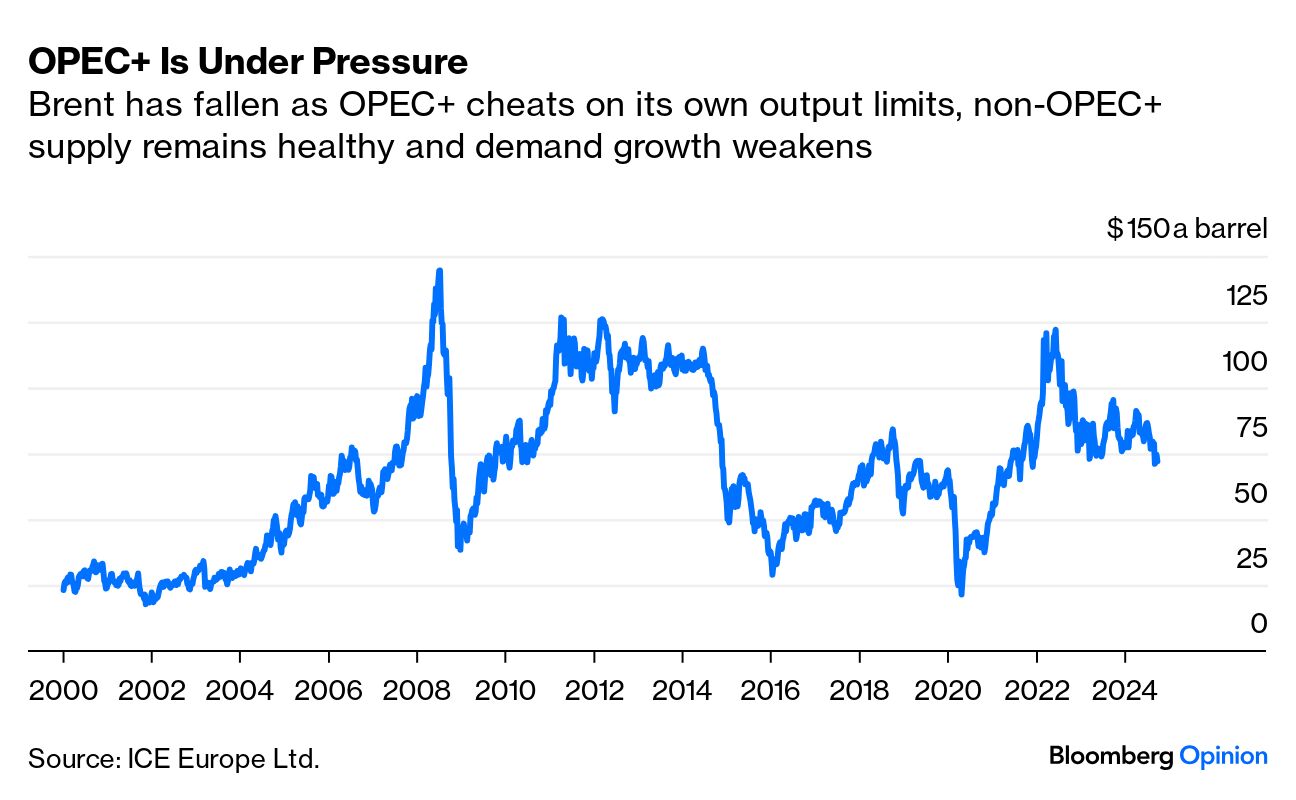

| The market for initial public offerings of companies owned by private equity firms is picking up, according to JPMorgan, buoying the outlook for first-time share sales heading into next year. At least four such US listings are slated for this month, including StandardAero. The aircraft maintenance services provider, backed by Carlyle Group, raised $1.44 billion in an IPO Tuesday. The burst of business will likely be welcome news for investors sitting on $3.2 trillion worth of companies that have been stuck in PE firm portfolios. "The recent IPOs and the ones that are getting ready to price span various sectors and serve different customers," said Keith Canton, JPMorgan's head of Americas equity capital markets. "However, they share several key characteristics: They generate real revenue, are profitable or on the path to profitability and have durable business models." —David E. Rovella A filing by US Special Counsel Jack Smith revealed previously undisclosed evidence in the most serious of three pending prosecutions of Donald Trump. Trump's trial for allegedly plotting to block President Joe Biden from taking office had been delayed by the US Supreme Court for months before its Republican-appointed supermajority severely limited the case's scope. In doing so, the court handed unprecedented power to the executive branch in the form of wide-ranging immunity for potential criminal acts in office. In the partially unsealed filing, Smith argued Trump "resorted to crimes" that were private in nature, and that the Republican does not deserve immunity simply because he was president at the time. Stock brokers in Hong Kong are having one of the busiest periods in their career, with a 31-year veteran describing the city's sudden rally as a "once in a century" event. Brokers across the city are experiencing a similar euphoria as the stocks of Chinese companies soar in the wake of landmark stimulus moves by Beijing last week. AI is a massive crash in the making. That's the potential takeaway from Daron Acemoglu, a professor at the Massachusetts Institute of Technology. As promising as AI may be, there's little chance it will live up to Wall Street's hype hype, he warns. By his calculation, only a small percentage of all jobs—a mere 5%—is ripe to be taken over, or at least heavily aided, by AI over the next decade. Good news for workers, true, but very bad for the companies sinking billions into the technology expecting it to drive a surge in productivity.  