| I'm Craig Stirling, a senior editor for economics in Frankfurt. Today we're looking at monetary policy in the euro zone. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China's central bank moved to support markets as data showed the economy expanding the least in six quarters.

- Bank of Japan officials see little need to rush into raising rates this month, sources say. Meanwhile, Japan's key inflation gauge slowed in September for the first time in five months, but a union group is calling for 5% wage growth.

- UK retail sales rose unexpectedly on demand for consumer tech including the new iPhone, a welcome boost for the new government.

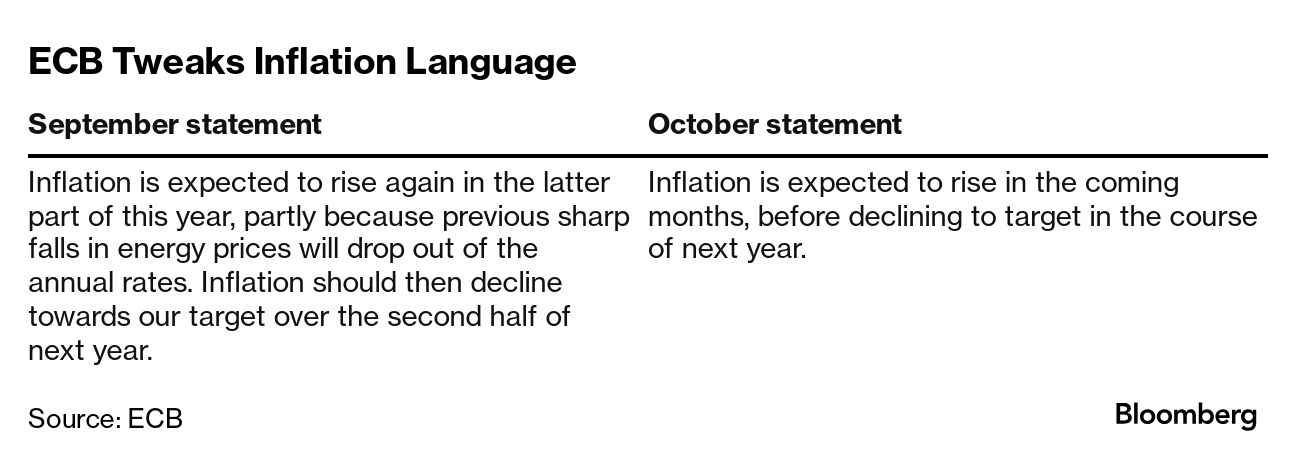

Investors don't need much nudging to read between the lines when a policymaker speaks, and yesterday in Frankfurt was no different. Christine Lagarde, president of the European Central Bank, delivered her usual language about how she and colleagues will be "data dependent" and set interest rates on a "meeting-by-meeting" basis. But given how sanguine her message sounded on inflation risks, and against the backdrop of a slowdown in the euro-zone economy, traders had little doubt about what to interpret: the floodgates are opening to borrowing costs falling even further— and possibly faster than before. Money markets now show a path of quarter-point steps at every meeting through April, and have even begun to speculate on whether policymakers could step up the pace with a half-point reduction in December. For all the caution displayed by officials, investors can take heart that recent bets have tended to work out well. By reacting nimbly to poor business survey data, they correctly judged the way the wind was blowing well before policymakers accepted that a rate cut they had all but excluded would indeed happen at Thursday's decision. The question now is, are such aggressive bets on easing really justified? Lagarde insisted yesterday that the ECB sees a "soft landing" for the euro region, and that "on the basis of the information that we have, we certainly do not see a recession." But that's not really how traders appear to perceive things. Market pricing "seems a little at odds with Lagarde's assertion that she does not see a recession coming," said Gareth Hill, a fund manager at Royal London Asset Management. So who will turn out to be right? Given how investors got this month's call right, and also priced in an inflation shock well before the ECB judged surging consumer prices to pose a genuine risk, the track record suggests they might know better. Then again, markets aren't always right. The policy outlook is particularly opaque at present, with a whole host of unknowns currently troubling officials, not least the outcome of next month's US presidential election. "The ECB continues to avoid guidance and is not committing to a particular path," Mark Wall, chief economist for Europe at Deutsche Bank AG in London, said after the decision. "This is sensible given the uncertainties that lie ahead. But chances are that today's decision represents a pivot point into a faster normalization." - Britain's so-called non-dom wealthy foreigners are battling proposals against more tax, while rich French company owners are bracing for inheritance levy changes.

- Chile's central bank cut its key rate by a quarter-point for the second straight meeting and signaled borrowing costs will keep falling.

- Thailand's 38-year-old prime minister is working on a plan to alleviate the economic drag from a household debt bill topping $500 billion.

- Canadians haven't felt this strongly opposed to immigration levels in a quarter century, a turnaround of attitude in a country that once embraced newcomers.

- Finally, in our Weekend Edition essay, China's lie-flat generation is threatening the country's economic recovery.

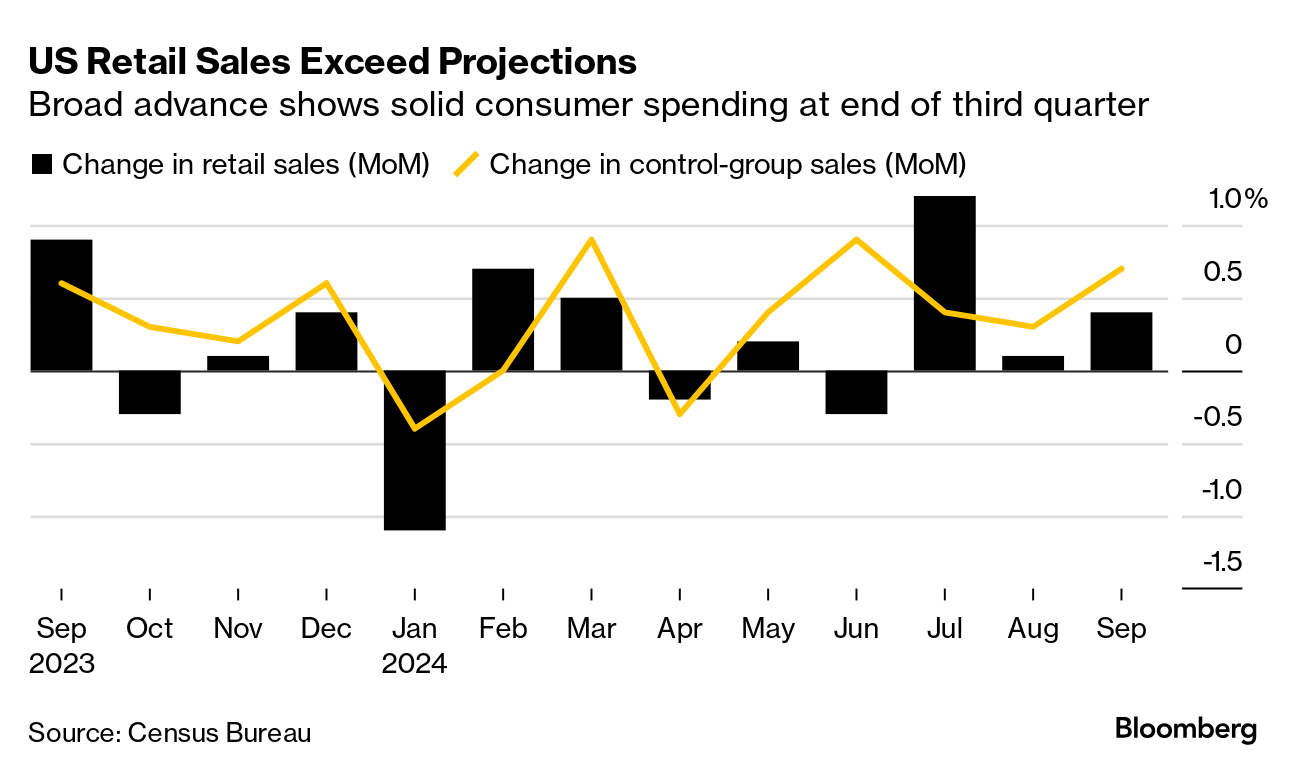

One takeaway from new Federal Reserve research on US consumer spending is that the wealthy have been driving things, as detailed in Monday's newsletter. Another aspect is that millennials are the key demographic group, CIBC economist Ali Jaffery says. "Millennial retail spending is far above other demographic groups in their study," Jaffery highlighted in a note Thursday. "Growing research shows they are open to spending a bit more on discretionary items than their parents, favoring leisure and more work-life balance which also adds up to more spending." "The influence of millennials is only going to grow and that has to factor into why the speed limit of the economy is faster," Jaffery said. He added that the solid September gain in US retail sales made CIBC "more confident that the potential or long-run growth rate for the US economy is well above 2%." IMF/World Bank Meetings: Policymakers around the world face tough choices to create better economic outcomes and opportunities for people. Gain insights on how to help strengthen the foundation for growth during the Oct. 21-26 annual meetings. Join the conversation. |

No comments:

Post a Comment