| I'm Cécile Daurat, an economics editor in the US. Today we're looking at Gen X, the forgotten generation. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - BOE Governor Andrew Bailey has held out the prospect of the UK central bank becoming more proactive in cutting interest rates.

- A leading economist in China said the country has room to ramp up fiscal support for the economy.

- US Southeast faces a humanitarian, economic and ecological crisis of staggering scope after Hurricane Helene.

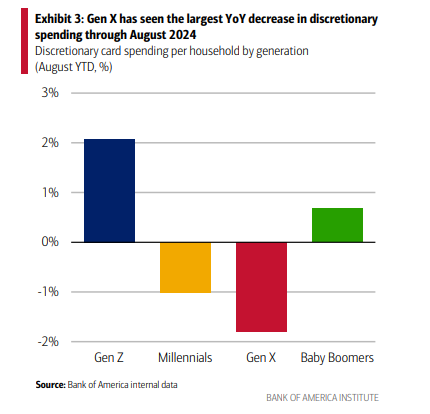

Gen Xers are starting to spend less and save more as many approach retirement age. It doesn't bode too well for the US economy. The generation was dubbed the "middle child" because it is tiny compared with the older Baby Boomers and younger Millennials, and oft overlooked by marketers and researchers alike. Yet these middle-age consumers — who today are aged 47 to 59 — have punched well above their weight when it comes to spending, according to a report from Bank of America Institute, keeping the economy roaring during the pandemic recovery. Economists at BofA Institute estimated that Gen X accounted for 33% of US consumer expenditures in 2022, even as they represented only 27% of all households. Since then, however, Gen X's discretionary spending has been weaker than that of other cohorts, based on Bank of America card data. One reason is that Gen Xers have lagged behind in retirement savings and are now attempting to catch up. When the generation entered the workforce in the 1980s and 1990s, US companies were shifting away from a pension system — where employers set aside funds in a pool of money and retired employees usually get a guaranteed income — to 401(k) plans that require each individual to prepare for their own retirement. Gen X was the "401(k) experiment" generation, as Goldman Sachs Asset Management put it in a report, and many were late to get started with personal savings. A study from Northwestern Mutual found that Gen Xers expect to need $1.56 million to retire comfortably — and yet have only saved $108,600 so far. Another factor at play is that Gen X is also a "sandwich generation," with more people taking care of older parents while kids — and, increasingly, adult children — are still at home or financially dependent. Until Gen X eventually inherits trillions of dollars in wealth accumulated by their Boomer parents, their discretionary spending will likely continue to be subdued, BofA Institute says. - Traders are re-loading speculative positions anticipating a weaker yen, emboldened by comments from Japanese Prime Minister Shigeru Ishiba that the economy isn't ready yet for further interest rate hikes.

- French Budget Minister Laurent Saint-Martin said temporary taxes to help rein in the country's runaway public finances would hit only the very richest households and largest companies.

- Australia will need to rein in fiscal spending in the event inflation fails to ease further, the International Monetary Fund said, countering the government's claims its policies aren't impacting price pressures.

- Turkey's annual inflation slowed less-than-expected by economists and the central bank's preferred gauge surged last month, potentially delaying discussions on interest-rate cuts anticipated in the fourth quarter.

- Oil rose for a third day amid mounting supply risks in the Middle East.

Don't worry so much about price spikes from the current US dockworkers' strike. But get ready for a swathe of job losses that could add to the chance of a 50 basis-point Federal Reserve interest-rate cut next month, Bloomberg Economics analysis shows. "US wholesalers and retailers frontloaded enough imports to buffer them against a strike lasting two weeks to a month," and that should help restrain prices, Anna Wong and Nicole Gorton-Caratelli wrote in a note this week. As for GDP, that could get hit by as much as $3 billion a day.  Workers picket outside of the APM container terminal at the Port of Newark, New Jersey, Oct. 1, 2024. Photographer: Michael Nagle/Bloomberg If the strike lasts more than two weeks, accounting for knock-on effects, the October payrolls figure could be lowered by as many as 80,000 jobs, the duo wrote. That "would boost the odds of a jumbo rate cut" at the Nov. 6-7 Fed policy meeting, they wrote. Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment