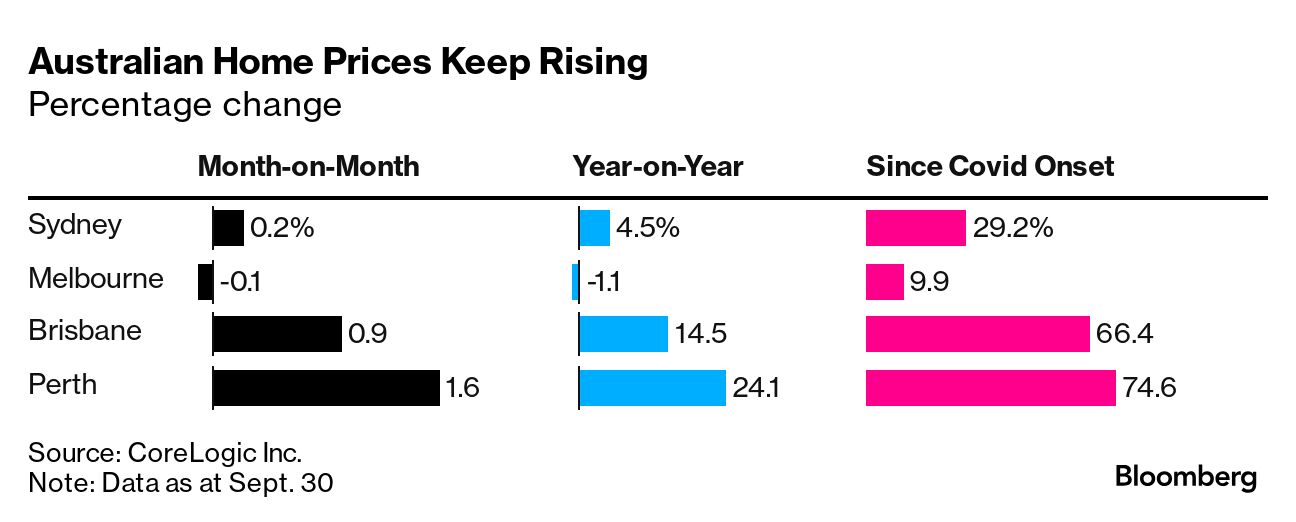

| Qatar Airways plans to take a 25% stake in Virgin Australia from Bain Capital, expanding the Gulf carrier's global network of equity holdings. The move aims to give Qatar Airways better access to the Australian market after it was denied more connections by the government last year. Australian home values rose in September — traditionally a strong month for sales — though the rate of growth remained steady amid increased supply and affordability concerns. Sydney advanced 0.2%, while Perth led major cities with a 1.6% gain. REA dropped its pursuit of Rightmove after the British property portal rebuffed four takeover proposals in less than a month. Rightmove shares slid after REA said it doesn't intend to make an offer for the company. ANZ chief Shayne Elliott says an alcohol ban would be "difficult to implement" as the bank works to restore an embattled reputation following a series of scandals in its trading arm. Watch his full interview with Bloomberg Television here. Droughts, downpours and fires at home and abroad are stoking worries about crop harvests, pushing up prices for food staples that could spur higher grocery bills. The Bloomberg Agriculture Spot Index — which includes nine major products — had a monthly gain of more than 7%, the most since Russia's invasion of Ukraine sent markets soaring in early 2022. |

No comments:

Post a Comment