| Hello from Sao Paulo. I'm Erik Schatzker, editorial director of Bloomberg New Economy, bringing you a special edition of the newsletter. Our Bloomberg New Economy at B20 event got underway here last night and continues today. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Bank of America's chief wants Fed interest-rate cuts to be measured, and the head of Blackstone said that no matter who wins the election, the US will avoid a recession.

- Japan's 40-year government bond yields rose to a 16-year high as traders unwound bets for aggressive US easing.

- Coming up, the Bank of Canada may deliver a jumbo cut in borrowing costs, and the International Monetary Fund releases its Fiscal Monitor report in Washington.

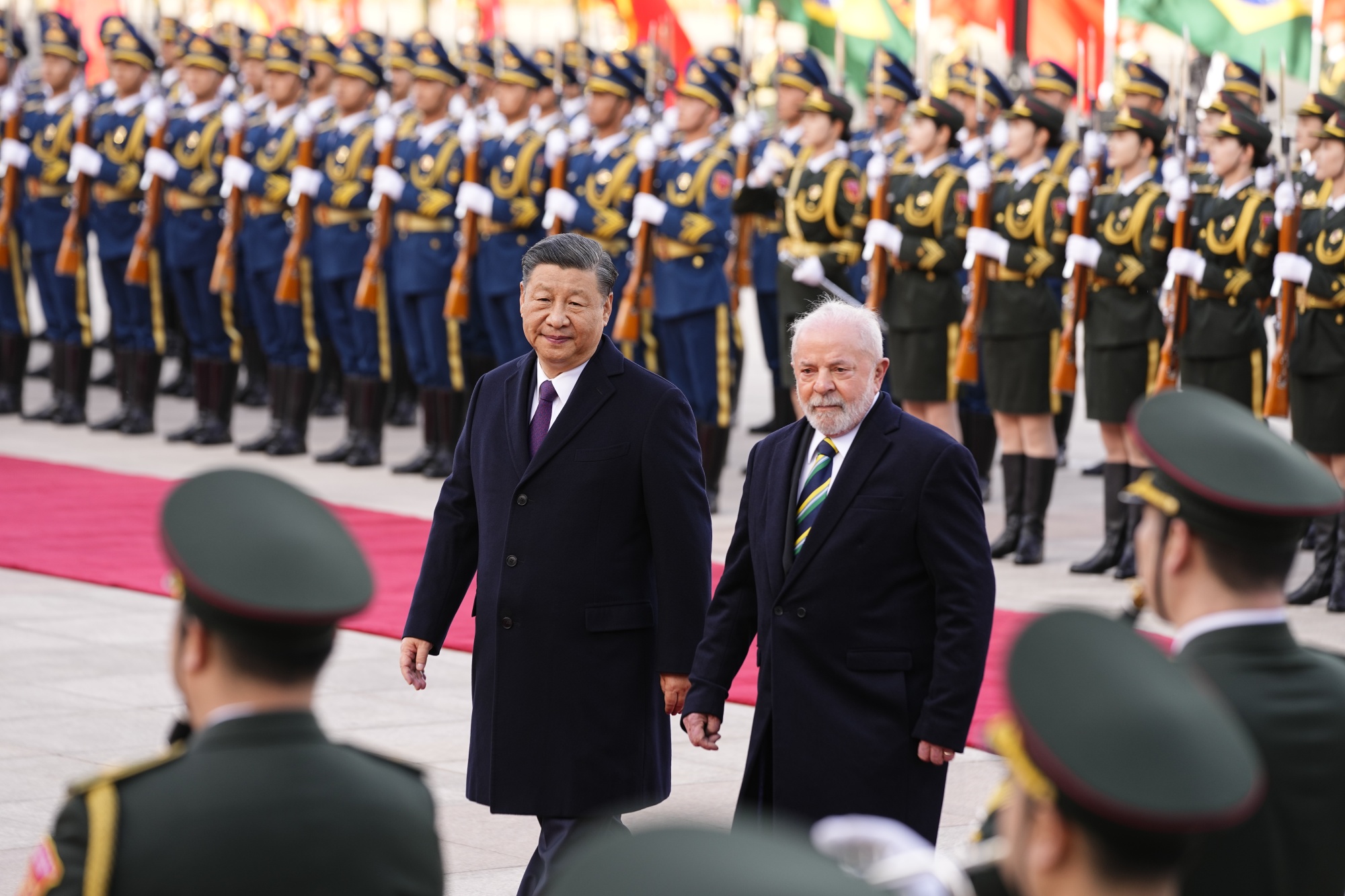

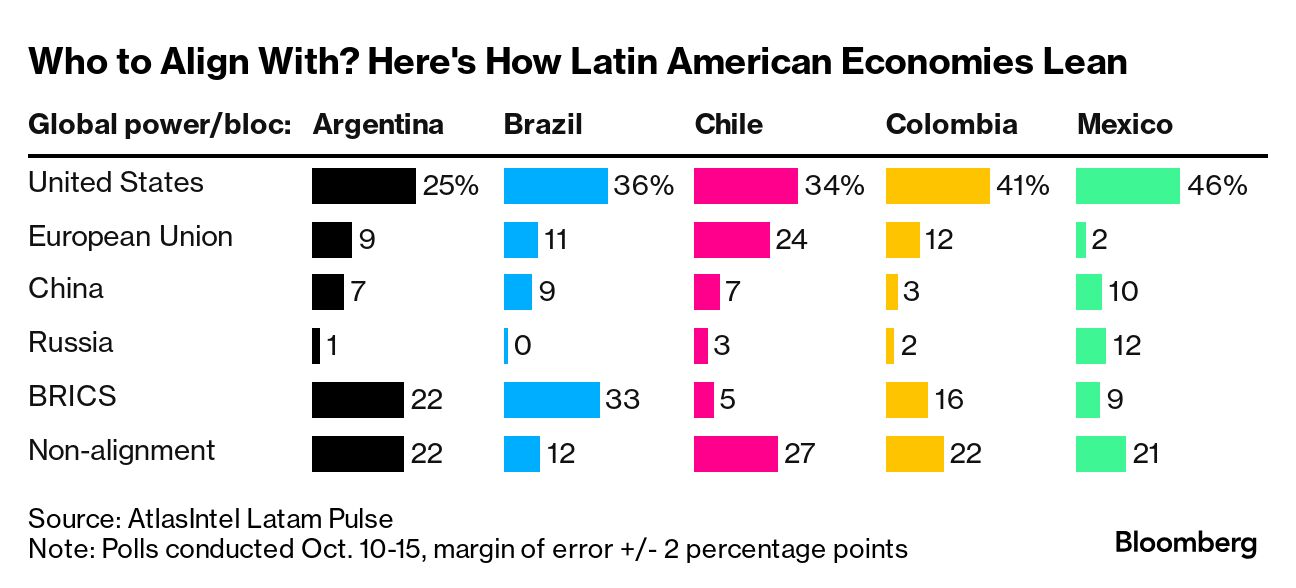

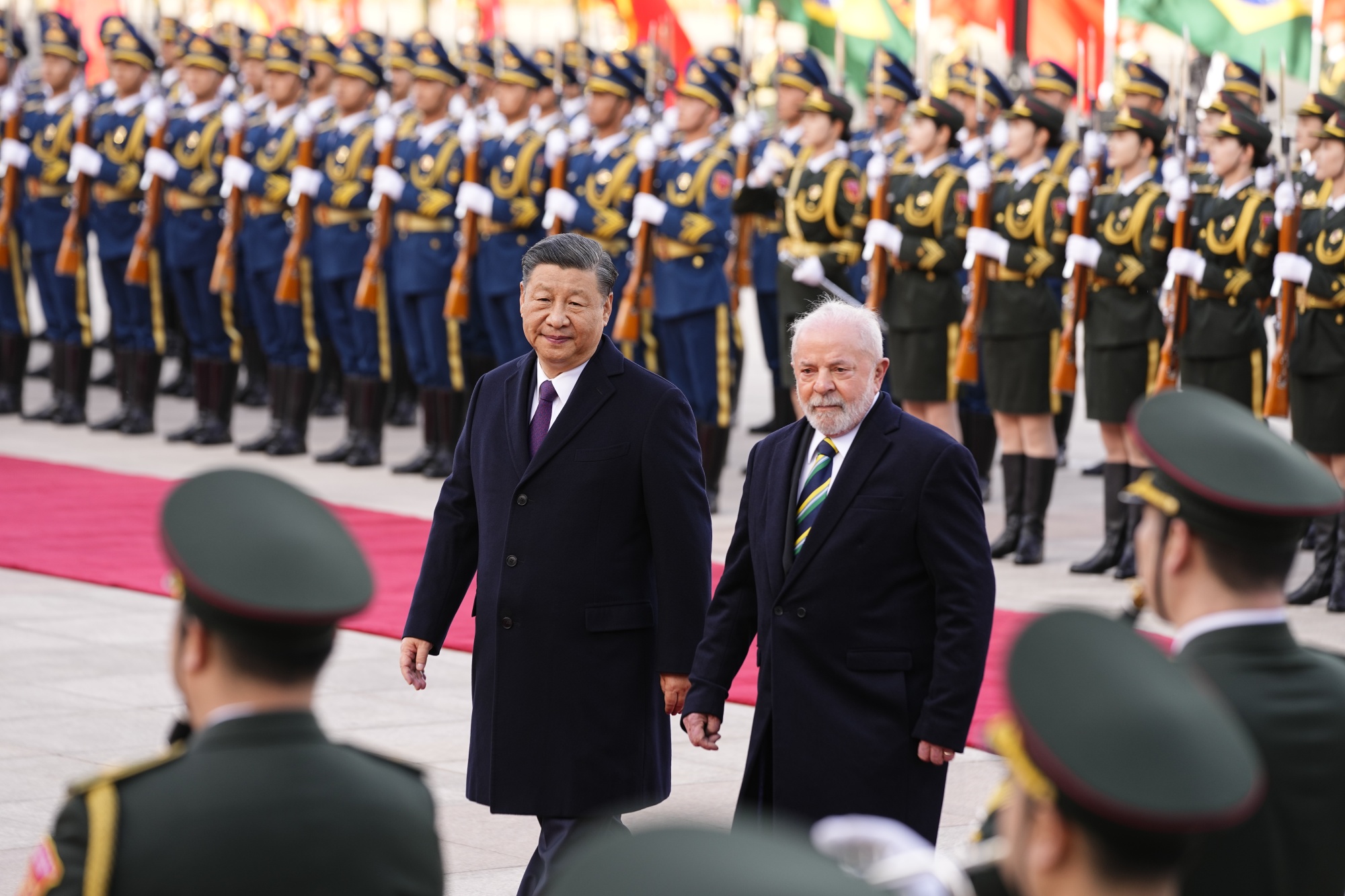

Which global power do you most want as an ally? That's the gist of a question put to citizens in five Latin American countries – Argentina, Brazil, Chile, Colombia and Mexico – in a recent Bloomberg poll. The six choices: the US, European Union, China, Russia, the BRICS or neutral non-alignment. The results say a lot about the current state of geopolitics and the future of everything from global trade to regional security. Respondents in Mexico gravitated most to the US – hardly surprising as the neighbors share a 1,954-mile border as well as membership in the USMCA free-trade agreement. Almost 85% of Mexico's exports went to the US last year. Brazil, by comparison, has good reason not to take sides: It counts on dozens of trading partners. China, the largest, and the US together account for just 42% of Brazil's exports. In recent years, the value of Brazilian shipments to non-aligned countries such as Indonesia, Malaysia, Vietnam, Turkey, Thailand and the UAE has been steadily climbing. No wonder then that Brazilian respondents were split. Only 36% chose the US, while 33% (the most of any country polled) favored the BRICS, 12% preferred non-alignment and 9% picked China. In theory, neutrality equals optionality. As the world fractures on geopolitical lines, aligning with one power bloc may come at the cost of trade and investment. Jair Bolsonaro, Brazil's president from 2019 to 2022, venerated Donald Trump and forged a closer political and economic relationship with the US. That alarmed the titans of Brazil's giant agribusiness and mining industries who depend overwhelmingly on sales to China. His successor, Luiz Inacio Lula Da Silva, has since pivoted back to a more neutral position and advocated for a more multilateral global order. Underscoring that focus, Lula was scheduled to travel to Russia for the BRICS summit – as well as meetings with Vladimir Putin and Xi Jinping – until a weekend accident forced him to cancel.  Luiz Inacio Lula da Silva, right, with Xi Jinping, inspects an honor guard in Beijing, during an April 2023 visit. Photographer: Pool/Getty Images AsiaPac Few countries in the Global South want to get ensnared in the US-China geopolitical standoff. If anything, they're hoping to benefit as manufacturing relocates and trading patterns shift. Look, for example, at what's happening in electric vehicles. The US and Europe are hiking tariffs on Chinese EVs. Brazil, meantime, has embraced them — two of China's biggest EV makers, BYD and Great Wall Motor, are building factories in Brazil and plan to hire thousands as they ramp up production. Brazil's not alone in favoring neutrality. In the Bloomberg poll, respondents in Argentina, Chile and Colombia still lean toward the US over the other options. But non-alignment came in a close second, well ahead of China, Russia, the EU or the BRICS. Today, at the conference here in Sao Paulo, we'll take up the question of alignment on a panel I'm moderating with Jon Huntsman, a former US ambassador to China and Russia, and Wesley Batista, one of two billionaire brothers who control the Brazilian meatpacking giant JBS, along with Ana Cabral, CEO of Sigma Lithium. - View the full agenda here, and find the livestream link for the event here.

- Vice President Kamala Harris backed raising the federal minimum wage to at least $15 an hour, seeking to woo working-class voters.

- China's economic policy measures are aimed at mitigating risks, a JPMorgan Chase economist said. A think tank said Beijing should issue $281 billion of special bonds.

- The European Central Bank has room to cut rates further but must pay attention to inflation risks, a Governing Council member said.

- The head of a solar equipment maker said eliminating President Joe Biden's clean-energy incentives would be bad for the US economy.

- Brazil's agriculture minister wants to join China's Belt and Road Initiative to counter protectionism by the US and European Union.

- Colombia is discussing a proposal that would nearly double government transfers to regions, potentially swelling the country's national debt.

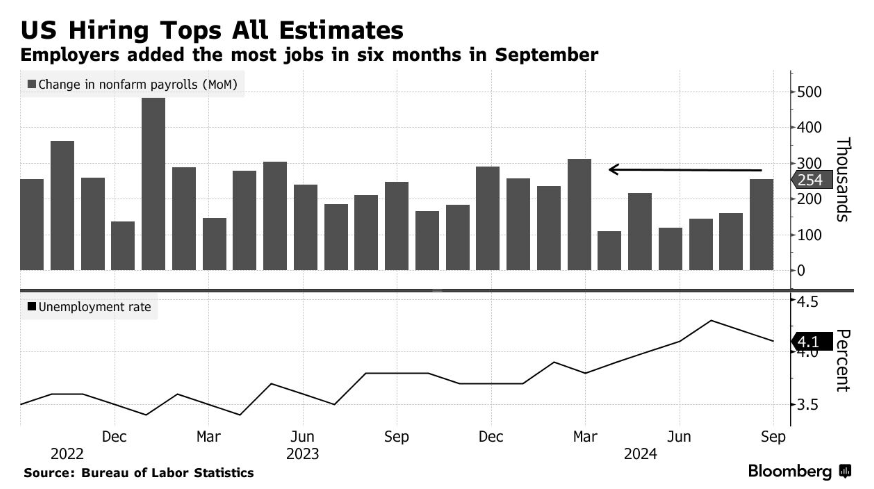

Don't get comfortable with the US unemployment rate, which dropped last month after rising for most of the year. Bloomberg Economics predicts it will soon enough be on the rise again after dipping to 4.1% in September. Brisk hiring in the education sector, special outlays ahead of the US election, along with outsize spending to address natural disasters helped to bring joblessness down in September, Anna Wong and Chris G. Collins wrote in a note this week. Take all of that away, and the unemployment rate was 4.23% rather than the 4.05% reported result, they estimated. Transitory factors likely drove down the unemployment rate in August and September. Some of them that boosted jobs — likely the upcoming election and hurricanes — may persist in October. We expect them to start reversing in December. Our baseline remains for the unemployment rate to rise to 4.5% by the end of the year. - For the full note on the Bloomberg terminal, click here.

|

No comments:

Post a Comment