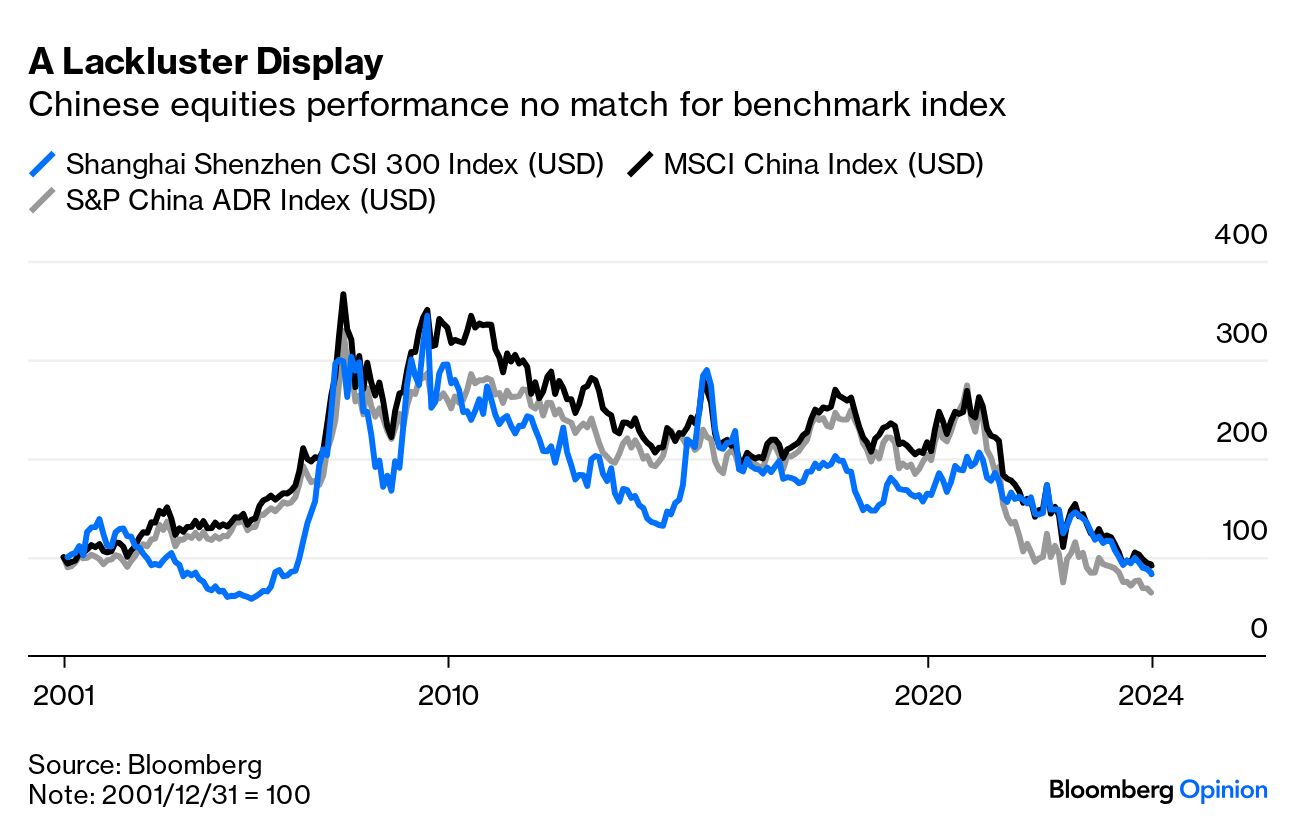

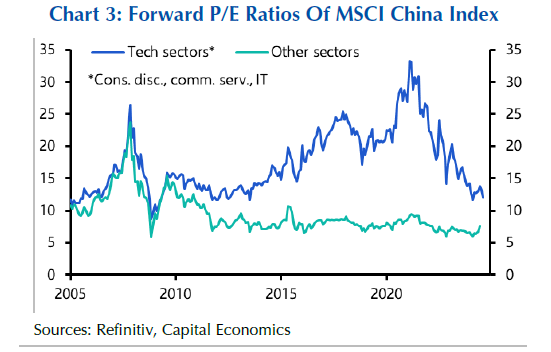

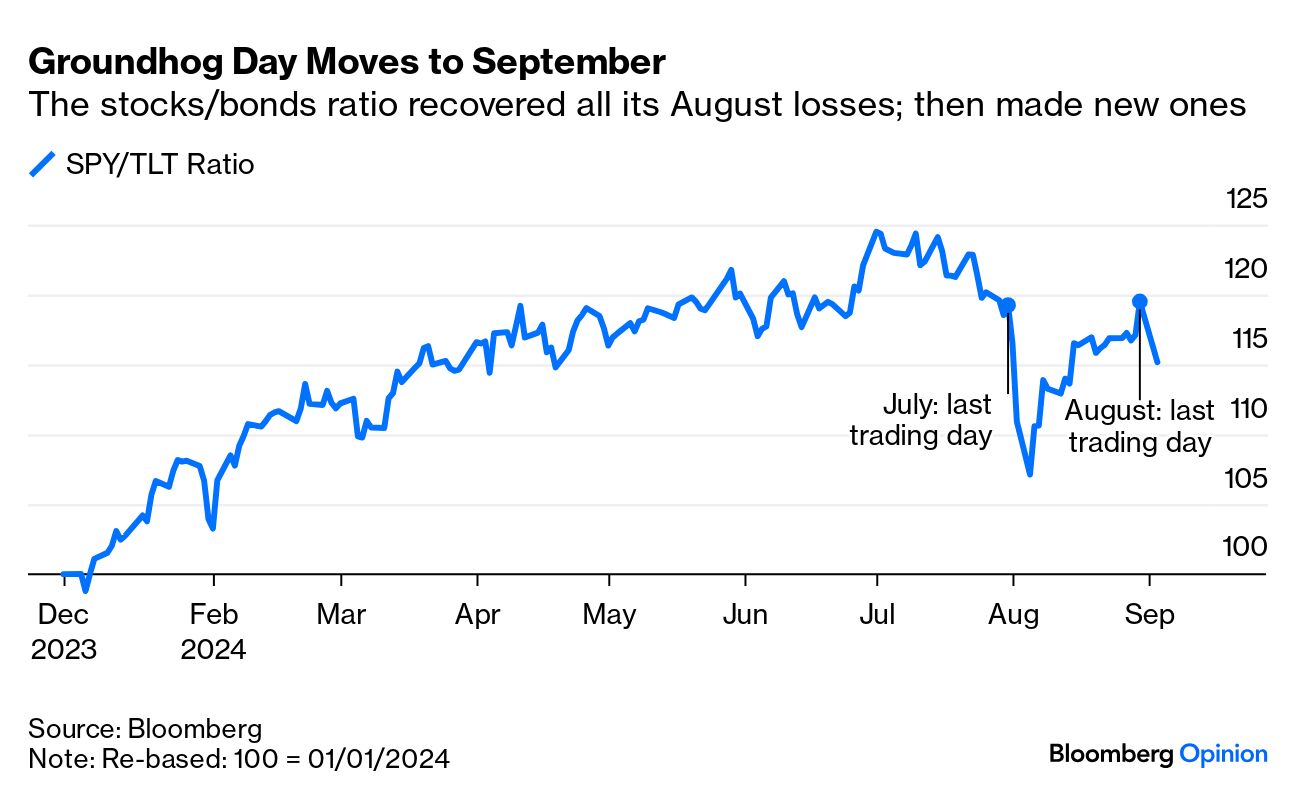

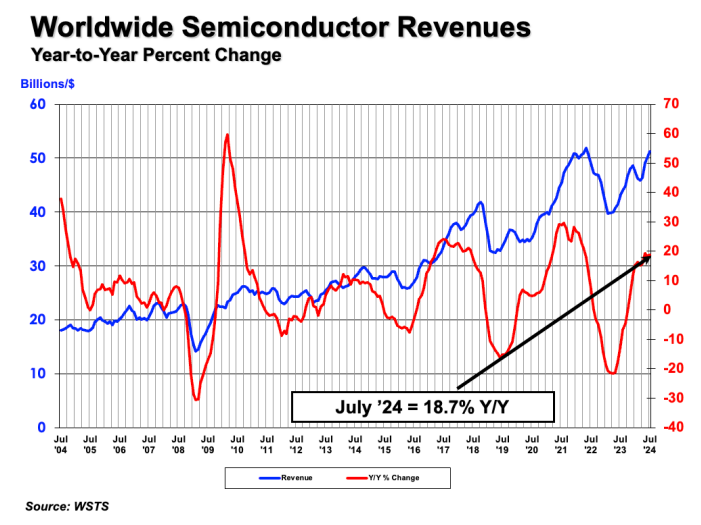

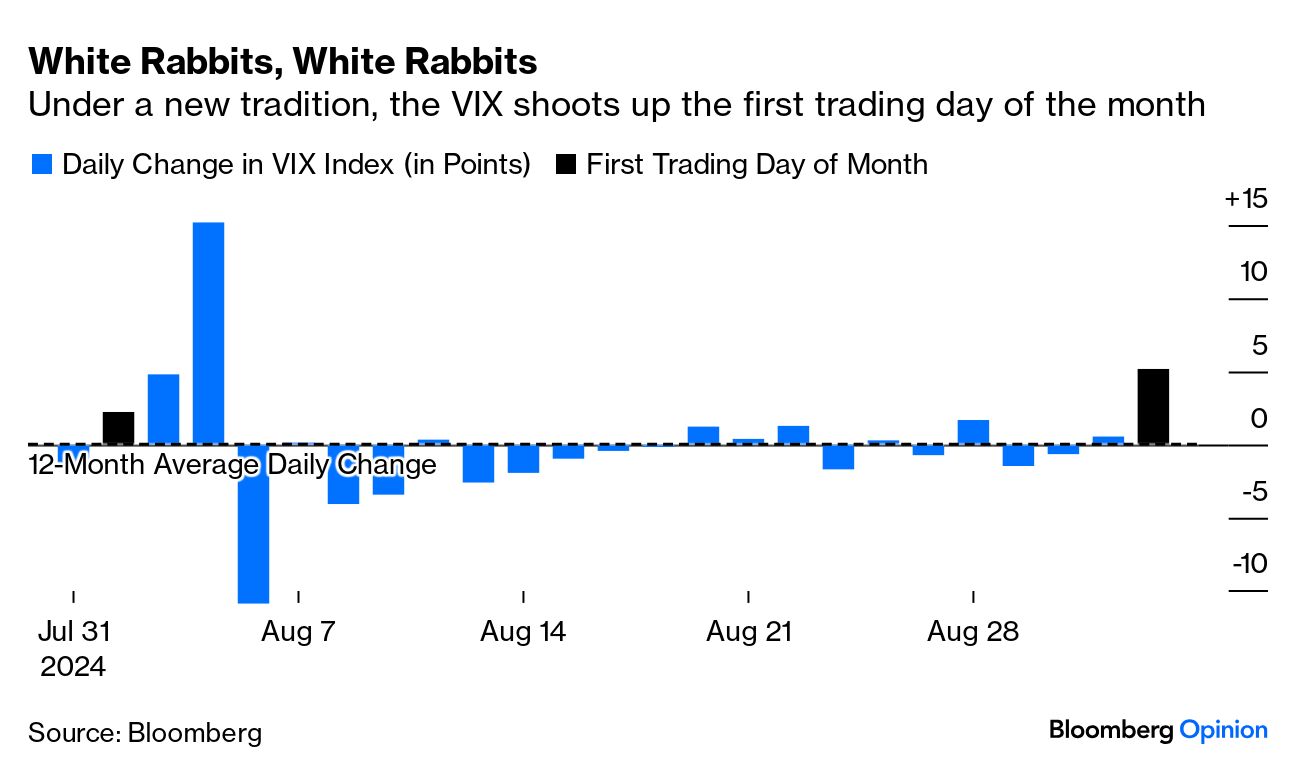

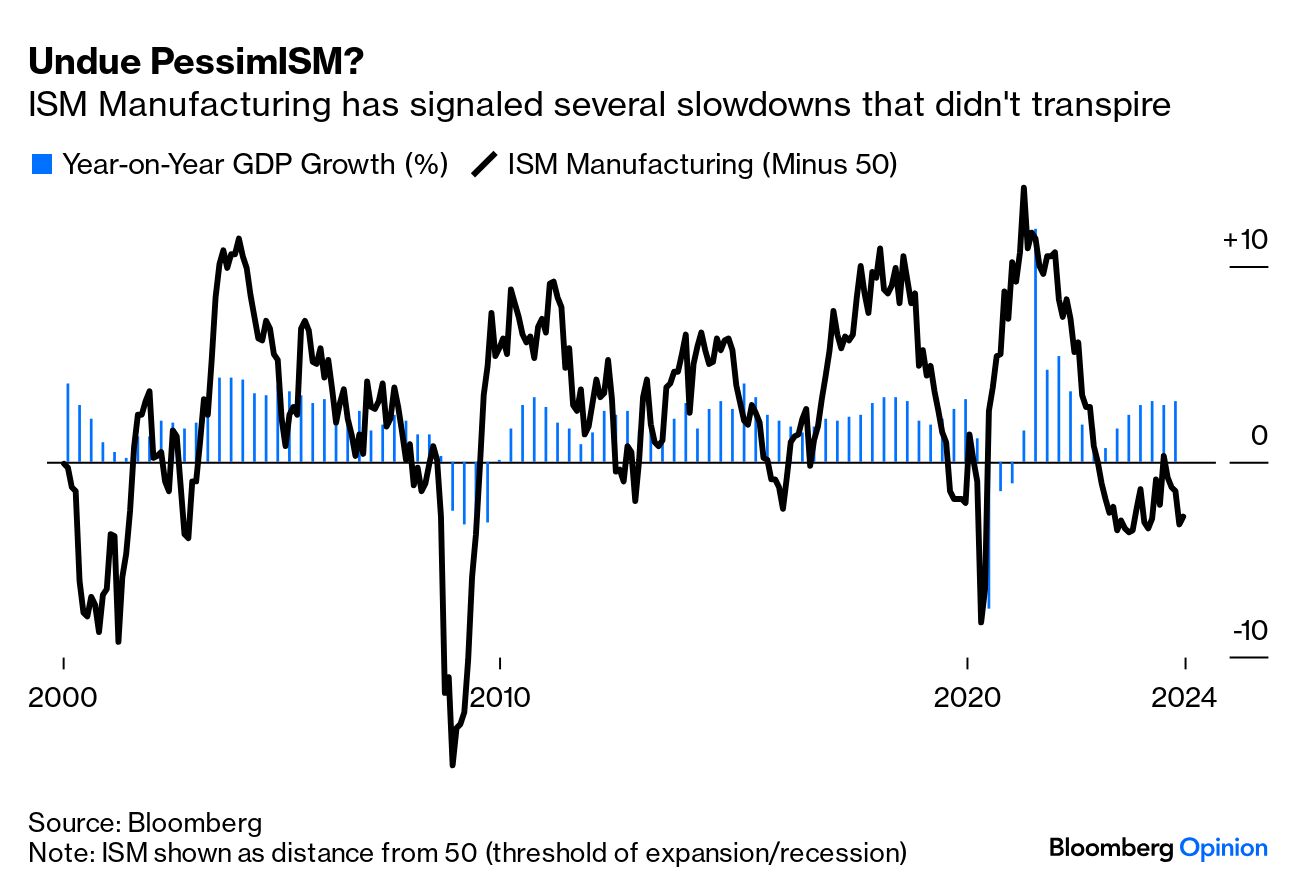

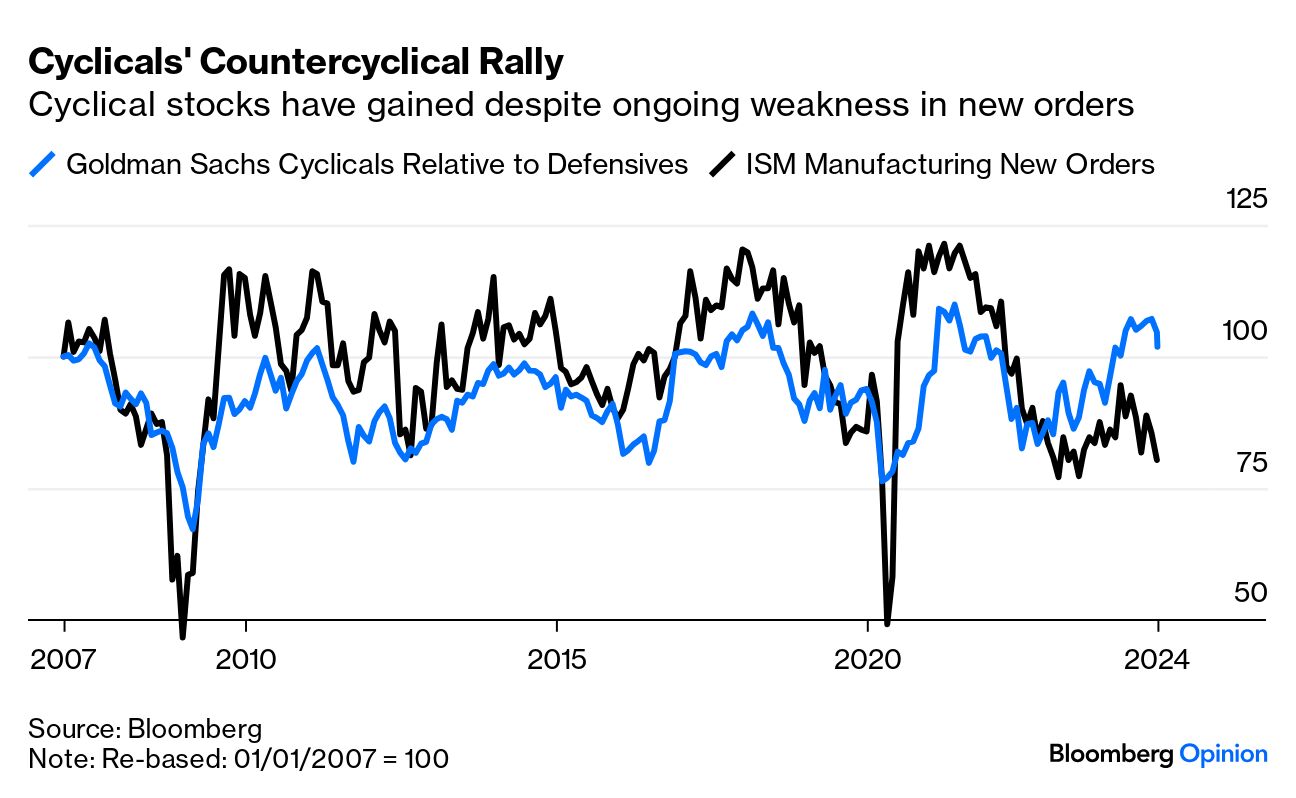

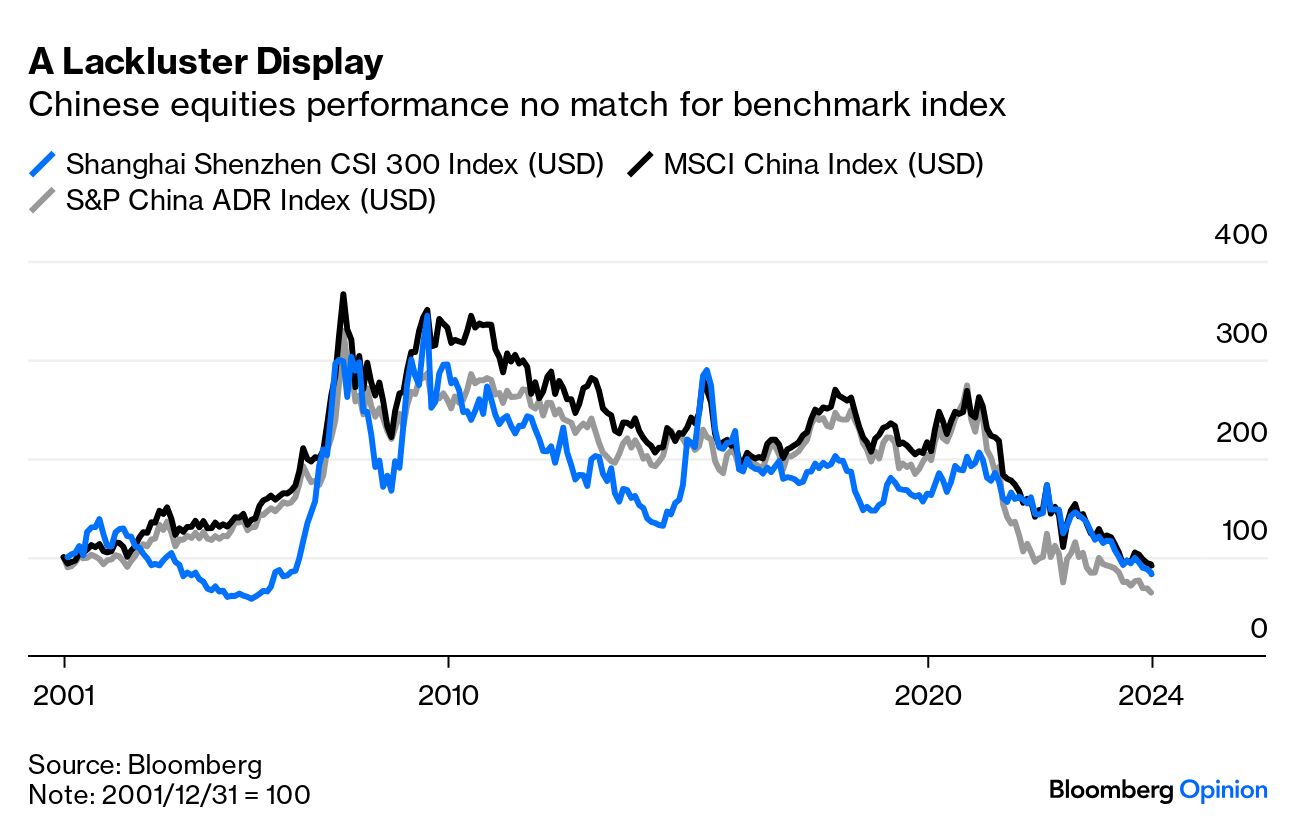

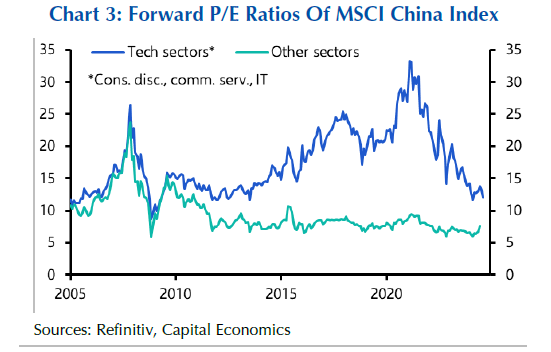

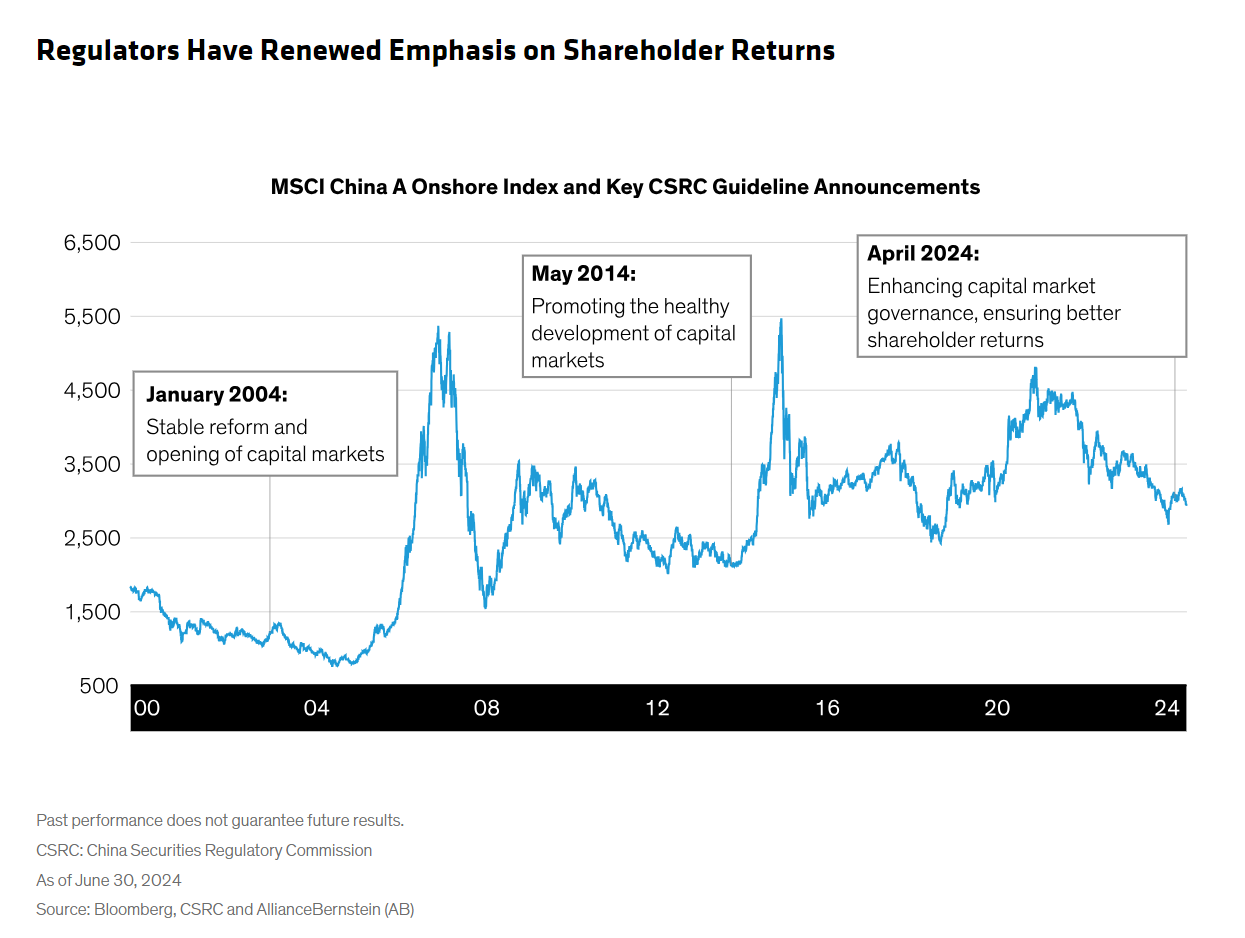

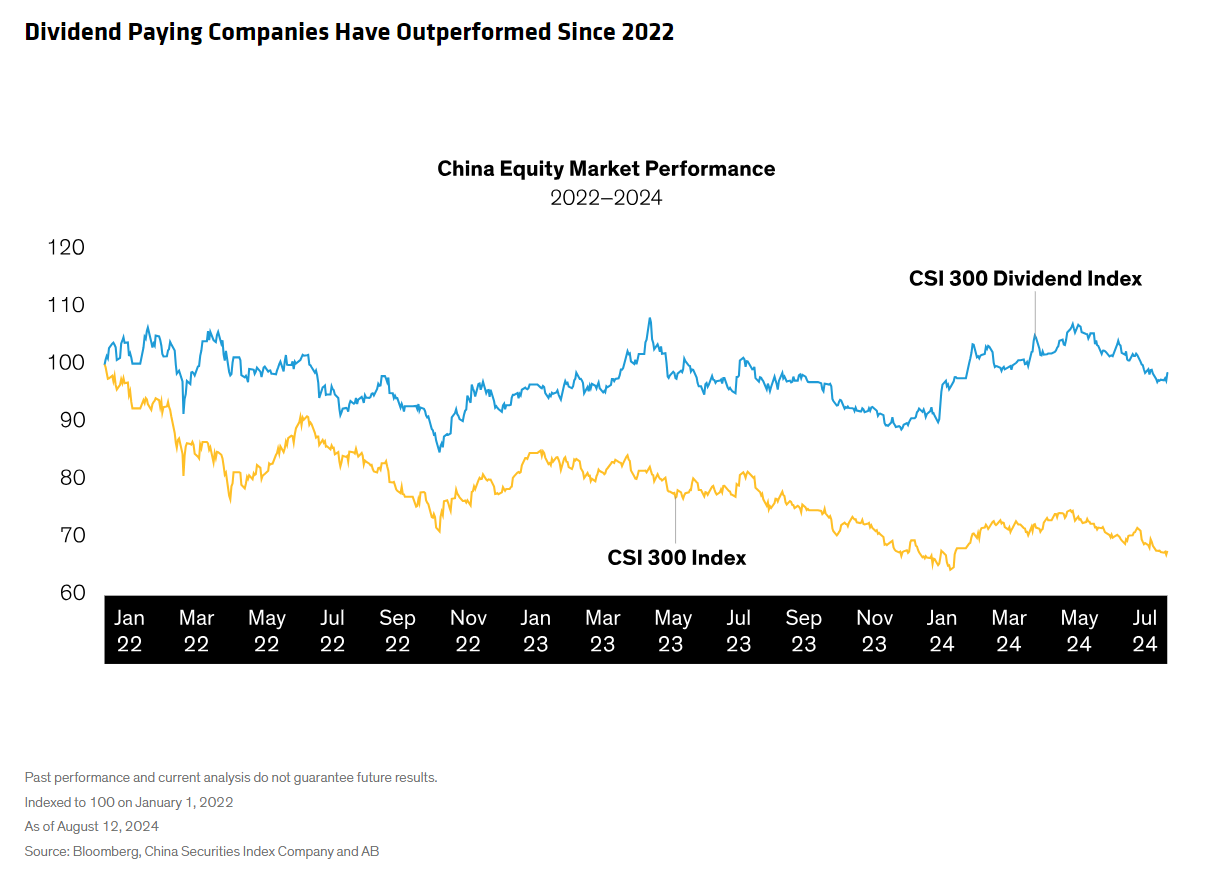

| To get John Authers' newsletter delivered directly to your inbox, sign up here. Wake me up when September ends. It's a common sentiment among investors, and seems amply justified by the post-Labor Day trading so far. Tuesday was truly dreadful for risk assets. The Philadelphia Stock Exchange semiconductor index, charting the most exciting stocks of the moment, had its worst day since March 2020, when Covid-19 hit; the market cap of Nvidia Corp., the phenomenon of the age, fell by $280 billion, the most ever by one company in one day; oil prices dropped to their low for the year; the S&P 500 fell more than 2% for the first time in a month; and the VIX rose by 33% to top 20 points once more, a volatility level that typically suggests that anxiety is high. What's most alarming about all this is that the best explanation anyone could offer was the date. September is historically the worst month for the US stock market (although that has much to do with the fact that the 9/11 terrorist attacks and the Lehman Brothers