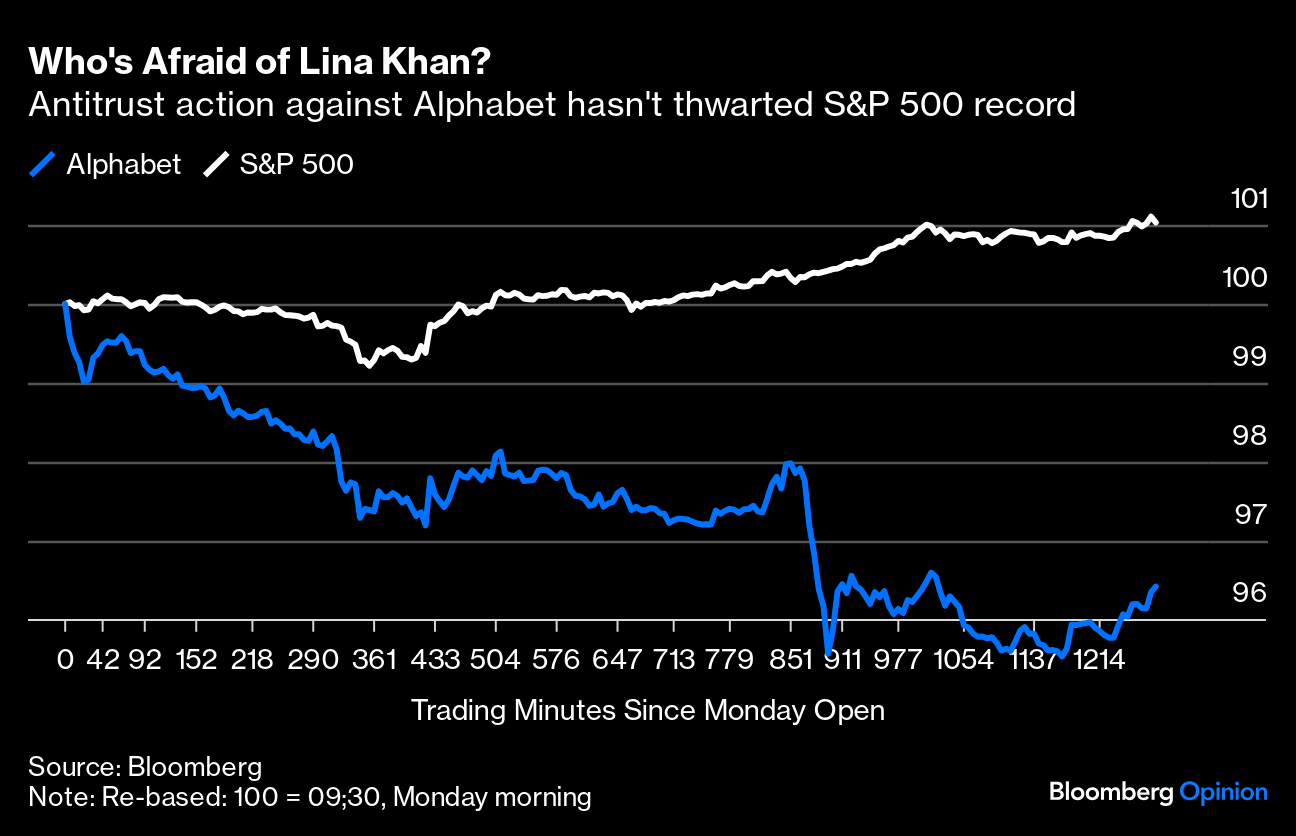

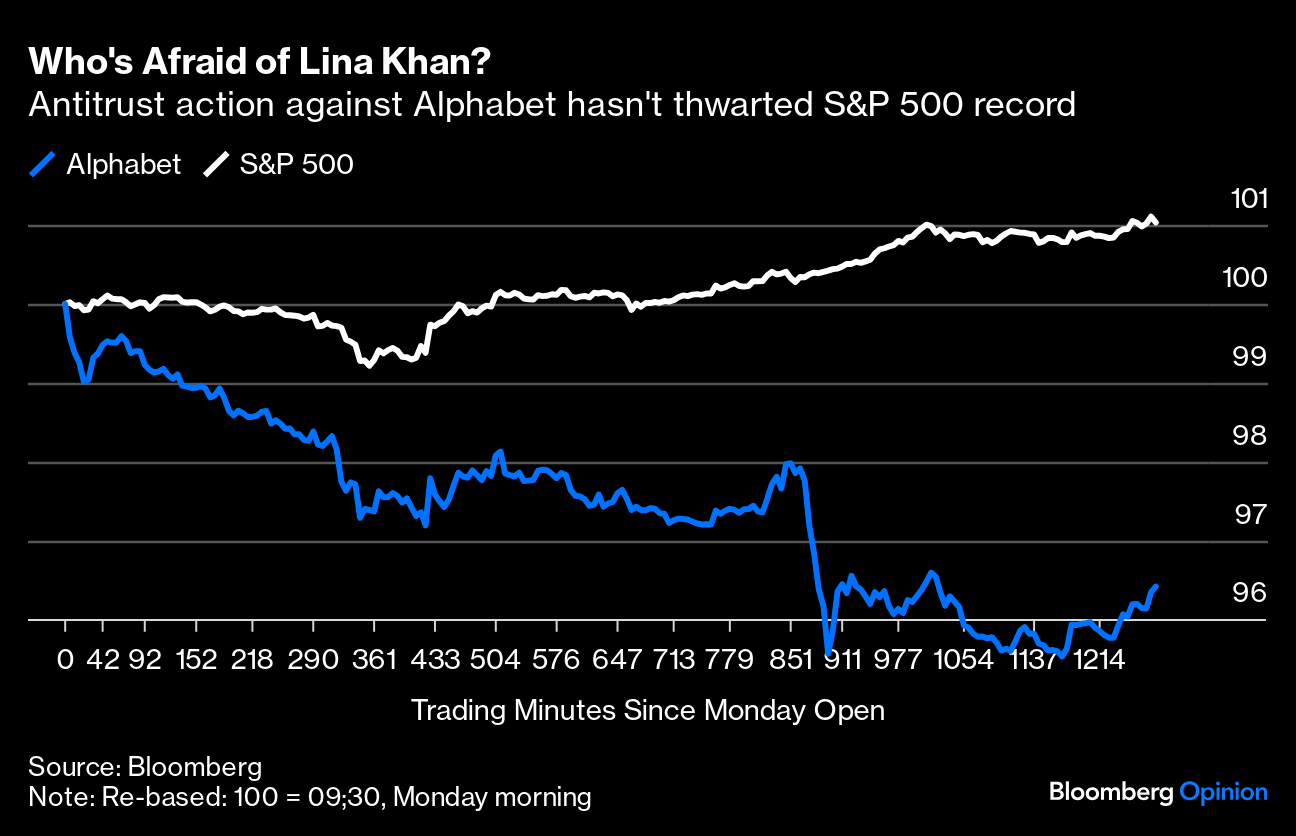

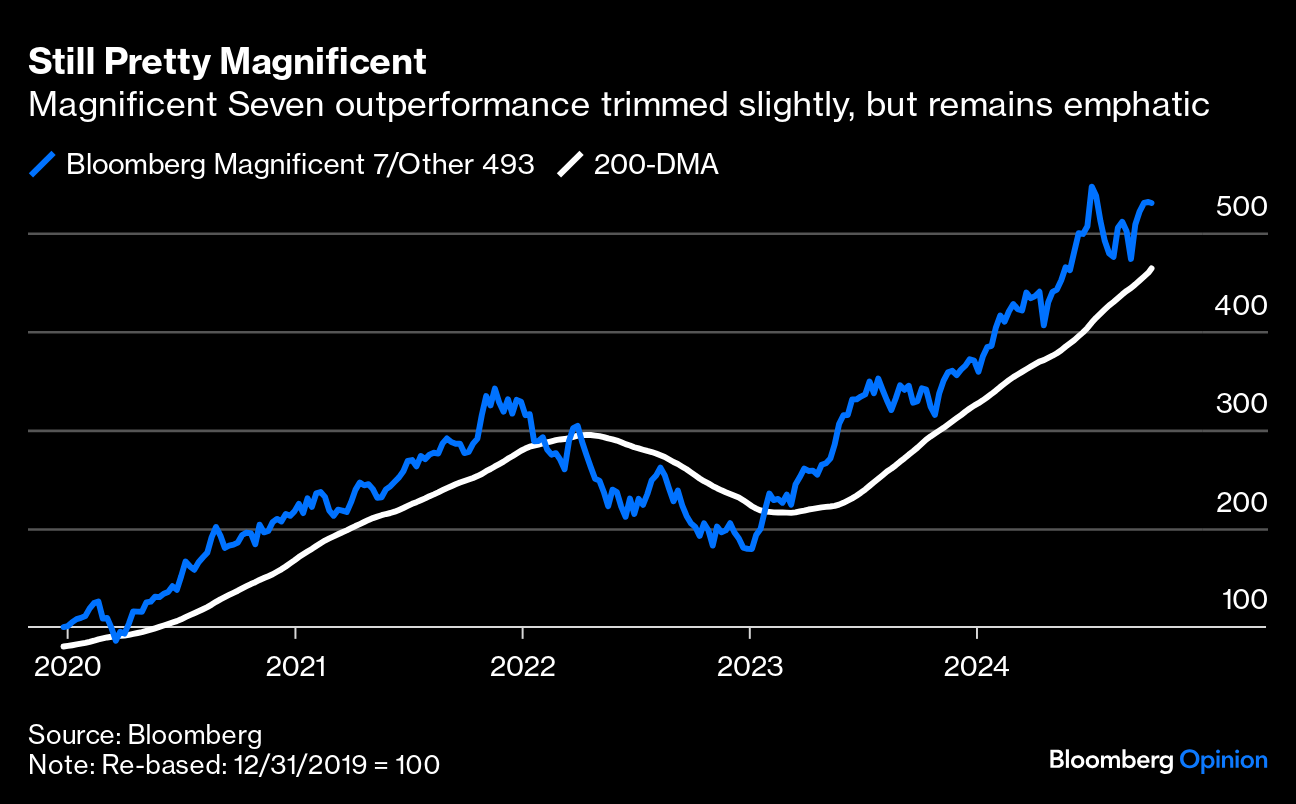

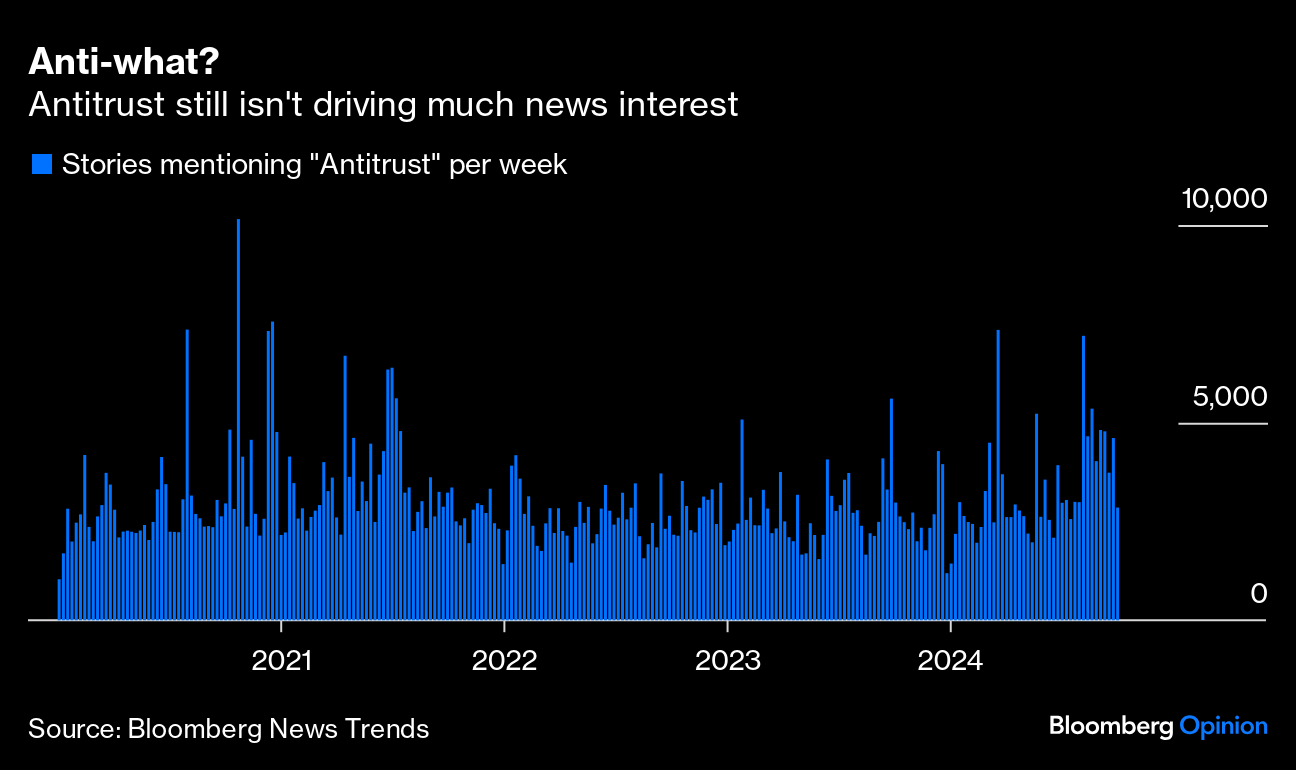

One of the strongest arguments against the Magnificent Seven has long been that they're so dominant that they invite the inevitable state intervention to split them up. So it's interesting to see how this week's news has played out in markets. Alphabet shares have suffered, but not so severely, and they haven't stopped the S&P 500 from hitting a new all-time high. This is how trading in Alphabet and the S&P has moved this week so far:  The Magnificent Seven as a whole have been trimmed back since their peak earlier in the summer, but the pandemic-era trend of extreme outperformance of the rest of the market remains firmly intact. This shows how the ratio of Bloomberg's Mag 7 index to the other 493 largest-cap US stocks has moved since the beginning of 2000: It's also intriguing that antitrust hasn't generated much excitement among journalists. Bloomberg News Trends, which covers all news stories appearing on the terminal (not just those by Bloomberg News), shows no particular interest in the subject of late:

The lack of excitement deserves some explanation. To be fair to the current candidates, none of them is exactly Teddy Roosevelt on this issue. Nonetheless, there's a belief that antitrust action is dependent on volatile politics. Democratic donors have been putting pressure on Kamala Harris to replace Lina Khan at the Federal Trade Commission; while Donald Trump's growing popularity in Silicon Valley makes him an unlikely trust-buster. In the event of a Harris victory and a reappointment for Khan, the threat to Alphabet might start to be taken more seriously.

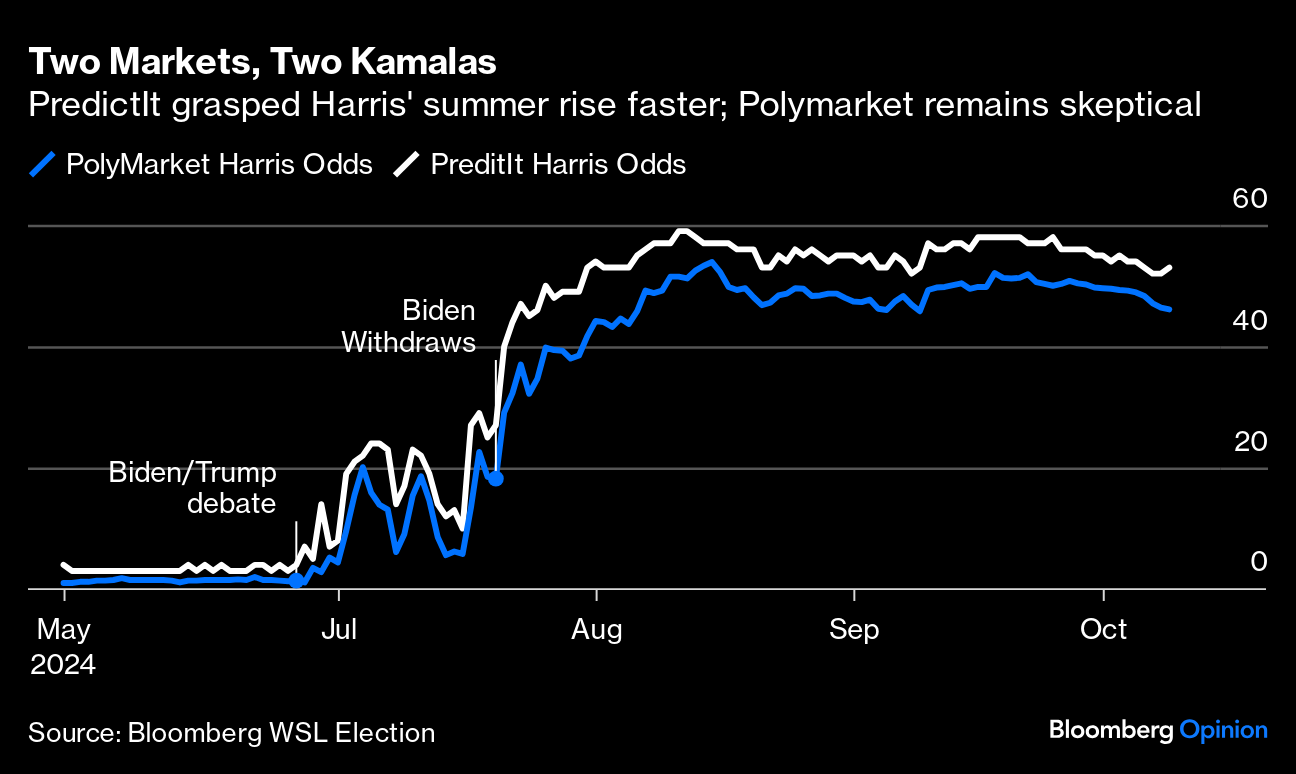

There's also the fact that antitrust actions take a long time. Lawyers for Alphabet, and the other Magnificents, should have little difficulty delaying any denouement for years. And the history of the last similar action, the attempt to split up Microsoft a quarter-century ago, suggests we shouldn't get too excited. It's still one of the three biggest companies in the world. Technological developments overhauled the issues that got it into trouble with the competition authorities, who called foul on the bundling of other products with the Windows operating system. But it does seem a little unwise to take the news so calmly. The Magnificent Seven are utterly dominant, and all of them practice the kind of bundling of products that got Microsoft and now Alphabet into trouble. There are politicians on both sides of the aisle who want to see more aggressive competition policy. For now, the message is that the market doesn't think it needs to worry about antitrust actions. Matt Levine is out with his own inimitable take on the prediction market furor. Everyone should read it. To update from the last Points of Return treatment, there are at least two conflicts. First, the Commodities and Futures Trading Commission is in a legal battle to stop Kalshi Inc. from offering futures contracts on the election. That case has a long way to go, but Kalshi has persuaded the court to allow it to do so for the next election, pending appeals. We have a live experiment coming, whether the CFTC wants it or not. Second, Polymarket, officially open only to non-US investors after its own run-in with the CFTC, saw a surge in Donald Trump's chances earlier this week that wasn't mirrored on PredictIt. How do we explain this? Since May, PredictIt has persistently rated Harris' chances more highly than Polymarket. During the drama of Joe Biden's dreadful debate performance and subsequent withdrawal, prices suggest that PredictIt bettors had a much better grasp that he'd probably stand down, and that it would be hard to stop Harris from getting the nomination. That's a point to PredictIt. Both see Harris' chances slipping recently, with Polymarket showing a more significant slide. It's too soon to tell who's right: How has such a difference emerged? The composition of the traders will inevitably have something to do with it. PredictIt is a haven for academics, who skew liberal. Polymarket is based on the blockchain and appeals to the crypto community, which skews toward Trump. As Matt points out, however, there should be arbitrage opportunities here. When markets diverge, generally someone makes money by closing the gap. Market mechanics are more important. PredictIt limits positions to $850. If you want to wager more than that, you'll have to do it elsewhere. Polymarket has no position limit, although it does caution those making very big trades that they might prompt the market to move against them (as happens in futures markets all the time). Whales cannot enter the PredictIt pool. On Polymarket, they can make as big a splash as they like. The argument for Polymarket is that it has bigger capacity and is more liquid. If people have greater conviction, they can express it — swiftly. As Matt and others have recounted, Polymarket is transparent and so we know that someone made a big trade as prices surged in Trump's favor Monday morning. That whale might conceivably be Elon Musk, although that's unlikely. The chance of a Musk-adjacent whale, however, looks strong.  