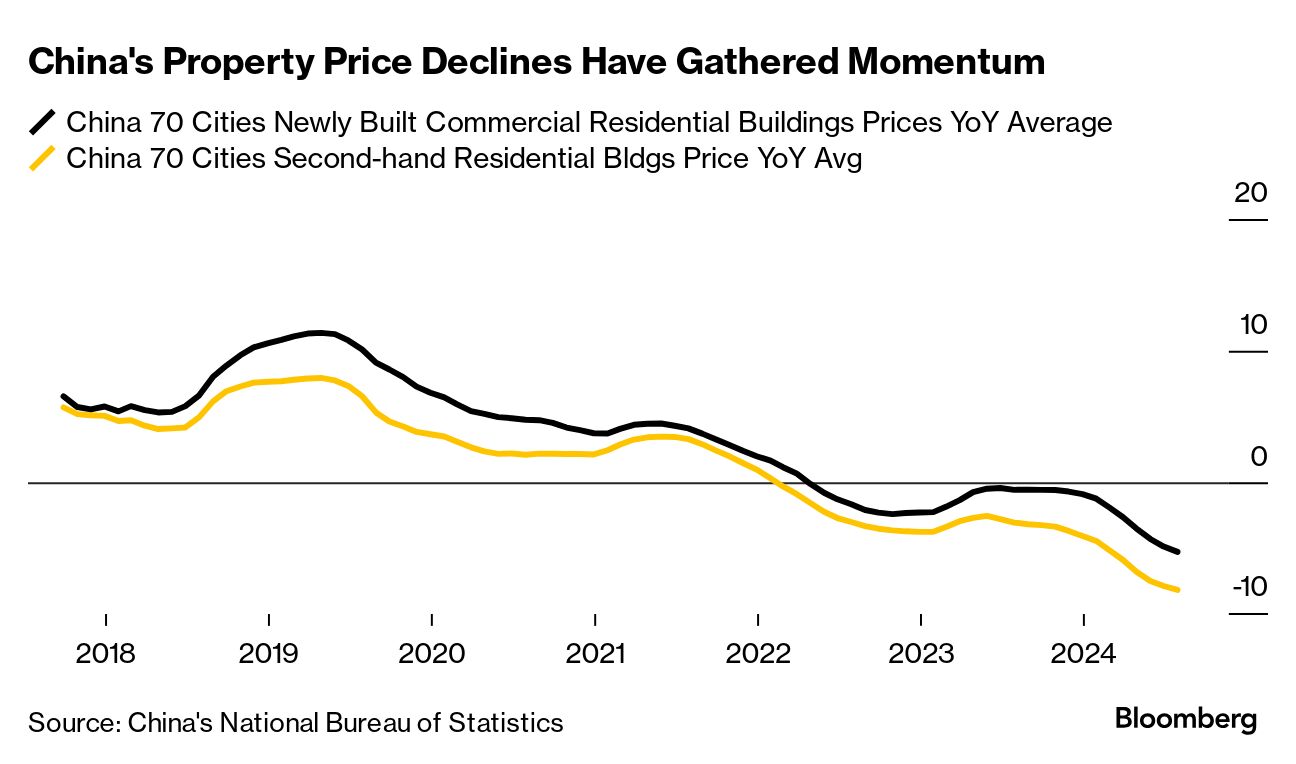

| China's leadership, after showing limited concern about the nation's sluggish growth in recent months, finally reached what Goldman Sachs termed its "pain threshold." With measures including a raft of interest-rate cuts, a new facility to prop up the stock market and a plan to recapitalize banks, policymakers this week decisively shifted gears in an apparent effort to ensure the government's 2024 growth target of about 5% is reached. The first step to solving a problem, as the adage goes, is to recognize there is one. And the official statement following the Communist Party Politburo gathering on Thursday acknowledged "new issues and problems." Arguably the most important part of the announcement was a pledge to get the real estate market "to stop declining and stabilize." "It's one thing to lay out plans in bold statements, and another to put effective measures into action," David Qu and Eric Zhu at Bloomberg Economics cautioned. "There's clear upside risk" to the growth outlook, but the duo said that "we'll assess the policies as they are implemented." In other words, it's not certain that the big investor cheer this week will be sustained. China's property slump—now in its fourth year—has weighed on consumer confidence and hurt domestic spending, so a real bailout would be a game-changer. The latest set of data showcased that, despite many announcements by both Beijing and local governments stretching back at least two years, housing remains mired in an epic slump. The value of new-home sales by the top 100 developers tumbled almost 27% in August from a year before. Last August, they were down about 34%. In August 2022, sales slumped 33% year-on-year. In other words, the market has been cratering for some time now. Perhaps as important, prices continue to decline, and the pace has accelerated. That's after a powerful upsurge in prices during China's period of rapid economic growth. Falling property values undermine household confidence, particularly against a backdrop where real estate makes up a notable share of wealth. The irony is, China's property crisis was one that policymakers manufactured. It began in 2020, when regulators set limits—dubbed three red lines—for developers seeking to borrow more. The intention was in part to contain prices that were becoming increasingly unaffordable, and in part to address financial-stability risks. Property companies had relied on leverage to scoop up large land banks that they would then develop. Practice was to sell housing units prior to finishing them, with the revenue paying for the construction. Once access to fresh borrowing dried up, the system broke down. "I don't know if the world has ever seen such a self-induced property implosion," Stephen Jen, chief executive of Eurizon SLJ Capital, wrote in a note to clients this week. "All of the other cases of property corrections were involuntary." Officials' actions up to now have relied on local governments taking action. Measures included setting up funding mechanisms to encourage them to buy unsold properties, potentially turning some buildings into social housing—a system that's worked well on a small scale in Singapore. But the trouble has been local authorities remain in austerity mode, having running up debts in part to pay for a draconian Covid containment infrastructure. They've also seen a decline in revenue due to the property slump, after having long relied on sales of land-use rights. To top it off, the economics of participating in bailout schemes were a hard sell amid widespread expectation of further price declines. In May, China's central government urged more than 200 cities to buy unsold homes to ease oversupply. By earlier this month, only 29 had heeded the call. But once President Xi Jinping has declared something a priority, that tends to mobilize things in China's single-party state. Xi oversaw the Communist Party Politburo meeting this week that unveiled the primacy of shoring up the economy.  Pan Gongsheng, governor of the People's Bank of China. On Sept. 24, he unveiled multiple monetary-easing steps to bolster China's economic growth. Photographer: Qilai Shen/Bloomberg "A change in the view from the very top is important. The housing market desperately needs more actions from the top to undo the self-inflicted damage," Jen said. Some developers already are jumping on the reflation bandwagon, pledging to make homebuyers whole should prices fall between contract signing and property delivery dates. But most economists aren't yet rushing to rewrite their economic growth forecasts until it's clear what sort of fiscal resources Beijing is prepared to deploy. Market speculation has centered on the potential for a 2 trillion yuan ($285 billion) injection. But one thing to keep in mind is the context of a contraction in budget spending (as noted in last week's edition) so far this year. Alicia Garcia Herrero, chief Asia-Pacific economist at Natixis SA, estimated China may need to unleash over 3 trillion yuan just to fill fiscal gaps. Beyond addressing China's property crisis, there remains a policy focus on value-added manufacturing rather than the services sector that could do most to provide jobs and income. The longer-term picture "still looks the same— grim," Qu and Zhu at Bloomberg Economics wrote. "Structural forces will keep considerable downward pressure on growth." —Chris Anstey |

No comments:

Post a Comment