| I'm Shawn Donnan, a senior writer for economics in Washington. Today we're looking at how tariffs can have unintended results. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China said it's confident in reaching its economic targets this year.

- A Fed governor called for a "balanced approach" on future rate cuts.

- UK Chancellor Reeves facing make-or-break budget on Oct. 30.

The US debate about tariffs in recent years has often focused on who pays their cost or the broader impact they can have on growth and supply chains. What gets less attention is another reason economists tend to hate tariffs: The way they can end up being used as cudgels in messy commercial fights. There's a great example of how painful things can get in what happened after the US in 2021 imposed anti-dumping tariffs on trailer chassis, which are used to carry shipping containers behind trucks and are therefore the literal wheels of globalization. It's the subject of a new feature in the annual economics issue of Bloomberg Markets magazine. Here's the abridged version of a tangled tale. The duties, of more than 220%, shut down imports from China International Marine Containers, or CIMC, the Chinese firm that dominates the global shipping containers market. CIMC, which at its height sold more than 45,000 new trailer chassis annually in a US market of 70,000 to 80,000, didn't give up, though. It shifted production to the US. It also created a new non-Chinese supply chain by pairing frames made in Thailand with axles manufactured in Kentucky and suspension kits from Missouri. One US competitor, Pitts Enterprises, which was part of the coalition that lobbied for the tariffs, saw its own opportunity. It decided not just to ramp up US production but to team up with a Vietnamese company to import almost 18,000 new chassis. Then came the first twist: US authorities in March 2023 found the Vietnamese chassis imported by Pitts contained lots of Chinese parts. That subjected them to the new duties, and it left Pitts — which is still fighting the result — facing a tariff bill worth tens of millions of dollars and a total hit of $250 million in lost revenue. The next twist came when Pitts and other domestic chassis makers turned around a month later and accused CIMC of cheating to get around tariffs. Which led to another investigation that dragged on for a year. CIMC was eventually cleared. But the probe led the company to idle production in the US and lay off hundreds of workers in California and Virginia. The hit there: More than $100 million in lost revenues. What's the takeaway? Tariffs may be having another moment in US politics, but tariff tales rarely have tidy endings. - The St. Louis Fed president said he supported the decision last month to lower interest rates by a half point, but emphasized he'd prefer further reductions to be gradual.

- China's latest steps to revive the housing market have had an immediate impact with brisk sales and buyer interest during a week-long holiday.

- Australia's central bank will hold rates at the current 12-year high until it's confident that inflation is moving toward target, minutes showed.

- Cutting rates in October wouldn't mean that the ECB is certain to do so again at its final meeting of the year, an official said.

- Japan saw the highest number of bankruptcies since 2013 in the six months through September, as companies were increasingly hit by rising costs.

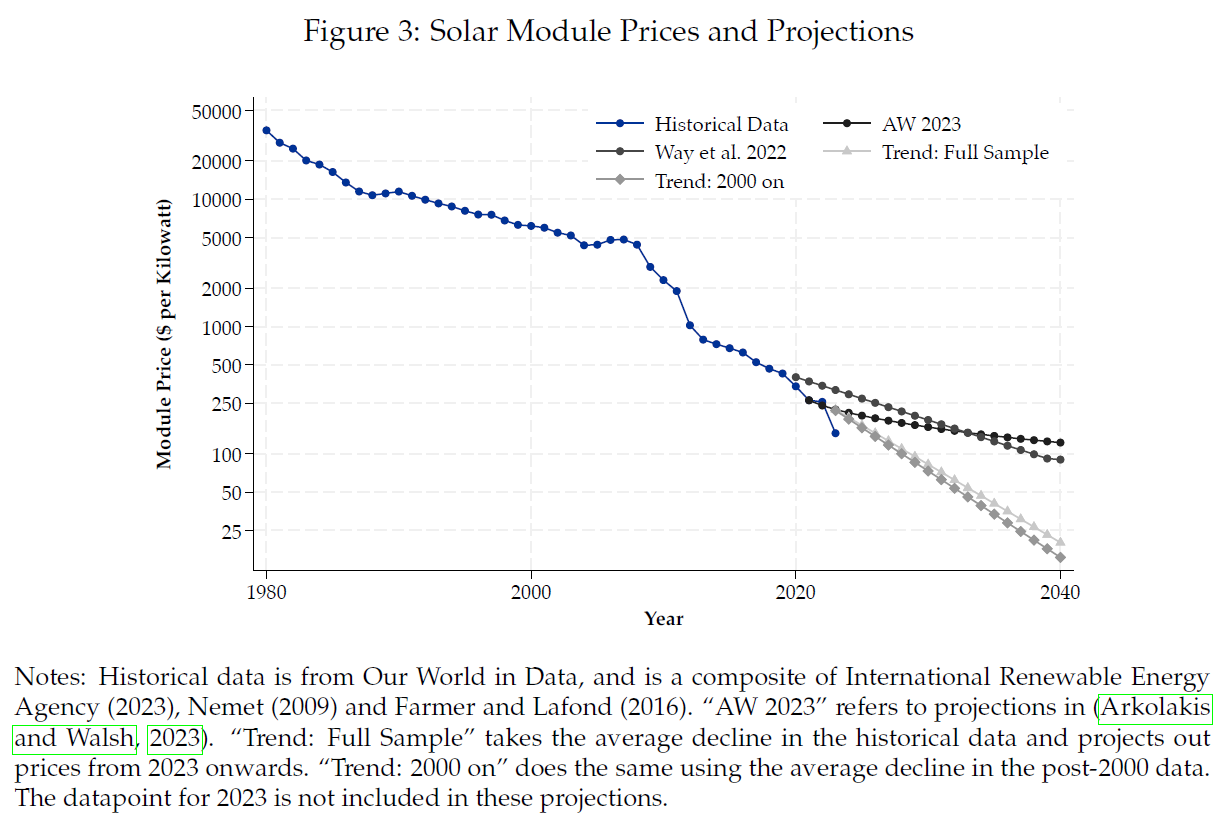

The rising role of renewables in US energy supply is likely to drive down electricity costs significantly over time, in a shift that will boost wages and productivity, a new National Bureau of Economic Research paper says. "The recent explosion of solar power and its pairing with lithium-ion storage leads us to believe that it will be the dominant technology" going forward, Costas Arkolakis of Yale and Conor Walsh of Columbia Business School wrote in the working paper. Projecting out to 2040, they see wholesale power prices sliding 20% to 80% depending on local resources. This positive supply shock will lead to a "fairly substantial increase in wages" of 2% to 3% nationwide, they wrote. It will also "free up innovative resources" that have, since the 1970s oil crisis, been flowing to the energy sector. This may then improve capital and labor productivity, they wrote. Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment