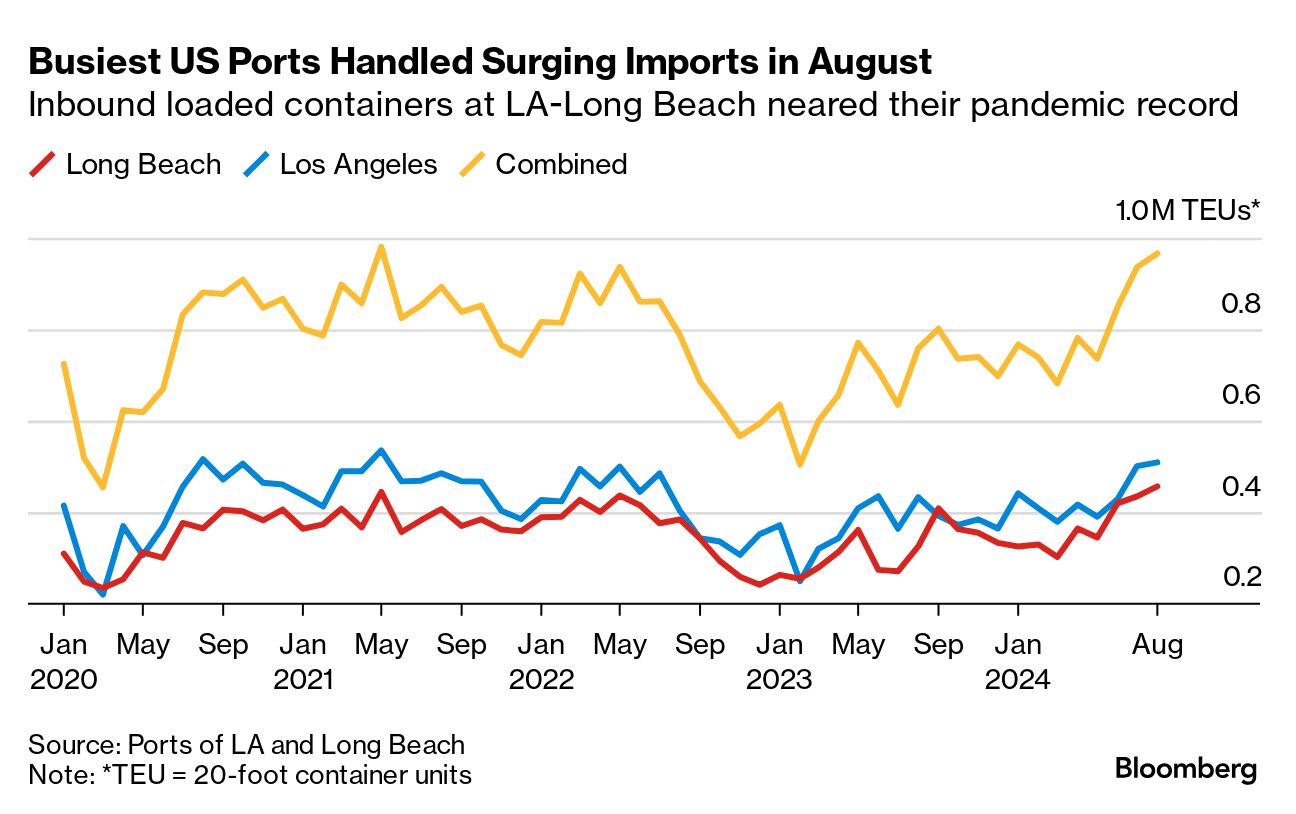

| The ports of Los Angeles and Long Beach, which account for roughly a third of all US container imports, have seen a surge this summer just shy of an all-time high reached in May 2021. Back then, a wave of inbound consumer goods caused supply bottlenecks on land and a queue of cargo ships waiting for a berth offshore was getting longer by the day. This time around, cargo is moving more smoothly through the twin ports, as businesses bring goods in ahead of potential tariff increases and the threat of a dockworker strike hangs over alternate ports. Read More: US Port Workers Meet on Wages, Issue Fresh Strike Threat The Port of Los Angeles processed more than 960,000 20-foot container units in August, marking the trade gateway's busiest non-pandemic month ever. "To give you some perspective on how busy we were in August, we had 97 container vessels called the port, the highest number in four years," Executive Director Gene Seroka told reporters on Wednesday. Next door, Long Beach had its busiest month on record in August, which CEO Mario Cordero credited last week with cargo diversions from other coasts and concerns about upcoming tariffs. Seroka spoke just as news broke of the Federal Reserve's half-point rate cut, which he said should juice the economy, increase consumer confidence and keep goods flowing. "It's a start, but very good news across the economic segments." Meanwhile, tens of thousands of dockworkers are poised to walk out of East and Gulf coast ports when their contract expires on Sept. 30, global shipping capacity is stretched from ongoing attacks on vessels in the Red Sea, and the threat of escalating trade wars are all flashing warning signs to importers that could keep them sending more cargo through Southern California. Seroka said the LA port is currently running at about 80% capacity and could handle more if necessary, though given strong economic data "all of our ports nationwide have to be running at top speed." Read More: Container Carrier Profits Soar on Record Volumes, Higher Rates George Goldman, the North America president of CMA CGM, said the container carrier and other members of the US Maritime Alliance want to reach a deal with the International Longshoremen's Union to avoid disruptions at major ports from Houston to Boston. "One day it's too long of a shutdown," Goldman said. "The reality is is that we're a fluid supply chain process. The moment you close the door, things begin to back up." —Laura Curtis in Los Angeles Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment