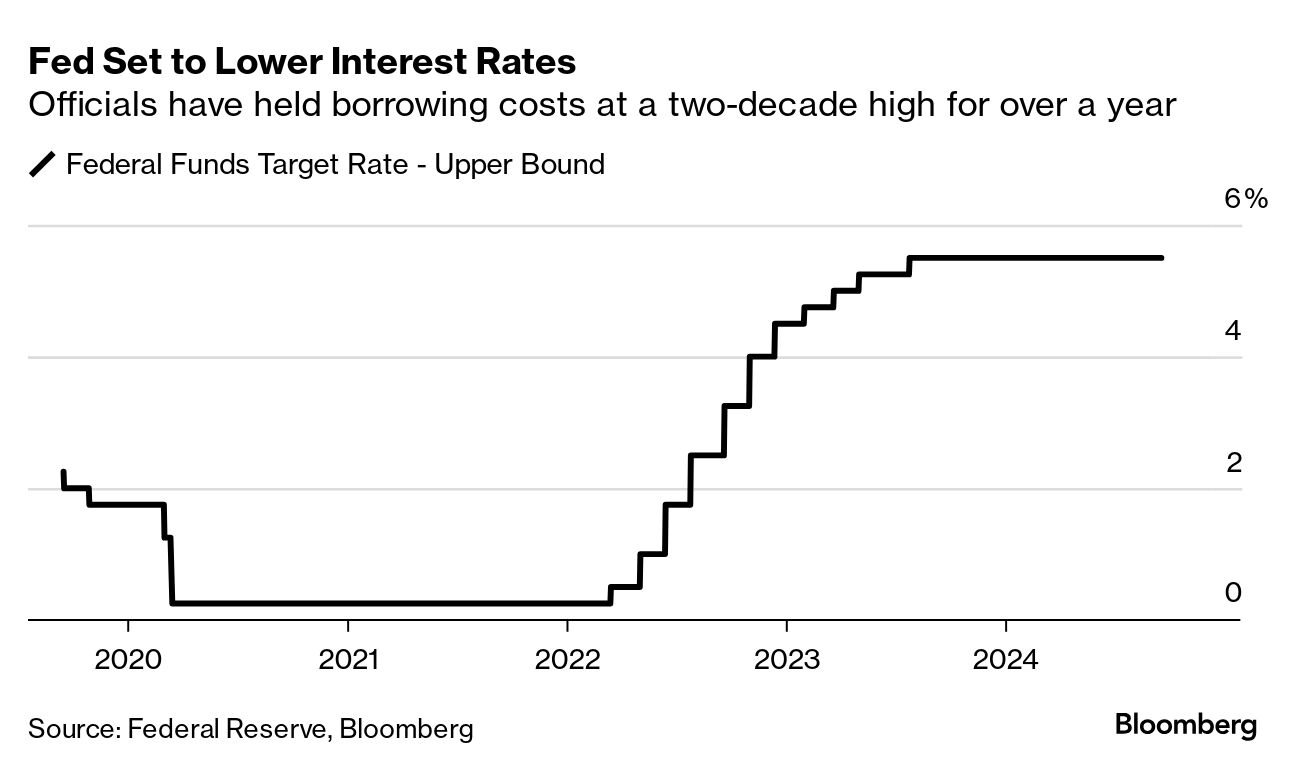

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at decision day for the Fed. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Federal Reserve officials term it a "live meeting" when some policy move may actually be taken at the gathering — not just a review of the economic and financial landscape that ends with standing pat on rates. It might be said that Wednesday's meeting is very live indeed. That's because Fed policymakers failed to signal clearly ahead of the meeting whether they favored lowering rates by 25 or 50 basis points. There's a lack of broad consensus among economists and investors. Interest-rate futures reflected significant wagers for 50, though that outcome wasn't fully priced in on Tuesday. While most economists surveyed by Bloomberg see 25, many warned that 50 is still possible. It's arguably the most uncertain Fed decision since 2015, when officials had to decide whether to raise rates in face of market ructions (they didn't). Why go by 50, effectively catching up with the rate cut in July that policymakers passed on after discussing it at the time? The simple answer is that the job market has weakened more and inflation has proved slower than they anticipated just months ago. Their median forecast in June was for the unemployment rate to end the year at 4%. But last month it already was 4.2%. They also forecast a 2.8% year-end pace for core inflation. That rate was 2.6% in the most recent reading. Policymakers will be issuing new projections alongside Wednesday's policy statement. That will also contain new forecasts for the benchmark rate. Derivatives markets suggest about 2.5 percentage point of cuts by the end of next year, taking the benchmark under 3%. - Japan's export growth slowed, with shipments to the US slipping for the first time in almost three years.

- The Bank of Canada's second-in-command said policymakers still want to see more progress on core inflation measures, even with the primary measure of price pressures back to the central bank's 2% target.

- Indonesia unexpectedly cut its key rate for the first time since 2021.

- The IMF indefinitely postponed its first planned consultations with Russia since the start of the invasion of Ukraine, amid EU criticism.

- South Africa's inflation slowed below the central bank's target midpoint for the first time since 2021, adding impetus to start easing.

- Hungarian Prime Minister Viktor Orban's big economic bet on electric vehicles isn't quite going to plan.

Evercore ISI in recent days flipped its forecast from a hard US landing to a soft one. "It feels like a bold moment" to do this — following a weakening in US jobs, manufacturing, and other data — economists including Ed Hyman, founder and chairman, wrote in a note. But household wealth continues to climb, inflation is slowing, corporate profits are supporting hiring and the housing market is "still OK," the team wrote. Plus, the Fed is poised to lower rates. Evercore boosted its GDP forecast for the fourth quarter to a 1% gain from a 2% drop. It sees that same pace continuing in the first half of 2025, with a pick-up later.  Ed Hyman. Photographer: Alex Flynn/Bloomberg "The economy is buzzing along," Hyman said on Bloomberg TV Tuesday. He also said he'd be "shocked" if the Fed doesn't cut its benchmark by a half percentage point Wednesday — a move that would reflect that "inflation really is coming down." |

No comments:

Post a Comment