Daron Acemoglu Photographer: Frank Molter/picture alliance Biden said Israel should hold off from attacking Iran's nuclear facilities in retaliation for an Iranian missile barrage this week, itself a retaliation for Israel's killings of leaders of Hezbollah and Hamas, as well as its attack on Lebanon which has killed hundreds. Group of Seven nations sought to tamp down a spiraling conflict that threatens to pull the US in even deeper. Asked if he would support an Israeli attack on nuclear sites, which some Israeli politicians have called for, Biden responded, "The answer is no." When thinking about oil, Saudi Arabia and OPEC+, the fabled $100-a-barrel target isn't relevant any more, Javier Blas writes in Bloomberg Opinion. In truth, it hasn't been since June, when the cartel's announcement of a plan to boost production effectively signaled it was abandoning its quest for triple-digit prices. Now, the reference value that matters is $50 a barrel. The European Commission moved to postpone a landmark law to tackle global deforestation, bowing to immense pressure from commodity-producing countries and industries. The commission suggested a 12-month delay to rules aimed at curbing forest clearance in nations that send products such as coffee, cocoa, soy and beef to the bloc. Global agricultural heavyweights from Brazil to Indonesia had fiercely criticized the plans. As flooding hammered Appalachia in the aftermath of Hurricane Helene, residents became intimately familiar with a new norm in the US's post-storm script: dams at imminent risk of failing. Officials last week said multiple dams were on the brink, including Tennessee's Nolichucky Dam and North Carolina's Walters and Lake Lure dams. People in nearby communities were ordered to evacuate. Ultimately, the dams held. But the close calls highlighted the stress on America's dams, many of which are more than half a century old and none of which were designed for the higher levels of precipitation brought on by climate change.  The Nolichucky Dam in Greene County, Tennessee on Sept. 28. Photographer: George Walker IV/AP Photo Ernesto Bertarelli might be Switzerland's wealthiest man, but a $135 million bet on a sailing race is a lot even for him. The America's Cup is a brutal, winner-take-all event. Every three to four years, teams attempt to build the world's fastest sailing yacht. Then, after just a few weeks of racing, they pack it up until next time. Few people know that the competition for the world's oldest international sporting trophy is even taking place, let alone that it involves some of the world's richest people betting hundreds of millions of dollars on just one race.  Alinghi Red Bull Racing's AC75 racing yacht Photographer: Lluis Gene/AFP Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg's flagship briefing in your mailbox daily. Bloomberg New Economy: The world faces a wide range of critical challenges, from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. Subscribe to the Bloomberg Australia podcast: Host Rebecca Jones and a rotating cast of Bloomberg journalists lift the lid on the biggest business stories shaping the nation. Sign up here. |

No comments:

Post a Comment