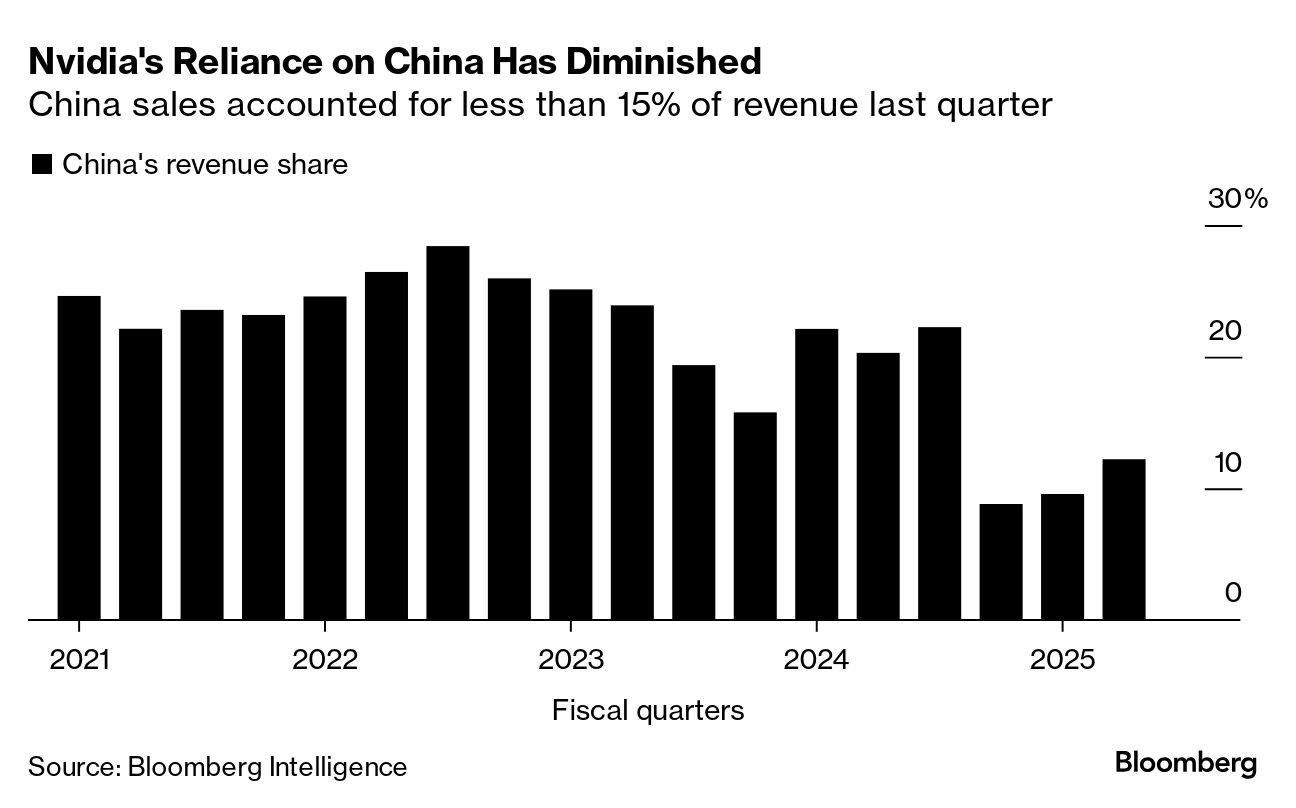

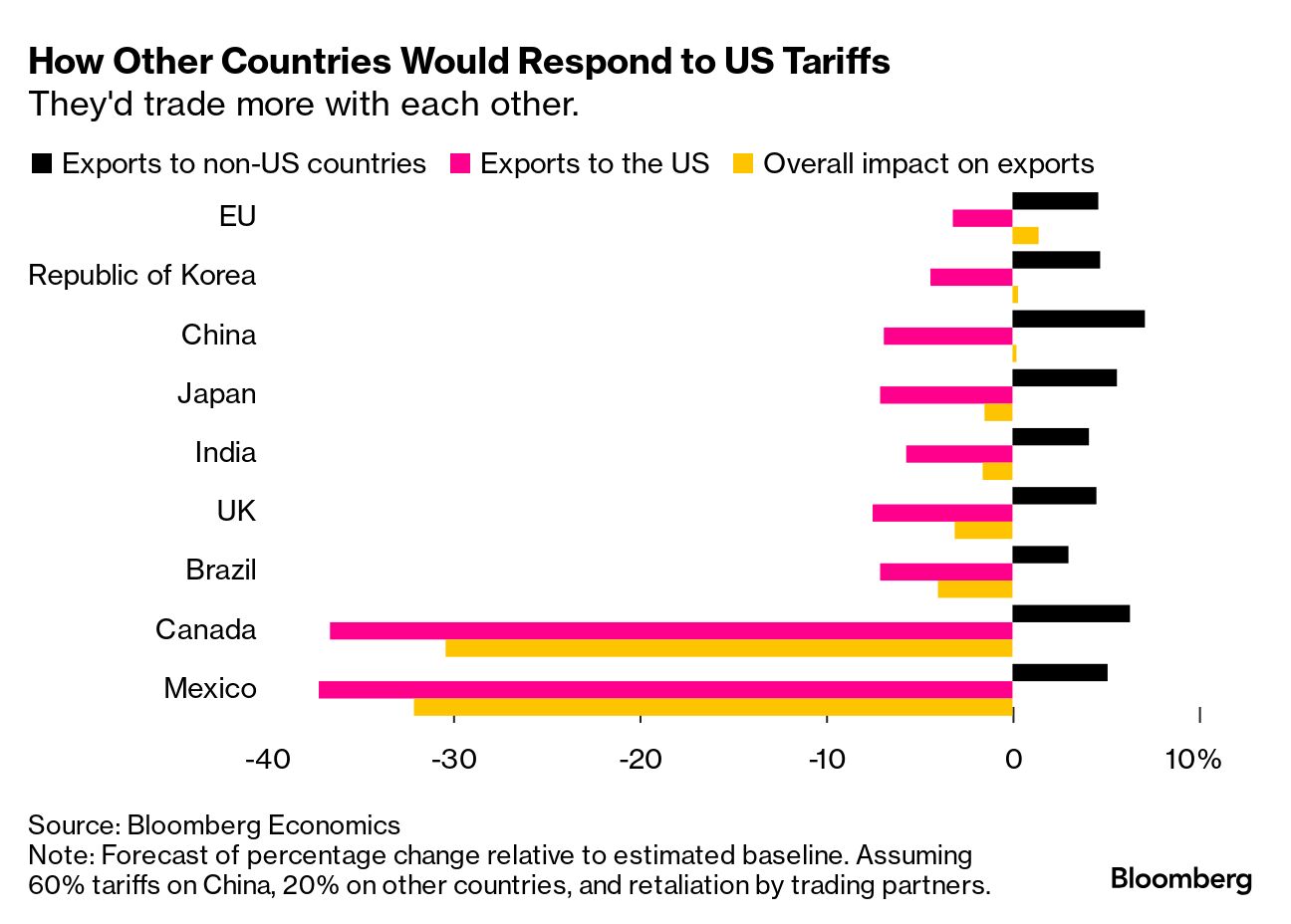

| Nvidia earnings are a moment when all macro investors pause to take notice. That's because the company has been — by far — the top contributor to returns in the S&P 500 in 2024. After nearly tripling its market cap this year, expectations for Nvidia's report on Nov. 20 are understandably high. But if earnings from its main chip supplier Taiwan Semiconductor Manufacturing Co. offer any clues, AI demand is still booming. The more interesting question is whether Donald Trump's promise of renewed trade wars can break the world's most valuable company. The short answer is that it's unlikely. First, it bears noting that Nvidia's China business has been significantly reduced by existing trade sanctions. In 2021, the company's revenue exposure to China was nearly 25%. That number was 12% as of the last reporting quarter. That decline didn't stop the company's earnings from exploding over the past year, rapidly making the chipmaker one of the top profit growth drivers in the S&P 500. Second, Nvidia enjoys plenty of demand at home in the US. The chipmaker's biggest customers, including Microsoft, Alphabet, Amazon and Meta, plowed a combined $59 billion into data center gear and other fixed assets in the third quarter and pledged to spend even more in the year ahead. Still, a universal tariff beyond China brings more unknowns. Nvidia derived 57% of its revenue from abroad last quarter, so this scenario could be more of a headwind for the company — and by extension, the entire stock market. When Trump's first round of tariffs were announced in 2018, Nvidia's stock plunged 31%. But the AI boom was not yet fully underway. Spending on generative AI may reach $200 billion in 2025, Bloomberg Intelligence estimates, and Nvidia will be on the receiving end of much of that. Its own executives have said that demand for the company's new Blackwell chips is "well above supply." In 2025, sturdier fundamentals will ultimately offset any trade-fueled weakness. —Tatiana Darie, Bloomberg Markets Live; with additional analysis by Ian King. |

No comments:

Post a Comment