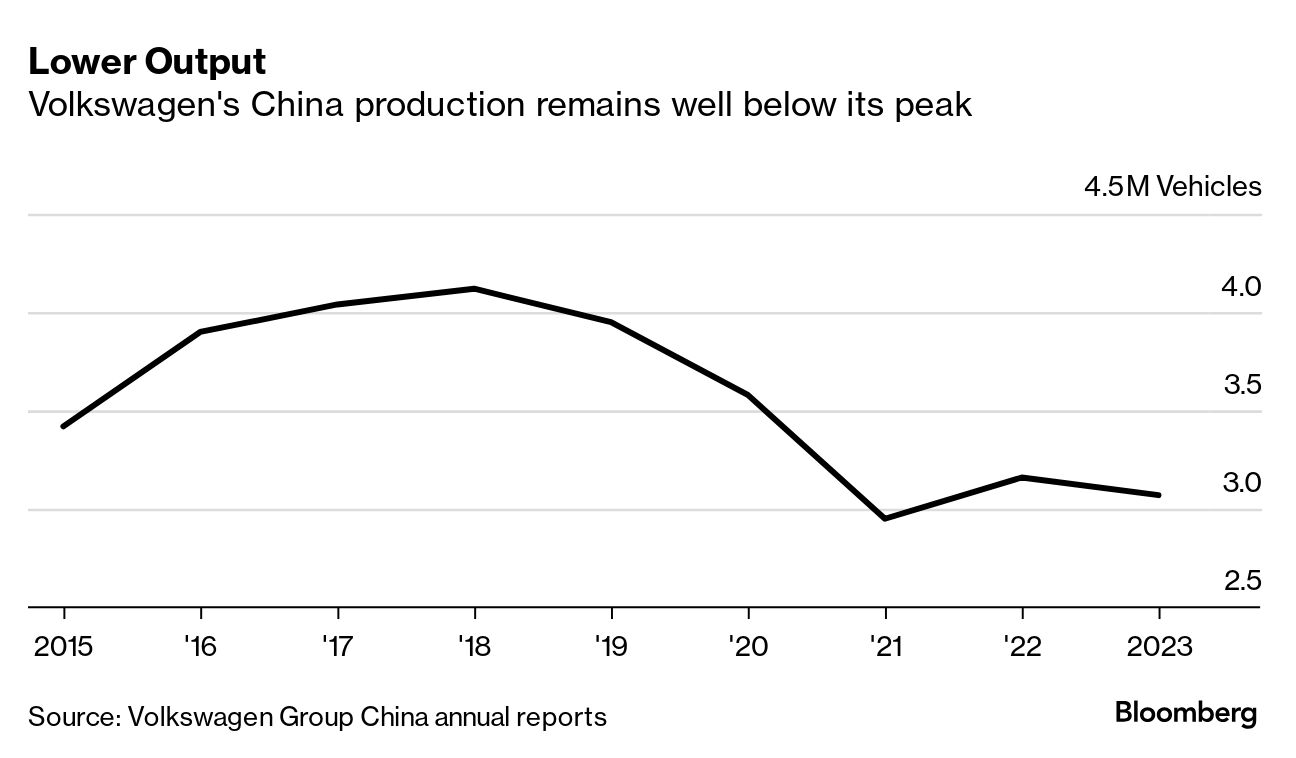

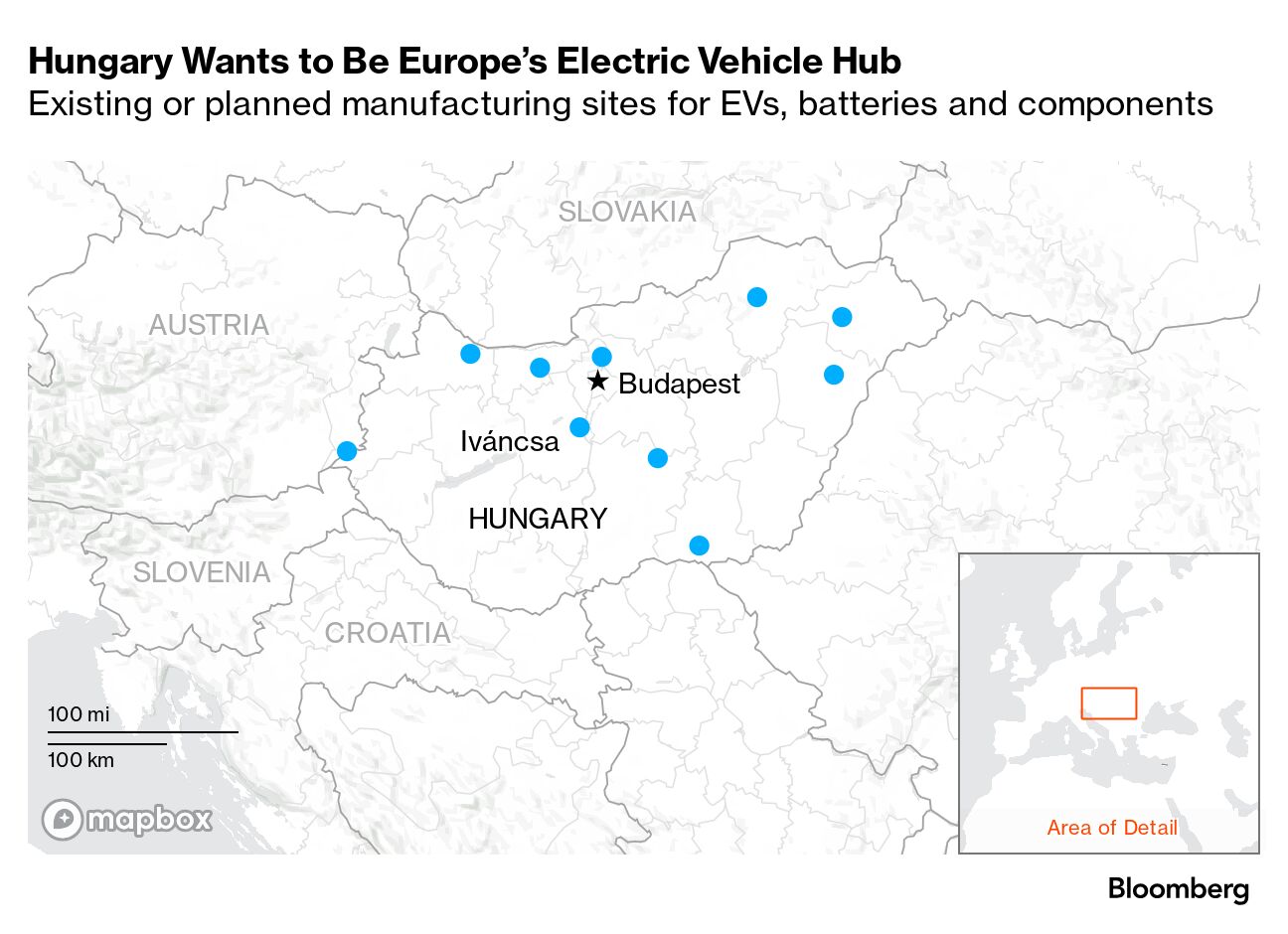

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Volkswagen and its oldest Chinese partner plan to shutter one plant in China and possibly more in response to slowing demand for combustion-engine cars, in a further pullback after the venture's first factory ceased output. The company's four-decade old venture with SAIC Motor is preparing to close a factory in Nanjing as soon as next year, according to people familiar with the matter. The site, which makes VW Passat and Skoda cars, has an annual capacity of as many as 360,000 vehicles.  An SAIC-VW assembly line in Shanghai, in 2006. Photographer: Qilai Shen/Bloomberg At its Shanghai base, SAIC Volkswagen Automobile two years ago stopped production at one factory open since the mid-1980s. A second plant has reduced output and could also be shut down or overhauled, said the people, who asked not to be named before final decisions are made. And the partners are conducting a strategy review of VW's mass-market Skoda brand after a steep dropoff in sales, the company confirmed, underscoring the magnitude of the difficulties it faces in China. A facility in Ningbo, in Zhejiang province, that makes several Skoda models has been idled for months at a time and also is being considered for closure, the people said. "All SAIC Volkswagen factories are operating normally according to the market requirements and our forecast," VW China said in an emailed response to questions from Bloomberg News. As the focus shifts toward smart electric vehicles, "we are also transforming vehicle production and the components plants step by step." The unprecedented retreat in VW's biggest market is being driven by a consumer slump and a rapid shift toward electric vehicles that's left the German manufacturer with too much conventional automaking capacity. Production at