| I'm Chris Anstey, an economics editor in Boston. Today we're looking at China's latest economic stimulus package. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. It probably says more about China's lack of policy stimulus to date that the package of monetary measures announced Tuesday amounted to the strongest set of steps seen in years. At a rare, high-level press conference, the government's financial officials unveiled a host of actions including: - A 20 basis point cut to the benchmark short-term rate, taking it to 1.5%

- Reductions to other key rates, along with lowering banks' reserve ratio

- A drop in minimum property down-payments and a mortgage-rate cut

- A recapitalization plan for China's banks

- A liquidity facility the central bank will offer to help prop up equities

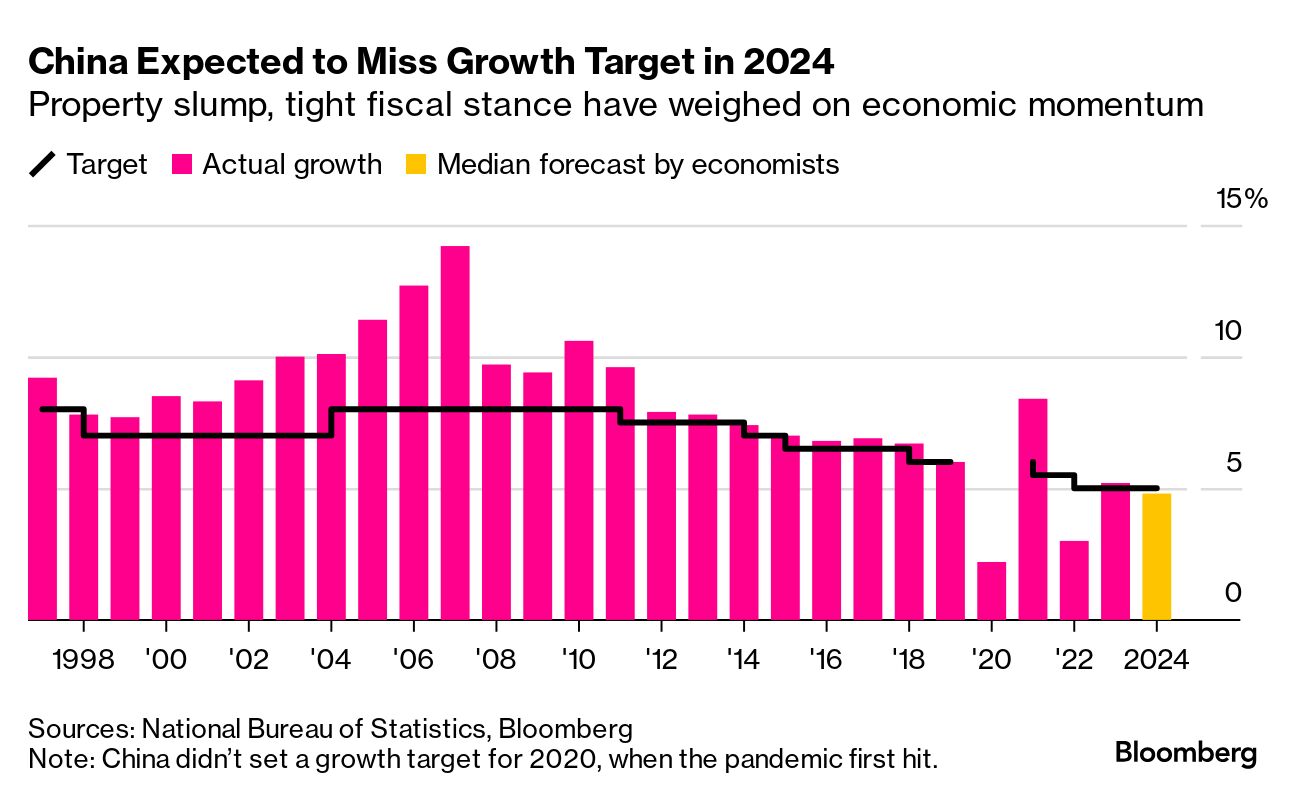

In a follow-up move on Wednesday, the central bank cut the rate charged on its one-year policy loans by the most on record. After months of underwhelming economists, the effort — overseen by People's Bank of China Governor Pan Gongsheng — largely exceeded their expectations this time around. Investors cheered in rare relief for the nation's beaten down equities. The production "speaks to the urgency felt in Beijing to head off deflationary risks and get growth on track for the 5% target" for 2024, Chang Shu and Eric Zhu of Bloomberg Economics wrote. The team's SHOK model indicates a boost of as much as about 1% of GDP over the coming year. - Read the duo's full analysis on the Bloomberg terminal here.