bankruptcy both happened in this month). Here is a list of factors that can't realistically be blamed: Rotation: July saw a sharp shift toward smaller-cap stocks as investors pulled out of the mega caps that had been dominating. Poor results for Nvidia, it was argued, might even be positive for the market as a whole as they would release capital to be reallocated elsewhere. That hasn't happened this time. The Russell 2000 index of smaller-cap companies was down 3.1%, while Bloomberg's Magnificent Seven index was down 3.35%. Not much rotation there: Flight to Safe Havens: Gold, the most obvious haven, dropped slightly Tuesday. So did Bitcoin, its putative modern high-tech replacement. Bond yields fell, so there was some move to havens, but not by a lot, and still not as far as during the scare in early August. Using the biggest exchange-traded funds for the S&P 500 and 20-year bonds as a proxy, stocks had recovered to exactly their level of July 31 by the end of last month, and started September the same way they started August: The Fed: Over the summer, there were plenty of adjustments to investors' expectations on the Federal Reserve's next move. Nothing has happened so far in September to shift those forecasts. Bloomberg's World Interest Rate Probabilities function, based on the fed funds futures market, now shows a 37% chance of a 50-basis-point cut later this month, up from 32% at the end of last week. A cut of at least 25 basis points is still a racing certainty. Odds further into the future barely moved. Geopolitics: The litany of scary international situations is well known. The far right enjoyed its best election results in Germany since the fall of Hitler (largely expected), while Hamas's execution of Israeli hostages and Russia's missile attacks in Ukraine signaled further horrifying escalations in conflicts that could disrupt the flow of oil. But it's difficult to say that geopolitical angst caused this Wall Street selloff, because crude fell significantly. Brent is at its low for the year, and close to its lowest since the invasion of Ukraine: When oil prices perform like this despite heightened geopolitical risks, that implies that global demand is very weak. Combine this with rising inventories as OPEC+ cartel members have tried to curtail supply, and crude prices fell. All else equal, that should have been good for US stocks outside the energy sector. Semiconductor Demand: The epicenter of the selling was in chip stocks, and there was indeed some news from the sector before Wall Street opened. Global sales were up only 2.7% in July compared to June. But viewed in perspective from this chart from World Semiconductor Trade Statistics, there's no compelling need to sell the sector on this evidence: Nvidia announced its news with its results last week. There was nothing new to justify writing another $280 billion off its value — as Bloomberg's revelation that the company has received a subpoena from the Justice Department came after the market. The Carry Trade: Last month's implosion owed much to the Bank of Japan's rate hike, which sped a selloff for the carry trade (borrowing cheaply in yen and parking elsewhere) that spilled over into other markets. And yes, the yen started the week strong. There may well be more speculative positioning to be unwound. But if investors were really scared by this, they must already have been badly lacking in confidence. This is what's happened to the popular Mexican peso/yen carry trade over the last 12 months: That's why some resort to blaming the calendar... There's an old British superstition that you need to say "White rabbits, white rabbits please bring me good luck" on the first morning of the month to ward off evil spirits. It would have worked about as well as any more sophisticated hedging strategy over the last few hours. This was the second straight month to get off to a terrible start. This shows daily changes in the VIX going back to July 31: There are reasons why the calendar might matter. Portfolio managers often engage in window-dressing, buying and selling on the last day of the month to make themselves look a bit better. Options expire. But this seems to be more about the fact that the first of each month brings with it the ISM survey of supply managers, long taken as a good leading indicator of manufacturing. Last month's ISM was deemed disappointing, and sparked angst that intensified the next day with the publication of non-farm