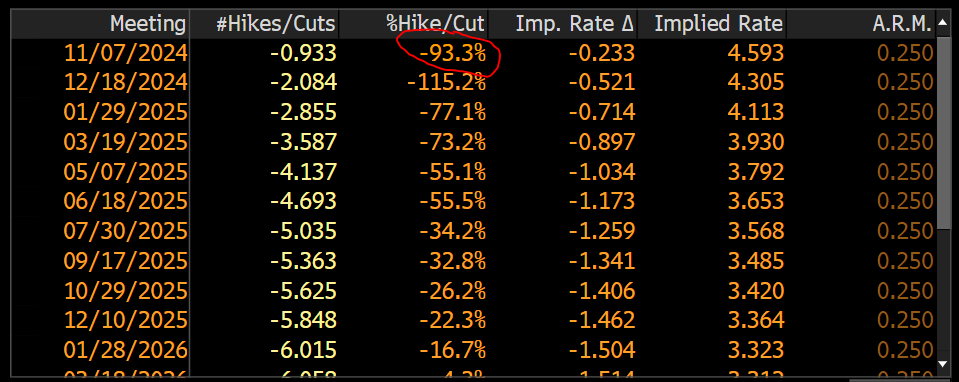

| Good morning. The US 10-year yield is back above 4%, traders weigh economic optimism against tensions in the Middle East and Wall Street experts are turning more bullish on stocks. Here's what's moving markets.— David Goodman Five Things will publish its last edition this Friday, Oct. 11. To keep you up to speed, you will automatically begin receiving the new, more expansive subscriber-only Markets Daily newsletter starting Oct. 14. Not a Bloomberg.com subscriber yet? You'll get a complimentary trial of Markets Daily. Joe Weisenthal will continue writing regularly over on the new daily Odd Lots newsletter. The yield on the benchmark 10-year US Treasury is back at 4%, a level not seen since August, after a blowout jobs report on Friday forced traders to reassess the outlook for monetary policy. The report, showing the fastest job growth in six months, has forced bond traders to once again consider a "no landing" scenario – a situation where the US economy keeps growing, inflation reignites and the Federal Reserve has little room to cut interest rates --- a narrative that was largely dismissed in recent months. There was less certainty for stock markets on Monday, where optimism about the US economy is being tempered by tensions in the Middle East. US futures lost ground throughout the European morning, with contracts on the S&P 500 shedding 0.6% and Nasdaq 100 futures falling 0.8%. Oil, another key barometer of geopolitical risk, swung from losses to gains. In the longer-term though, the market might be eying more gains. That's certainly the view of two of Wall Street's top strategists — Morgan Stanley's Michael Wilson and Goldman Sachs's David Kostin — who have turned more optimistic about US stocks on signs of a robust labor market, economic resilience and lower interest rates. Kostin upgraded his 12-month target for the benchmark to 6,300 points from 6,000, implying gains of about 10% from current levels. Goldman has also upgraded its call on Chinese stocks, saying gauges tracking the nation's equities may rise another 15%-20% if authorities deliver on policy measures, strategists including Tim Moe wrote in a note dated Oct. 5. While Goldman is not alone in seeing more gains, the world-beating rally is failing to convince others, with Invesco and Nomura among those viewing the recent rebound with skepticism. The CSI 300 Index has rallied 27% from a low hit in September and traders will watch to see if it builds on gains when onshore markets reopen on Tuesday after a holiday. Meanwhile, data shows hedge funds turned bullish on the yen just before dovish comments by Japan's new prime minister and the robust US jobs report helped spark the worst week for Japan's currency since 2009. The yen tumbled 4.4% against the dollar last week, as the jobs surprise and Shigeru Ishiba's commentary spurred a rethink on the currency's path. Investors including some hedge funds have begun re-loading short yen bets in risky carry trades, reflecting bearish sentiment on the currency. This is what's caught our eye over the past 24 hours. Good morning 5 Things readers. A little personal news from me. After about nine years of contributing to the 5 Things newsletter, this week will be the last for me of jotting down whatever random thing is on my mind at 4 a.m. on any given day. (Actually, just in the interest of full transparency, sometimes I wrote it the evening before). But I'm not going very far. Starting next week, on Oct. 14, I'll be writing regularly for the Odd Lots newsletter, alongside my podcast with co-host Tracy Alloway. Tracy and I are really excited about building out the newsletter component of the Odd Lots brand. We've been publishing it once a week for a couple of years now. In addition to turning it into a daily newsletter that both Tracy and I will contribute to, we're going to bring in a roster of guest contributors -- outside specialists, experts, and practitioners -- that we've come to know from doing the podcast. So head on over here to sign up for the newsletter, which is available free to any Bloomberg.com subscribers. And if you're not a Bloomberg.com subscriber already, well then now is a good opportunity to change that, which you can do here. Anyway, in the meantime... I'm still here, and obviously I'm thinking about Friday's monster jobs report which saw 254K new jobs created, an unemployment rate of just 4.1% (close to a rounded 4.0% actually) and 72K jobs added to the prior two months. There's no doubt that this is a real narrative-scrambler. Last week at this time, markets were assigning substantial odds to a 50 basis point rate cut at the Fed's November meeting. As of this morning, according to the WIRP function on the Terminal, the market is only pricing in a 93.3% chance of a 25 basis point cut, meaning a non-zero chance of no cut at all. Also this morning, 10-year yields are back above 4% for the first time since early August. The stock market surged on Friday after the report, which I thought was kind of interesting. To me the takeaway is that as long as the Fed is seen as still being in easing mode and the labor market is still seen as humming, that's like rocket fuel for stocks. Still, if the labor side of the mandate is looking more secure than maybe we start glancing an eye back toward the price stability side of the mandate. The last few months, we've been paying less attention to the inflation measures, and that's been fine since the inflation readings have been benign. And for now there's no evidence that that's changing or anything like that. But on Thursday we'll get the September CPI report. Markets are expecting a normal 0.2% MoM reading on core. Maybe it'll get some extra scrutiny compared to months past. Joe Weisenthal is the co-host of Bloomberg's Odd Lots podcast. Follow him on X @TheStalwart Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

No comments:

Post a Comment