But at the end of the day it's a "growth boost," not an "economy fix," Shu and Zhu wrote. For Wang Tao, UBS's chief China economist, the package wasn't even enough to move the needle on growth. She kept her forecast for gross domestic product this year at 4.6% and next year's at 4%. The missing element, many economists said, was a fiscal stimulus to pump-prime spending and finally address a housing depression that's hammered consumer confidence. "The real bottleneck faced by the economy is a lack of effective demand rather than loanable funds available," Nomura economists led by Ting Lu wrote — in an observation made by multiple observers Tuesday. What could a fiscal fix, should it come at all, look like? A recapitalization of some sort for China's developers could help them complete buildings and move them off their balance sheets. Stepped up pension or healthcare provisions could reassure hard-pressed households and reduce incentives for saving. Large-scale assistance from Beijing for local governments would alleviate their fiscal strains. Gabriel Wildau, a China specialist at advisory firm Teneo, is among those anticipating announcements on the fiscal front, "in the coming weeks, if not sooner." President Xi Jinping is set to convene the Communist Party's 24-member Politburo ahead of a weeklong annual holiday starting Tuesday, offering one potential date. The risk is that without fiscal measures to match, Tuesday's shock-and-awe on the monetary front could fall flat. - The US economy looks to be on track for a soft landing, according to the chief of the International Monetary Fund.

- Japan's economic revival is failing to save its vanishing towns.

- European Central Bank official Klaas Knot expects gradual rate cuts and Megan Greene of the Bank of England prefers a "cautious" approach too.

- Brazil's 2024 fiscal result will exceed investor expectations, Treasury Secretary Rogerio Ceron said in an interview.

- Zimbabwe's latest attempt to introduce a new currency is coming undone just five months after initially being praised for taming inflation.

- Coming up: Czech officials may cut rates today, and early tomorrow their Swiss peers will probably do so too in a cliffhanger decision.

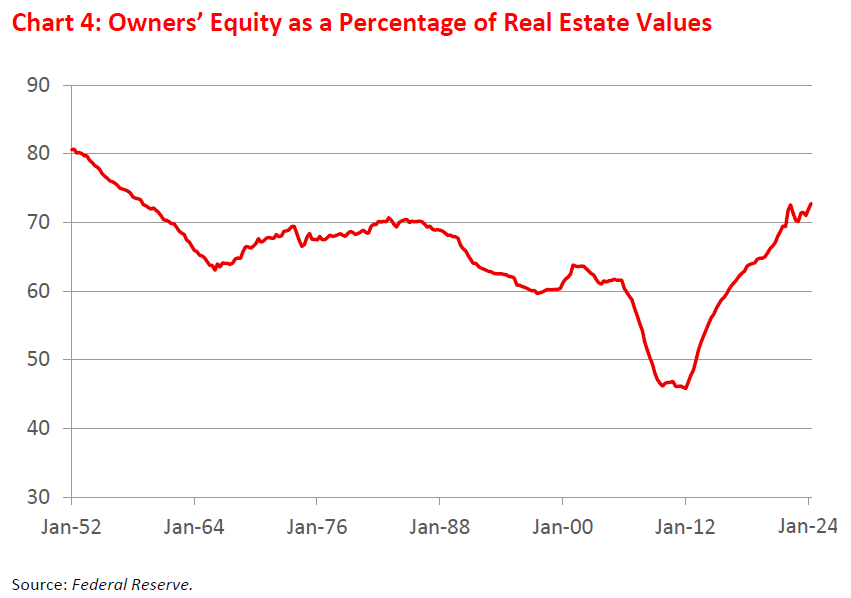

US households' net worth climbed to a record last quarter, propelled in part by swelling property values. But that may not translate into a stimulus for consumer spending, Stephen Stanley cautions. Homeowners are in fact so well positioned that their equity as a share of values has hit the highest since 1958, Stanley, chief US economist at Santander US Capital Markets, wrote in a note Tuesday. Trouble is, they cannot easily cash out the equity as they once could. That's because many would lose the rock-bottom mortgage rates they locked in years ago. The so-called wealth effect "has likely been far more limited than it might have been under a different interest rate profile," Stanley wrote. That leaves spending reliant on job and real income growth, which he characterizes as "anemic" this year. In short, consumption is set to moderate in coming months, he said. |

No comments:

Post a Comment