| Good morning. Oil is rallying for a second day as Middle East tensions mount. US stocks are poised for a muted open following yesterday's flight to safety, Nike shares are set to fall after the firm withdrew its guidance and KKR is weighing a takeover bid for an Asian chipmaker. Here's what's moving markets. — Morwenna Coniam Want to receive this newsletter in Spanish? Sign up to get the Five Things: Spanish Edition newsletter. Oil rose for a second day after Iran fired about 200 ballistic missiles at Israel, drawing a vow of retaliation from Prime Minister Benjamin Netanyahu and further raising the risks to crude supplies from the region. Global benchmark Brent climbed toward $75 a barrel. Crude's advance reflects investors pricing in a renewed risk premium for the world's most important commodity, given the Middle East accounts for about a third of global supplies. Stocks posted small moves with markets in a wait-and-see mood due to unrest in the Middle East. Gold hovered near a record. Europe's Stoxx 600 index rose, led by shares of energy firms and defense stocks. Futures on the S&P 500 pointed to a muted open after Tuesday's flight to safety. Treasury yields edged up and the dollar traded flat. Nike shares fell in premarket trading after the sportswear firm withdrew its full-year guidance, citing a change of CEO later this month, and reported sales which missed estimates. Nike is also postponing its investor day, which had been scheduled for November, giving incoming CEO Elliott Hill more time to develop his turnaround strategy. Chinese stocks listed in Hong Kong jumped the most in almost two years after Beijing followed other major cities in relaxing home purchase rules. Property developers led the rally, with a gauge of the sector surging as much as 47%, while an index of brokerage shares jumped 35%, both record intraday moves. There's growing optimism China's recently announced stimulus blitz has brought an end to the three-year slide in Chinese shares that was driven by the stuttering economy and a multi-year property crisis. KKR is considering a takeover bid for the roughly $5 billion semiconductor and electronics equipment maker ASMPT, according to people familiar with the matter, in a move that would follow previous acquisition attempts from other bidders. Dutch semiconductor-equipment maker ASM International, which holds a roughly 25% stake in ASMPT, has in the past been pushed by activist investors to sell its stake. This is what's caught our eye over the past 24 hours. There was uncertainty and drama going into the Fed's latest rate decision in September, when it cut 50 bps. But obviously people knew that 50 was on the table, in part because Chairman Jerome Powell gave a very urgent speech at Jackson Hole.

The source of his urgency was very specific. He wasn't worried about GDP growth. He wasn't worried about financial market volatility. He was worried about the strength of the labor market, which had clearly weakened based on a whole host of measures. The unemployment rate had gone up. The hiring rate had fallen. Job Openings had tumbled etc. There's been a lot of confusion about the state of the economy (still is) but the cooling in the labor market has been fairly clear. And anyway, since maximum employment is one half of the Fed's dual mandate, it started off the rate cut cycle in decisive faction, with that 50 bps cut.

The next Fed meeting is Nov. 7, and the market is leaning towards just a 25 bp cut. And one thing I'm wondering about is whether the Fed (or Powell specifically) still feels the same urgency about cutting off left tail outcomes in the labor market.

There are two things that have me thinking about this specifically.