VW's 39 Chinese plants last year remained more than a quarter below a pre-pandemic peak. Its share of operating earnings from its Chinese ventures fell 20% in 2023 to €2.62 billion ($2.92 billion), and is down by about half from a high-water mark in 2015. VW is reassessing its Chinese footprint as it also weighs plant closures at home, highlighting the complex challenges the company must navigate to stay ahead of a perilous and uneven global transition away from fossil-fuel vehicles. While VW and other manufacturers were caught off-guard by stagnating EV demand in Europe this year, electrification is rapidly moving ahead in China. There, local rivals like BYD have seized the upper hand with innovative and affordable models, while combustion-engine sales are in decline. Across China, sales of battery-electric vehicles and plug-in hybrids rose 43% in August to 1.03 million units from a year earlier, according to the country's passenger car association. Sales of such vehicles surpassed 6 million for the first eight months of the year. Volkswagen has spent four decades building its carmaking capacity in China, starting with the venture formed with state-owned SAIC in 1985. Several other partnerships have followed: By the end of 2023, VW had more than 90,000 employees at its Chinese unit, but the company now finds itself out of position.  Employees check a VW Tiguan at the Volkswagen plant in Anting, China, in 2015. Photographer: Ole Spata/picture alliance/Getty Images At SAIC-VW alone, factory utilization last year stood at about 58% of a 2.1 million-car ceiling, according to SAIC's annual report. Scaling back would save costs for its co-owners as they seek to strengthen their hand in EVs. One change has already occurred. In 2022, SAIC-VW stopped making cars at its No. 1 Auto Plant at its hub in the the Anting manufacturing zone of Shanghai, the company confirmed. Production has