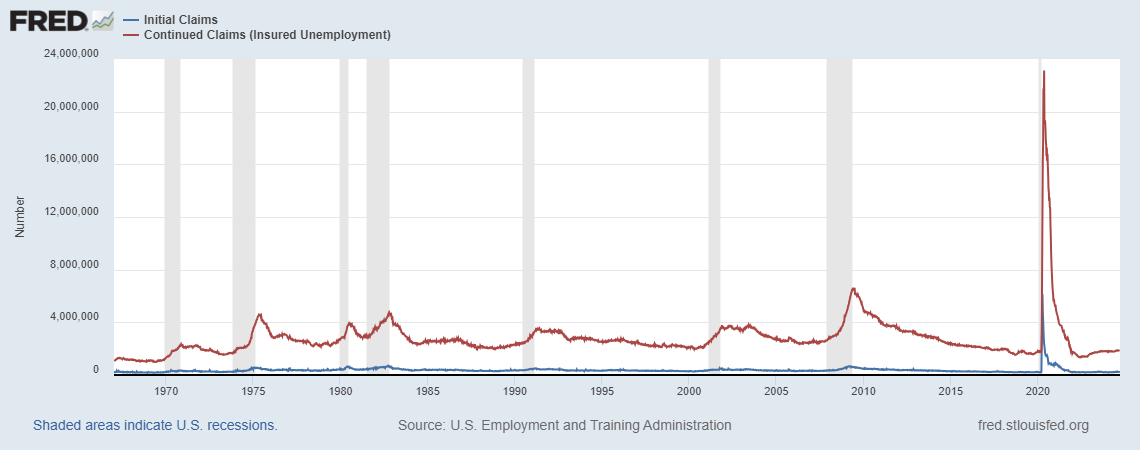

| I'm Jarrell Dillard, an economics reporter in Washington. Today we're looking at US jobless claims. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Financial markets are latching onto US jobless claims every Thursday morning for clues about the health of the labor market. But should they? The record of applications for unemployment benefits as a reliable indicator seems patchy at best. Bloomberg Economics argued earlier this year that the weekly claims should not be taken at face value. That's partly because a low percentage of people without a job apply for unemployment insurance and the payments are paltry in some states — and haven't kept up with inflation. In the past two years, there's been another wrinkle: A surge of immigrants helped power payroll growth. But many are undocumented or have temporary work permits, and they're not eligible to apply for benefits in many states. If those workers are losing their jobs, it wouldn't show up in the claims data. (By contrast, at least some would be included in monthly unemployment figures.) The weekly claims, dating back to 1945, were the "original high-frequency economic indicator," said St. Louis Fed researchers in a blog post last year. But even in the post-war decades, they proved a relatively mediocre predictor of the direction of unemployment, according to New York Fed research from the winter of 1983-1984. Fast-forward to today, employers aren't hiring as much and the unemployment rate has crept above 4%. The rise in joblessness was concerning enough to tilt the Fed toward a larger 50-basis-point cut in interest rates last week to kick off its policy-easing campaign. Yet, first-time applications for unemployment benefits hover near historical lows. Recurring claims, a proxy for people who remain unemployed for a longer time, have dropped in recent weeks after reaching a two-year high in July. The answer to why claims are so low is simple, says Steven Englander of Standard Chartered: "People who can claim benefits aren't getting fired." Claims remain an indicator to watch, Englander added. But for better insight into the job market, investors will need to wait another week for the September employment report. - US Treasury Secretary Janet Yellen defended the role of regulation in supporting a resilient financial system.

- Germany's gross domestic product will shrink slightly this year, according to new forecasts from the country's economic institutes.

- Australian Treasurer Jim Chalmers will kick off a visit to China on Thursday seeking to stabilize the economic relationship.

- Italy will seek ways to finance its budget with a direct contribution from banks and companies, but won't put a tax on extra corporate profits.

- UK indicators are bolstering arguments that the Labour government's efforts to prepare people for a tough budget have backfired on sentiment.

- Coming up: later today, Mexico's central bank will likely lower borrowing costs for a second straight meeting.

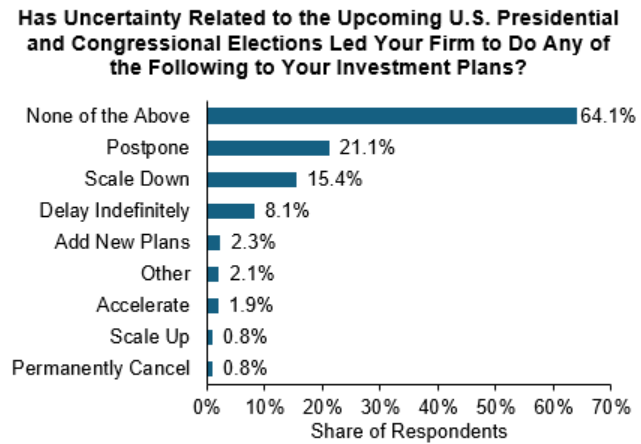

Fresh evidence has emerged that US companies, uncertain about the results of the upcoming November presidential and congressional election, are holding off on big decisions for the moment. Some 30% of firms have postponed, scaled down or canceled investment plans because of uncertainty around the election, up from 28% last quarter, according to a survey published Wednesday by the Federal Reserve Banks of Atlanta and Richmond and Duke University's Fuqua School of Business. "Relative to their non-impacted peers, impacted firms are less optimistic, are less likely to invest in expanding or maintaining capacity but more likely to invest in cost reduction, and expect slower revenue and employment growth in 2024," Atlanta Fed researchers Brent Meyer and Daniel Weitz wrote in a blog post. |

No comments:

Post a Comment