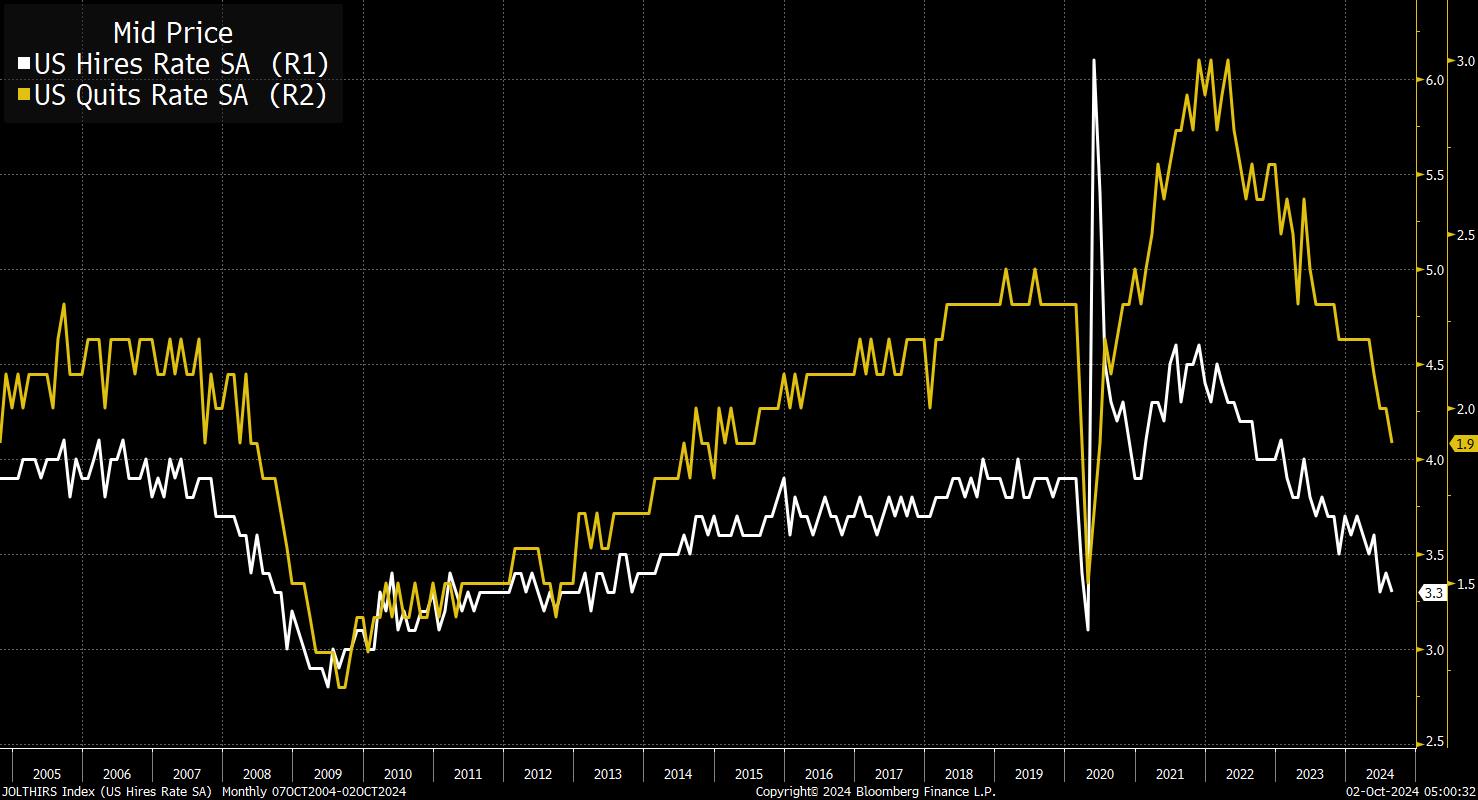

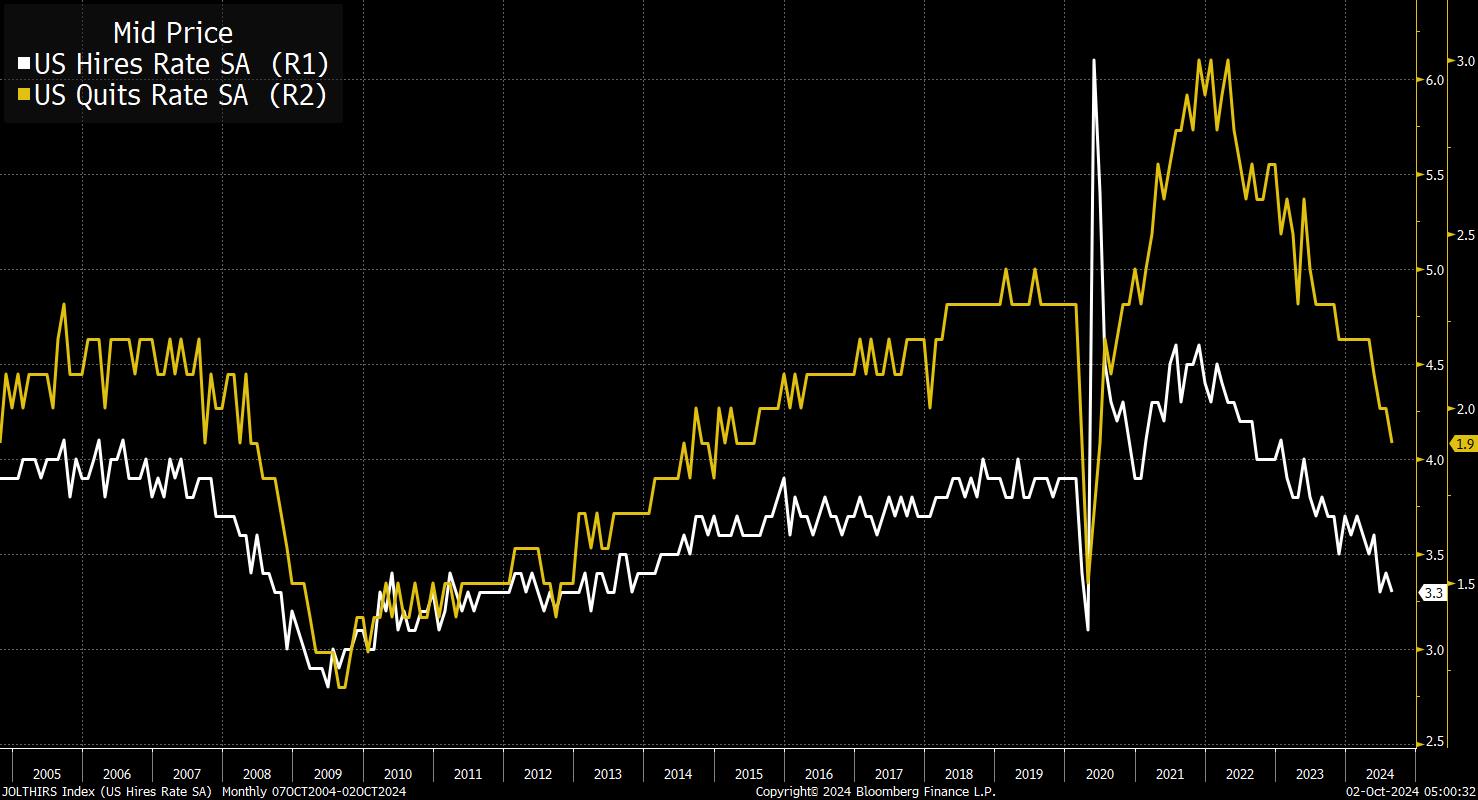

First, yesterday's JOLTS report. Both the Hiring Rate and the Quits Rate continued to show ongoing softening. The Hiring Rate is important, because one part of the story for why the unemployment rate has risen is that more people have been entering the workforce (as opposed to layoffs). Well at some point, the economy is going to need to absorb search for work. And a declining hiring rate is the wrong direction from that. The Quits Rate tells you that people don't have other jobs lined up, or that they're not confident about finding another job, should they leave now.  I should just say here in the spirit of intellectual honesty that the JOLTS report wasn't all bad news. The absolute level of Job Openings in the economy did bounce back to above 8 million. Which was its highest level since May. I'll also add that all JOLTS numbers are from August, so there's a staleness to the data. So take it all as you will.

While we're talking about data, yesterday we got the ISM report for September, and it fell to 43.9 from 46. Anything below 50 is contraction.

Ok, so that's the data. As for the Fed's perspective: Earlier this week Powell gave a speech, which was perhaps a touch hawkish at the margin. He called the labor market "solid" and in "balance," while acknowledging that things have cooled. He said risks are still "two sided," which means there are still some lingering concerns about inflation (even if their actions imply that they're more worried about employment.) Right now, he says the Fed doesn't feel like it's in a "hurry" to cut quickly.

There was one other thing that caught my attention, where he mentioned that recent economic revisions (to GDP and to the savings rate, each of which was revised higher) were encouraging and that they gave the Fed some comfort about the state of the economy, and that it could keep on expanding.

Of course, all things equal, it's probably good that the savings rate was higher than we thought and also that GDP growth has been higher than we thought. But to some extent we're talking about levels here. The size of the economy is larger than we realized. Consumers have more savings than we realized. There's no doubt that if you took a snapshot of the economy right now, you'd say things are historically pretty good. 4.2% unemployment is a nice level to see. Layoffs are low.

But none of this changes the question about pace and the overall cooling of the labor market, particularly the amount of job creation that's happening.

Now granted there's a lot of time and data before the November meeting (there's even an election). We get a fresh jobs report in just two days. But if there's a reason to be concerned it's simply this: There is still a narrative to think that the labor market is slipping away, and the most recent Powell talk does not have the same urgency as he expressed in Jackson Hole. Maybe that's warranted. Maybe things have stabilized in a good way. But it's possible that the risks are still the same, while the posture has changed. Follow Bloomberg's Joe Weisenthal on X @TheStalwart | .png)

No comments:

Post a Comment