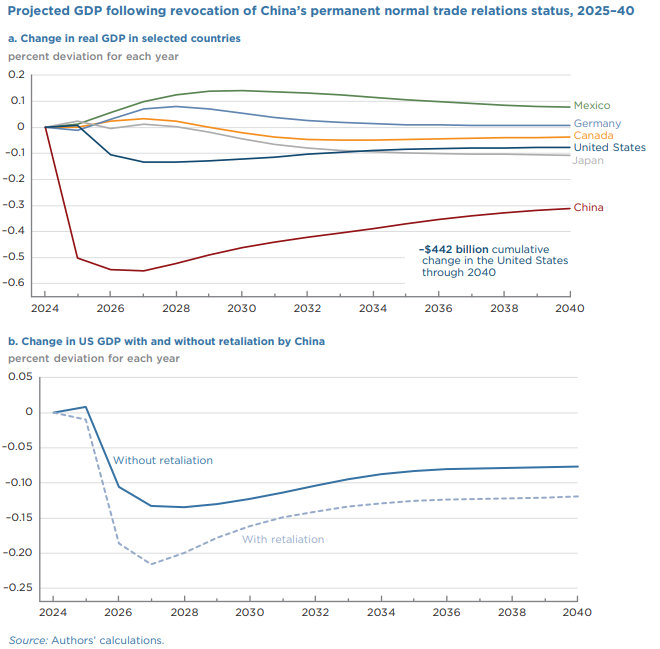

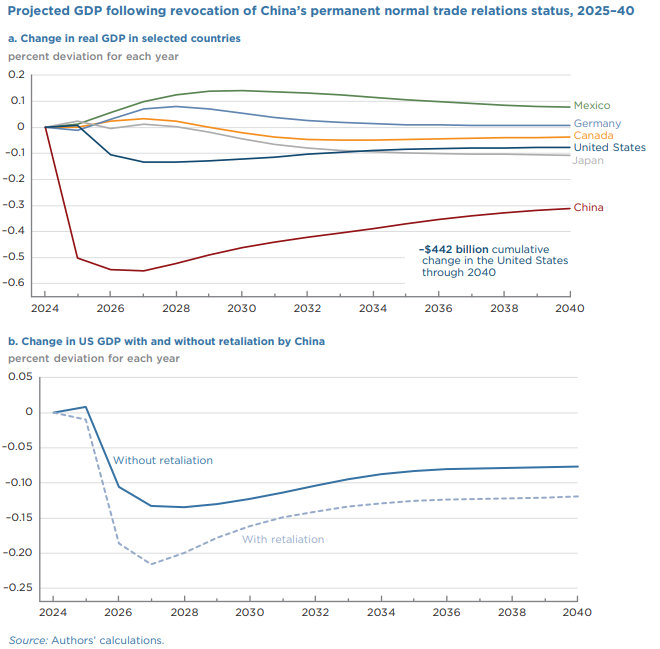

| Given the state of US-China relations at this point, it's surprising that Congress hasn't revoked the country's permanent normal trade-relations status, formerly known as "most favored nation." It's hard to find anyone on Capitol Hill willing to publicly defend that 24-year-old deal, and its staying power is even more mind-bending when reading through accounts of the agreement from that time: President Bill Clinton called it a "good day for America" when the House of Representatives approved his administration's agreement with China, and said "10 years from now we will look back on this day and be glad we did this." Nearly a quarter century later the results are in. While no one is particularly happy with the deal, there are some groups who say a full repeal would do harm to the US economy. According to a new study by the Peterson Institute for International Economics, agriculture, mining and durable manufacturing would be hardest hit initially. "Over time, these unemployed workers would be absorbed into the services sector, through a fall in real wages across the US economy," the report says. Overall, revoking China's PNTR status would result in "a short-term decline in US GDP relative to baseline from which the economy never fully recovers."  Source: PIIE Inflation would also spike as a result of repealing the status, by 0.2% if additional tariffs are imposed and 0.4% if China retaliates, according to the report. That's not an attractive prospect for either presidential candidate vowing to take on inflation — and just imagine what policymakers at the Federal Reserve might think. The one aspect of PNTR repeal that does seem likely, especially given the sentiment toward China on Capitol Hill, is a return to where US-China relations were before the year 2000. For the two decades between 1980 and the dawn of the new millennium, the US granted China normal trade relations on an annual basis. It just wasn't "permanent." The House Committee on Competition with China recommended a similar move in their 2023 report after receiving push-back from industry groups on a harsher proposal. Once a a measure is signed into law it's very difficult to repeal, which is one of the reasons lobbyists spend most of their time trying to prevent legislation from getting passed. A complete repeal of China's permanent normal trade-relations status is unlikely, but that's what the 2024 GOP platform calls for, and it could happen if former President Donald Trump returns to the White House.

If Vice President Kamala Harris wins, a full repeal isn't off the table, but Congress may find that returning to the pre-2000 status quo might be just as attractive a proposition, though not easy to pull off.

—Daniel Flatley in Washington

Read More: |

No comments:

Post a Comment