payrolls data. How seriously should we take ISM? Manufacturing is an ever smaller part of the US economy, and its strength as an indicator looks increasingly questionable. So far this century, the ISM has dipped below 50, the notional threshold between expansion and recession, five separate times without a slowdown resulting. That's a lot of false positives. This time, it has shown manufacturing in horrible trouble for a while: Further, the stock market doesn't see what the survey respondents are seeing. Over time, the new orders segment of the ISM has moved closely in line with cyclical stocks; as you might expect, they rise compared to defensives when new orders are rising. For the last two years, however, cyclicals (which don't include Big Tech) have staged a rally even as new orders have looked horrible: It's just possible, therefore, that the ISM might be slightly less rational than the stock market. More realistically, the pandemic was such a big and unusual shock that many indicators remain out of kilter. Where does that leave us? US stocks are very, very rich, anything connected to AI has done remarkably well, and anyone holding such stocks is sitting on big profits. If this ISM number, like the last one, is followed by disappointing data about US jobs on Friday, then we might well get a rerun of August's selloff. That wouldn't be a risk unless stocks were already overpriced, whatever the date on the calendar. Chinese equity markets are unrecognizable from their early 2021 highs. This week, they plunged to the lowest since 2006. Even by their abysmal post-pandemic record, this is as depressing as it gets, and doesn't imply confidence that the Communist Party can engineer its badly wanted economic recovery. This chart tracks the performance of Chinese stocks quoted in Shanghai and Shenzhen, in Hong Kong and in the US against the MSCI World Index in dollar terms. All three measures have been in a free fall after peaking more than three years ago:  The world's second-largest economy has been blowing hot and cold since the pandemic, with the leadership proffering a raft of policies to resuscitate it, none of which yet appears to have hit the target. Points of Return has covered in detail some of those policies here and here. Beneath the malaise, other factors lie in plain sight. Chinese tech valuations are sitting out the good run spurred by the artificial intelligence frenzy. As Capital Economics' Hubert de Barochez notes, the price to 12-month forward earnings (P/E) ratio of the combined IT, communication services and consumer discretionary sectors of the MSCI China Index is now roughly a third of its early-2021 peak. The P/E of the rest of China's stock market has been relatively stable:  Tech is crucial to overall performance, so if it were to recover that could bode well. Barochez predicts Chinese equities could recover some lost ground in the coming months. "After all, we expect enthusiasm about AI to return soon. And we don't think it's too late for Chinese tech stocks to join the party. What's more, we suspect the broader stock market there could benefit from fiscal support and exports propping up activity." Also, prompting by the Chinese Securities Regulatory Commission for companies to return cash to shareholders might unlock value for equity investors. AllianceBernstein analysts John Lin and Stuart Rae describe regulations released in April as a "big shift" that could usefully drive increased dividend payouts. Historically, similar regulatory directives have coincided with some degree of market outperformance, although there's no guarantee of a similar outcome: A comparative performance analysis of the CSI 300 Dividend Index and the broader market over the past two years suggests investors are already pivoting to dividend-paying companies. Again, Lin and Rae argue that this explains why Chinese value stocks have outperformed growth stocks. Since early 2022, the MSCI China A-share Value Index, which has a higher dividend yield, has beaten the equivalent growth index by 38%: Still, the uncertainty will not disappear overnight. AllianceBernstein cautions that China's unpredictable regulatory environment could upend the trends toward dividends. The weakening economy could also weigh on stocks: While most large-cap companies have managed to sustain revenues and margins despite the sluggish economic backdrop, dividends ultimately are derived from profits. If economic growth were to decelerate further, companies would face a squeeze on earnings and profit margins that could constrain dividends.

Meanwhile, the latest economic data aren't looking good. Factory activity contracted for a fourth straight month in August. Home sales data showed that a slump in residential properties continues unabated. Manufacturing, which has previously held up against all odds, is showing weakness. The Caixin manufacturing purchasing managers index flashed warning signs. These economic headwinds present a tough hurdle for investors betting on a sustainable recovery for equities. (And the absence of a voracious ever-growing China doubtless contributes to jitters on Wall Street. — Richard Abbey Returning to White Rabbit; I can think of no more awful progression for any musician than Grace Slick's from Jefferson Airplane to Starship. "White Rabbit" or Crown of Creation were touched by psychedelic brilliance. She was at Woodstock. What was she doing on We Built This City? Watch the video and you'll find a ghastly sequence where Abraham Lincoln's statue jumps up and starts dancing. You'll also see Slick looking embarrassed to be there. For more falls from grace (I only just realized the pun; sorry), try the Trainwreckords series on Youtube on albums that destroyed their artist's careers. They're great stuff, presented by the mysteriously veiled Todd in the Shadows. As Oasis are reuniting, you might start with Be Here Now. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment