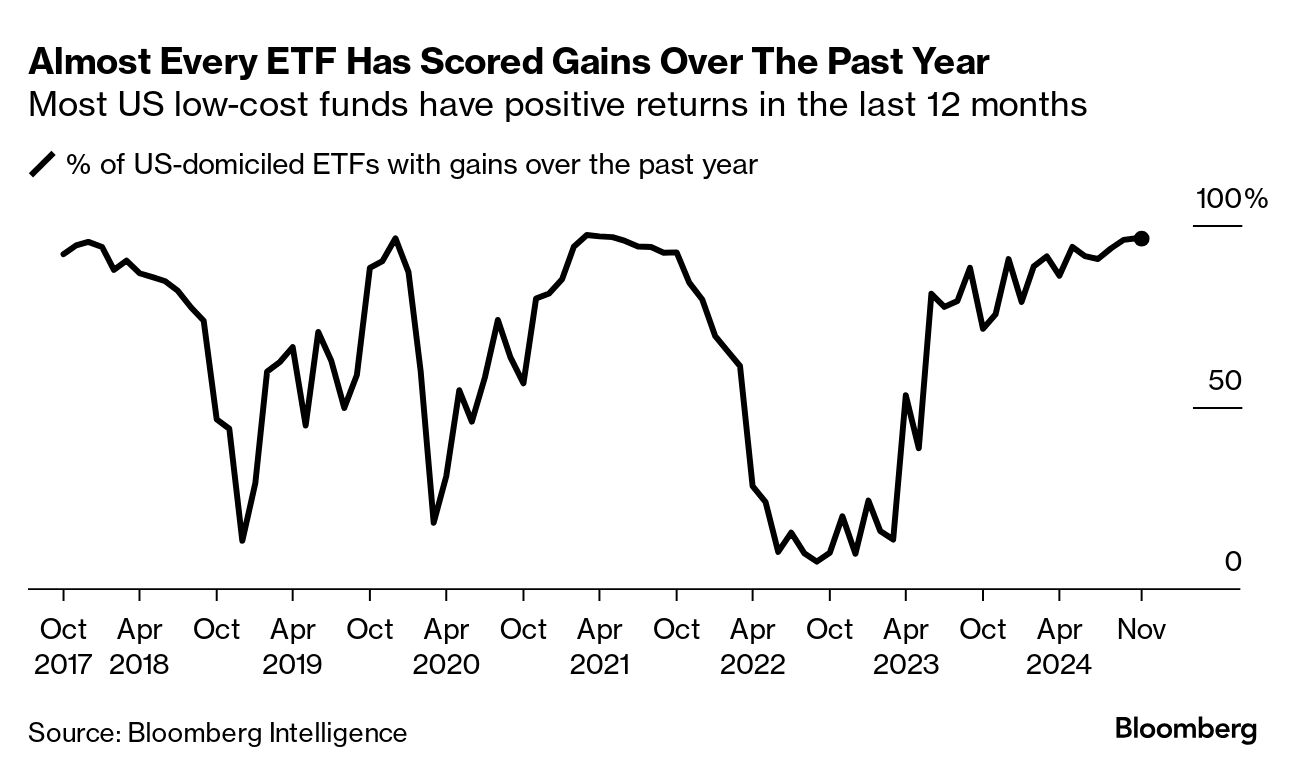

| Don't get too disheartened by last week's stock pullback after the intense post-election rally: It's been a banner year all round for building wealth from financial markets. Case in point: If you've put money in an exchange-traded fund — those cheap products designed for the masses — you're likely enjoying stellar gains, no matter what you've been betting on. A near-record 96% of ETFs have posted positive returns over the past year, with the majority of products headed for double-digit wins, according to an analysis by Bloomberg Intelligence. But things are less impressive when looking at the performance of so-called smart-money investors on Wall Street. While the average US-domiciled ETF is up 14% over the past 12 months, popular gauges tracking hedge-fund returns are scoring much smaller victories. These higher-fee strategies have proved too complex for their own good, either by diversifying bets across the stock market or shorting weak-looking companies. This tactic hasn't looked particularly smart this year given technology stocks have driven markets to records, in turn boosting low-cost ETFs that track indexes and more. "Not only are ETFs generally inexpensive, but it would have been virtually impossible to lose money this year," said Bloomberg Intelligence's Athanasios Psarofagis.

If these trends endure, there are two obvious takeaways. First, the stock market is boosting the stock-owning class across America to a historic degree. The net worth of US households reached a fresh record in the second quarter of $163.8 trillion, according to data from the Federal Reserve.

Second, if simple bets on US equities continue to wow, life will get even harder for money managers trying to convince mom-and-pop investors to diversify their holdings, whether it's by allocating money overseas or buying less-loved equities. Still, the investment rationale is reasonable in theory. Valuations for popular trades are already sky-high and an inflation resurgence may yet undercut the great risk rally. But for now, it's been a good stretch for the average 401(k). —Denitsa Tsekova |

No comments:

Post a Comment