Harris at a campaign event in Flint, Michigan. Photographer: Sarah Rice/Bloomberg When predicting an election, the opinion of a graduate student completing their Ph.D in political science is worth at least as much as Musk's. But the student cannot wager anything like as much. On PredictIt, position limits forcibly contain the playing field, and the two views are equivalent. On Polymarket, the student's views are minimally important compared to the world's richest man's. This points to a subtle difference in market aims. PredictIt, a non-profit, is an experiment in using market mechanisms to improve predictions; put experts together, and they should thrash out a better forecast if they have money at stake. Polymarket, a for-profit, is about allowing people to make money, and manage risk, like a standard futures market. The argument against allowing Kalshi to be an onshore Polymarket is that political outcomes shouldn't be traded in this way; there's too much risk of manipulation that can change elections. Using them as an academic exercise to sharpen minds is fine. That's why PredictIt plies its trade while Kalshi has provoked opposition. There's a month to go. Almost inadvertently, we have embarked on a crucial experiment in how prediction markets should work, how much we can trust them, and how we should regulate them. All thoughts are welcome. Stay tuned. Brown University's conflict over whether to divest from 10 companies its students deem to be complicit in the Israeli war effort has reached a conclusion. Its trustees voted against divestment. With luck, that's the end of the matter. Their reasons are well worth reading. The question is whether the student body will accept the decision, which appears to me to have been the result of an impeccably fair and transparent process. If they do, and divert their energies to protesting against entities who bear some responsibility for the appalling events in the Middle East (unlike their own university), that would be a wonderful thing. Thoughts are welcome on this, too. Come Friday, financials will set the third-quarter earnings season in motion. Investors will be parsing banks' earnings calls and reports for clues on how the start of the Federal Reserve's easing cycle will affect the sector (and by extension the economy). The timing of September's rate cut waters down its impact on the quarter. But FactSet's Sean Ryan argues that loose monetary policy is already affecting short-term net interest margin expectations as the immediate impact on asset-sensitive balance sheets outweighs the longer-term benefits: The interest rate environment was positive in the second quarter, with one significant caveat; the 10-year Treasury yield declined 58 basis points to 3.79%, which should reduce other comprehensive income losses (thus boosting book values), and the 2-10 spread steepened by 49bps, finally ending an extended period of inversion and ending the quarter in positive territory, if only just (14 basis points).

