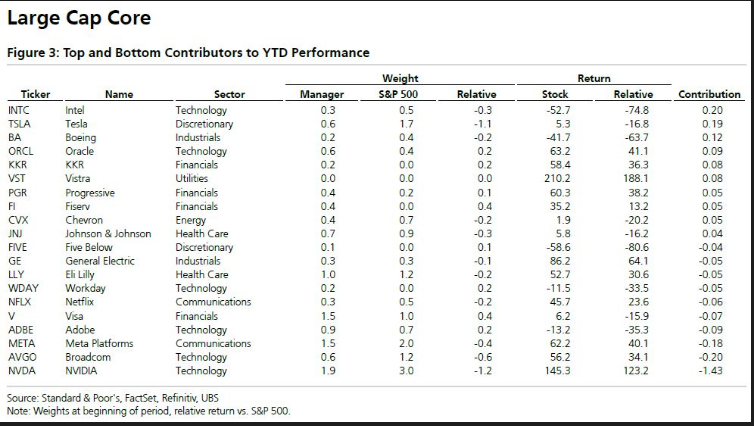

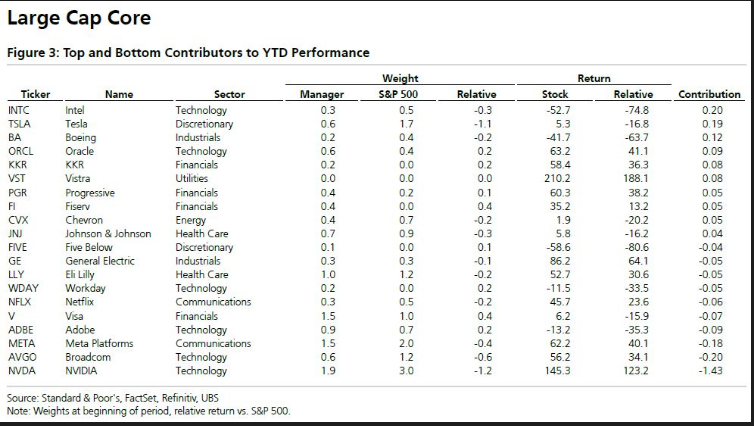

| Good morning. US stock futures are mixed as traders await jobs data crucial for the Fed's rate outlook. US dockworkers end a three-day strike and oil is set for its largest weekly increase since early 2023 as Middle East tension rises. — Morwenna Coniam Want to receive this newsletter in Spanish? Sign up to get the Five Things: Spanish Edition newsletter. European stocks and US futures fluctuated ahead of key American jobs data that will help determine the path for interest rates. An oil price rally extended after spiraling tensions in the Middle East led to the biggest one-day jump in almost a year. Treasuries were flat after selling off on Thursday and an index of dollar strength was set for the biggest weekly gain in nearly six months as traders pared back expectations for aggressive US rate cuts. Economists anticipate that hiring picked up slightly in September while the unemployment rate held steady at 4.2%, which would assuage concerns labor demand is deteriorating, something Fed Chair Jerome Powell has said he wouldn't want to see. Nonfarm payrolls likely rose by 150,000 last month, up from 142,000 in August and the most in four months. Softer hiring and a rise in the jobless rate earlier this year were major drivers behind the Fed's decision to start its policy-easing campaign last month. Oil headed for its strongest weekly increase in more than a year on fears that Israel may decide to strike Iranian petroleum facilities in retaliation for a missile assault on its territory. Brent extended gains Friday after surging 5% a day earlier as President Joe Biden said the US was discussing whether to support potential attacks on Iranian energy infrastructure. A US official said later the administration was still in talks with Israel and believed no decision had yet been taken. Crude has soared almost 9% this week as the escalation of hostilities raises the possibility of disruption to Middle East oil supplies. US dockworkers agreed to end a three-day strike that had paralyzed trade on the US East and Gulf coasts, and threatened to become a factor in the presidential election. The International Longshoremen's Association and the US Maritime Association extended their previous contract through Jan. 15, the groups said. Work will restart Friday morning and the two sides will restart negotiations on a long-term agreement, which will include a pay increase of about 62%. Fears of a sustained emergency swelled through the week, with estimates of the cost to the US economy of up to $5 billion per day. While its grander rivals have mostly made near double-digit profits this year, former Goldman Sachs prodigy Ed Eisler's hedge fund is losing money. The litmus test for hedge funds is how much cash they get from investors. Eisler Capital oversees about $4 billion now, less than what it managed in 2021. The fund's difficulties show just how tough it is to grab a seat at the hedge fund industry's top table. Read more in today's Big Take. This is what's caught our eye over the past 24 hours. UBS has a note out about large-cap active managers. Surprise, surprise: they're lagging the S&P 500 by 2.1% so far in 2024, net of fees. The team of strategists led by Patrick Palfrey made the point that this has been an especially tough year because gains have been famously led by the largest companies. Just Nvidia alone (which made up 23% of the S&P 500's rally this year, per Bloomberg data) accounted for 143 basis points of underperformance.  There is some evidence that stock pickers have historically always done worse when the market is led by the largest companies. That's because compared to benchmarks, active managers tend to be closer to equal weight than capitalization weights: In other words, they'll generally have lower weights on the mega-caps and higher weights on the smallest index members relative to the benchmark. It makes sense: They're paid to be different, and given how concentrated the S&P 500 is, it's hard to make a case to be even more overweight Nvidia. (This is even more true of quantitative managers, who, rather than studying any particular name, are all about applying their investing rules across a large number of stocks based on the belief that they will lead to better outcomes on average.) If stock outcomes are often skewed, one response is to bet big and be concentrated yourself. But the problem is it also means the pain of missing out on the big winners is even greater. As the UBS note shows, this is why it's mathematically difficult for the majority of stock pickers to beat a cap-weighted benchmark in any given year. There's a study from Morningstar back in January that illustrates this dilemma. It looked at the relationship between the hit rate--or how often a manager picked stocks that outperformed--and fund performance. To set the scene, only 42% of its constituents beat the Russell 1000 over the average three years in the past decade. More than half of the large-blend managers had a better hit rate than that, but 84% of them still underperformed the benchmark. This means that they owned the stocks that beat the index but didn't overweight those stocks enough or those names' margin of outperformance was ultimately not enough when you have a mega-cap like Nvidia soaring 148% in a year. As we talked about last week, picking the right investments and sizing your position correctly are two different things, and it's getting tougher in a winner-takes-all equity market. Justina Lee is a cross-asset reporter based in London. Follow Justina on X @Justinaknope |

No comments:

Post a Comment