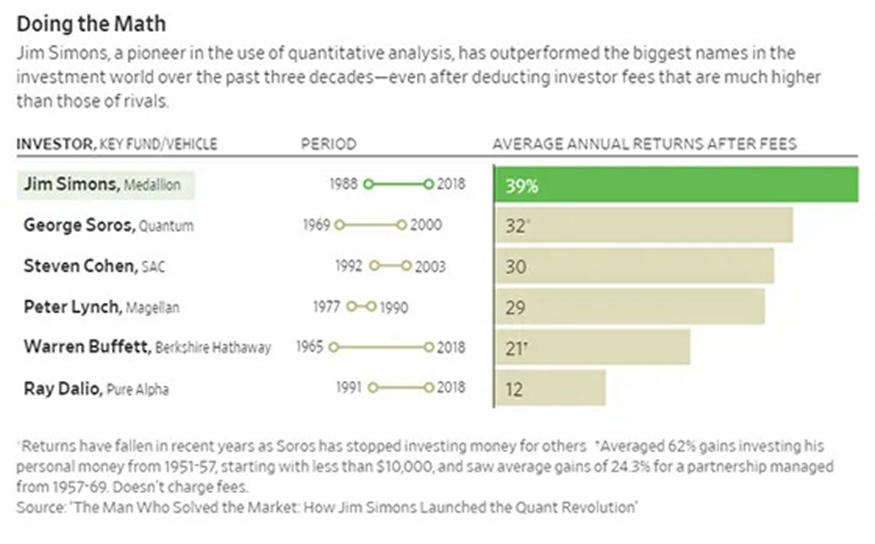

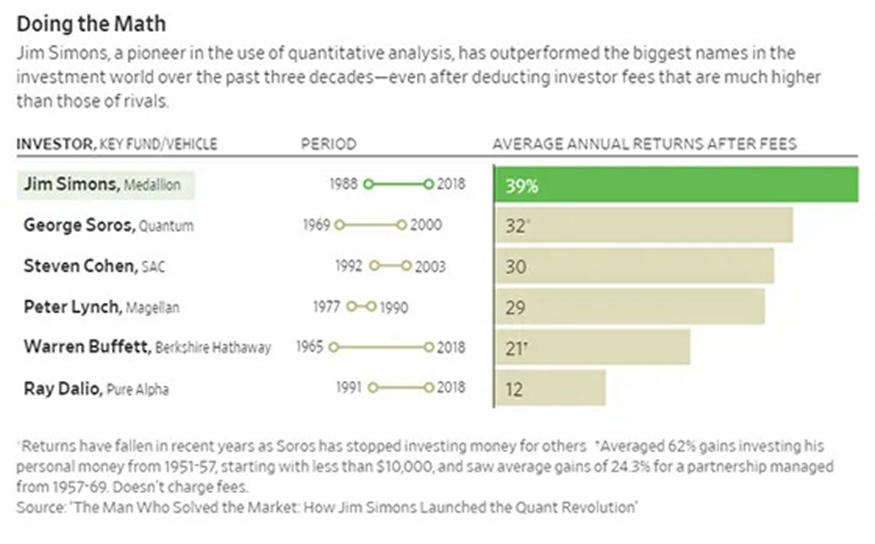

How the late Jim Simons dominated the market … the quant approach created by Luke Lango … the benefits of a stage analysis framework … the coming “tech reversal” The young staffer was worried his boss was suicidal … He had just found the hedge fund manager lying on his couch, reeling from a disastrous bet on bond-futures contracts. The mistimed call had lost nearly a million dollars of client money. This was 1979, so that was a large sum, especially for this small investment shop. "Sometimes I look at this and feel I'm just some guy who doesn't really know what he's doing," said the fund manager. At the time, there was no way to know that this tortured person would go on to become the most successful money maker in the history of modern finance … The unparalleled success of Jim Simons Guys like Warren Buffett and George Soros get the limelight, but when it comes to returns, no one tops the late Jim Simons. Starting in 1988, his flagship Medallion fund has generated average annual returns of roughly 66%, generating trading gains of more than $100 billion. No other marquee hedge fund manager even gets close. See for yourself below (by the way, realize that you're seeing after-fee returns to investors).  The remarkable thing is that Simons began his investment career with practically zero investment experience. He was just a mathematician who decided to try his hand at trading currencies. He had no finance classes in his background, and no real trading experience. And unlike so many traditional hedge fund managers at the time, he had no idea how to perform basic investment analysis such as estimating earnings, or using macro factors to predict changes to the broader economy. And yet somehow, over three decades of volatile markets, he still returned his investors 39% each year – even after taking his enormous fees. | ADVERTISEMENT  Donald Trump knocked Joe Biden out of the race after a disastrous debate performance. But months before, one man’s firm already predicted it would happen. Now, even as the mainstream media is doing everything they can to anoint Kamala Harris the next president, they’re predicting the end of her campaign. And it’s all because of just 12 words.

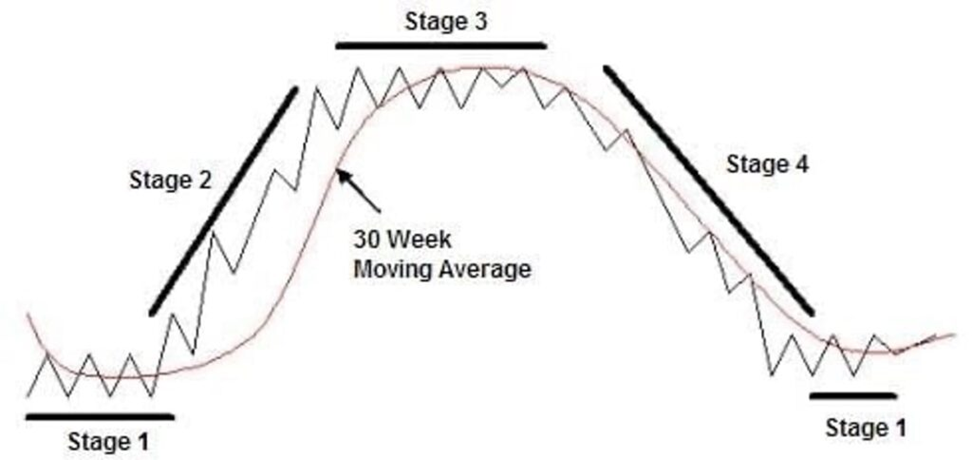

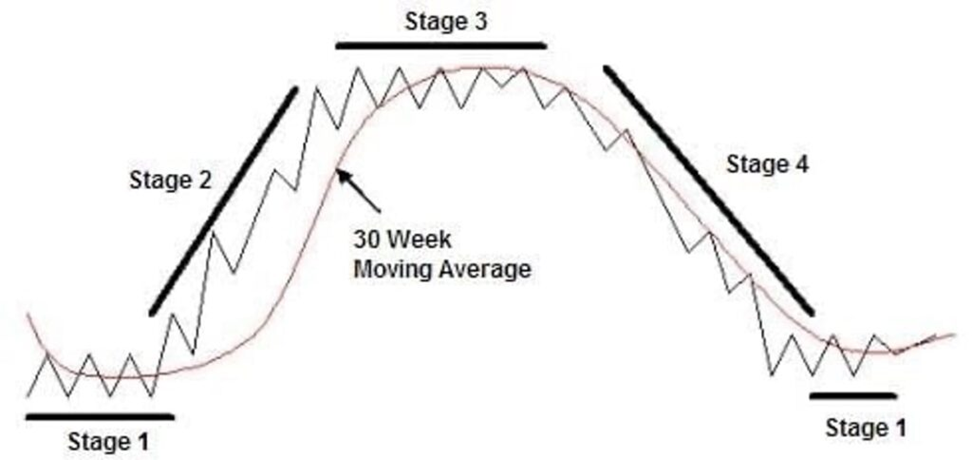

Hear them for yourself and make up your own mind. | What’s behind this astonishing success? From The Wall Street Journal: For a while, Mr. Simons traded like most everyone else, relying on intuition and old-fashioned research. But the ups and downs left him sick to his stomach. Given this, eventually, Simons decided to adopt a different approach … Mathematics. He built a high-tech trading system guided by preset algorithms — basically, step-by-step computer instructions. It was a program designed to digest vast quantities of market data from which it would then select attractive trades. The goal was to remove human emotion and instinct from the investment selection process. Simons told a friend, "I don't want to have to worry about the market every minute. I want models that will make money while I sleep. A pure system without humans interfering." Roughly two years ago, our own Luke Lango decided to create his own quant-based market approach Here's Luke from back in 2022 describing the process and mindset that he and his team of CalTech engineers used in creating their model: Over the past year, my team of data scientists and myself have developed, tested, and fine-tuned a quantitative trading system to help crush the market. We realized that the era of human-driven investing is drawing to a close. The era of machine-driven investing has arrived. So, we built a quantitative trading model to help us do just that. With it, we leverage the power of machines and big data to beat the markets. Like most successful market approaches, Luke's system is simple in theory, but challenging in application. It involves something called "stage analysis." For newer Digest readers, the underlying idea is simple… At any given point in time, an asset is either going up, down, or sideways. To that end, it's always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down. Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time.  Obviously, the key to scoring consistently big returns in the market is to find stocks on the cusp of entering Stage 2 – or stocks that are about to break out.

| ADVERTISEMENT  According to mainstream news, the race is all but over. Do you believe it? If so, no need to read further. But if you’re willing to do your own thinking, you need to hear this message from Charles Sizemore. You may not like what he has to say, but you cannot deny his firm has been right - about Biden dropping out… about a radical Californian replacing him… about a spike in market volatility…

And he’s helping a small group of readers protect and set themselves up to grow their wealth even as these events blindside millions of other Americans.

Charles’s latest prediction may be his most shocking and controversial yet. But it may also be his most important.

Click here prepare for the NEXT election shock. |

As we’ve highlighted in Digests this spring/summer, we think trading is a fantastic approach to today’s market That's because it offers flexibility. If this bull run continues or even accelerates this fall, you're benefiting alongside this Stage-2 bullish trend. But if momentum changes direction and Stage-4 weakness grips the market, the technical indicators that underpin a stage analysis approach would trigger, helping investors sidestep the worst of the market pullback. What I find so powerful about this approach is its focus – price itself. How many times have you identified a compelling fundamental reason to buy a stock, yet it lost you money? Even if your theory was correct? That's one of the challenges with investing/trading – even if your analysis is correct, the market has a mind of its own and can refuse to "play nice." But this frustration points us toward a key attribute of stage analysis trading… Knowing "why?" a stock or sector is surging is great – but it's unnecessary and largely irrelevant. When you’re utilizing stage analysis, your focus is on the one thing that matters The most important thing is the price action itself, and whether it's headed in the direction you want with robust momentum. Knowing "why?" a stock is climbing is just icing on the cake. But at the end of the day, it really doesn't matter. The only thing that matters is that the stock is moving north, making you money. Think about it… Imagine that Stock A was losing customers, losing market share, and hemorrhaging cash – yet its stock price was surging higher. Would you prefer to stay on the sidelines because you know that Stock A has all of these fundamental warts associated with it? Or would you prefer to jump into the trade based purely on its surging price, and ride the momentum higher for as long as it runs? Even though there's no great reason why the stock is surging. At the end of the day, the only thing that matters when it comes to wealth creation is the market price – and whether your exit price is higher than your entry price. When you better understand stage analysis, you'll see the market through a new lens that can help explain some of your past, underwhelming stock picks. I suspect you'll recognize that – even though you had a sound reason to invest – you simply bought during the wrong stage. Now, with this broad explanation behind us, Luke believes we’re on the verge of a major market event that’s going to goose the results of a stage analysis approach I'm still getting the details from Luke as I write this, but my impression is that what's coming involves a big uptick in volatility, a specific catalyst that Luke believes will trigger it, and a massive "tech reversal." Some stocks are likely to soar. Other could be in for a serious correction. Either way, all this plays directly into a stage analysis market framework. After all, though fundamental analysis is great, at the end of the day, price is truth. We'll bring you more on this from Luke later this week. Have a good evening, Jeff Remsburg |

No comments:

Post a Comment