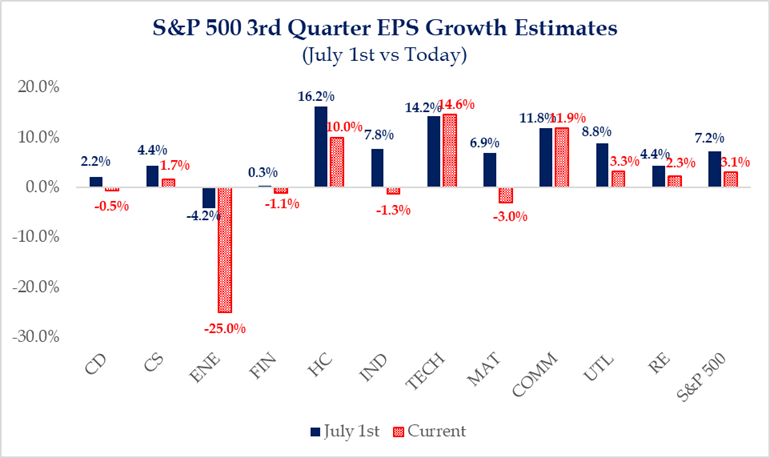

Ryan expects sluggish loan growth to restrain net interest income — the arbitrage banks earn from charging higher interest rates to borrowers than they pay out to depositors. Loose monetary policy should also translate into a recovery in credit. Bank of America's Ebrahim Poonawala and Brandon Berman suggest that banks' earnings will show credit quality is holding up with the potential for a rebound in lending, investment banking and mortgage activity on the back of lower rates and elections visibility. FactSet expects banks to record a year-over-year 12% decline in earnings, the only industry in financials in red. If we take them out, the estimated earnings growth rate for the sector improves to 6.9% from -0.4%. After the scourge of last spring's crisis, regional banks are projected to post year-over-year growth of less than 1%. The KBW Bank Index shows US banks' valuations are in healthy shape, trending above dreaded levels seen last winter as the rout from the regional banking crisis cooled. Here's a chart showing the trajectory of banks' price-to-book ratio: Robust economic growth will be a prop. S&P 500 earnings per share have grown faster than the long-term average in the last three quarters. Typically, analyst estimates decline going into reporting season and rise once announcements begin. As of July 1, EPS growth was estimated at 7.2%, and today, it sits at 3.1%, a revision of -4.1%. Strategas Research Partners suggest that this is concerning but not extreme relative to the last 20 years. For the past quarter, the biggest revisions have been in energy stocks, affected by the oil price: Technology powered by the artificial intelligence frenzy continues its expansion. Together with communications, Strategas expects the two sectors to expand beyond what was forecast at the start of the quarter. Health care is the only other sector expected to grow by double digits, but estimates have come down to 10% from 16.2%. For the bulls, the point is that a low bar offers every chance for companies to record beats. —Richard Abbey After another day of talking to people arguing about the US election, I am again in need of music to de-stress. It's so ugly. Some reader suggestions include Bob Marley's Three Little Birds, Just the Smile by Rory Gallagher, A Calf Born in Winter by Khruangbin, I Don't Know That You Don't Know My Name by Ten Years After, Breathe Deeper by Tame Impala, Exhale Inhale by Aurora, or The Sea by Morcheeba. It's turning into quite an ecelectic list. Any other suggestions?

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Mark Gongloff: America's Flood Insurance System Requires Urgent Fixes

- Andreas Kluth: Vance Plays Saruman to Trump's Sauron

- Dave Lee: Meta Oversight Board's Big Leap Will Make a Small Splash

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment