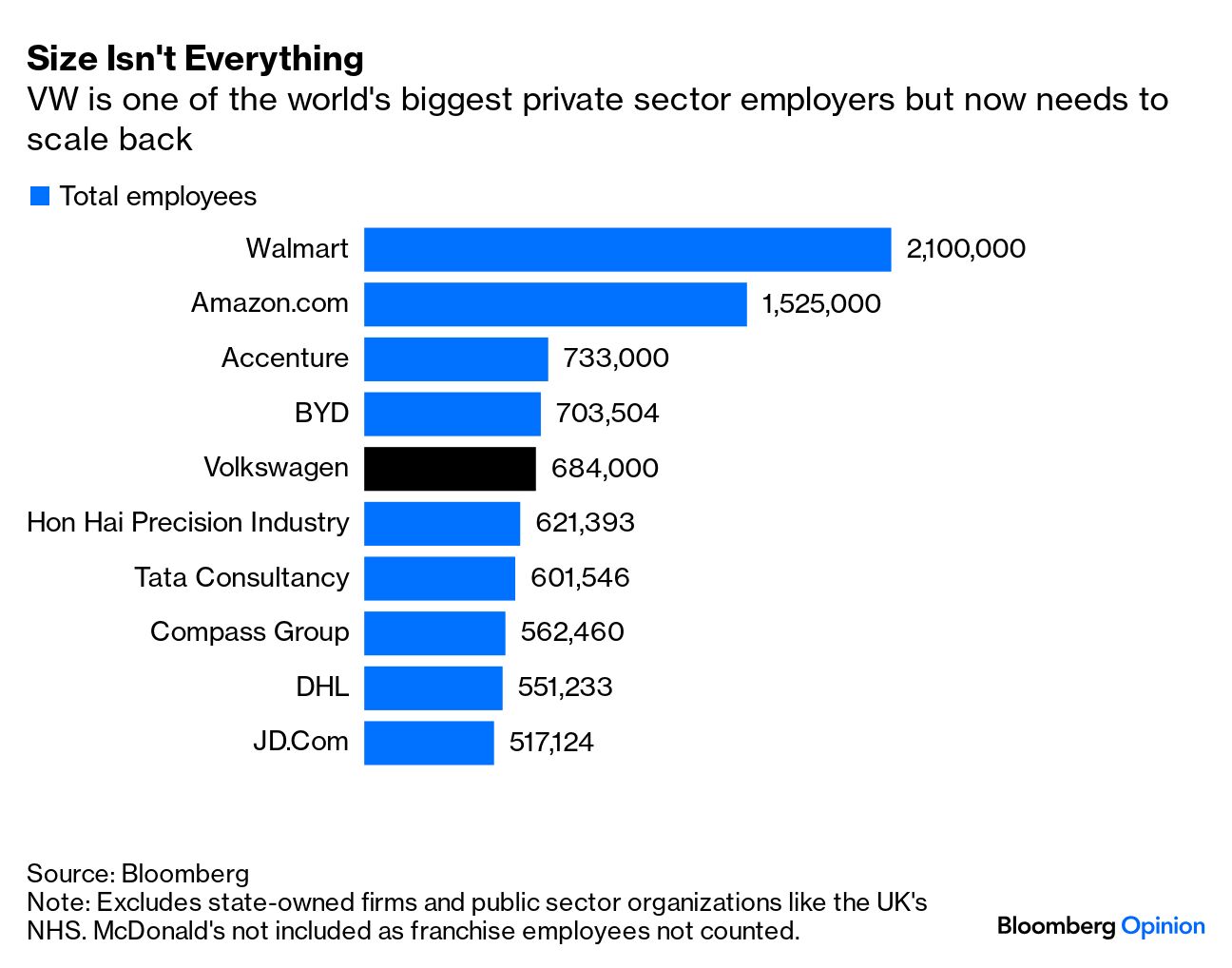

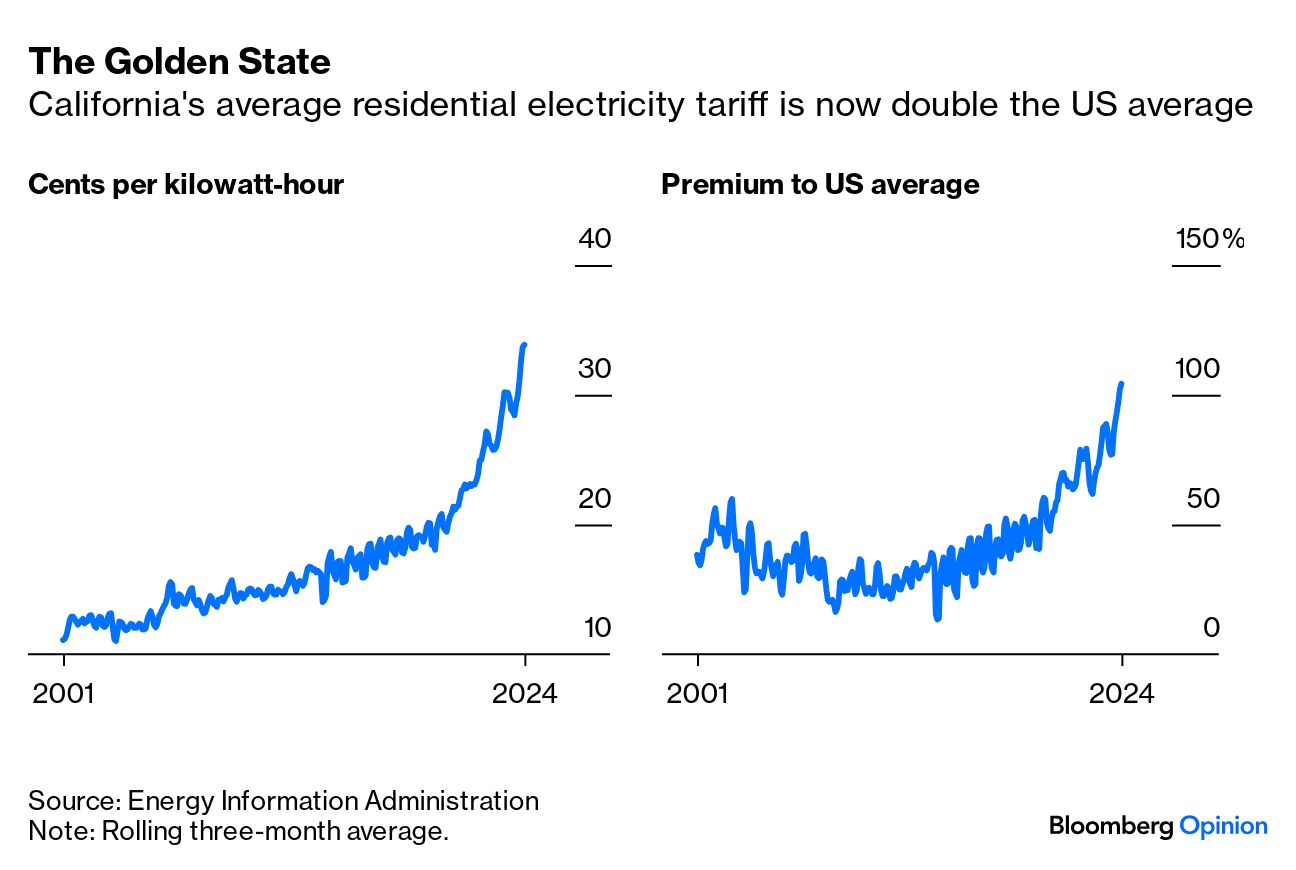

| I'm Jonathan Levin, and this is Bloomberg Opinion Today, a smorgasbord of Bloomberg Opinion's opinions on geopolitical risks and the economy. Sign up here. Today's Agenda As we've been tracking, there may be no greater challenge for the next US president than that of dealing with China. US National Security Adviser Jake Sullivan paid a visit to Beijing last week, but President Joe Biden's administration looks poised leave behind a long list of outstanding concerns that will continue to dog both parties. Hal Brands notes that the Biden administration has steered key legislation through Congress "promoting generational investments in semiconductors and clean-energy technology, two vital sectors in the clash for economic and geopolitical power." The current administration has also strengthened US alliances to push back against Beijing. But that's not to say the job is done. "The glaring problems under Biden have been the things that haven't happened," Hal writes. "China's never-ending military buildup threatens to leave the US and its allies outgunned in future crises over Taiwan, the South China Sea, or other hotspots." According to Hal, Biden has also left it to his successor to marshal a response to the threat of Beijing potentially flooding markets with heavily subsidized goods. Overall, Hal says that Biden's strategy has the US headed in the right direction, but also left it with a long way to go. On that note, the Editorial Board published a piece Tuesday arguing that "offense is more important than defense" for the American efforts to keep its technological edge over China in semiconductors. Most of the $39 billion in grants have now been preliminarily allocated under the CHIPS and Science Act, and the projects could — in theory— take the US from its current status as a non-factor in advanced logic chips to accounting for 28% of the world's production in 2032. Still, the editors write that the "only sure way for the US to maintain technological leadership is through continued innovation." They also note that, while the CHIPS Act set aside $11 billion for research and development, the initiative hasn't advanced as quickly as you'd hope. "Officials would be wise to move faster," they write. Karishma Vaswani writes that China's large and growing network of global port investments presents security and trade challenges of its own. China has found willing recipients of its investment dollars in strategically significant developing countries as far apart as Cambodia and Tanzania. Among other things, the US and its allies worry that the ports could be used for military activities. Karishma says that the nations would be wise to consider providing an alternative source of funding: "Targeting areas the Chinese don't typically invest in — like education and healthcare — would be a good first step." US Economy There are still some folks who remain extremely worked up about preliminary revisions to government data last month — which suggested that there were 818,000 fewer nonfarm payroll jobs in the US than previously understood. Claudia Sahm writes that she isn't one of them. As Claudia notes, the revisions are a "normal part of obtaining an accurate picture of the nearly $30 trillion US economy with a labor force of about 170 million people" — certainly not a partisan conspiracy and probably not a particularly scary omen for the economy in general. As Claudia says, revisions are a healthy reminder that we should always take individual data points with a grain of salt and focus on averages across months. "Applying that approach to the monthly payroll estimates — both the latest issue and the revisions of previous ones — shows that the basic story of a cooling labor market is mostly unchanged," she writes. In my column today, I also tackle bearish interpretations of the US economy and stock market and conclude that things really aren't that bad. Since the pandemic, Wall Street strategists have repeatedly underestimated the US stock market in their annual projections, and they continue to see little upside potential in large-capitalization US equities. "That's perplexing because many pieces of that 2023-2024 story remain broadly intact, supported by real-time data," I write. "The Federal Reserve Bank of Atlanta's GDPNow model suggests the economy is currently growing at a 2.5% annualized rate." Telltale Charts In his latest column, Chris Bryant takes a look at Volkswagen AG as it considers its first-ever factory closure in Germany. As Chris puts it, the development is a "long-overdue recognition that the German giant must adapt to new realities," after rival automakers got ahead of it in cutting costs. That could have ripple effects for one of the world's biggest private-sector employers. Finally, Liam Denning has some eye-opening charts on California electricity. It's getting much more expensive to provide power in the Golden State as efforts to combat the perils of climate change and avoid wildfires — by burying powerlines, for instance — effectively get rolled into monthly electricity bills. As Liam notes, the state will have to come up with clever ways of financing climate costs somehow, but "hiding them in utility bills is not the way to go." Liam says that costs are extremely regressive, "since poorer households pay a bigger share of their income for energy." Further Reading India is emulating China's post-2001 tight money policy. —Andy Mukherjee The race to reduce jet emissions is pushing technology to its limits. —David Fickling Dynamic pricing is really upsetting Oasis fans. —Matthew Brooker The Fed is helping China's currency and that's ironic. —Daniel Moss Leveraged single-stock funds triple your fun. —Matt Levine ICYMI Molson Coors Beverage Co. is cutting back on corporate diversity efforts. New Jersey is trying to lure the Philadelphia 76ers away from Philly. Subway is aiming to borrow $2.3 billion. Kickers Former Russian spy whale Hvaldimir has turned up dead, mysteriously. A Florida whistleblower has been fired. Oasis might come to the US after UK ticket debacle. Notes: Please send outrageous electricity bills (and feedback on this newsletter) to Jonathan Levin at jlevin20@bloomberg.net. |

No comments:

Post a Comment