been transferred to a plant in Yizheng, in Jiangsu province, while Anting No. 1 is now being used for research and development. "There is no complete closure of the No. 1 Auto Plant," VW China said in an email. "It is now being used primarily for R&D purposes as part of the company's transformation." The No. 1 plant dates to the start of the SAIC-VW partnership, when the Santana model it churned out by the hundreds of thousands became a symbol of access into China's rising middle class. The facility was making the VW Polo compact, along with Skoda's Octavia and Fabia, before production ended. VW has a brand-new 300,000-car plant in Anting built specifically for electric vehicles. The company's EV deliveries in China increased by 23% to 190,820 units last year. The timing of decisions for the other plants remains unclear, though some of the people said cutbacks are already under way. Many of the factories being scaled back make Skoda models which share platforms with VW cars like the Passat and Golf. Skoda production in China crumbled by more than half last year to fewer than 20,000 units. Amid the review, the partners are adjusting Skoda's marketing and restructuring the dealer network, VW China said, with an eye toward increasing their focus on used-car sales. — By Haze Fan and Chunying Zhang Under Prime Minister Viktor Orban, Hungary has attracted about $20 billion in EV-related investments since 2017. The aim was to ramp up battery capacity faster than any other country and give the economy a badly needed shot in the arm. That's taking longer than expected. A sharp slowdown in the sales of pricier European EVs and a brewing trade war with China are making Hungary vulnerable. The country's industrial output has plunged, dragged down by car and battery manufacturing. Rather than a new era of growth, there's the prospect of another recession. |

No comments:

Post a Comment