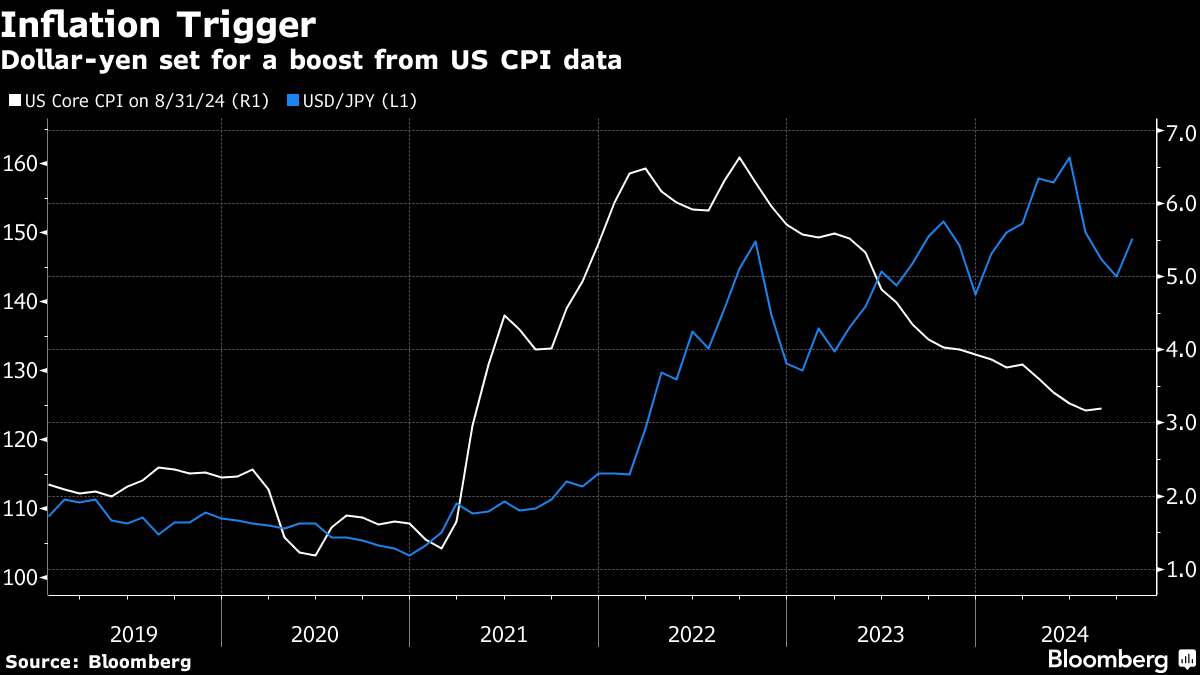

| The dollar's path toward 150 yen and beyond is set for a turbo boost with the US inflation report later today. Should core CPI match or beat estimates, that would seal the deal for another robust debate at November's Federal Reserve meeting. While traders will be expecting the central bank to deliver a 25-basis-point interest-rate cut, a hot inflation number would give the Fed an opening to signal a pause in December. And that would be positive for the US dollar. Only a very soft inflation print is likely to work in favor of the yen. Indeed, the Japanese currency is also under pressure from domestic factors. Prime Minister Shigeru Ishiba will soon start campaigning for a snap general election which has implications for Bank of Japan policy. It is now likely the central bank will defer raising interest rates again until 2025 after Ishiba recently said the environment is not ready for an additional rate hike. Once the Japanese elections are out of the way, the landscape will be clearer for the BOJ, but policymakers will still need to see economic data that supports tighter monetary settings. The next key input will be inflation data in two weeks' time. Core CPI will be in focus as it needs to be on a sustained path above the 2% forecast to allow the central bank room to hike again. Meanwhile, implied volatility for the dollar-yen exchange rate is running well below the levels seen during the wild days of August. That suggests there is room for momentum players to add to strategies shorting the yen, at least in the near term. Mark Cranfield is a macro strategist for Bloomberg's Markets Live team, based in Singapore. |

No comments:

Post a Comment